By Type (6)

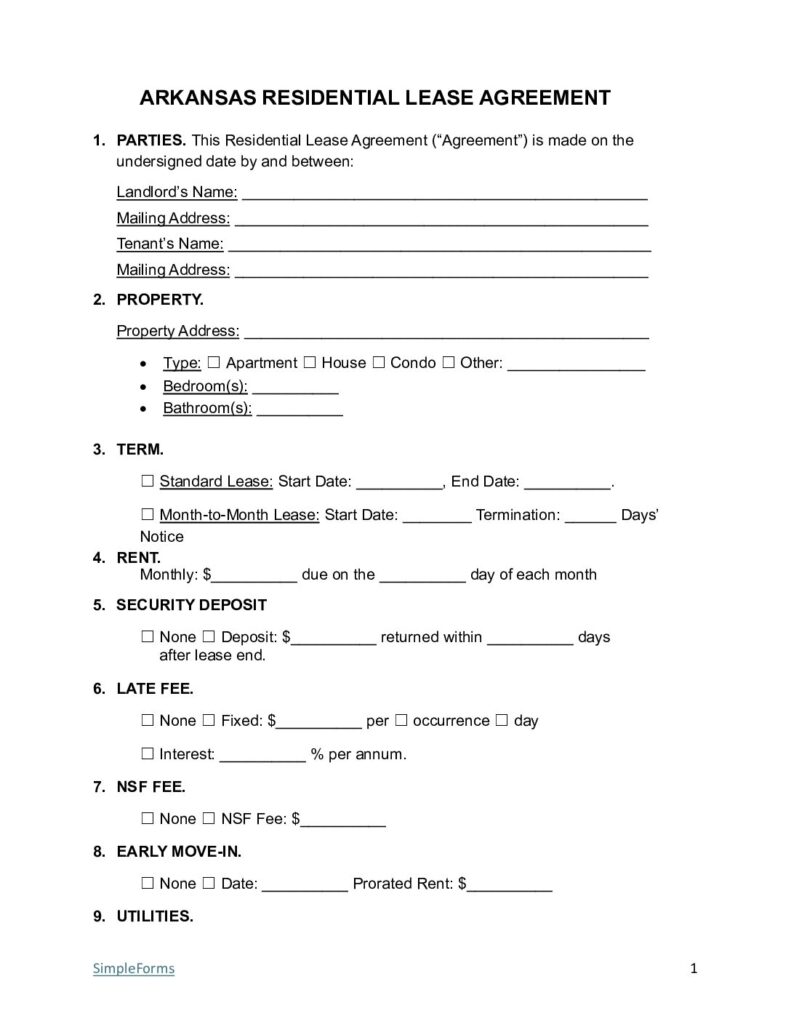

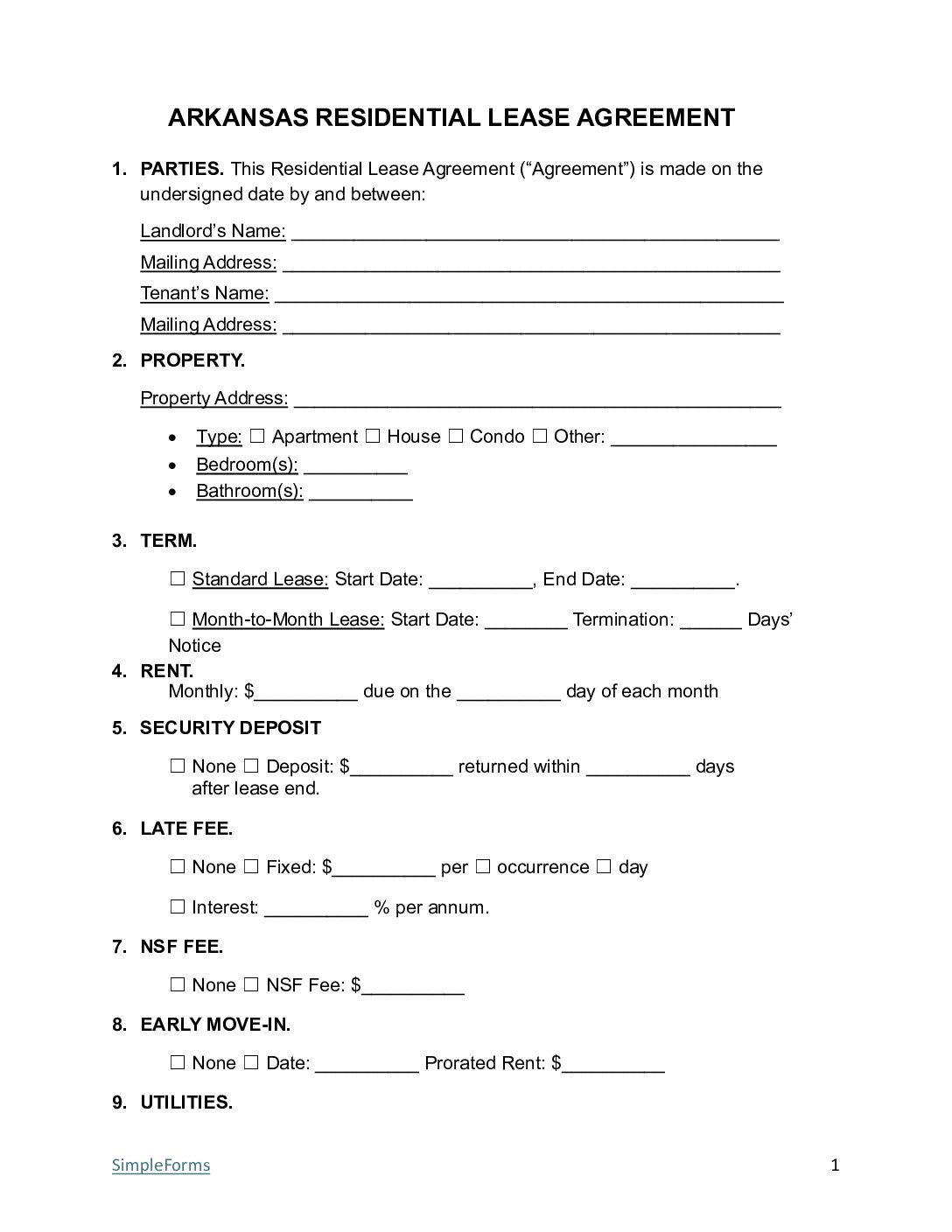

| Arkansas Residential Lease Agreement – a standard 1-year (12 months) lease term for residential use including an apartment, condo, or home. Download: PDF | Word (.docx) |

|

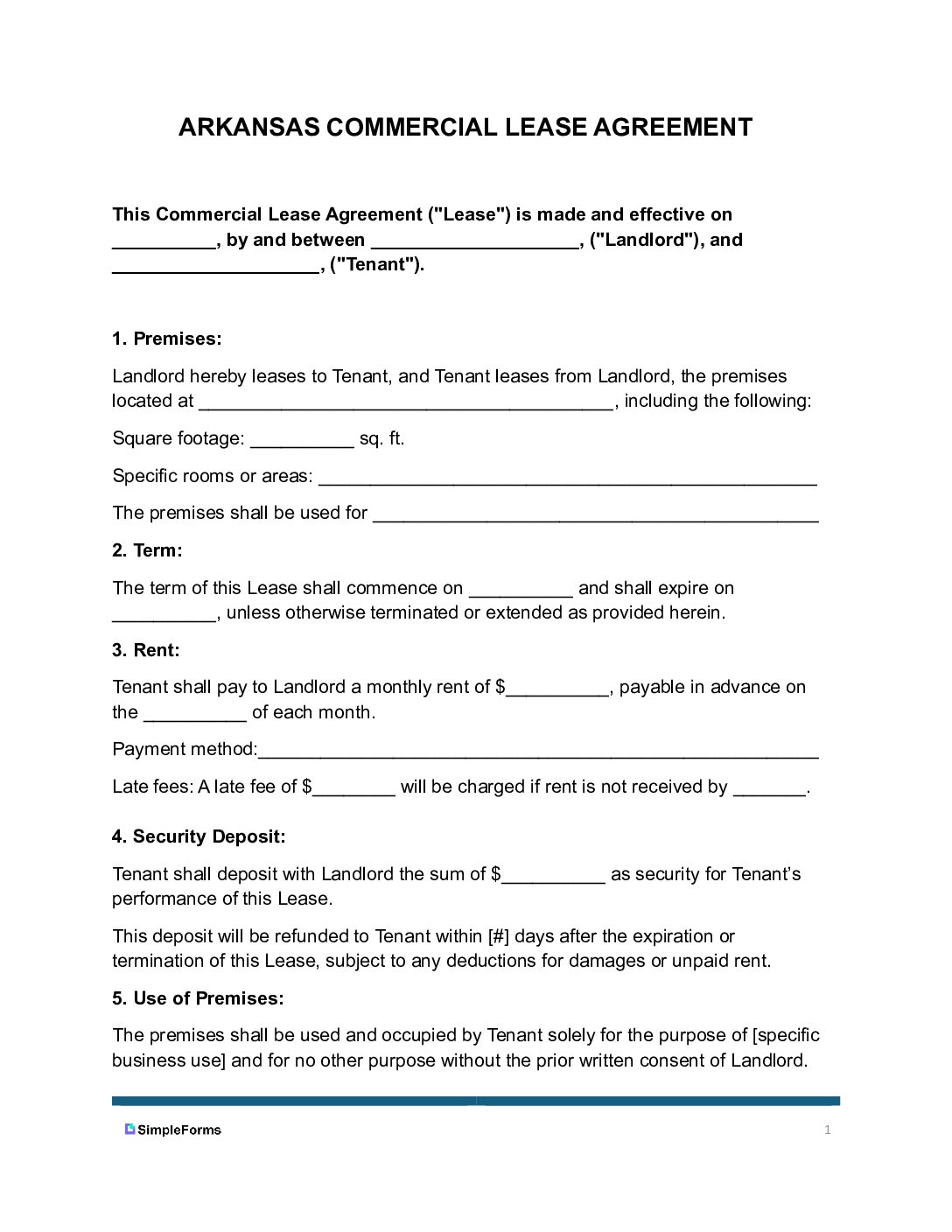

| Arkansas Commercial Lease Agreement – a legal contract between a landlord and a business tenant outlining the terms, conditions, and responsibilities for renting commercial property in Arkansas. Download: PDF | Word (.docx) |

|

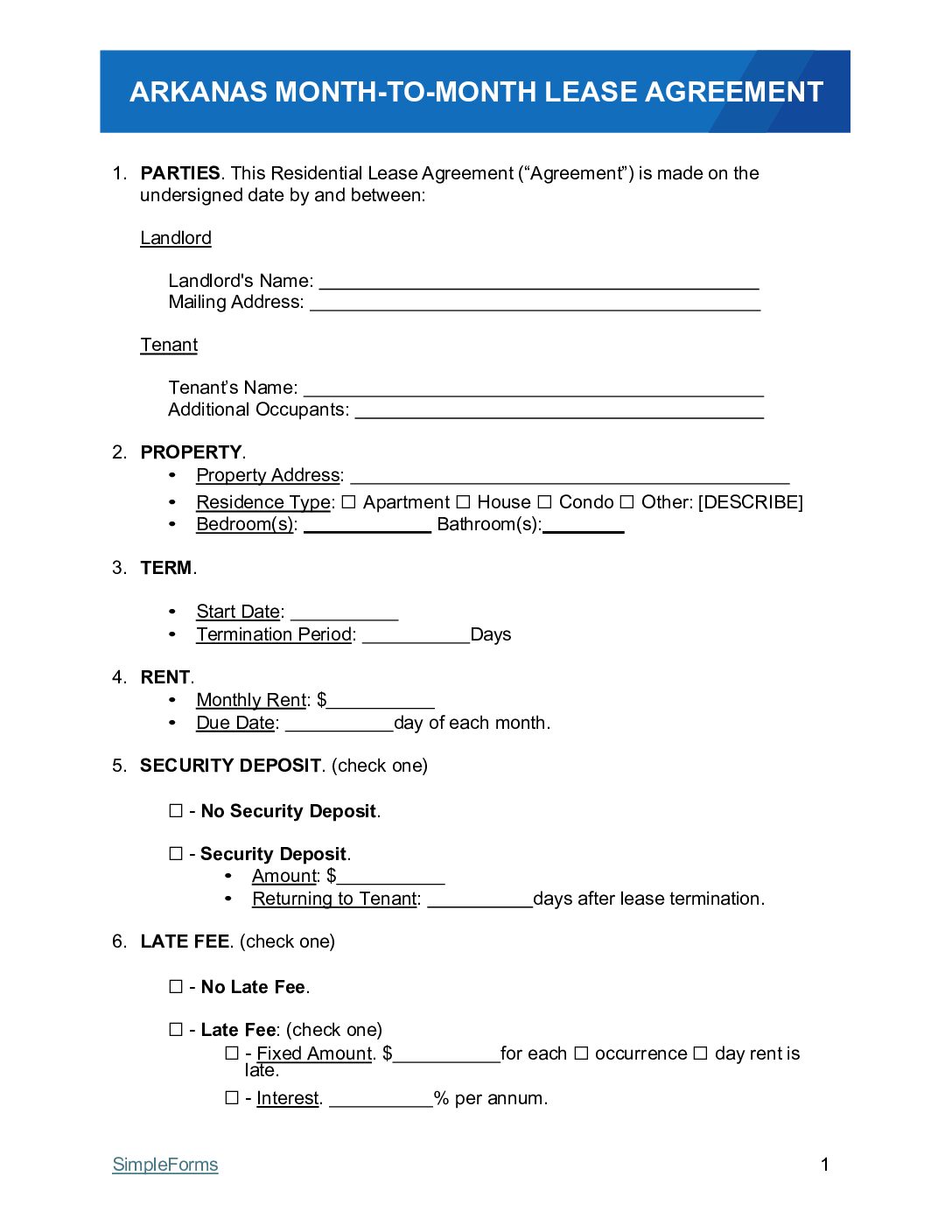

| Arkansas Month-to-Month Lease Agreement – a rental contract between a landlord and tenant that automatically renews each month, allowing either party to terminate with proper notice Download: PDF | Word (.docx) |

|

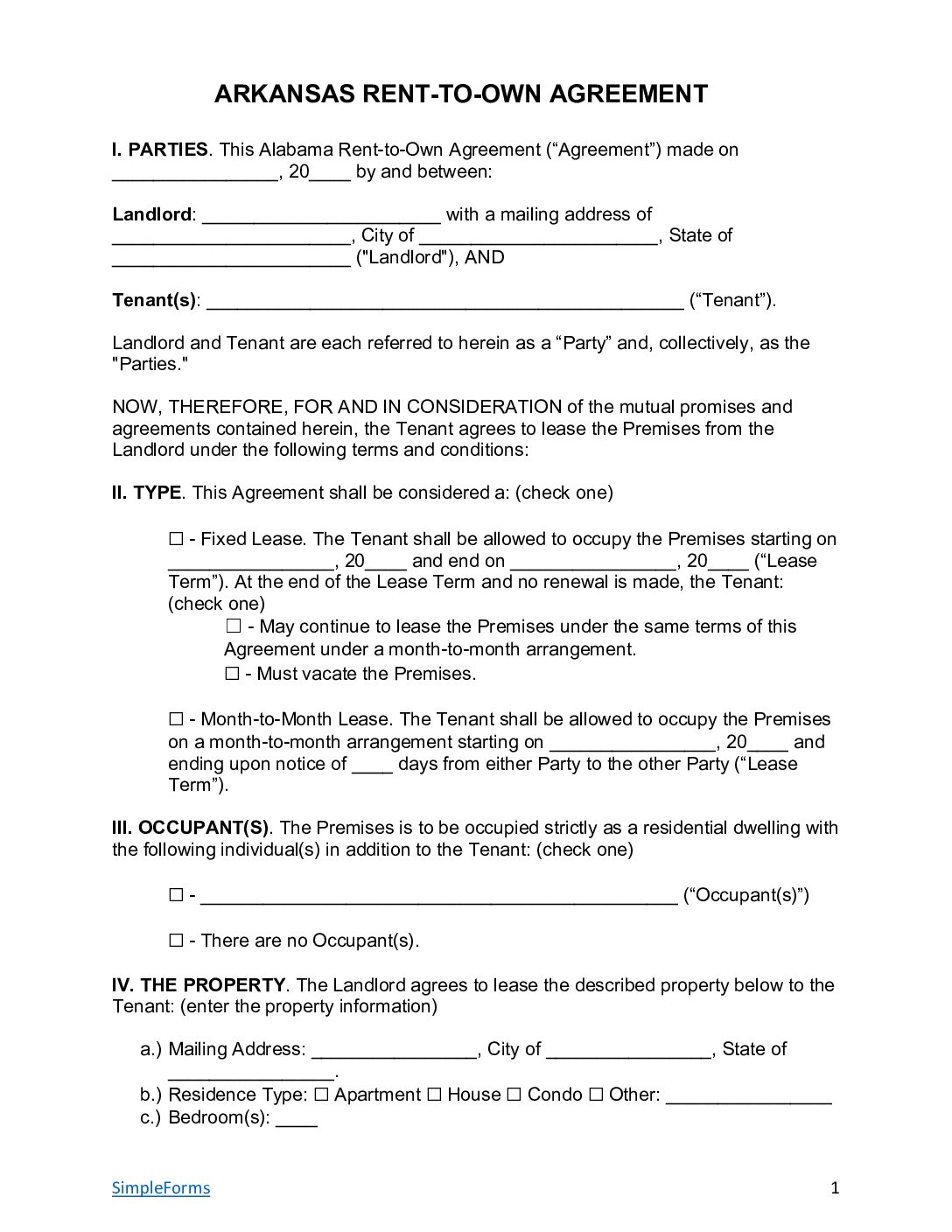

| Arkansas Rent to Own Lease Agreement – a contract that allows a tenant to rent a property with the option to purchase it later, usually after a specified period. Download: PDF | Word (.docx) |

|

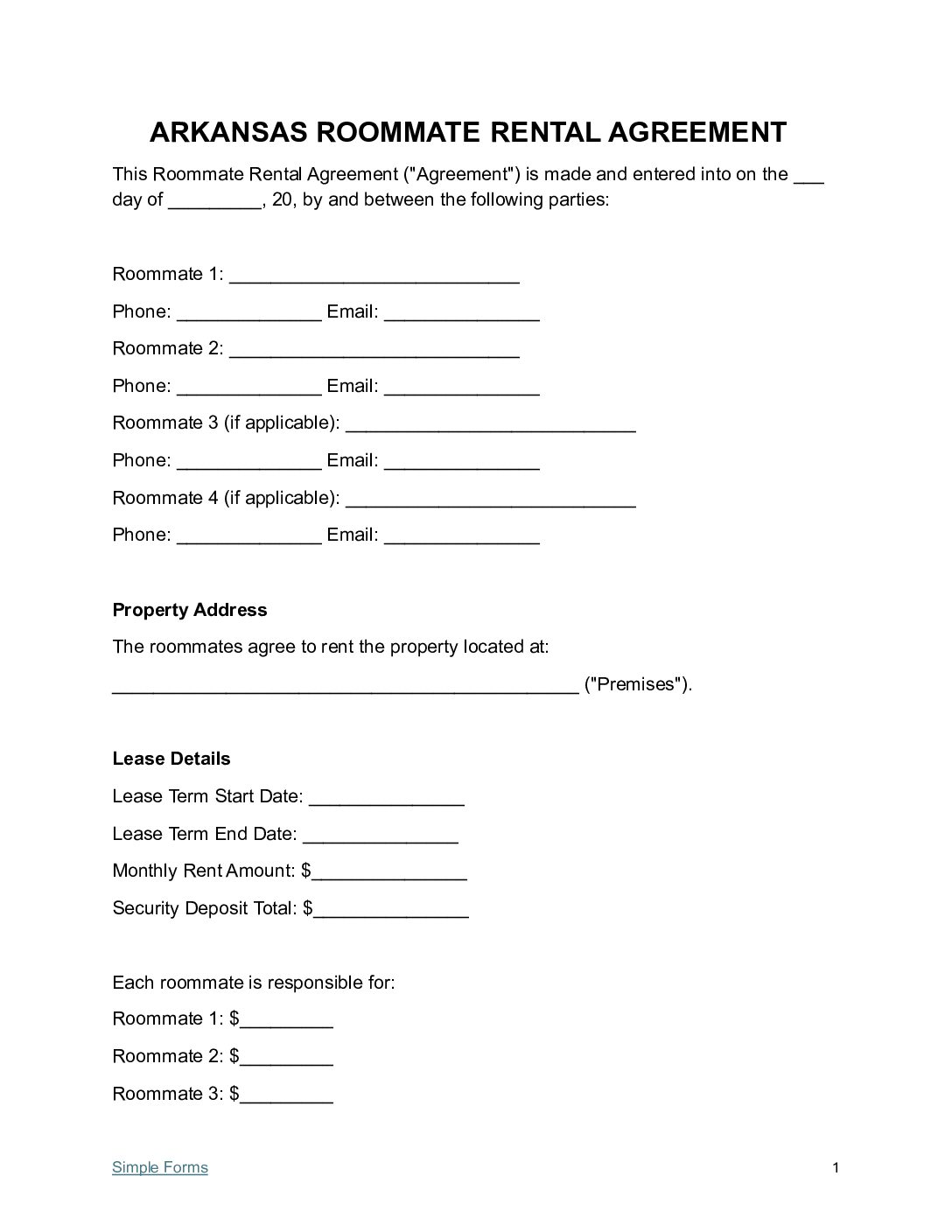

| Arkansas Roommate Lease Agreement – a contract between a landlord and tenant outlining the terms for renting a single room within a shared property. Download: PDF | Word (.docx) |

|

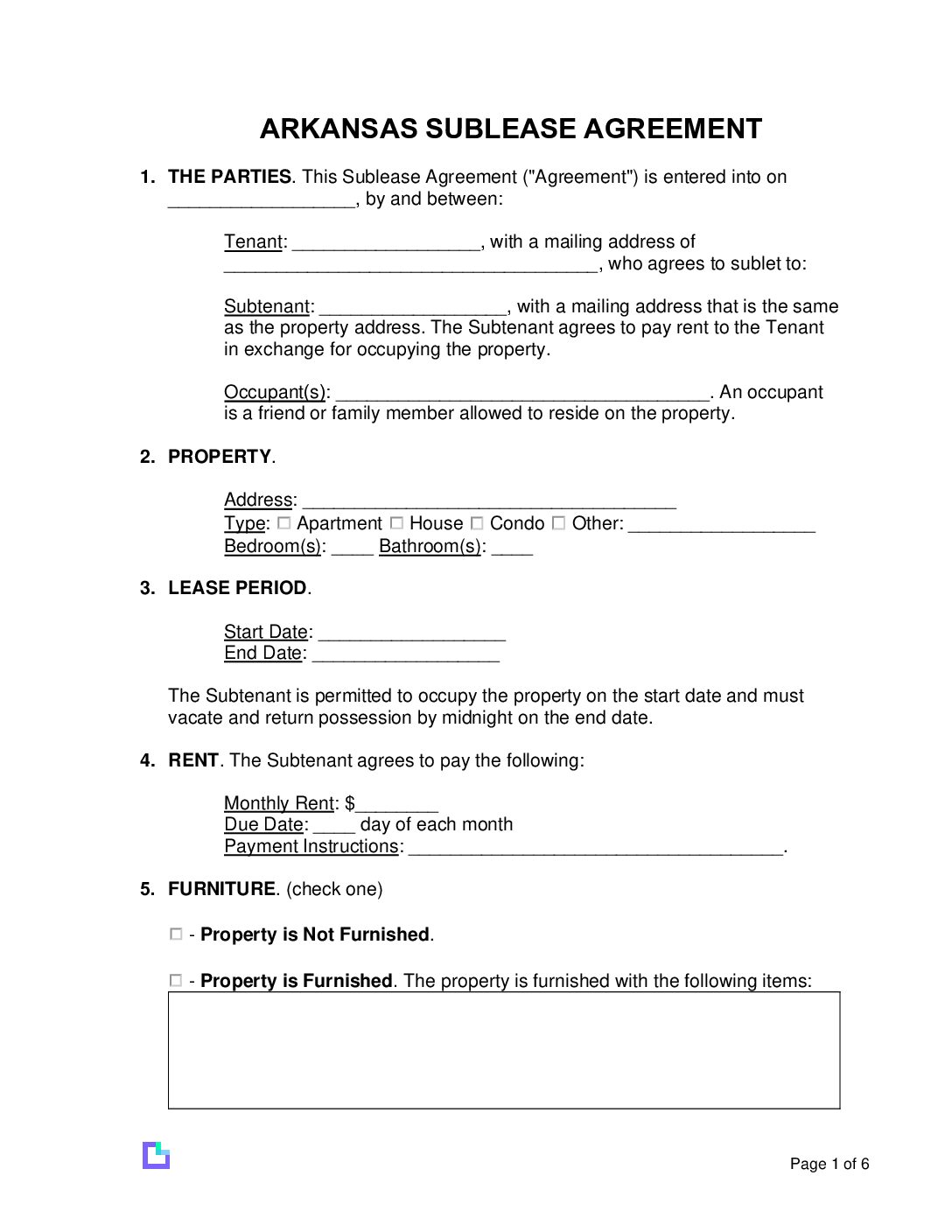

| Arkansas Sublease Agreement – is used to permit a renter to lease all or part of their rented space to someone else for a designated time. Download: PDF | Word (.docx) |

What does the Arkansas Rental Lease Agreement Template cover?

In Arkansas, landlords can charge a security deposit of up to two months’ rent for unfurnished properties and must maintain rental units in a habitable condition that is up to date with local health and safety codes. Tenants are protected from retaliatory eviction and have the right to make any repairs if landlords fail to do so after being notified.

The following includes an in-depth detail of what laws are included in the Arkansas rental lease agreement template:

- Security Deposits

- Disclosure of Lead-Based Paint

- Retaliatory Eviction

- Notice for Lease Termination

- Condition of Premises

- Tenant’s Right to Repairs

- Eviction Process

- Habitability Laws

- Tenant’s Right to Privacy

Security Deposits

Security deposits that landlords can requests from tenants cannot be more than a total of the two-months rent amount for unfurnished properties and no more than one-months rent for furnished properties.[1]

Disclosure of Lead-Based Paint

For homes built before 1978, landlords must disclose any known lead-based paint hazards and give the tenant the lead-based paint disclosure form.[2]

Retaliatory Eviction

- Landlords cannot go after tenants legally if tenants report any health or safety issues.

- Landlords also cannot evict or increase rent if tenants report them for the same issues.[3]

Notice for Lease Termination

- Month-to-month leases – landlords must give tenants at least 30-days’ notice.

- Yearly leases – the notice depends on whats written in the agreement.[4]

Condition of Premises

Landlords are required to keep the property habitable by keeping up with the standard health and safety codes.[5]

Tenant’s Right to Repairs

Eviction Process

Habitability Laws

Tenant’s Right to Privacy

Required Disclosure Forms

Landlords must give the Tenants the following disclosure forms:

- Lead-Based Paint Disclosure Form – For properties built before 1978, a lead-based paint disclosure and EPA pamphlet must be signed by the Tenant.[10]

- Move-in Inspection – Tenant must sign to show they received a report on any known known property issues (i.e., HVAC system issue or a ceiling leak).[11]

- Owner/Manager Contact Info – Lease includes Landlord/Manager’s name and contact details including full mailing address to send notices. [12]

Sample Arkansas Rental Lease Agreement Template

Sources

Arkansas Lease Agreement Checklist

✅ Before Signing Checklist

Landlord Preparation:

Tenant Preparation:

✅ After Signing Checklist

Immediate Actions (First 24 Hours):

First Week Actions: