By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

By Type (15)

|

Residential Lease AgreementA standard 1-year lease is commonly used for apartments, houses, and rental units across the U.S. and offers stability for both parties. |

|

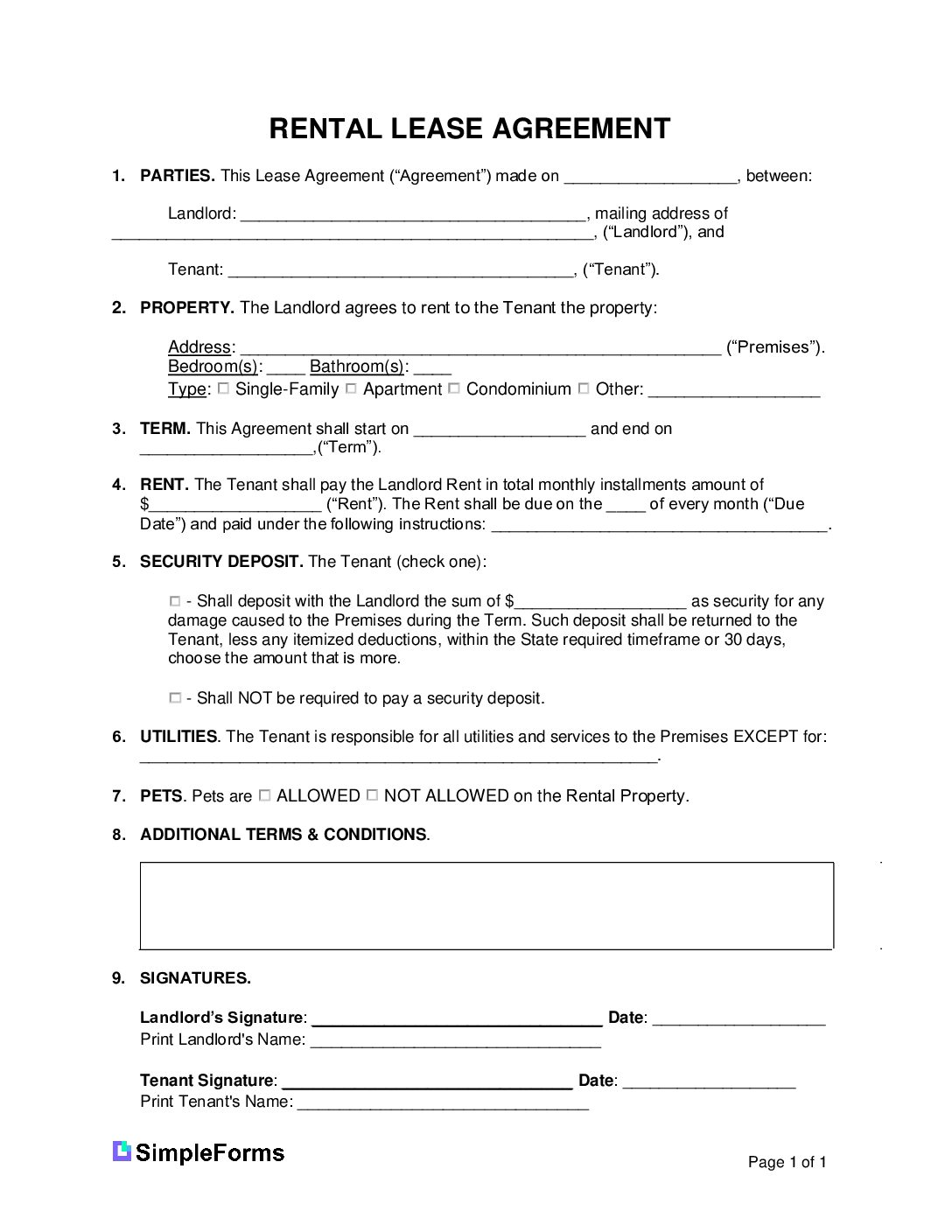

Simple 1-Page Lease AgreementA short and straightforward rental contract used for landlords and tenants seeking a quick, legally binding rental form without unnecessary complexity. |

|

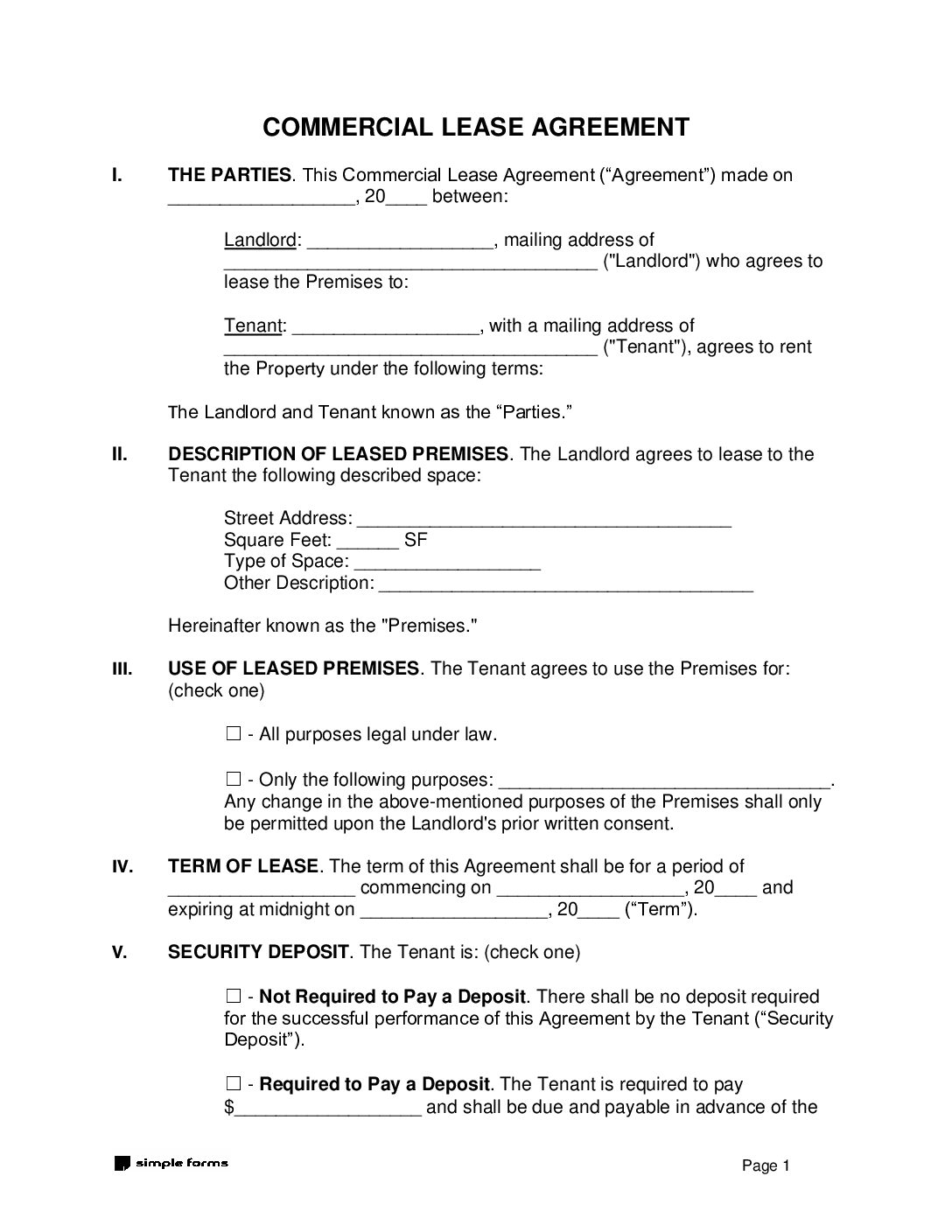

Commercial Lease AgreementA legal contract between a landlord and a business tenant for leasing non-residential property, such as retail stores, office buildings, warehouses, or industrial facilities. |

|

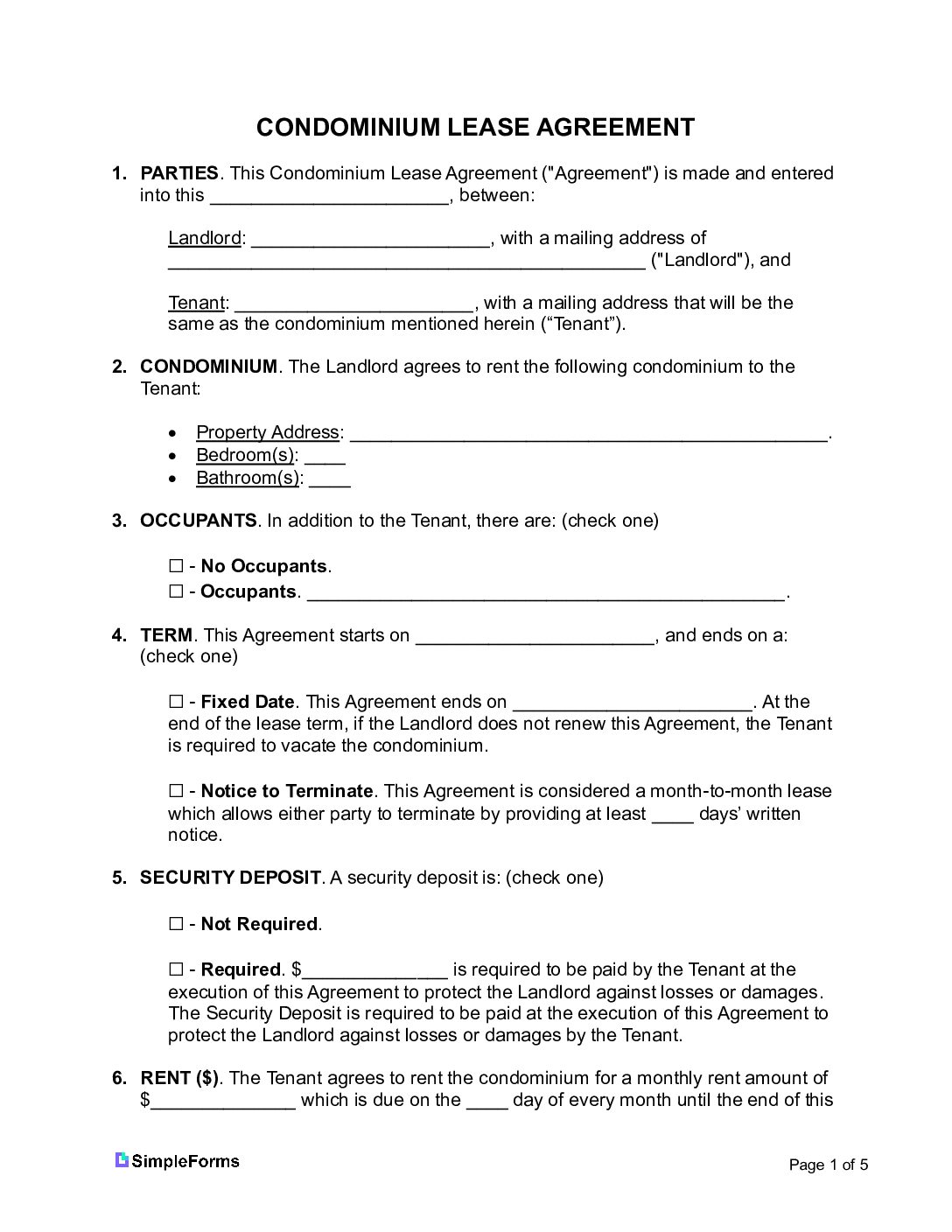

Condominium Lease AgreementUsed for renting units in condo communities, includes rules and policies specific to the condominium association, HOA regulations, shared amenities, and community guidelines. |

|

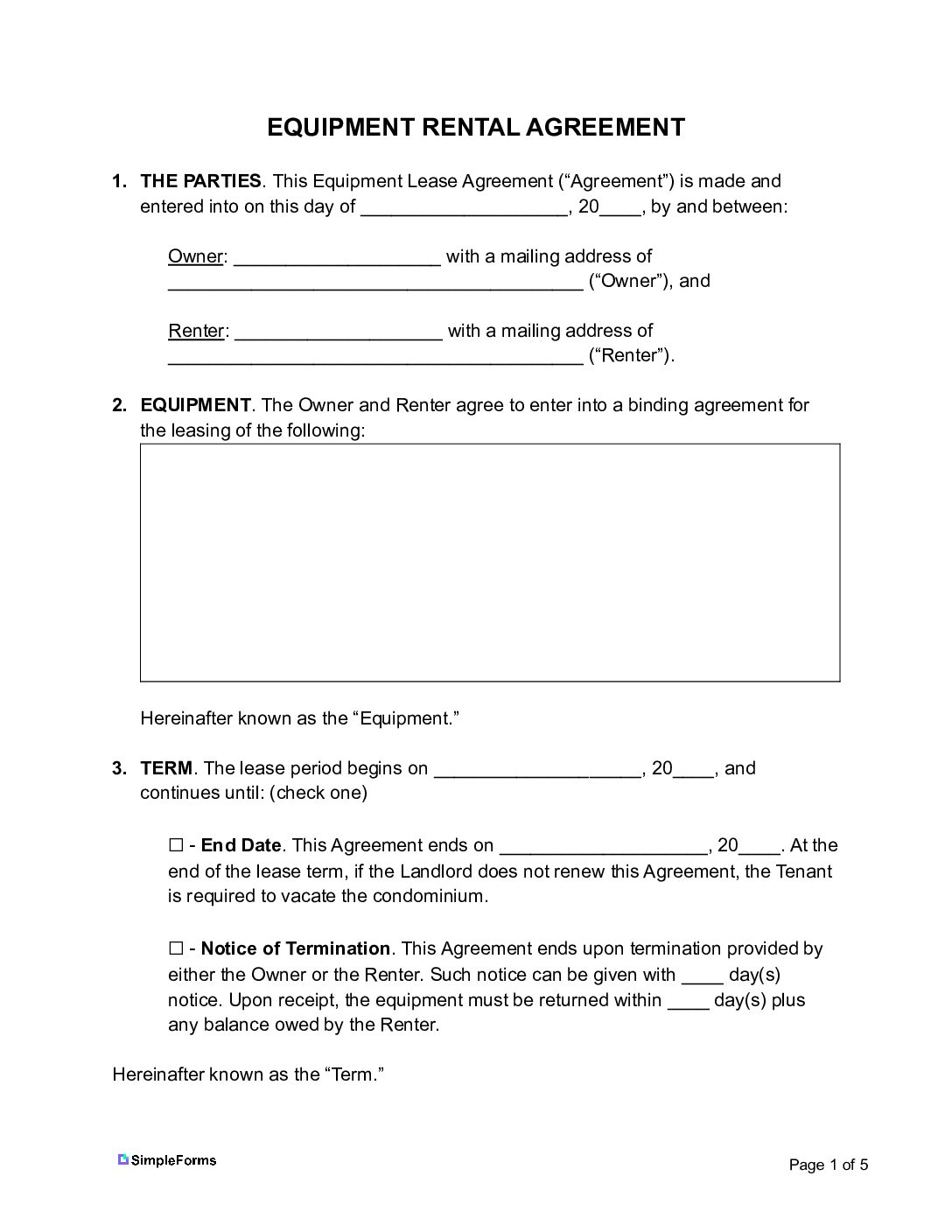

Equipment Rental AgreementUsed by equipment owners (lessor) and a renter (lessee) for the use of tools, machinery, and electronics. Commonly used for construction equipment, audio/visual gear, office machines. |

|

Family Member Rental Lease AgreementUsed when one relative rents property from another. It outlines rent, lease terms, and responsibilities to avoid misunderstandings, even in informal family arrangements. |

|

Hunting Land LeaseA legal agreement that allows individuals to rent private land for hunting. It outlines lease duration, permitted game, access rights, and land use rules for a safe and lawful hunting experience. |

|

Month-to-Month Lease AgreementTenancy at will with automatic renewals every 30 days. |

|

Parking Space Lease AgreementUsed for renting parking space. Download: PDF | Word (.docx) |

|

Rent-to-Own Conveyance Lease AgreementA lease agreement that includes an option for the tenant to purchase the property during the lease term. |

|

Room (Roommate) Rental Lease AgreementShared living arrangements. A legally binding contract that outlines the responsibilities and agreements between co-tenants. |

|

Short-Term(Vacation) LeaseUsed for short-term leases of 30 days or less. |

|

Storage Space (Unit) Rental LeaseRent storage space in exchange for rent payments. |

|

Sublease Agreement TemplateUsed to sublet units with landlord approval. |

|

Weekly Lease AgreementUsed for seven (7) day lease periods. Commonly used for AirBnb type of leases. |

What is a boilerplate rental lease agreement?

Why use a simple rental agreement form?

A written and signed simple rental agreement form protects both the Landlord and the Tenant by clearly outlining the rules and responsibilities of both parties during the lease term.

- Protect the Rights of Both Parties: The roles of each party are written down so there is no confusion.

- Misunderstandings: Having the agreement in writing makes it straightforward to both parties what the roles are.

- Customize: Create a rental lease contract tailored to the rental property.

Rental Lease Agreement Template Features

- Legally Binding

- Customizable

- Multiple Formats (PDF, Word, Excel, Open Document)

- Free Samples

What is a Residential Lease?

A Residential Lease Agreement is a contract for renting a home, outlining the landlord’s and tenant’s rights and responsibilities. It is used for apartments, houses, and condos. A residential lease is also known as the following:

- Lease agreement

- Rental agreement

- Rental contract

- Apartment lease

- House rental agreement

- Tenancy agreement

- Rent-to-own lease

Does a lease takeover count as breaking a rental agreement?

Who Pays the Security Deposit in a Lease Agreement?

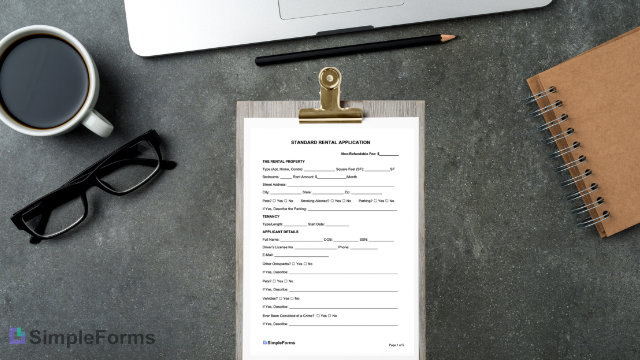

How to Write a Rental Lease Agreement?

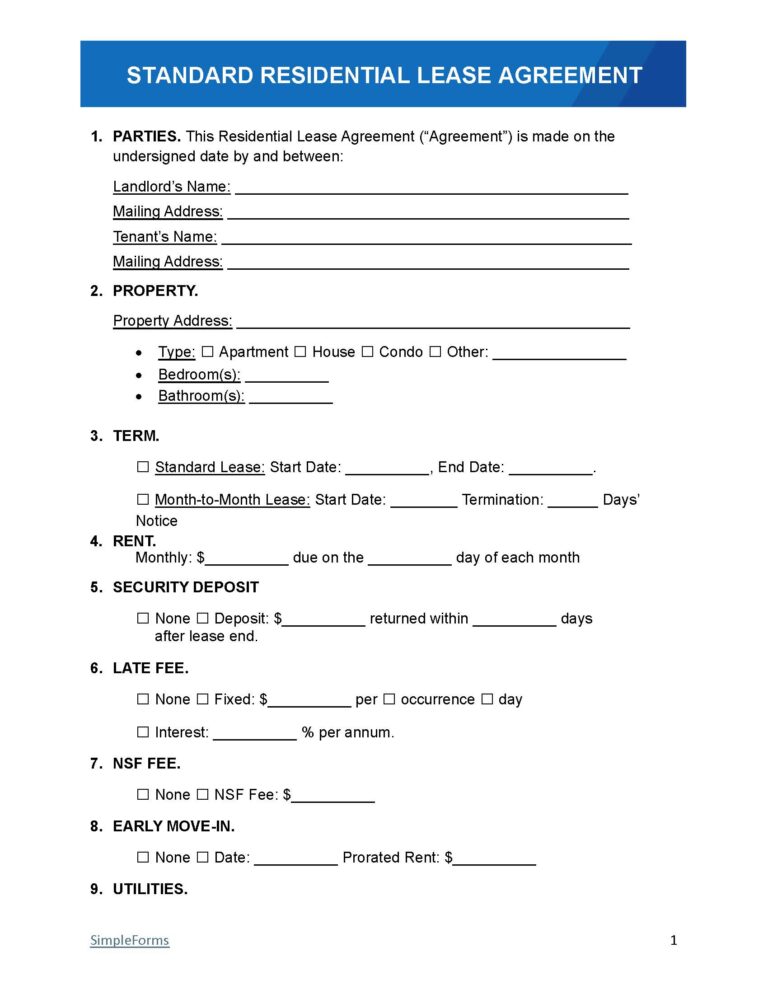

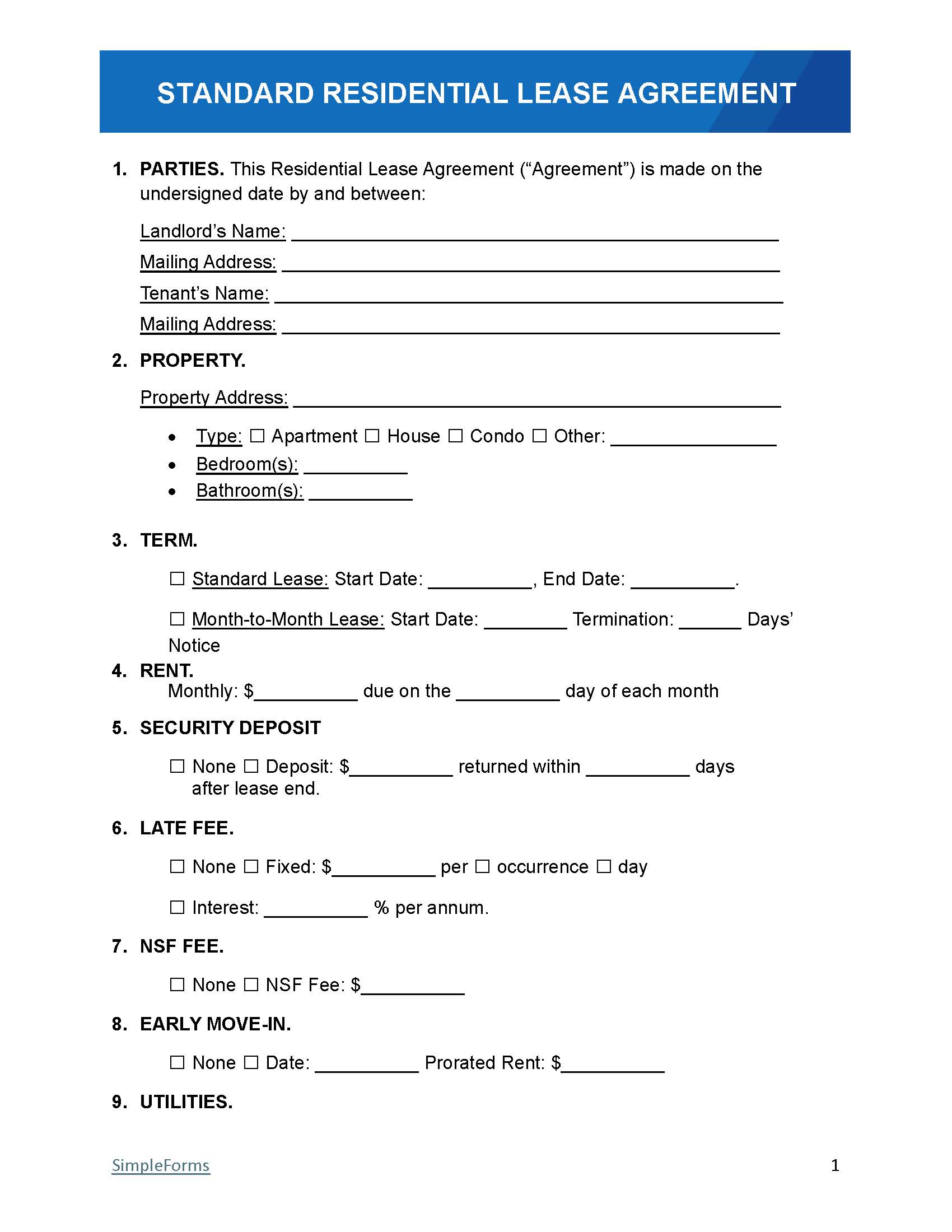

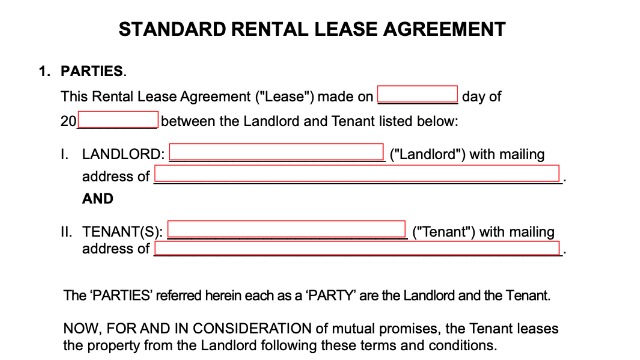

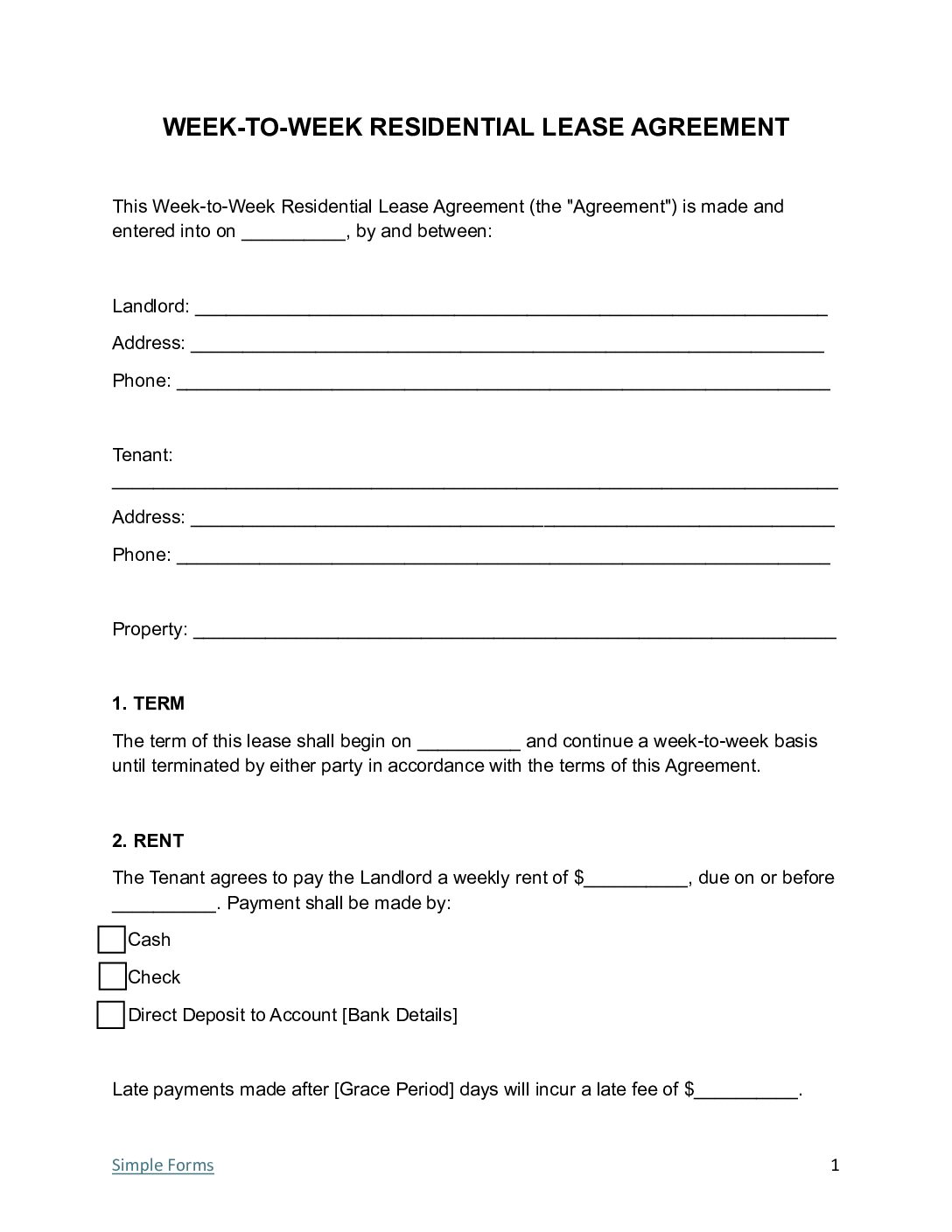

Step 1 – Title the Agreement Form and add the Parties’ Names

- Add the name of the agreement form, “Rental Lease Agreement.”

- Add the date and year the agreement was made.

- Add the full legal names and addresses of the Landlord and Tenant.

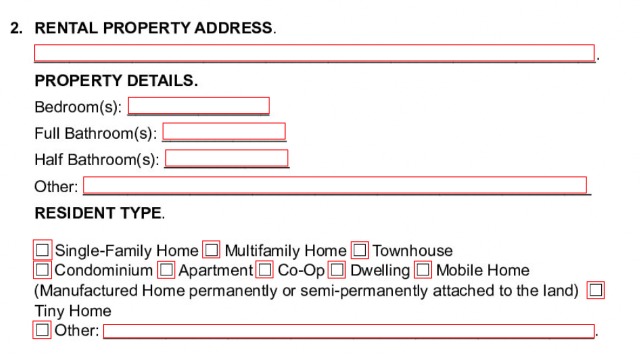

Step 2 – Add Rental Property Address, Details and Residence Type

- Please enter the entire rental property address where it is located.

- Add the property details, such as the number of bedrooms, bathrooms, half-bathrooms, and any other information the Tenant should know.

- Please add the type of residence, such as a single-family home, multifamily home, townhouse, condominium, apartment, co-op, dwelling, mobile home, tiny home, or other.

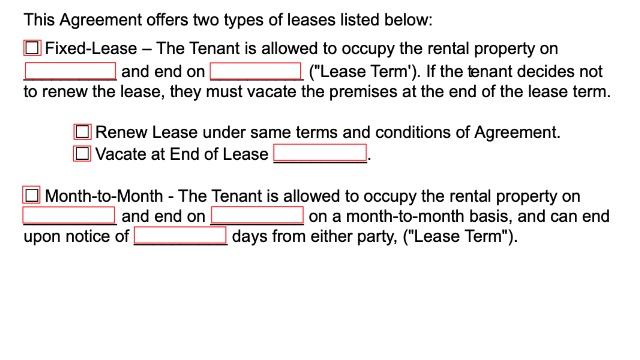

Step 3 – Select Fixed-Lease or Month-to-Month Lease Type with Dates

- Check if the type of lease is a fixed lease or a month-to-month lease.

- Add start and end dates.

- Add renewal options (if any).

Step 4 – Add names of Occupant(s)

The Tenant must list any occupant(s) (if any) staying in the rental unit.

How to Lease Your Property (9 Steps)

Step 1 – Type of Lease

- Long-term lease – Minimum of one year (12 months) or more. These Tenants typically are young professionals or family units where one needs to stay consistently in one geographic area to be close to a job or school for long periods.

- Short-term lease—Up to one year (12 months) or monthly (month-to-month). These Tenants tend to be college kids who need to rent an apartment for nine months out of the year before going home for summer vacation at their parents’ house.

- Vacation lease—One month (30 days) or less. These Tenants come from all different walks of life as one travels throughout one’s lifetime. It’s becoming more common, especially after the pandemic, for people to work remotely and also study remotely online.

- Hunting Land Lease – PDF

Step 2 – Preparing the Rental Property for Showings

Once the final decision is made on the lease type, the next step is to prepare the rental property for showings – in person and online. This step is when a cleaning company or a painter fixes interior and/or exterior touch-ups. The plumber might also need to be contacted if a faucet leaks or a toilet is clogged.

A trip to Lowe’s or Home Depot might be a good idea for light bulbs, smoke detectors (including the compatible batteries), and having extra keys made (think extra keys for Lock-box, Brokers, and Tenants).

Double-check that all of the essentials needed to make your home 100% habitable are present prior to showing or posting any videos or pictures of the rental space online or in print ads.

Step 3 – Finding the Right Tenant(s)

The third step is finding and vetting potential Tenant(s). This is done by listing the property online, including entering information in the Multiple Listing Service (MLS). At this point, you may consider hiring a Real Estate Broker to help with the leasing process to avoid any financial or legal issues.

Advertising: Advertising rental properties depends on the local market and the target audiences. Landlords or property owners can choose from different advertising platforms, but it’s essential to be transparent about the property’s condition, updated photos, and prices to simplify the rental process. Also, consider hiring a real estate agent to manage the rental process.

- High-end markets – Sotheby’s, Rent.com

- Middle-cost markets – Zillow, Redfin

- Low-budget markets – Craigslist

Step 4 – Preparing a Rental Application

A rental application serves to uncover three major concerns for an owner of property about a Tenant:

- Criminal history

- Credit history

- Previous evictions by prior landlords

If a Tenant passes all three checks, then verify the Tenant’s employment and means of paying rent. Landlords have the legal right to ask for government-approved identification, a social security number, and an applicant’s legal status.

Law Alert ⚖️

The Fair Housing Act, 42 U.S.C. 3601, prohibits landlords and property owners from discriminating (denying) prospective tenants the ability to rent based on the following criteria:

- disability

- familial status or national origin

- race or color

- religion

- sex

Ways to Screen a Tenant:

- TransUnion SmartMove – TransUnion offers a tenant screening service called SmartMove. It allows landlords to request credit reports and criminal background checks on prospective tenants. SmartMove provides a credit-based recommendation that helps you assess the tenant’s financial stability and risk profile.

- Experian Connect – Experian offers a similar service called Experian Connect. Landlords can request credit reports and view a tenant’s credit history. This can help you gauge their creditworthiness and financial responsibility.

- Local Court Records – You can check your local court’s website or visit in person to search for eviction records, judgments, or any legal disputes involving prospective tenants. This can give you insight into their rental history and legal issues.

- Social Media and Online Searches – Conducting online searches and checking social media profiles can provide additional information about a tenant. While this isn’t an official screening method, it can give you an idea of their lifestyle, behavior, and any red flags.

Step 5 – Tenant Views the Space

Depending on the property owner, one may require a rental application from the applicant before or after viewing the property. There could be disclosures you will need to offer each tenant before they view the property, depending on the state.

Law Alert ⚖️

The most common disclosure the federal government requires is the Lead-Based Paint Disclosure, which requires owners of property built before 1978 to give prospective tenants a pamphlet (PDF)↗.

Step 6 – Verify References

Landlords and property owners should be particular when asking for references from a prospective tenant. Asking for personal friends or family as references serves little use. An owner must abide by no laws or limitations when contacting references. When asking for references, it’s best to ask for the following contacts:

- Previous and current employer;

- Prior landlord/owner of rented property.

Step 7 – Approving the Tenant

A landlord can approve a tenant for any reason. However, when rejecting a tenant from occupancy, the landlord must give the reason (which must be legal). A rejected application is due to a negative report on a credit report.

Law Alert ⚖️

The Fair Credit Reporting Act↗requires property owners/landlords to disclose the information as to why a rental application was denied. Landlords must provide the denied applicant with the following:

- A written statement explaining the adverse facts

- A source of the reporting agency

Step 8 – Signing the Lease

Leases can be signed online using DocuSign↗ or eSign↗. If the lease is signed in person, having the lease notarized is recommended. Property owners do not need to be named on the lease if a property management company controls the property. Verbal agreements are not legally binding.

- All persons who have applied to reside at the property;

- Owner or manager of property;

- If signing in person, a notary (public officer) is recommended.

Security Deposits

Most U.S. states follow the rules set out by HUD↗, a federal department that administers laws and regulations regarding housing.

- One month rent – Landlords are allowed to ask for a security deposit equal to 1 (one) month’s rent;

- Interest-bearing account – Security deposits must be kept in a separate interest-bearing account;

- Unpaid Dues – The Landlord may use the security deposit as reimbursement for any unpaid dues when the lease expires;

- Refund – The landlord must return the security deposit in full within 30 days of notice;

Source: § 880.608

Step 9 – Occupancy

The Tenant(s) have the right to occupy the property on the start date stated within the lease agreement unless otherwise written and agreed upon. Once the tenant has begun to occupy the property, the owner loses their right to enter it without proper notice. The lease agreement termination will be outlined in the agreement.

Rental Lease Break Clause

A lease break clause lets a Tenant end their lease early under certain conditions.

Landlord-Tenant Laws

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

State Security Deposit Laws By State

| State | Maximum Deposit | Notice Period | Sources |

|---|---|---|---|

| Alabama | 1 month’s rent | 60 days | § 8-8-15(b)§ 35-9A-201(a), § 35-9A-201(b) |

| Alaska | 2 months’ rent | 14-30 days | § 34.03.070(a), § 34.03.070(g) |

| Arizona | 1.5 months’ rent | 14 days | § 33-1321 |

| Arkansas | 2 months’ rent | 60 days | § 18-16-304, § 18-16-305 |

| California | 1 month’s rent | 21 days | § 1950.5 |

| Colorado | 2 months’ rent | 1-2 months | § 38-12-102.5, § 38-12-103 |

| Connecticut | 1-2 months’ rent | 21-15 days | § 47a-21 |

| Delaware | 1 month’s rent | 20 days | § 1301A |

| Florida | No Limit | 15-30 days | § 83.49(3)(a) |

| Georgia | 2 months rent | 30 days | § 44-7-30.1, § 44-7-34 |

| Hawaii | 1 month’s rent | 14 days | § 521-44 |

| Idaho | No limit | 21-30 days | § 6-321 |

| Illinois | No limit | 30-45 days | § 765 ILCS 710 |

| Indiana | No limit | 45 days | § 32-31-3-12 |

| Iowa | 2 months’ rent | 30 days | § 562A.12 |

| Kansas | 1 month’s rent (unfurnished), 1.5 months’ rent (furnished) | 14-30 days | § 58-2550 |

| Kentucky | No limit | 60 days | § 383.580(6) |

| Louisiana | No limit | 1 month | § 9:3251§ 6032 |

| Maine | 2 months’ rent | 21-30 days | § 6032, § 6033 |

| Maryland | 1 month’s rent | 45 days | § 8–203 |

| Massachusetts | 1 month’s rent | 30 days | Chapter 186, Section 15B |

| Michigan | 1.5 months’ rent | 30 days | § 554.602, § 554.609 |

| Minnesota | No limit | 3 weeks | § 504B.178 |

| Mississippi | No limit | 45 days | § 89-8-21 |

| Missouri | 2 months’ rent | 30 days | § 535.300 |

| Montana | No limit | 10-30 days | § 70-25-202 |

| Nebraska | 1 month’s rent (excluding pet fees) | 14 days | § 76-1416 |

| Nevada | 3 months’ rent | 30 days | NRS 118A.242 |

| New Hampshire | 1 month’s rent or $100 (whichever is greater) | 20-30 days | RSA 540-A:6, RSA 540-A:7 |

| New Jersey | 1.5 months’ rent | 30 days | § 46:8-21.2, § 46:8-21.1 |

| New Mexico | 1.5 months’ rent | 30 days | § 47-8-18 |

| New York | 1 month’s rent | 14 days | § 7-108(e) |

| North Carolina | 1.5-2 months’ rent | 30-60 days | § 42-51, § 42-52 |

| North Dakota | 1 month’s rent (excluding pet deposits) | 30 days | § 47-16-07.1 |

| Ohio | No limit | 30 days | § 5321.16 |

| Oklahoma | No limit | 45 days | § 41-115(B) |

| Oregon | No limit | 31. days | § 90.300 |

| Pennsylvania | 2 months’ rent | 30 days | § 250.511a, § 250.512 |

| South Carolina | No limit | 30 days | § 27-40-410 |

| South Dakota | 1 month’s rent | 14-45 days | § 43-32-6.1, § 43-32-24 |

| Tennessee | No limit | 30 days | § 66-28-301 |

| Texas | No limit | 30 days | § 92.103 |

| Utah | No limit | 30 days | § 57-17-3 |

| Vermont | No limit | 14-16 days | § 4461 |

| Virginia | 2 months’ rent | 45 days | § 55.1-1226(A) |

| Washington | No limit | 30 days | § 59.18.280 |

| West Virginia | No limit | 45-60 days | § 37-6A-2 |

| Wisconsin | No limit | 21 days | § 134.06 |

| Wyoming | No limit | 15-30 days | § 1-21-1208(A) |

Non-Sufficient Funds (NSF) Fees By State

| State | Maximum Fee | Laws |

|---|---|---|

| Alabama | $30 | § 8-8-15(b) |

| Alaska | $30 | § 09.68.115(2) |

| Arizona | No Maximum | N/A |

| Arkansas | $30 | § 5-37-307, § 5-37-304 |

| California | $25 (Plus $35 for each additional bad check provided.) | § 1719. |

| Colorado | $20 | § 13-21-109 |

| Connecticut | N/A | § 52-565a(d) |

| Delaware | $40 | § 1301A |

| Florida | $25: For checks, $50 or less. $30: For checks over $50 but less than $300. $40 or 5% of the total value (whichever is greater): For checks over $300. |

§ 68.065 |

| Georgia | $30 or 5% of the rent check amount | § 13-6-15 (b) |

| Hawaii | N/A | N/A |

| Idaho | The total amount of the check plus any fees. | § 28-22-1051 |

| Illinois | The amount of the check plus any fees. | 720 ILCS § 5/17-1(E) |

| Indiana | $27.50 or 5% of check amount. | § 35-43-5-5 |

| Iowa | Amount of check and any fees. | § 714.1(6) |

| Kansas | $30 | § 60-2610 |

| Kentucky | $50 | § 514.040 |

| Lousiana | $15 plus any bank fees. | § 14:71 |

| Maine | Check amount and bank fees. | § 14-6071 |

| Maryland | N/A | N/A |

| Massachusetts | $30 | § 62C-35 |

| Michigan | $25 (if rent check is paid within 7 days); $35 (if rent check is paid within 30 days. | § 600.2952 |

| Minnesota | N/A | N/A |

| Mississippi | $30 | § 97-19-75 |

| Missouri | $25 | § 570.120 |

| Montana | $30 | § 27-1-717 |

| Nebraska | $10 | § 28-611 |

| Nevada | N/A | N/A |

| New Hampshire | N/A | § 638-4 |

| New Jersey | $100 or 3 times the check amount. | § 2A-32A-1 |

| New Mexico | N/A | N/A |

| New York | $20 | § 5-328 |

| North Carolina | $25 | § 25-3-506 |

| North Dakota | $30 | § 6-8-16.2a |

| Ohio | $30 or 10% of the Check’s Amount | § 1319.16 |

| Oklahoma | N/A | N/A |

| Oregon | $35 | § 30.701 |

| Pennsylvania | $50 | § 18.4105e |

| South Carolina | $30 | § 6-42-3 |

| South Dakota | $40 | § 57A-3-421 |

| Tennessee | $30 | § 47-29-102 |

| Texas | N/a | N/A |

| Utah | $20 | § 7-15-2 |

| Vermont | $5 | § 2022 |

| Virginia | $50 | § 8.01-27.1 |

| Washington | $40 | § 62A.3-515(b)(1) |

| West Virginia | $25 | § 61-3-39e |

| Wisconsin | N/A | N/A |

| Wyoming | $30 | § 1-1-115 |

Definitions

- Abandonment

- Abandonment is the act of vacating the premises before fulfilling the terms of the agreement without notice or consent, is abandonment.

- Addendum: Addendum is a signed document that adds terms to a lease.

- Agent

- Agent is someone acting on behalf of another (Realtor, real estate agent, or property manager)

- Alterations and Improvements

- Alterations and Improvements are changes to a property’s appearance or function.

- Appliances

- Large household machines, such as refrigerators or stoves.

- Amenities

- Extra features that add value, such as a balcony or fitness center.

- Appraisal

- An appraisal is a professional evaluation of the value of a property by a licensed appraiser.

- Binding Effect

- A clause in the lease that benefits all parties and their heirs or assigns.

- Breach of Contract

- Breaking lease terms, leading to termination.

- Boilerplate Contract

- Clauses in lease agreements that correlate critical legal points.

- Closing Costs

- Buyers and sellers typically incur various expenses beyond the property price to complete a real estate transaction. These expenses include fees for title insurance, legal services, and more.

- Default

- Steps taken when a tenant violates the lease.

- Closing Costs

- Buyers and sellers typically incur various expenses beyond the property price to complete a real estate transaction. These expenses include fees for title insurance, legal services, and more.

- Default

- Steps taken when a tenant violates the lease.

- Due Date

- The day rent is due; a grace period before late fees apply.

- Down Payment

- The down payment in a real estate transaction is the first initial payment made by the buyer (Tenant) when purchasing a home. It is usually a percentage of the total purchase price.

- Escrow

- A third party of the Landlord and Tenant holds the funds until a transaction is completed.

- Entire Agreement

- Confirms all agreements are included in the lease document.

- Eviction

- Landlord’s legal process to remove a tenant.

- Fair Housing Act

- Prohibits rental discrimination based on personal characteristics (race/religion).

- Fair Market Rent

- Fair Market Rent is determined by the 40th percentile of gross rents for typical, standard-quality rental units in a specific housing market..

- Furnishings

- Removable items like furniture or decor.

- Governing Law

- States the lease follows local state laws.

- Grace Period

- Extra time before late fees are charged for unpaid rent.

- Guests

- Non-residents staying in rental unit temporarily.

- Hazardous Materials

- Substances on the property that may pose risks.

- Landlord and Tenant

- The landlord agrees to let the tenant use the property for a specified period in exchange for rent.

- Lease Agreement vs. Rental Agreement

- A lease agreement is usually for long lease contracts, 6 months or more, and a rental agreement is usually for short-term leases of 30 days.

- Property Rentals

- Real Estate assets that are owned by individuals or entities (businesses) that are rented out to Tenants/Occupants for a specific period of time in exchange for rent payments.

- House rules

- Guidelines for shared living spaces.

- Indemnification

- Protects the landlord from liability for injuries or damages.

- Insurance (Bond)

- Covers landlord and tenant liability.

- Landlord/Lessor

- The property owner renting out the unit.

- Late Fee

- Charge for overdue rent.

- Lease Agreement

- A legal document outlining rental terms.

- Lease Renewal

- Extending the lease after expiration.

- Maintenance

- Required property upkeep by the tenant.

- Monthly Rent

- Rent amount due monthly, usually on the 1st.

- Month-to-Month

- Flexible lease renewed every 30 days.

- Non-Delivery of Possession

- Clause for tenant move-in delays.

- Notice

- Written communication from landlord about lease-related issues.

- Occupants

- Non-tenant residents, like family members.

- Parking

- Defines parking arrangements for tenants.

- Parties

- Individuals (Lessor/Lessee) involved in the lease (Landlord/Tenant).

- Payment Location

- Address for delivering rent payments.

- Personal Property

- Removable belongings not part of the rental unit.

- Pet Deposit Fee

- Extra payment for pets in the rental property.

- Property Description

- Address and details of the rental unit.

- Property Manager

- Person managing the property for the owner.

- Prorated Rent

- Adjusted rent for partial months.

- Real Property

- Land and attached structures.

- Receipt of Agreement

- Proof that both parties received signed documents.

- Returned Check

- A bounced check due to insufficient funds (NSF Fees might occur).

- Security Deposit

- Money held for potential damages.

- Security Deposit Refund

- Return of deposit after deductions for damages.

- Severability Clause

- Invalid clauses don’t affect the rest of the lease.

- Sub-landlord – (Sublessor)

- Tenant renting the unit to another person.

- Subleasing

- When a tenant rents the property to someone else.

- Subtenant (Sublessee)

- Person renting from the primary tenant.

- Tenancy

- Occupancy of the rental unit.

- Tenant

- Person renting the property.

Federal Leasing Laws ⚖️

Fair Housing Act (FHA)

Cannot discrimination based on race, religion, or disability. (hud.gov)

Americans with Disabilities Act (ADA)

Must include accessibility and rights for individuals with disabilities (reasonable accommodations and allowing service animals on property). (ada.gov)

Lead-Based Paint Hazard Reduction Act

Must be included for homes built before 1978. (epa.gov)

Fair Credit Reporting Act (FCRA)

Disclosures when checking credit reports for screening tenants. (ftc.gov)

Privacy and Security Laws

The roommate agreement must outline how personal information and data is protected. This is part of the Truth in Lending Act. (occ.treas.gov)

Uniform Residential Landlord and Tenant Act (URLTA)

URLTA provides guidelines for leases and tenant rights and covers security deposits, repairs, and maintenance rules. (nchh.org)

Anti-Retaliation Laws

Protects tenants from retaliation for asserting rights; the agreement cannot penalize roommates for exercising legal rights. (nhlp.org)

Landlord Access Notice Requirements by State

| State | Required Notice | Statute |

| Alabama | 2 days | § 35-9A-303 |

| Alaska | 24 hours | § 34.03.140 |

| Arizona | 48 hours | § 33-1343 |

| Arkansas | N/A | N/A |

| California | 24 hours (non-emergency), 48 hours (move-out inspection) | § 1954 |

| Colorado | N/A | N/A |

| Connecticut | Reasonable notice | § 47a-16 |

| Delaware | 48 hours | Title 25 § 5509 |

| Florida | 24 hours | § 83.53 |

| Georgia | N/A | N/A |

| Hawaii | 2 days | § 521-53 |

| Idaho | N/A | N/A |

| Illinois | N/A | N/A |

| Indiana | Reasonable notice | § 32-31-5-6 |

| Iowa | 24 hours | § 562A.19 |

| Kansas | Reasonable notice | § 58-2557 |

| Kentucky | 2 days | § 383.615 |

| Louisiana | N/A | N/A |

| Maine | 24 hours | § 6025 |

| Maryland | N/A | N/A |

| Massachusetts | Reasonable notice | Sanitary Code (410.810) |

| Michigan | N/A | N/A |

| Minnesota | “Reasonable notice” (no less than 24 hours) | § 504B.211 |

| Mississippi | N/A | N/A |

| Missouri | N/A | N/A |

| Montana | 24 hours | § 70-24-312 |

| Nebraska | 24 hours | § 76-1423 |

| Nevada | 24 hours | NRS 118A.330 |

| New Hampshire | Reasonable notice | RSA 540-A:3 |

| New Jersey | 1 day | § 5:10-5.1 |

| New Mexico | 24 hours | § 47-8-24 |

| New York | N/A | N/A |

| North Carolina | N/A | N/A |

| North Dakota | Reasonable notice | § 47-16-07.3 |

| Ohio | 24 hours | § 5321.04 |

| Oklahoma | 1 day | § 41-128 |

| Oregon | 24 hours | § 90.322 |

| Pennsylvania | N/A | N/A |

| Rhode Island | 2 days | § 34-18-26 |

| South Carolina | 24 hours | § 27-40-530 |

| South Dakota | 24 hours | § 43-32-32 |

| Tennessee | 24 hours | § 66-28-403 |

| Texas | N/A | N/A |

| Utah | 24 hours | § 57-22-4 |

| Vermont | 48 hours | § 4460 |

| Virginia | 24 hours | § 55.1-1229(A) |

| Washington | 2 days (repairs), 1 day (showings) | § 59.18.150 |

| West Virginia | N/A | N/A |

| Wisconsin | Advance notice | § 704.05(2) |

| Wyoming | N/A | N/A |

USPS Informed Delivery: Email Landlord/Tenant Notices

Sign up with USPS Informed Delivery (usps.com) to receive mail virtually, no matter where you are. Never miss a Notice in the mail again, as these Notices can be time-sensitive.

Frequently Asked Questions

Q. Does a lease takeover count as breaking a rental agreement?

Answer: A lease transfer doesn’t usually count as breaking a rental agreement. Always double-check with the written lease agreement contract that you signed.

Q. What are renters’ rights without a formal written lease agreement?

Answer: Tenants’ rights without a formal lease agreement depend from state to state. Read our basic guideline for more information.

Q. What is a Rental Agreement Form?

Answer: A rental agreement is a month-long contract that is similar to a lease in many ways. It’s different from a lease in that it is automatically renewed.

Q. How do you get out of a lease agreement?

Answer: Laws are in place that override the lease agreement where the tenants can break the contract.

Q. How do you spot a fake lease agreement?

Answer: Some lease agreements are fake; here are the top ways to spot one: the landlord asks for a large deposit, the landlord puts time pressure on you to sign the agreement, and the lease agreement does not allow you to legally get out of the lease respectfully.

Q. What are the 2025 Fannie Mae Selling and Renting Updates?

Answer: Fannie Mae’s tools and resources are free, including the 2025 selling guide PDF.

Q. How to cancel a lease agreement?

Answer: Landlords usually require a 30-day notice, although it’s best to check with local laws and your lease agreement. The lessor and lessee MUST sign a letter stating the cancellation.

Q. What is a triple-net lease agreement?

Answer: Although this type of lease mostly pertains to commercial property, it’s when the tenant agrees to pay for all expenses/bills of the rental property, including taxes, insurance, and maintenance.

Sample Rental Lease Agreement

PDF | Word | Excel | ODT | Google Docs | Google Sheets

Sources

- 2022 BLS Housing Study (1st slide)

- FRED (Economic Data) – Total Households

- 2022 BLS Housing Study (2nd slide)

- Moody’s – Key Takeaways from the 4th Quarter Housing Affordability Update

- Results from the Zillow Consumer Housing Trends Report 2023

- Results from the Zillow Consumer Housing Trends Report 2023

- Zillow – Consumer Housing Trends Report 2024 (Page 30)