By Type (6)

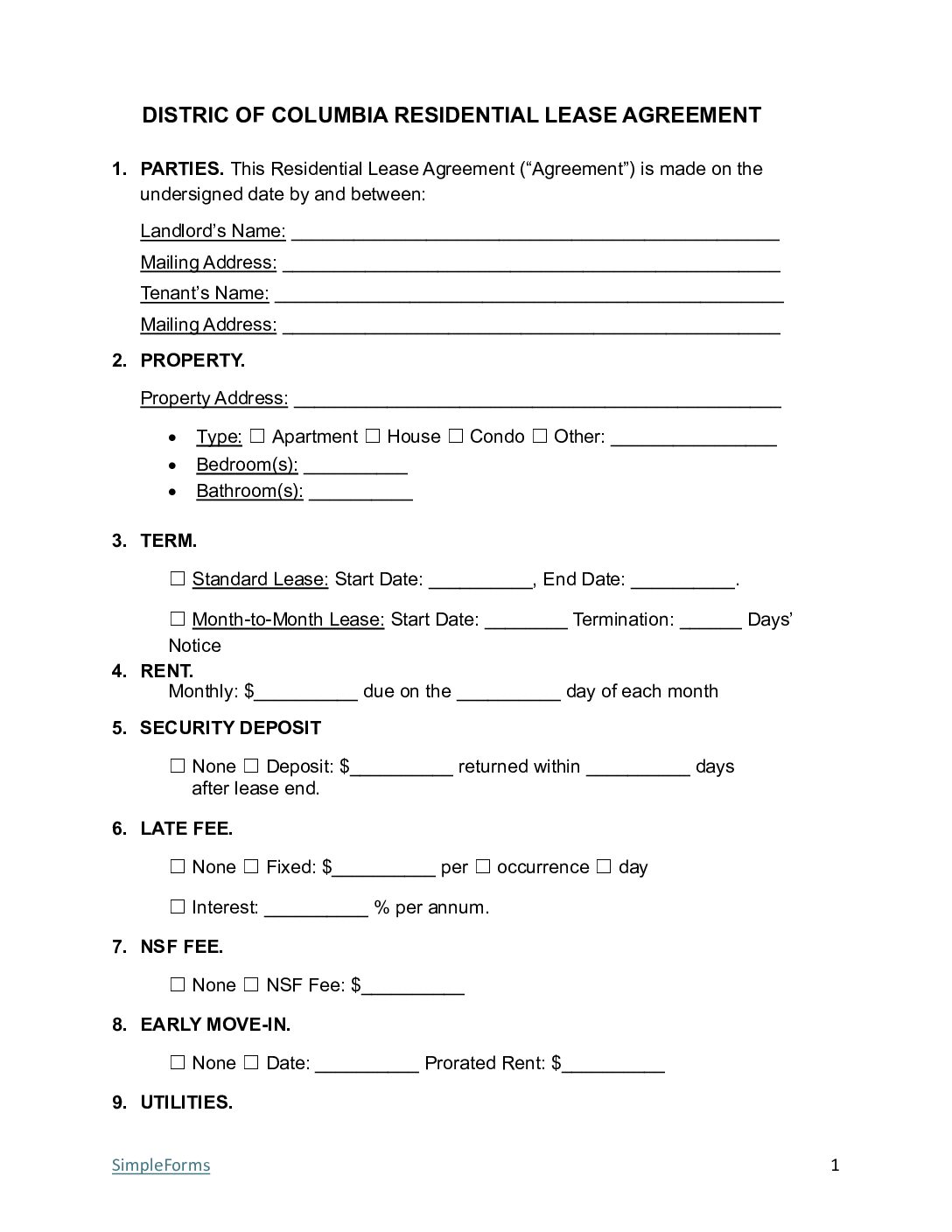

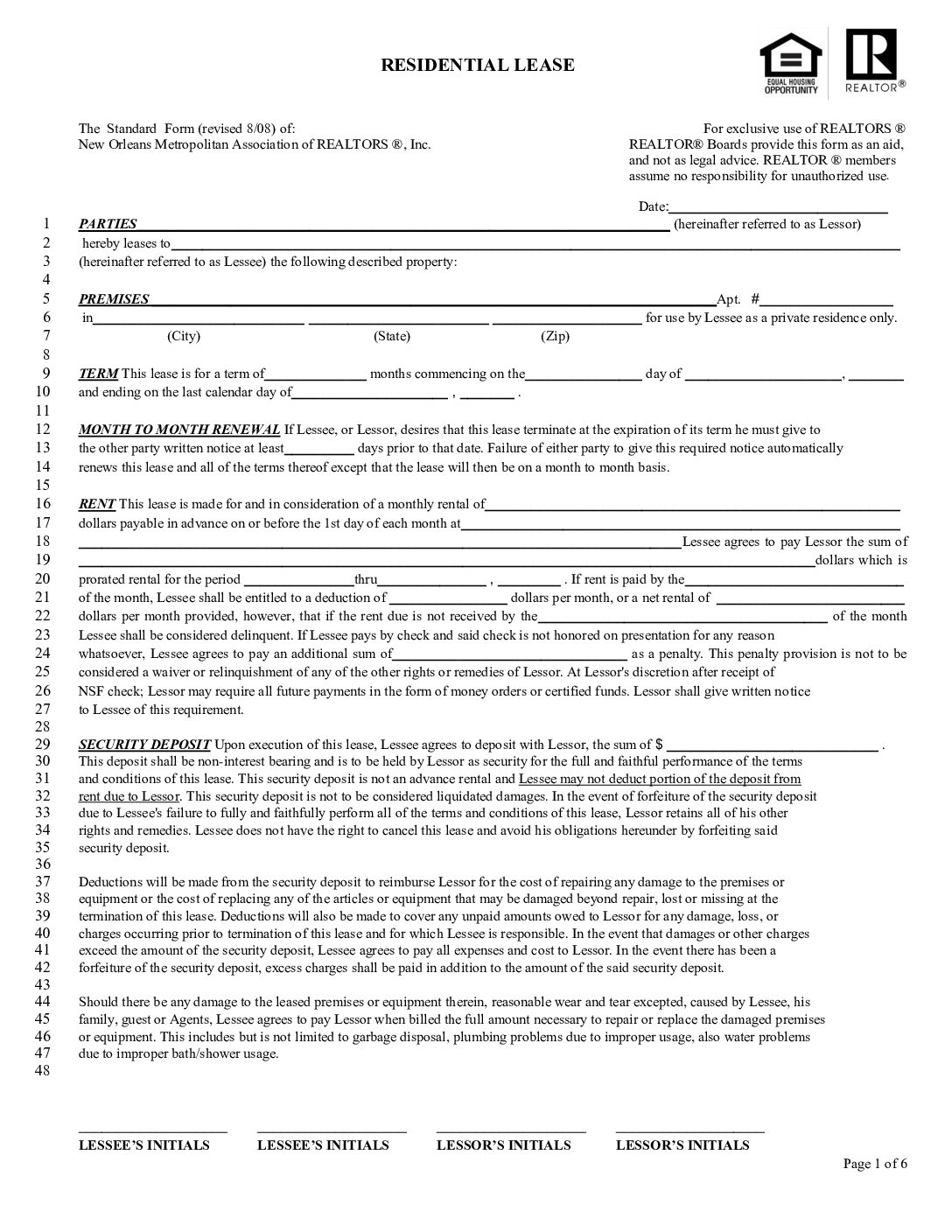

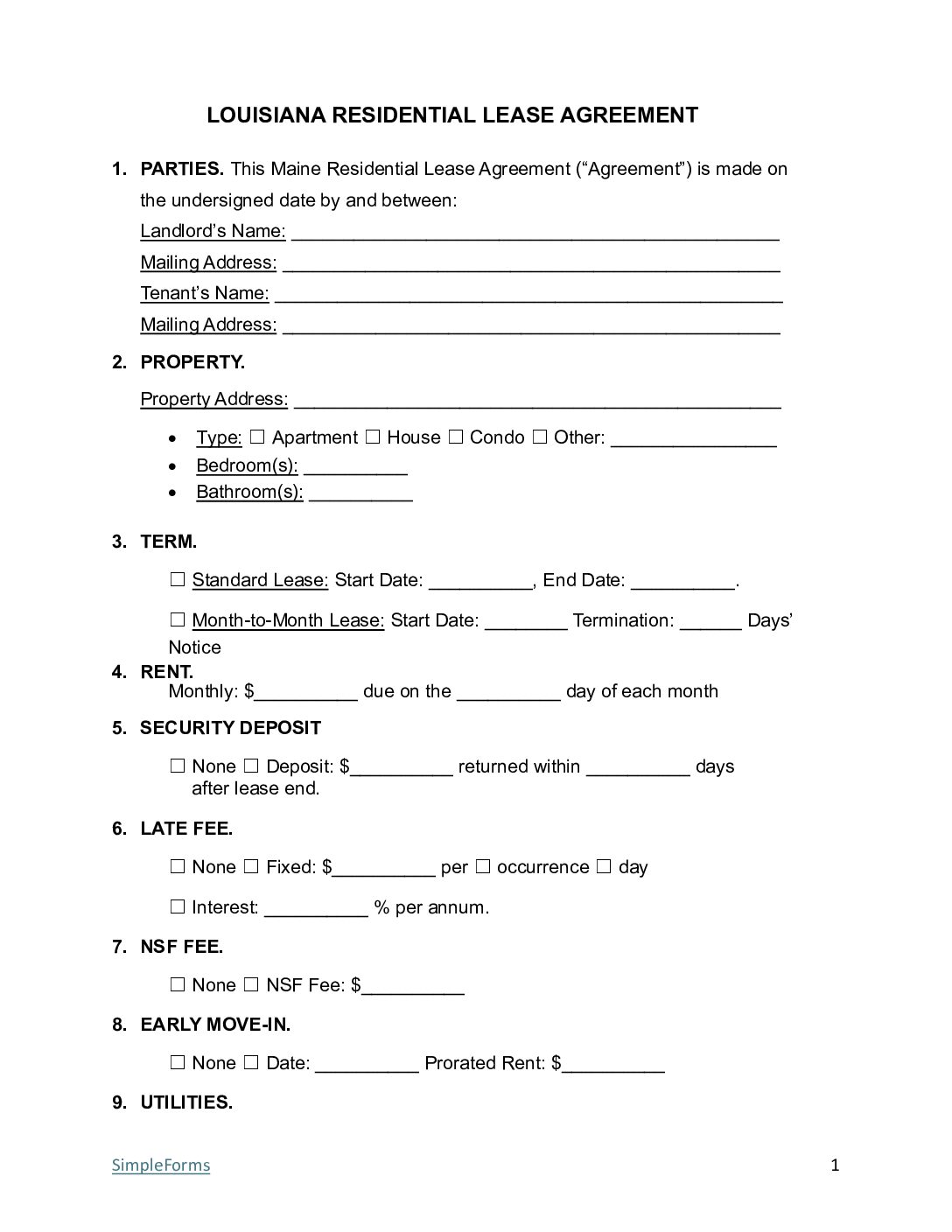

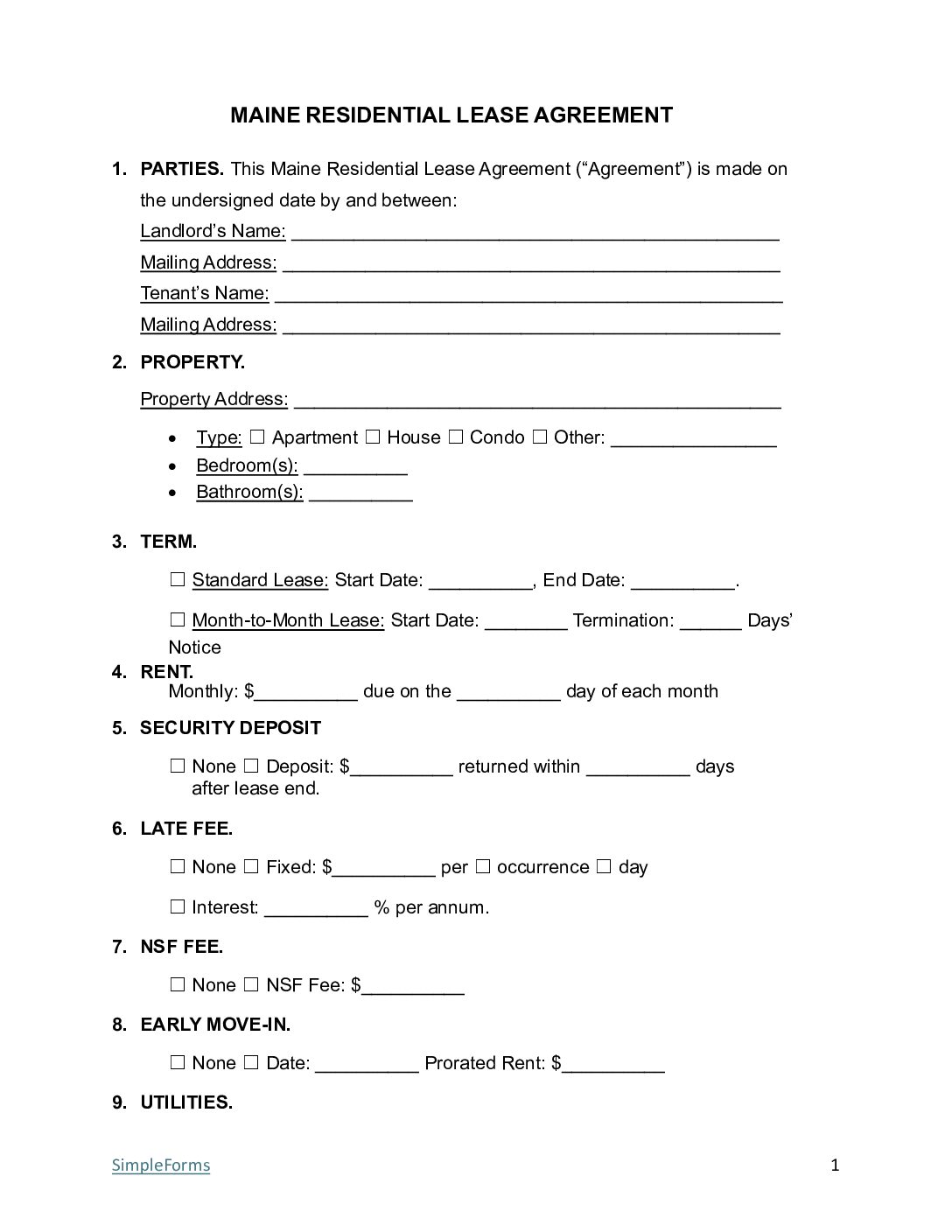

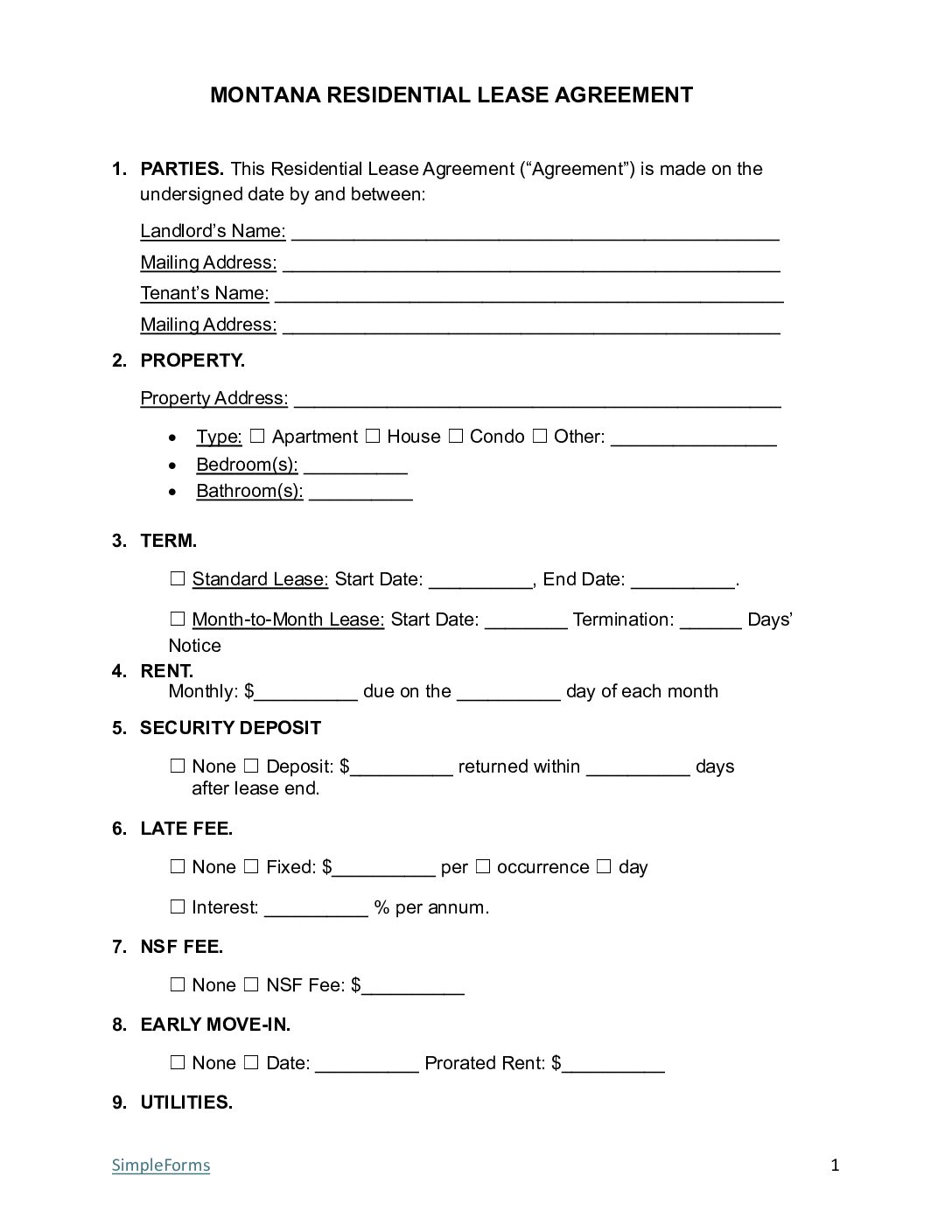

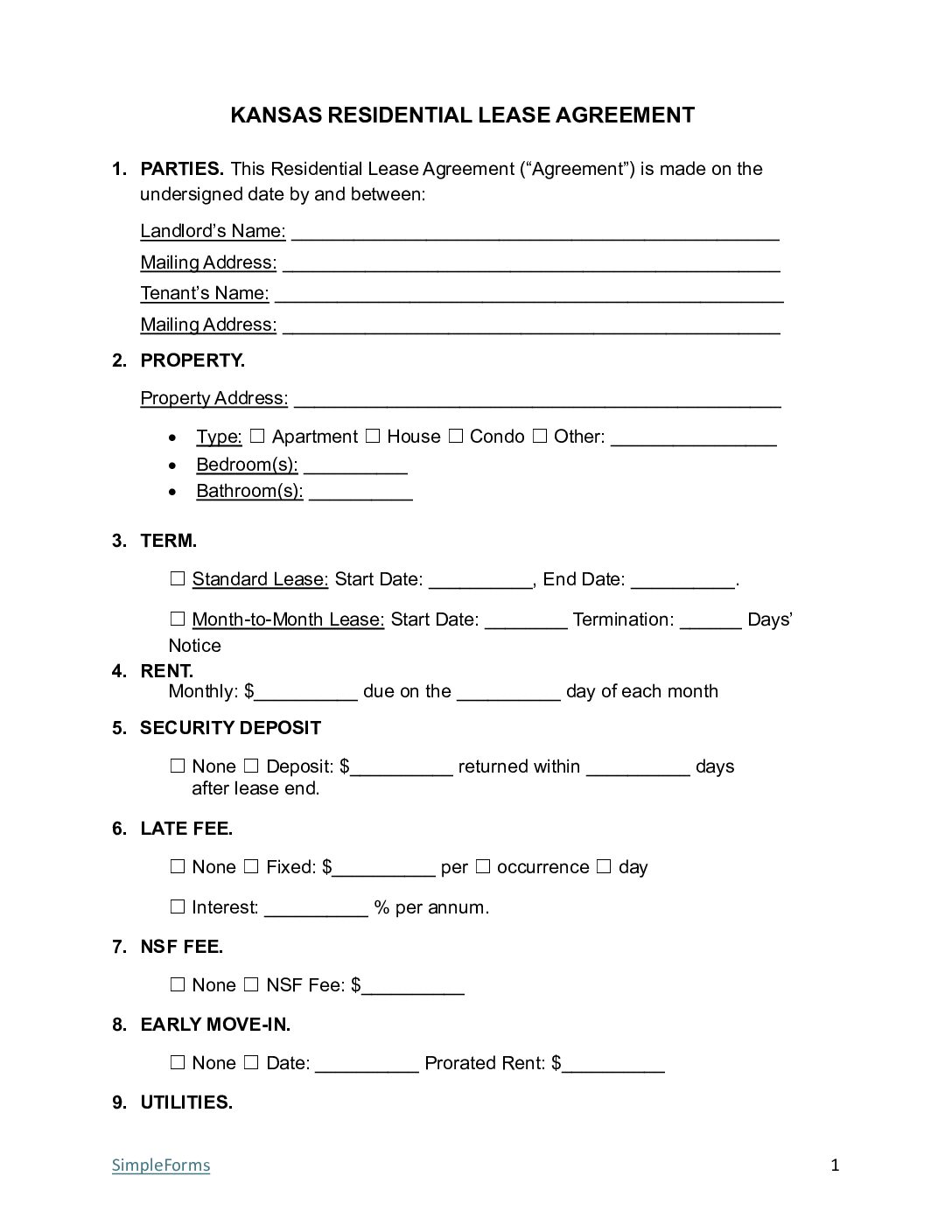

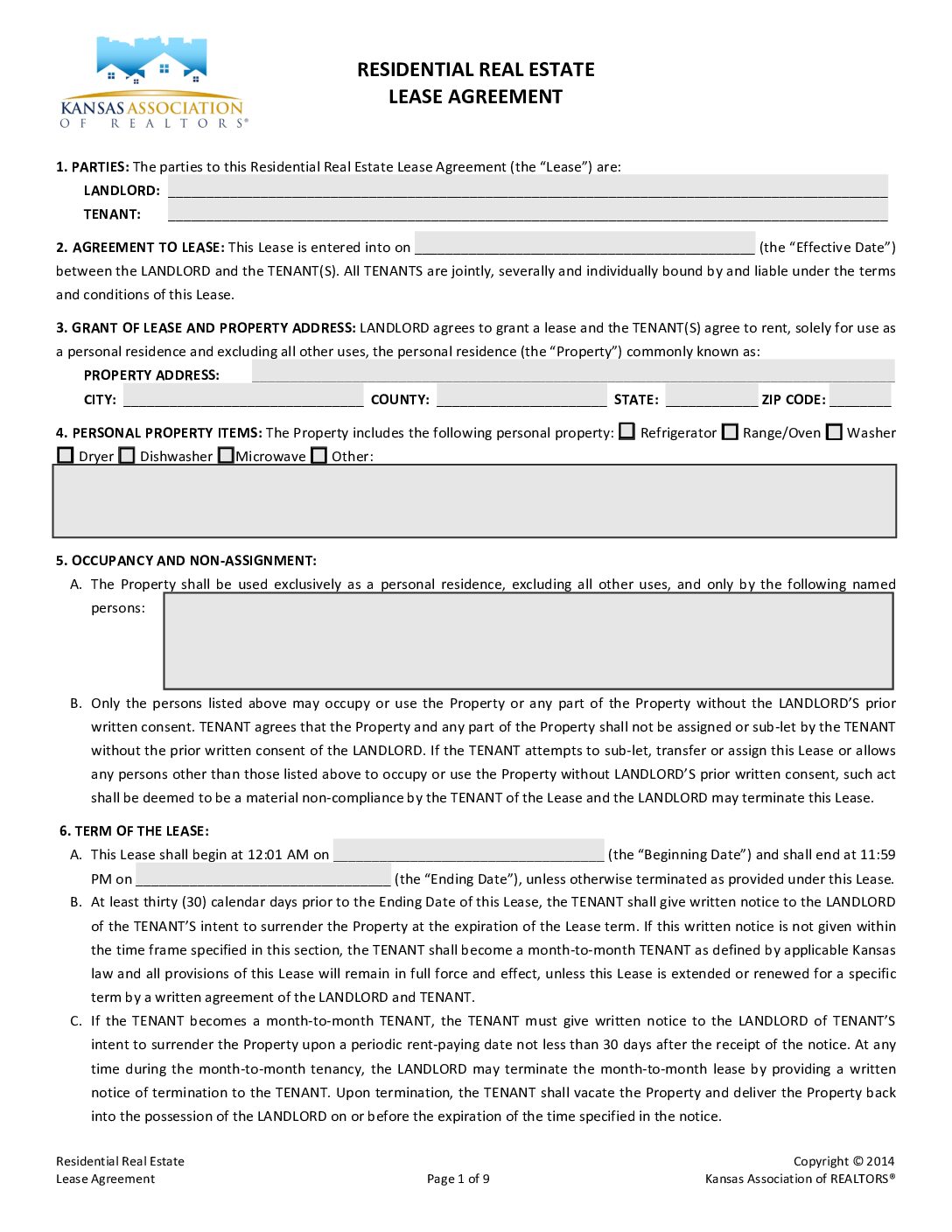

| Residential Lease Agreement – Standard 1-year lease term. Download: PDF | Word (.docx) |

|

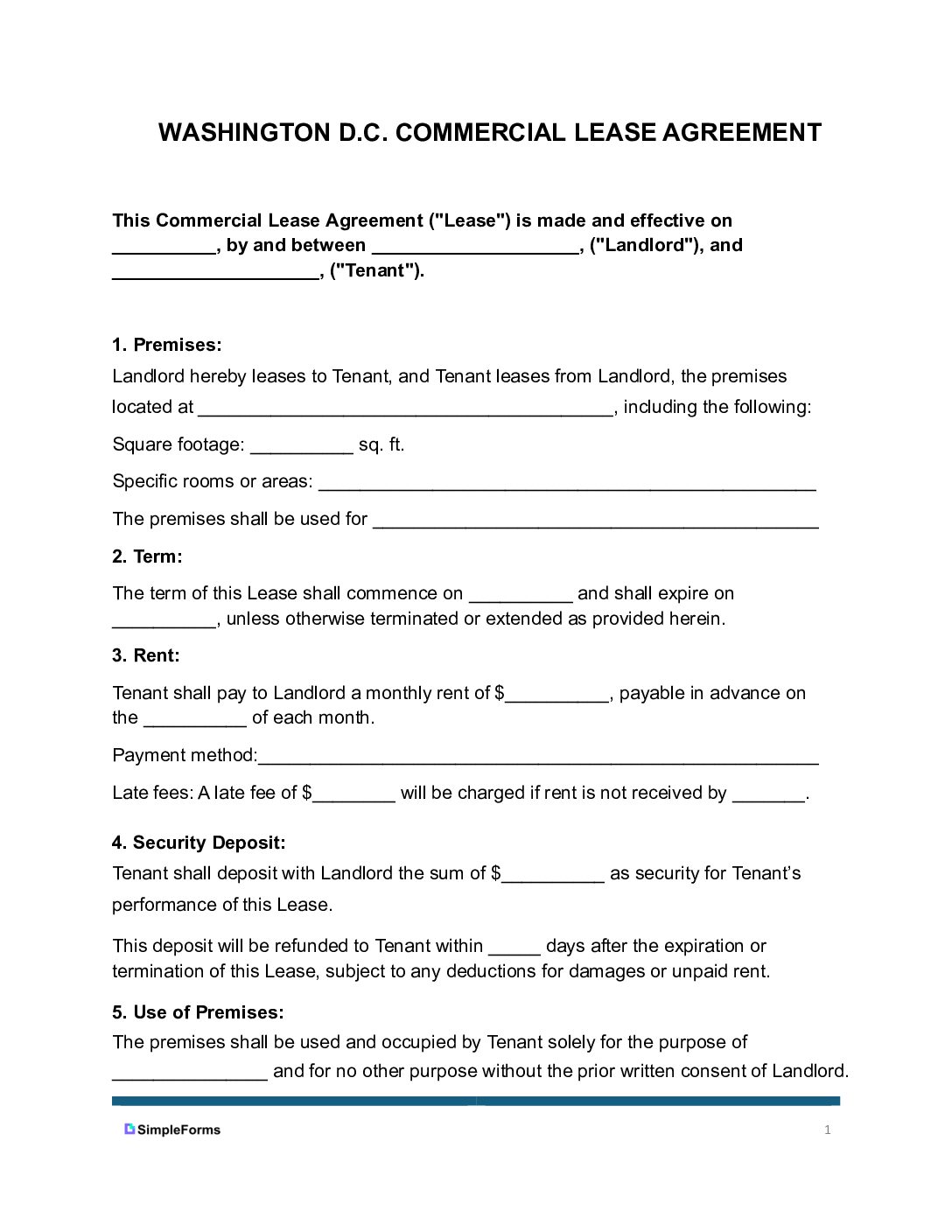

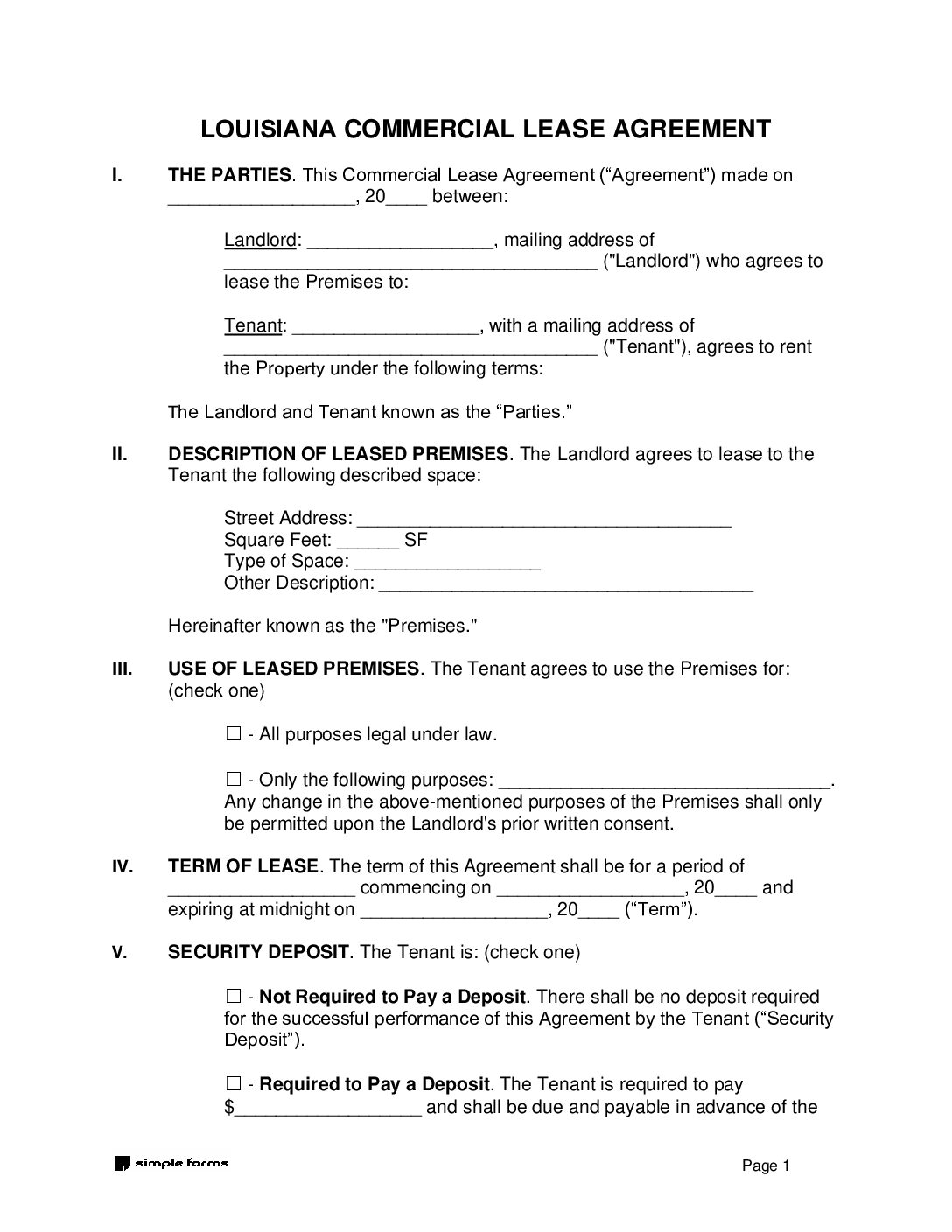

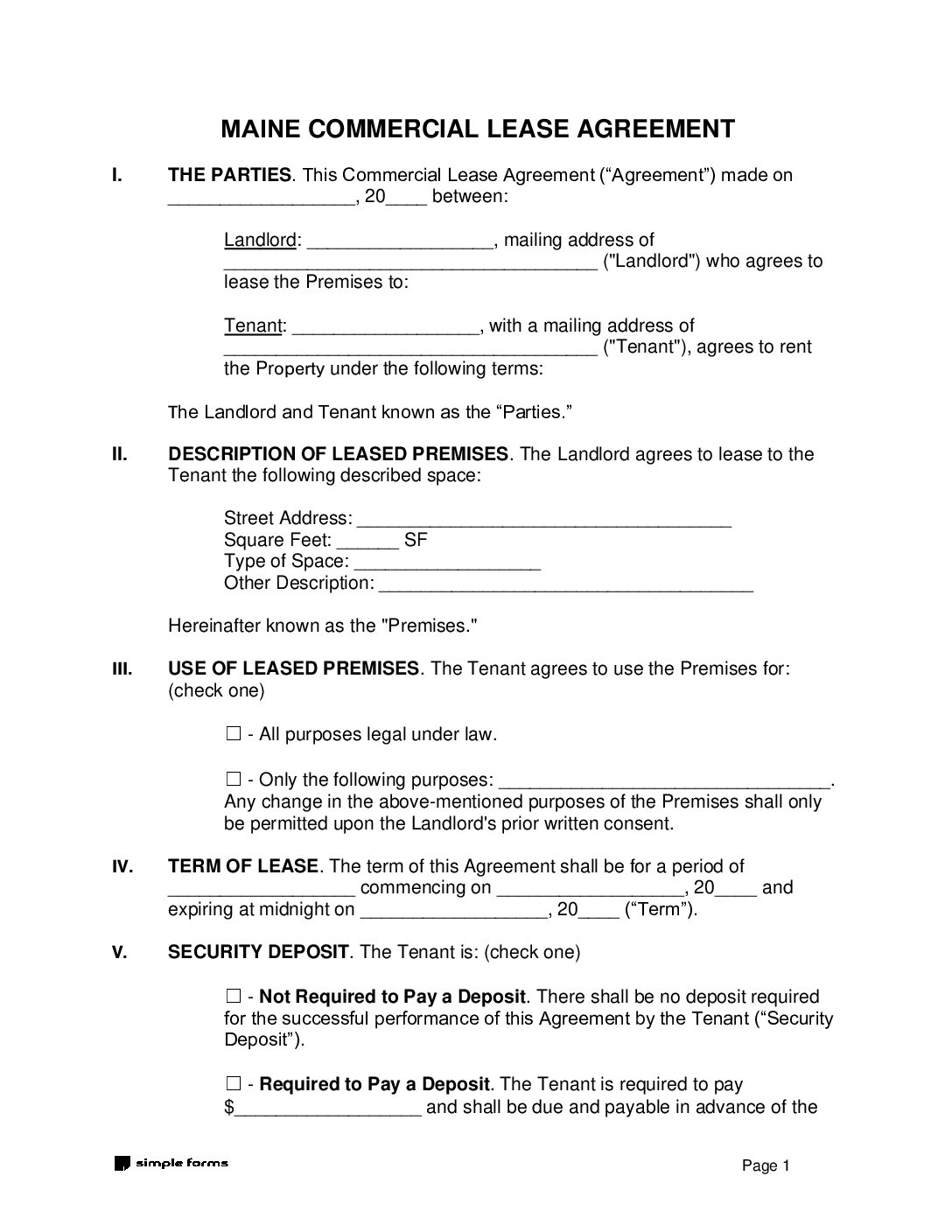

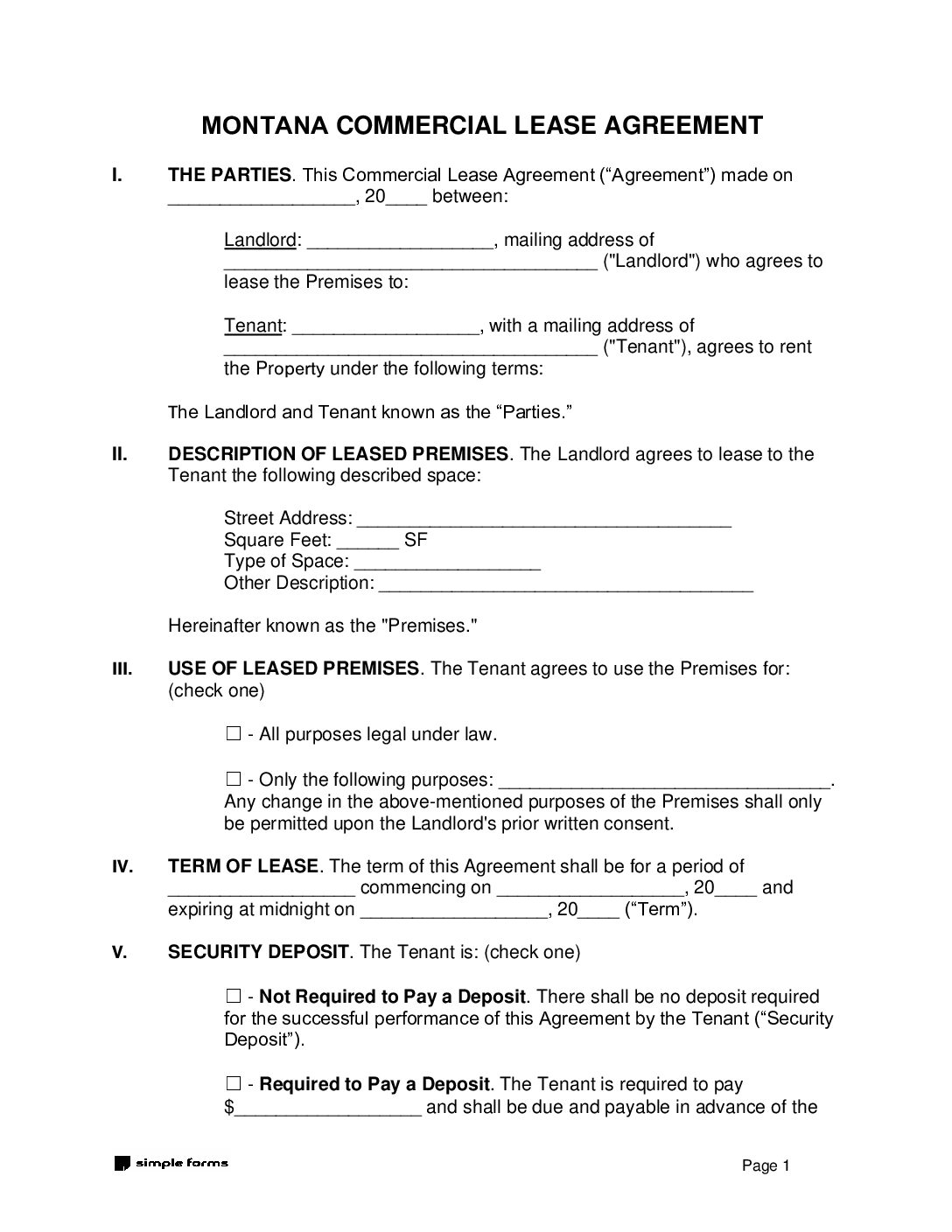

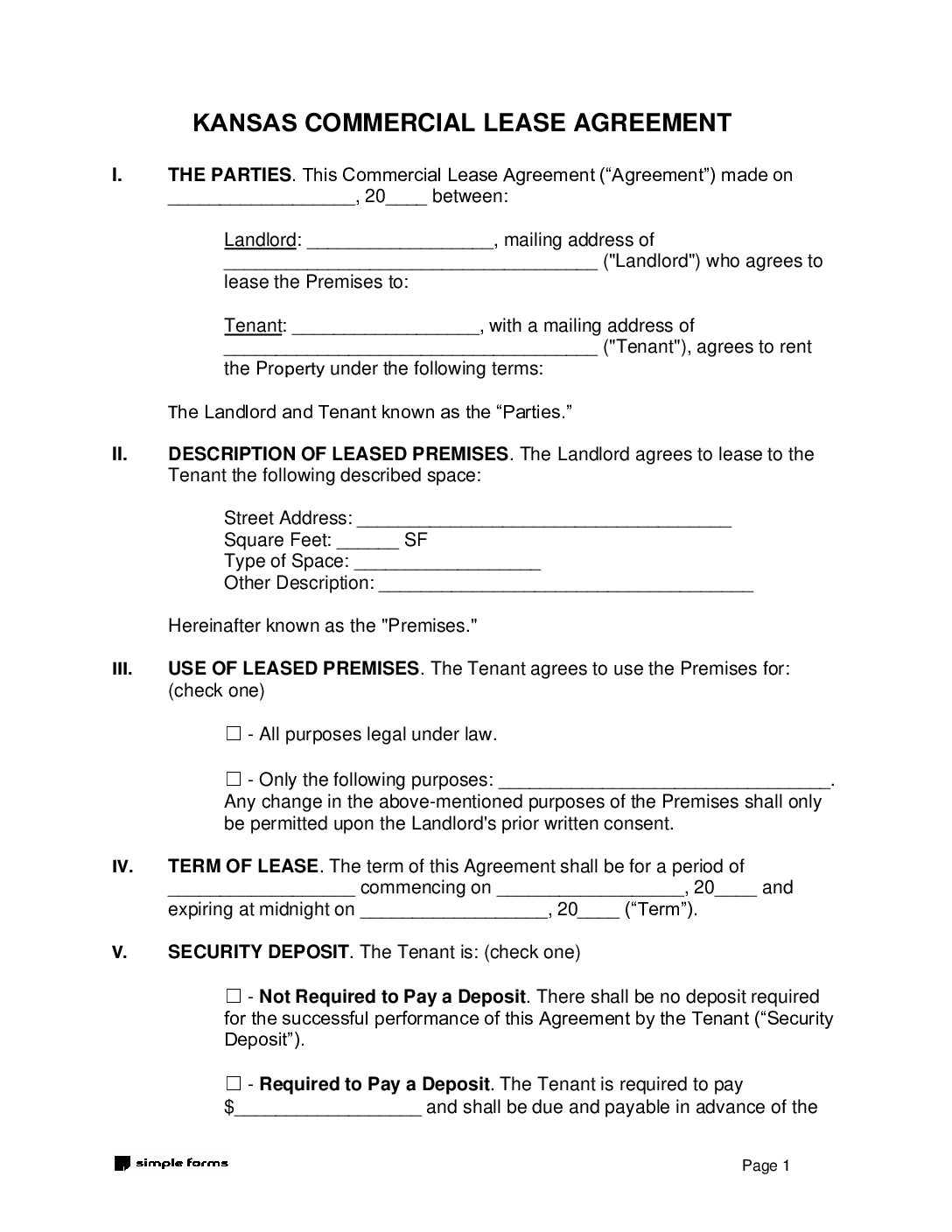

| Commercial Lease Agreement – Used for retail spaces, office buildings, warehouses, and industrial facilities. Download: PDF |

|

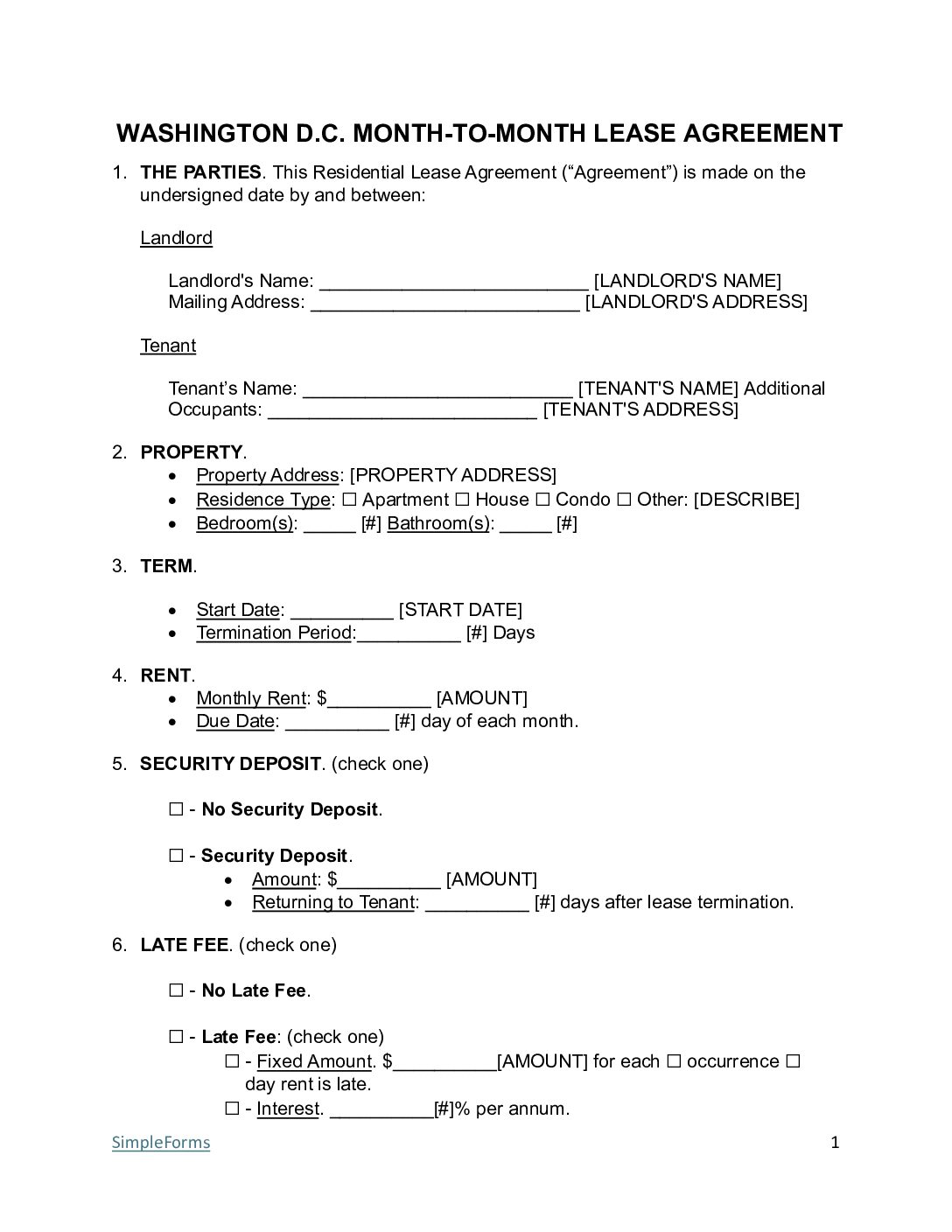

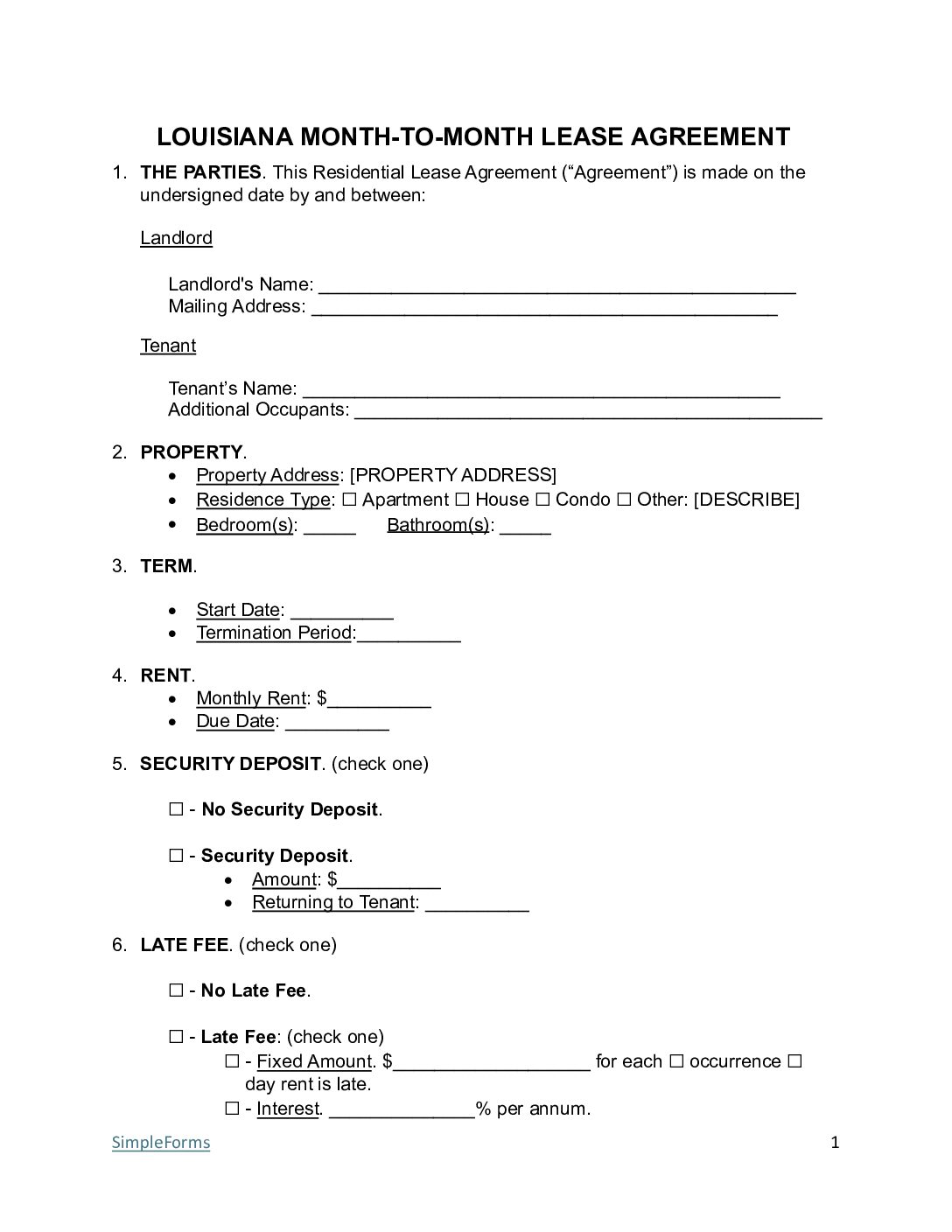

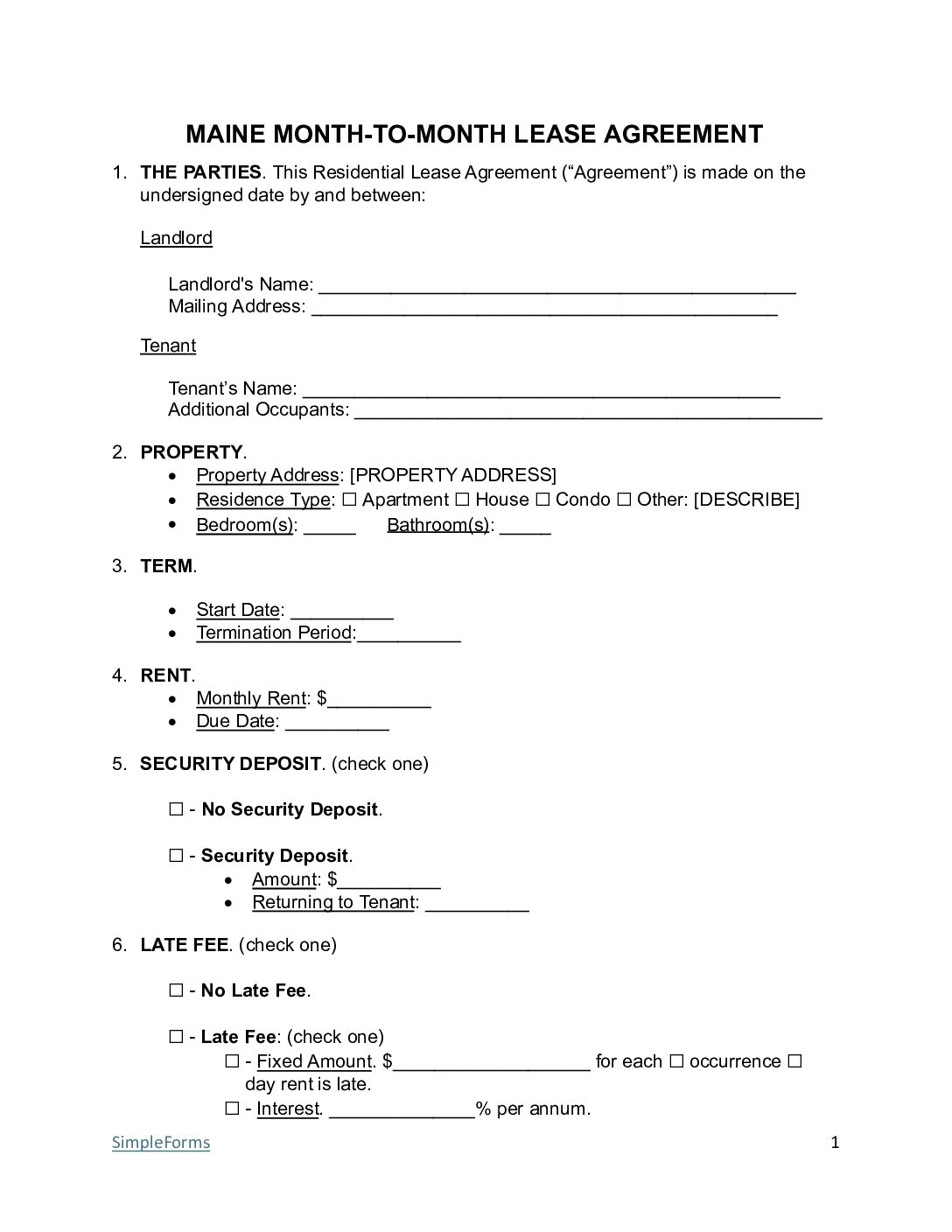

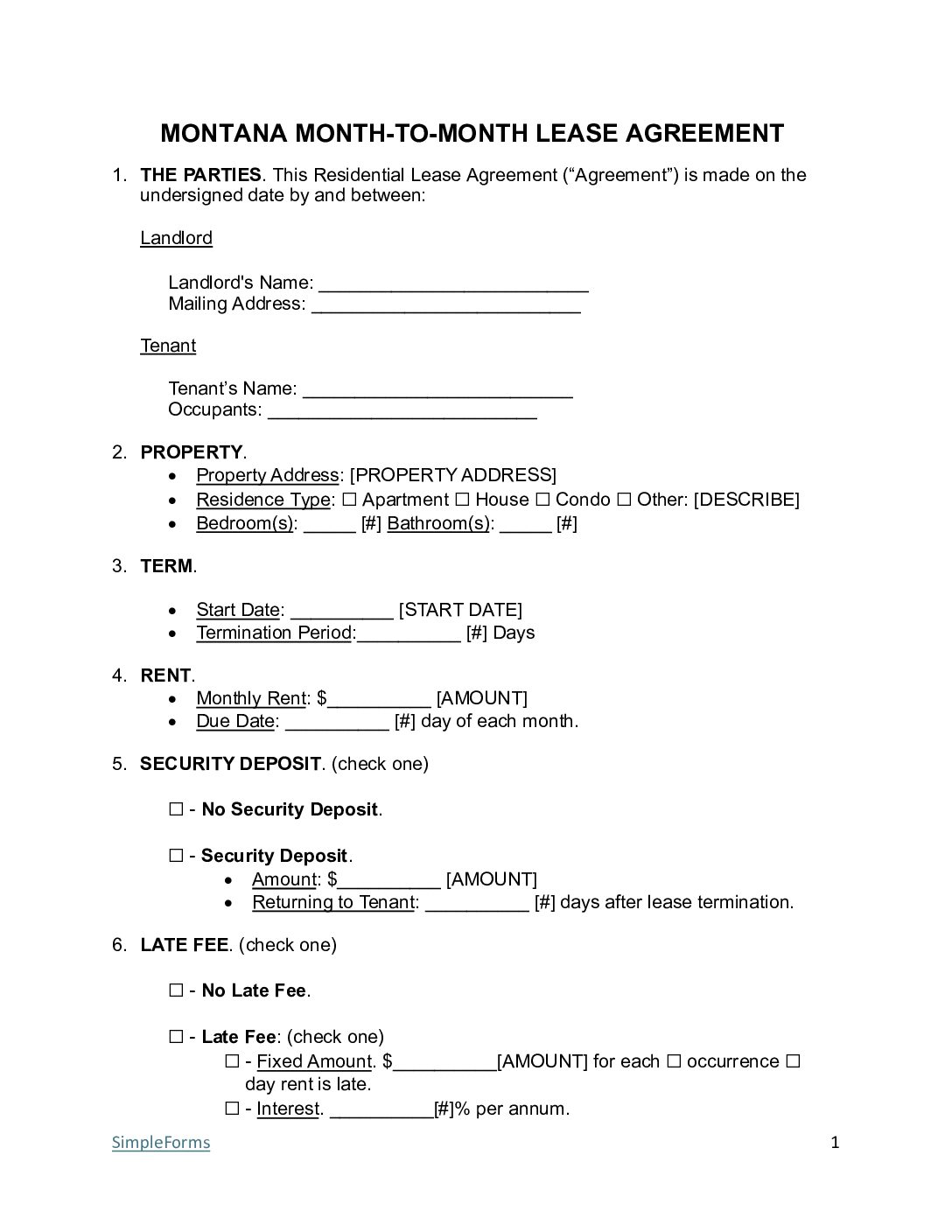

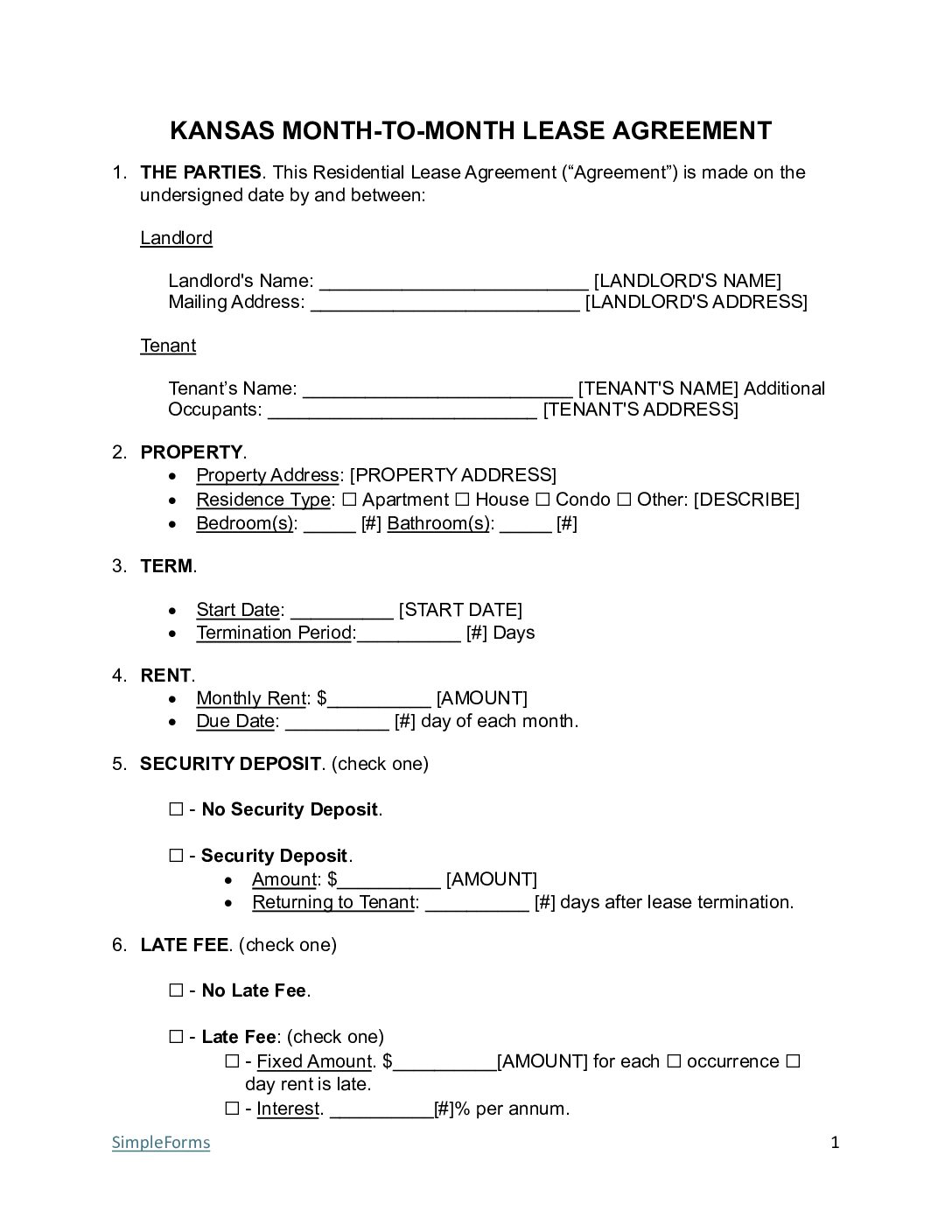

| Month-to-Month Lease Agreement – Tenancy at will with renewals every 30 days. Download: PDF | Word (.docx) |

|

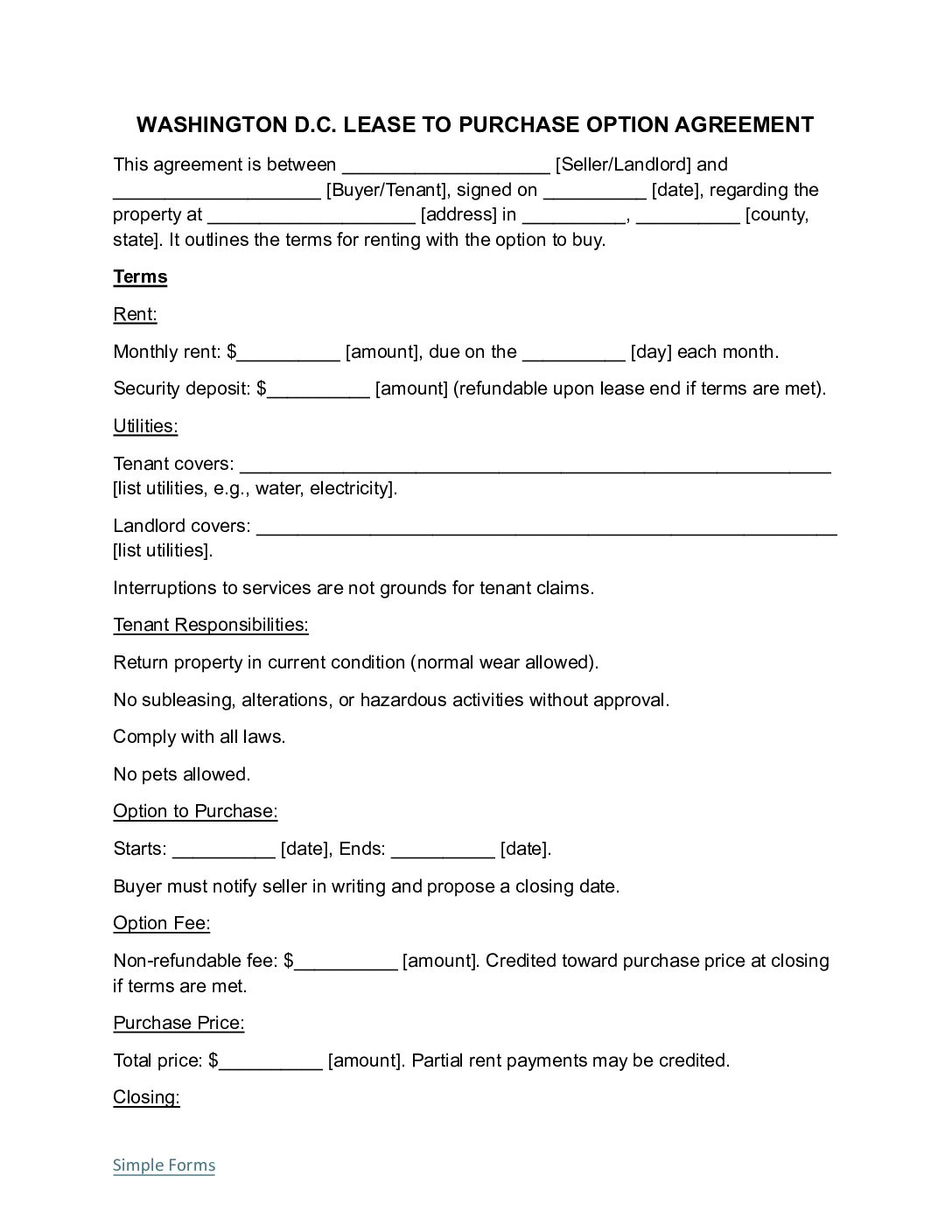

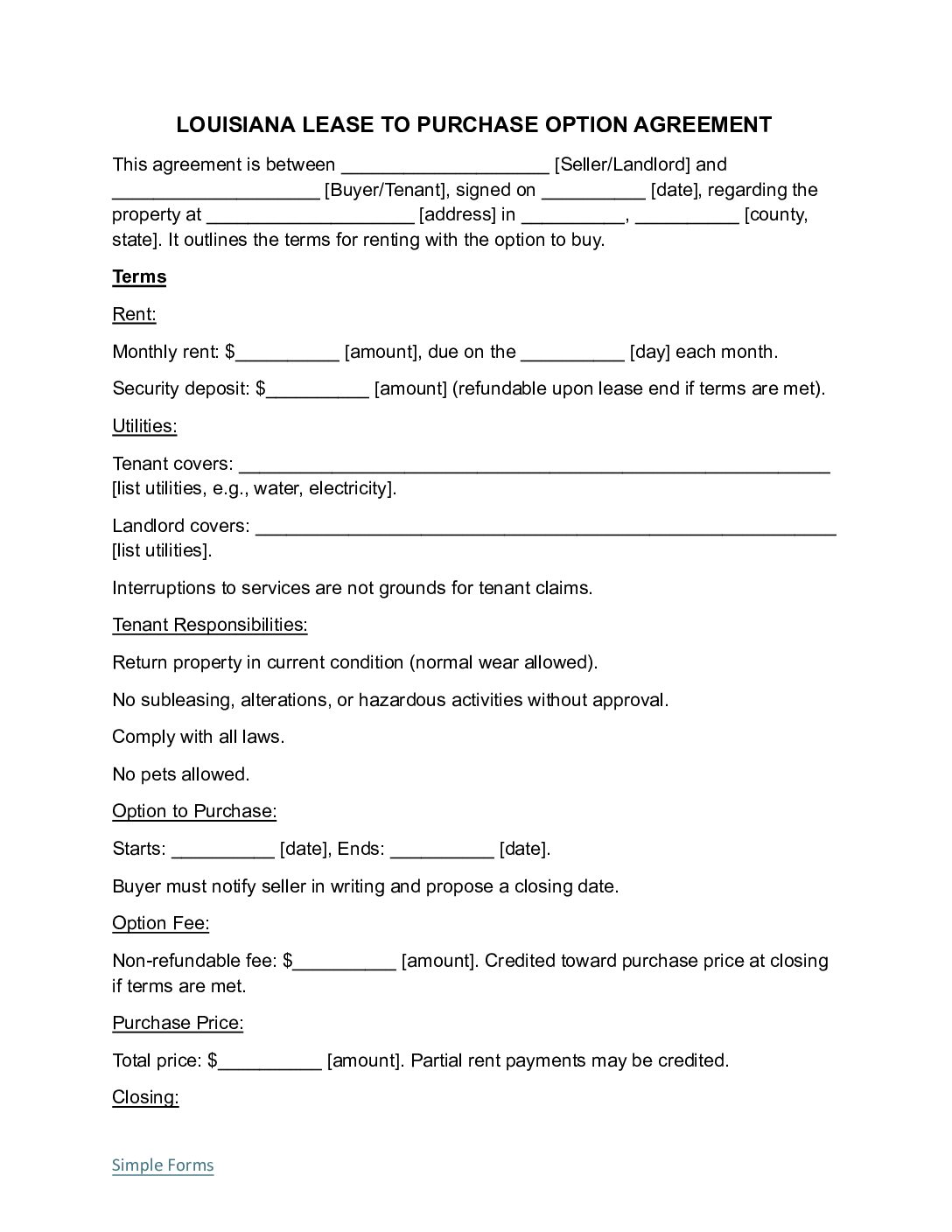

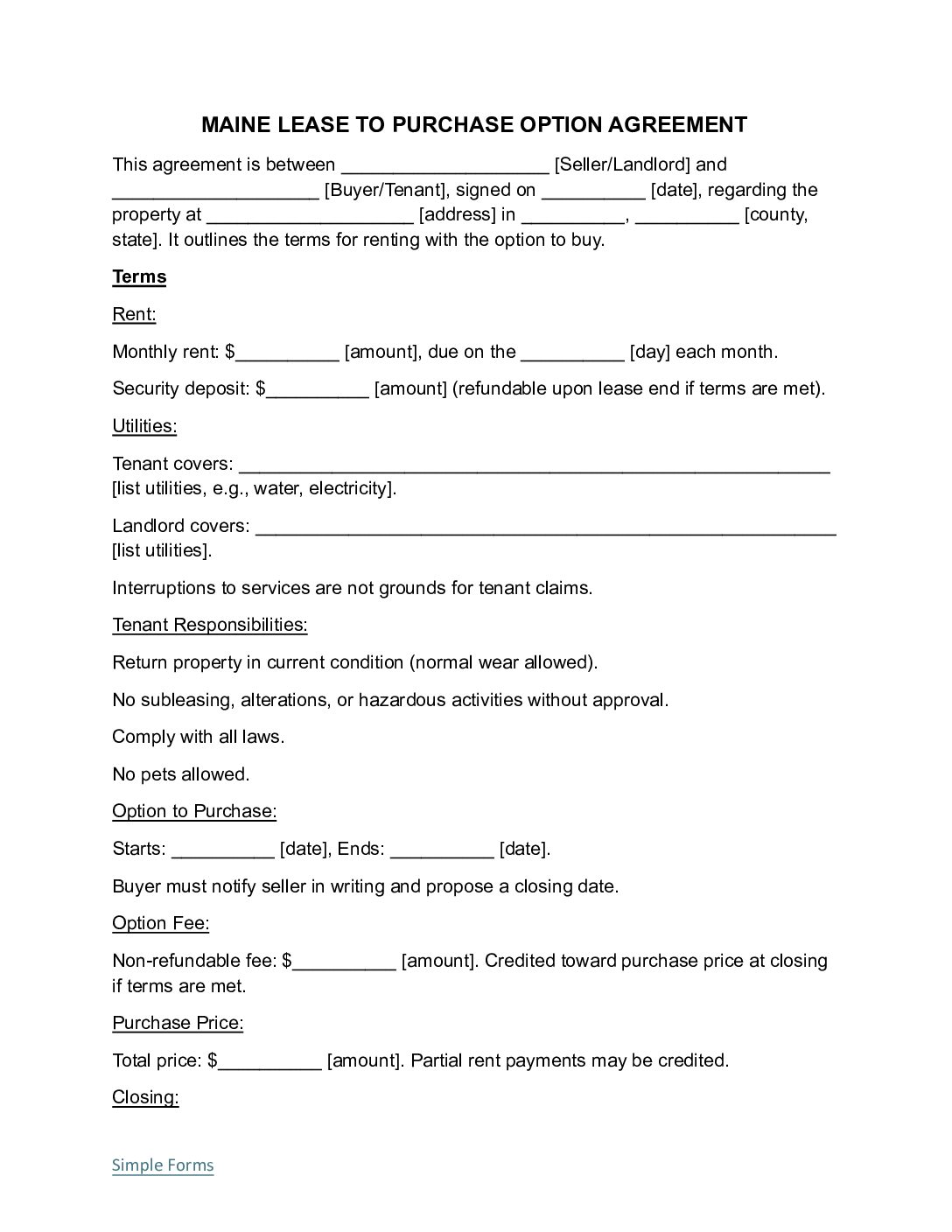

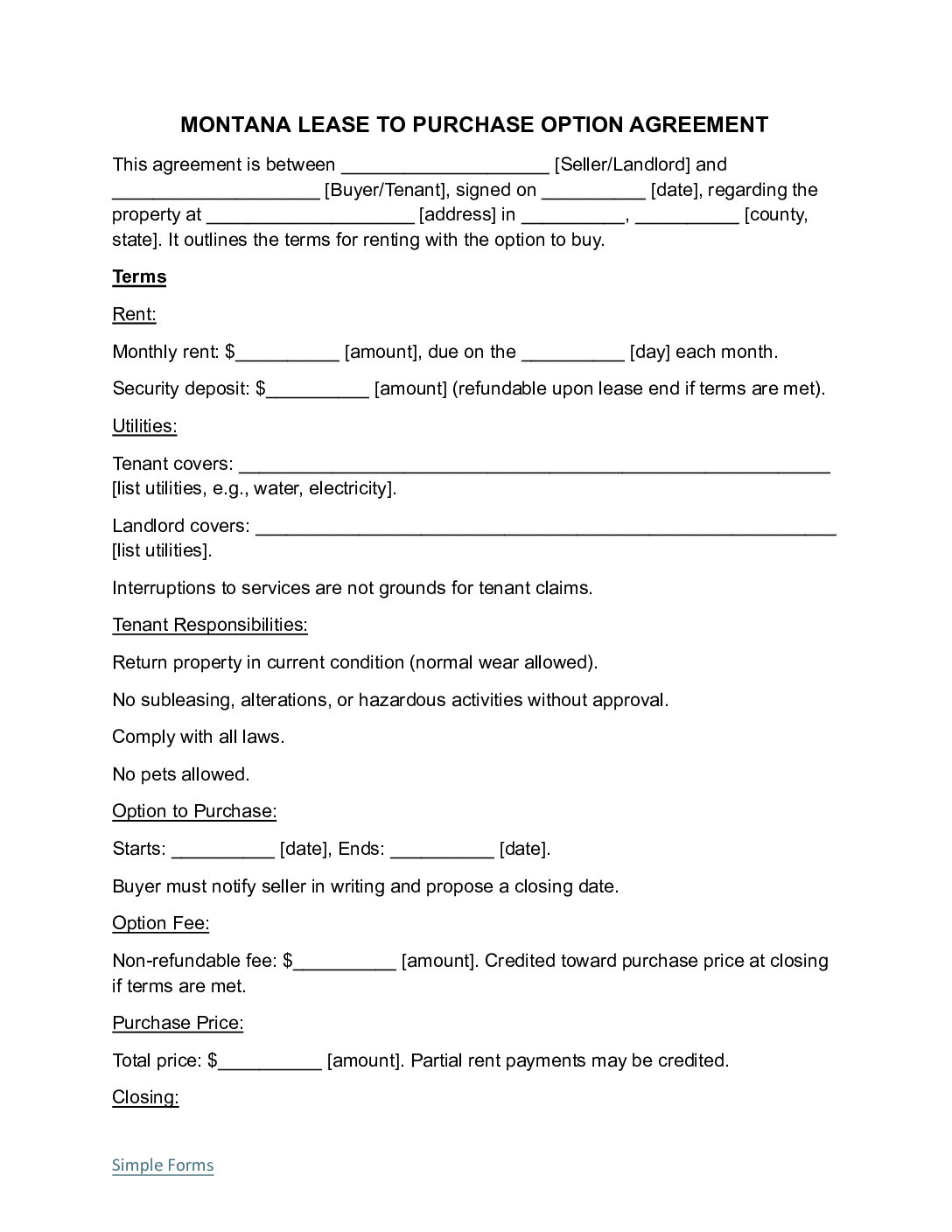

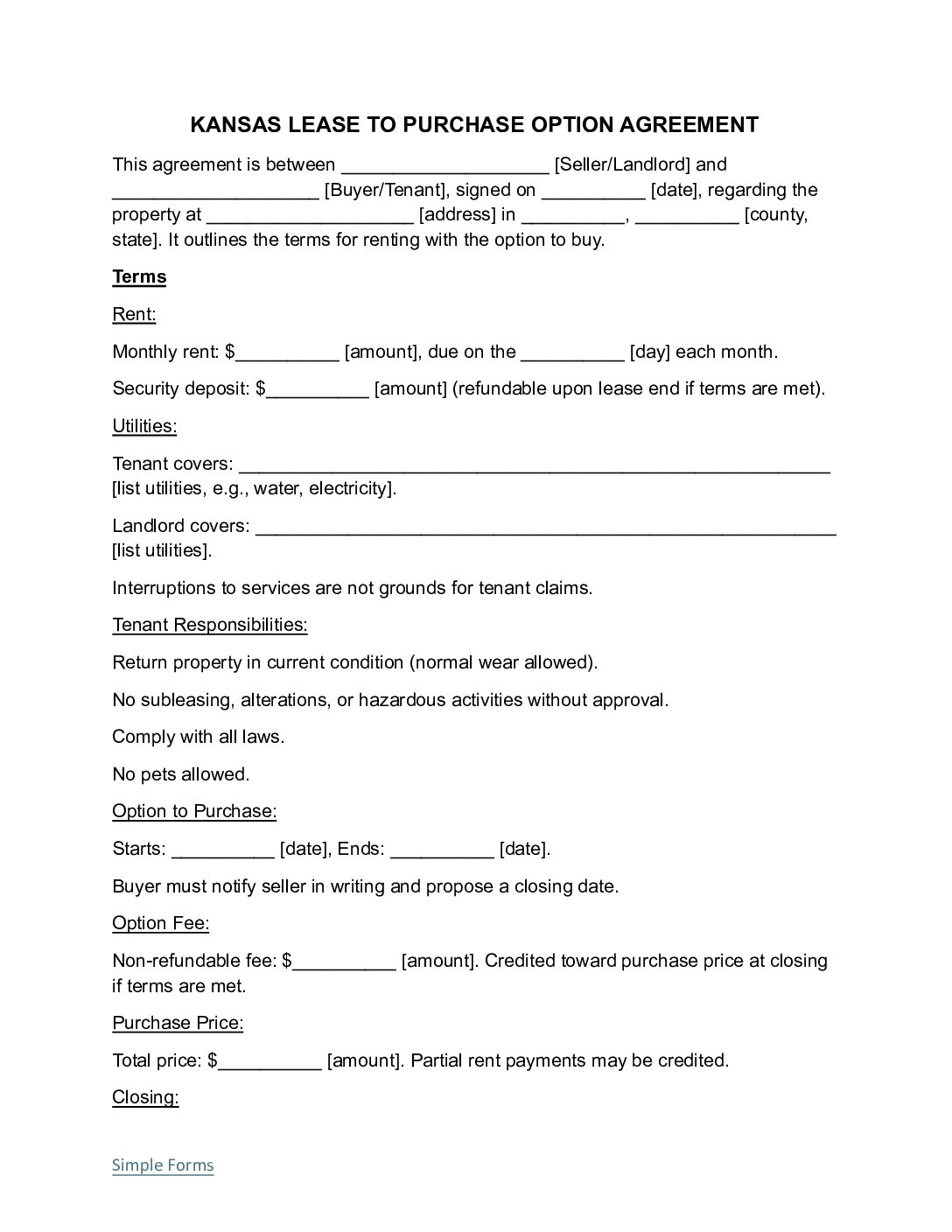

| Rent to Own Lease Agreement – A lease that includes an option for the tenant to purchase the property. Download: PDF | Word (.docx) |

|

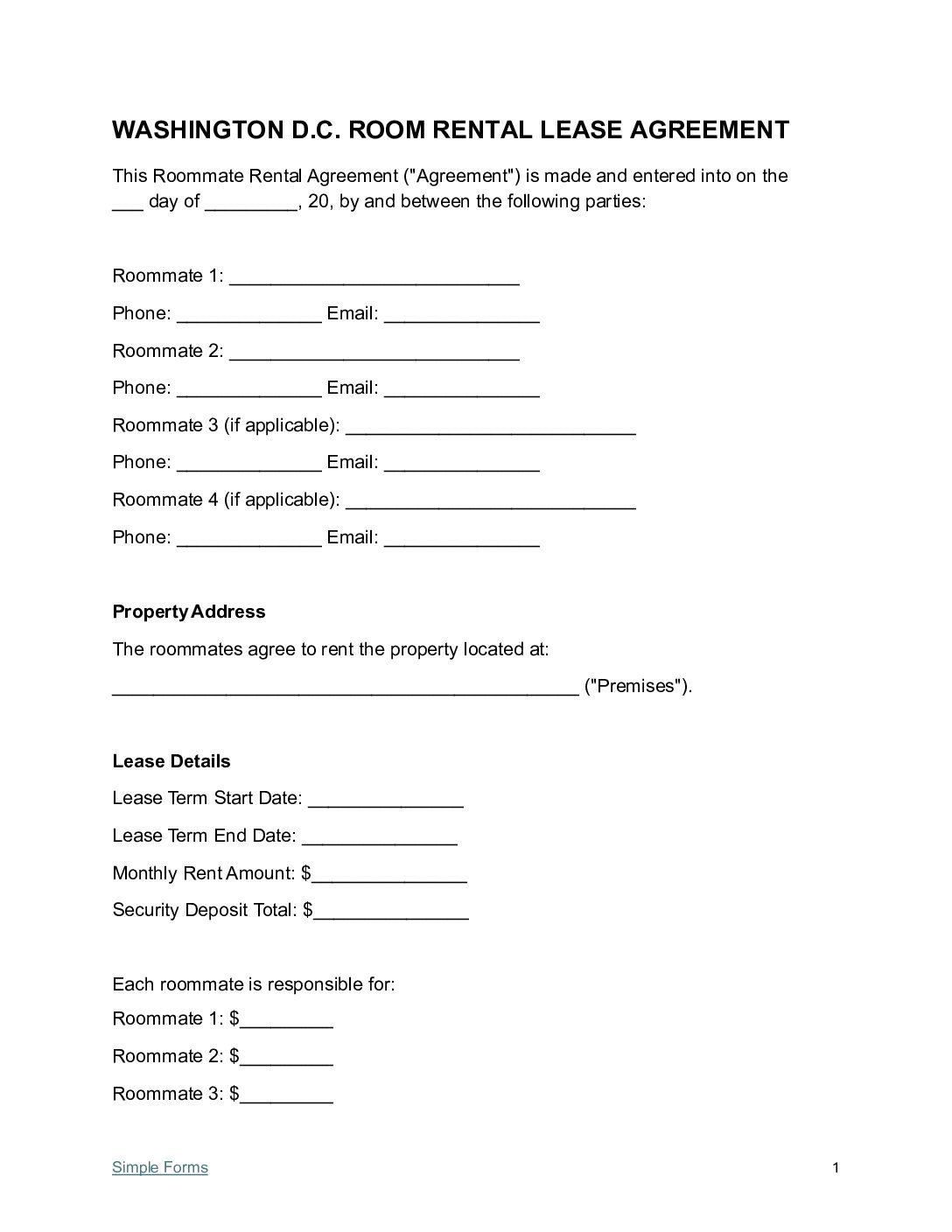

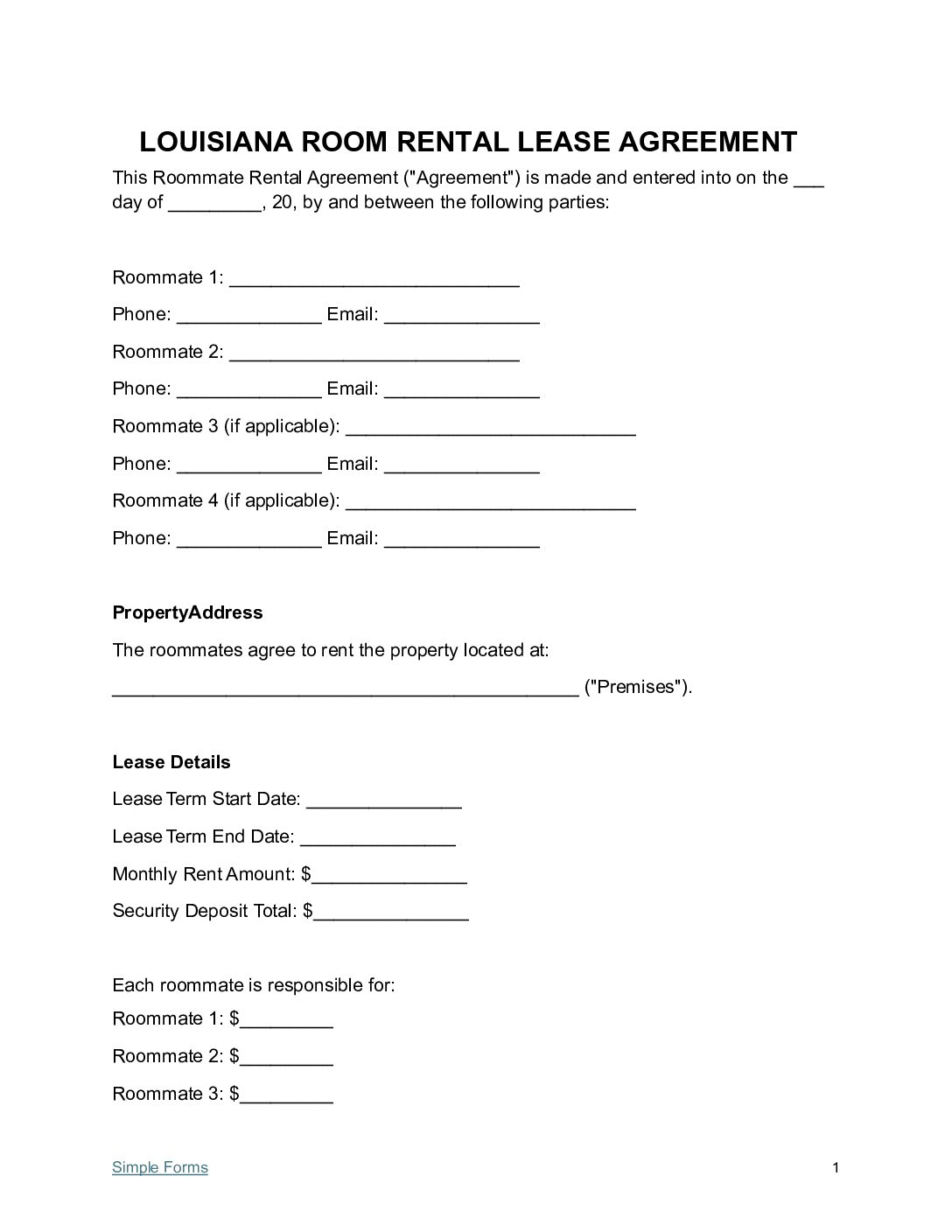

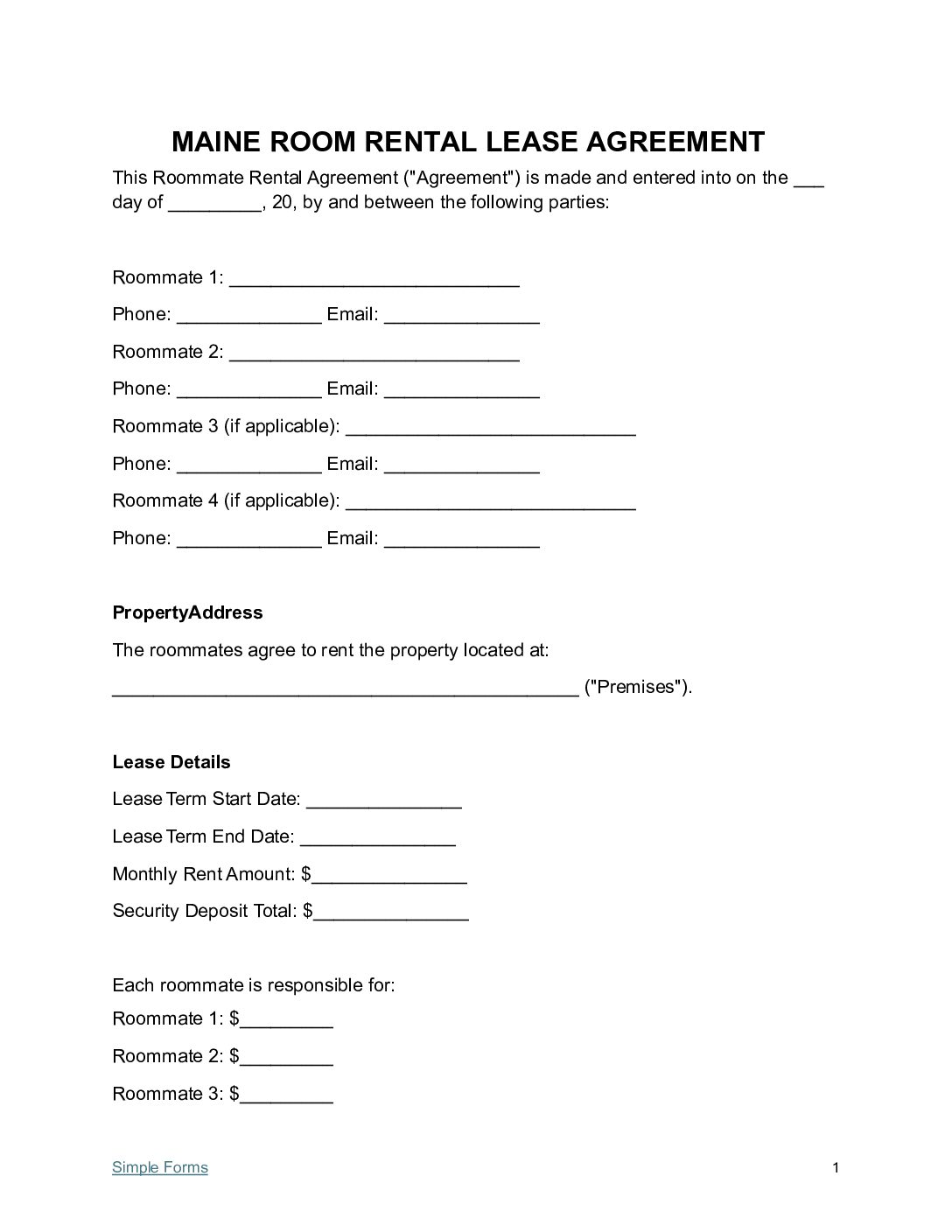

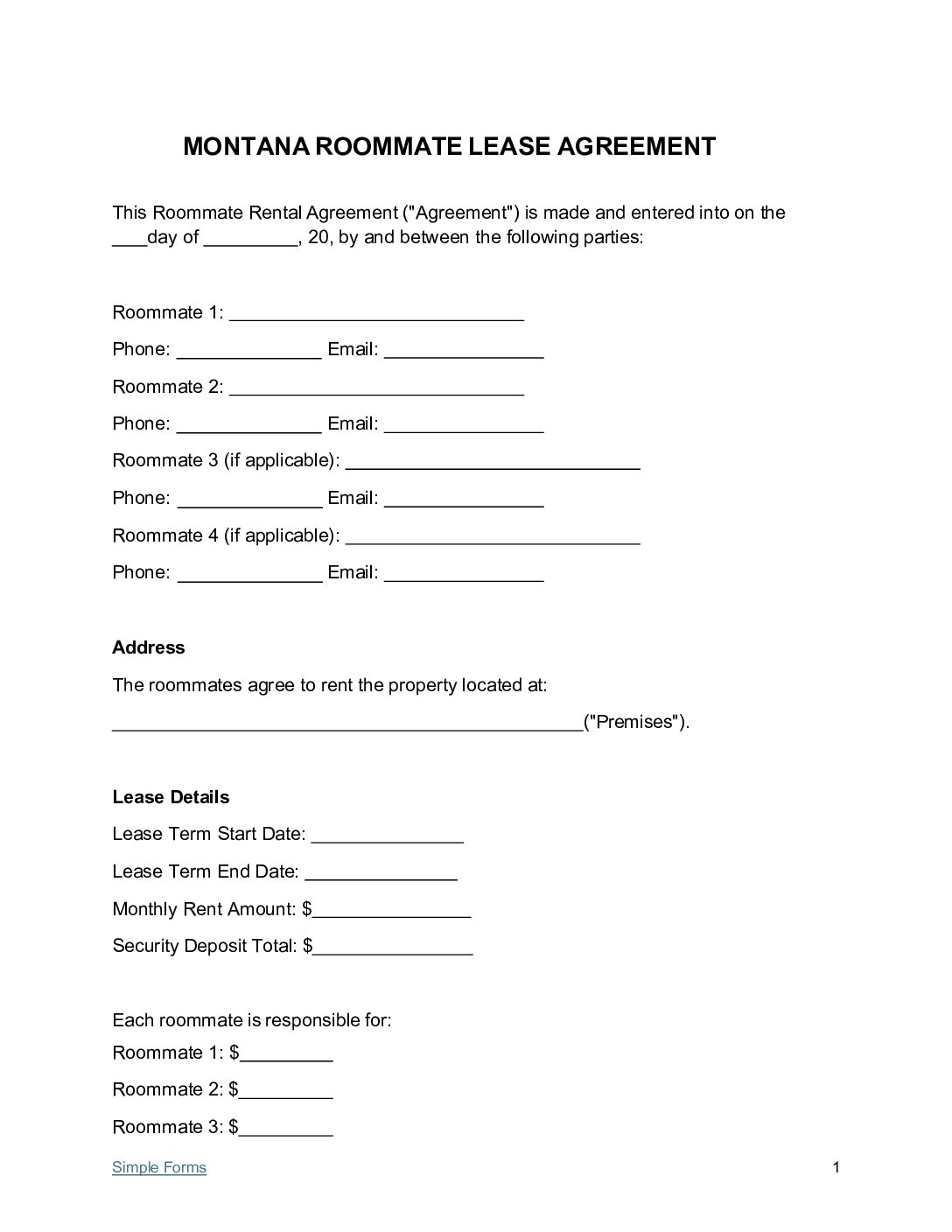

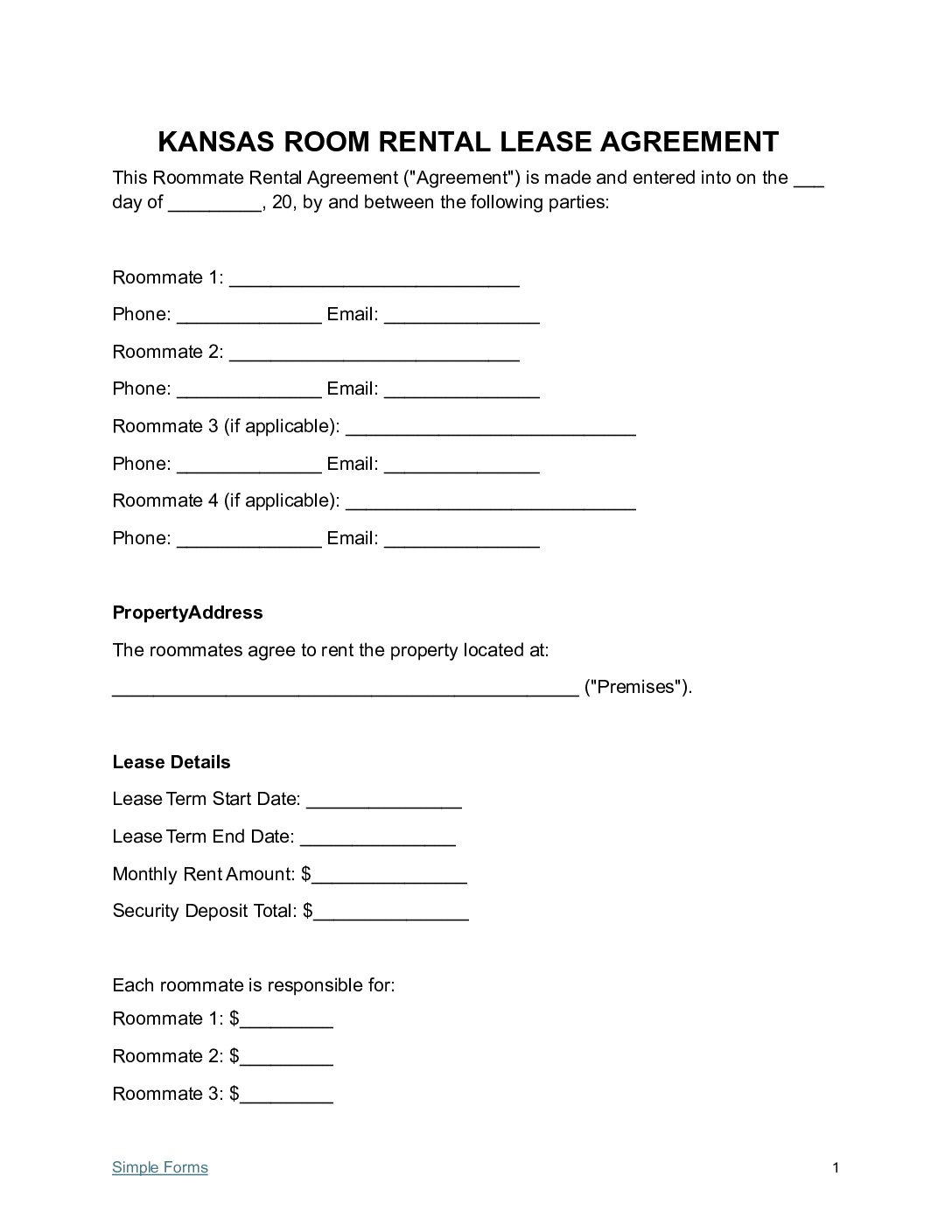

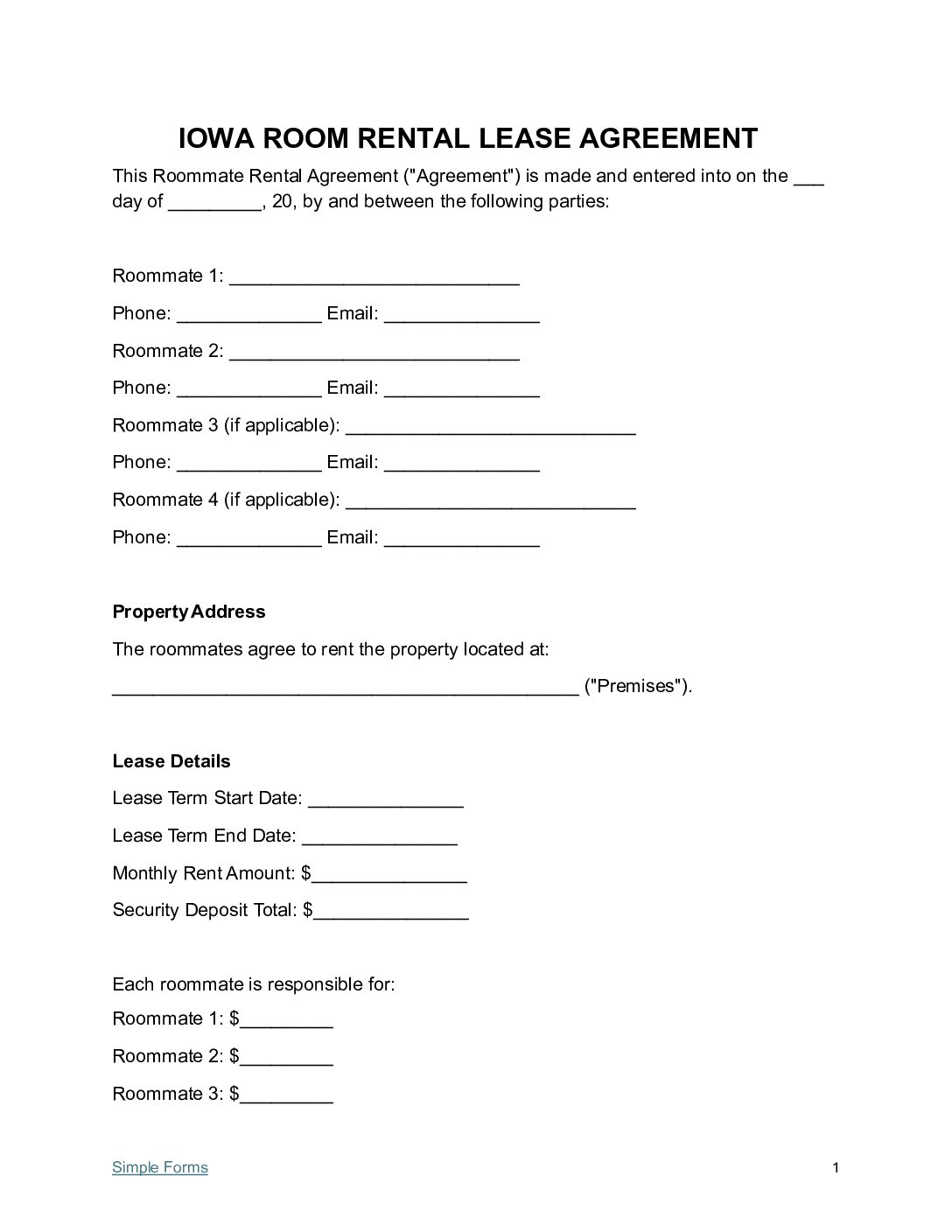

| Room Rental Lease Agreement Template – Shared living arrangements. A binding contract outlining responsibilities and agreements between co-tenants. Download: PDF | Word (.docx) |

|

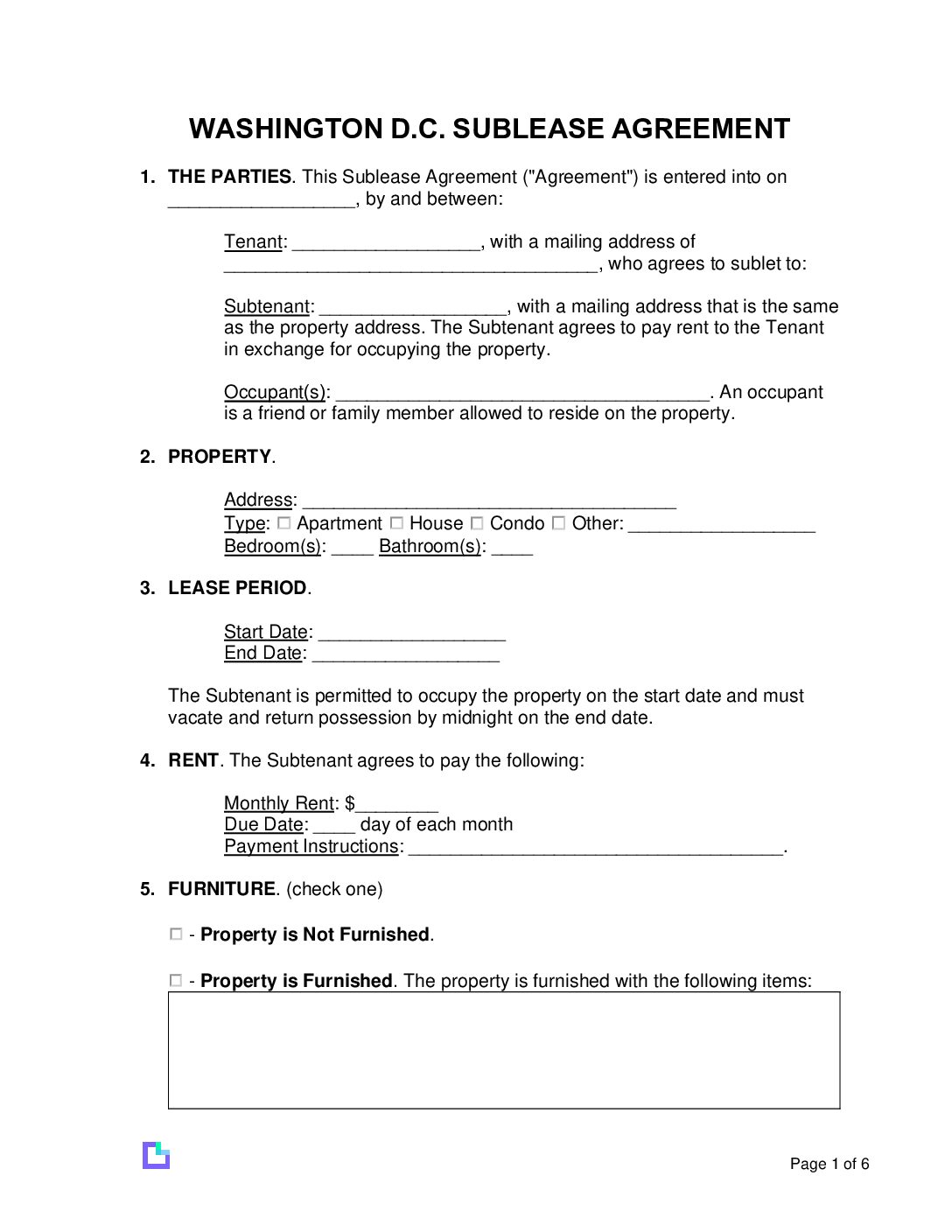

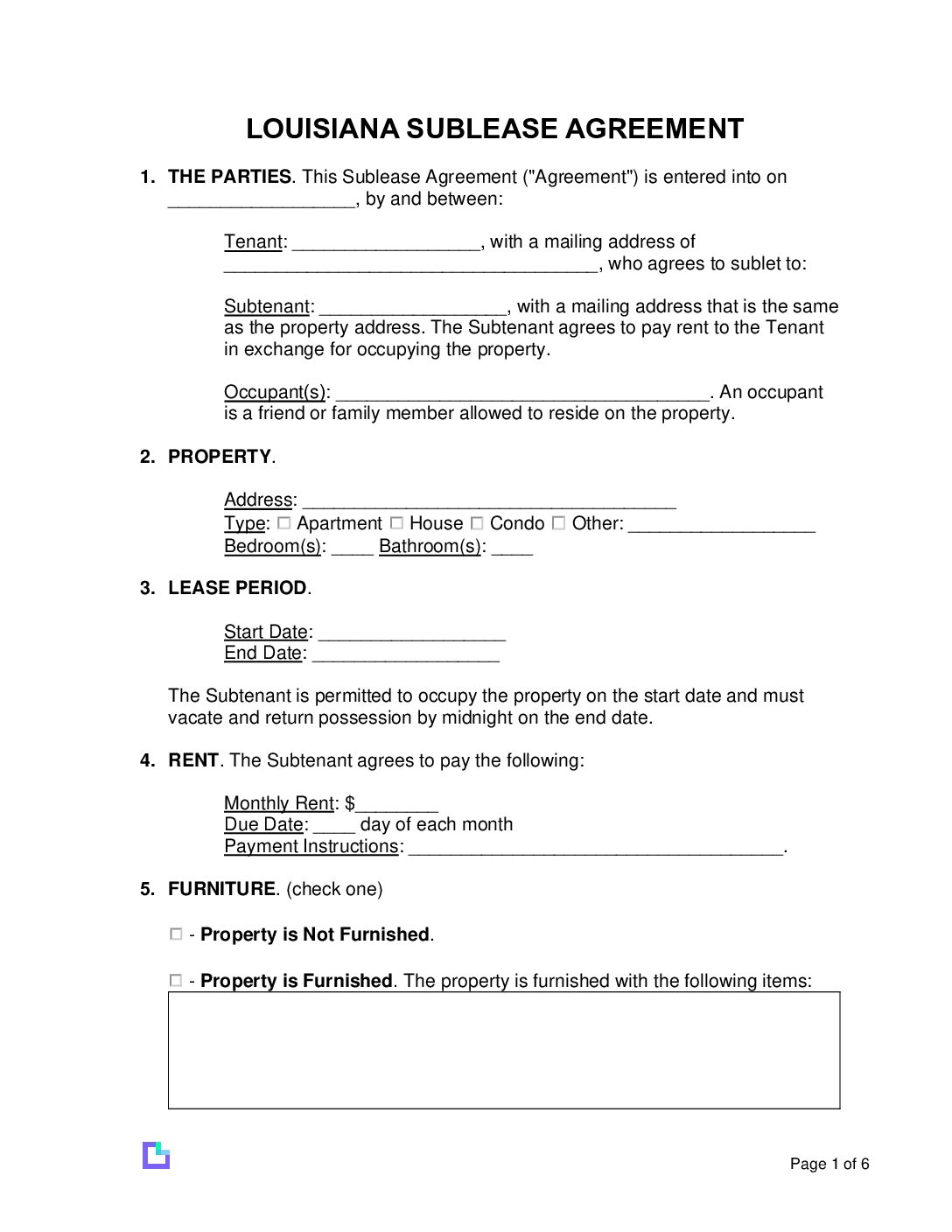

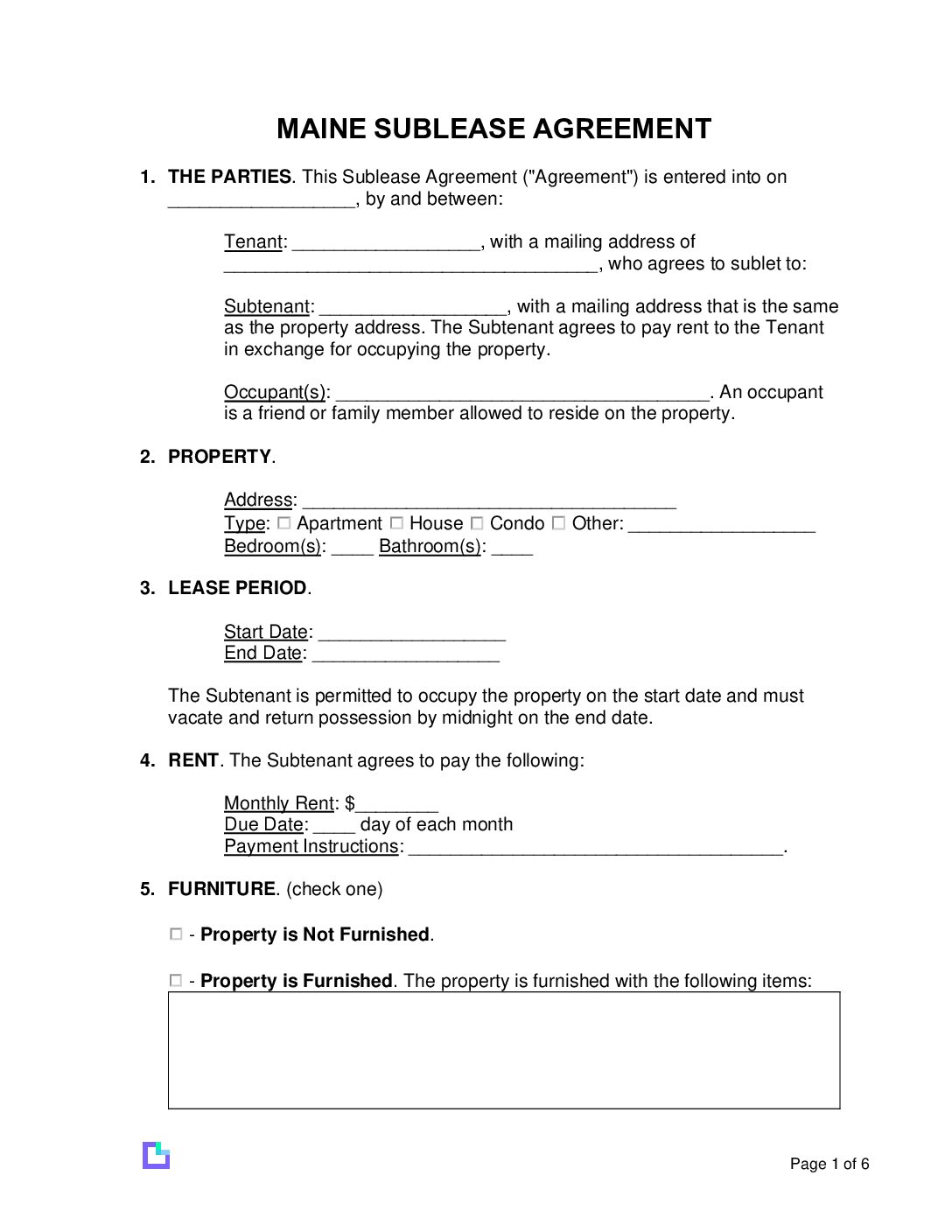

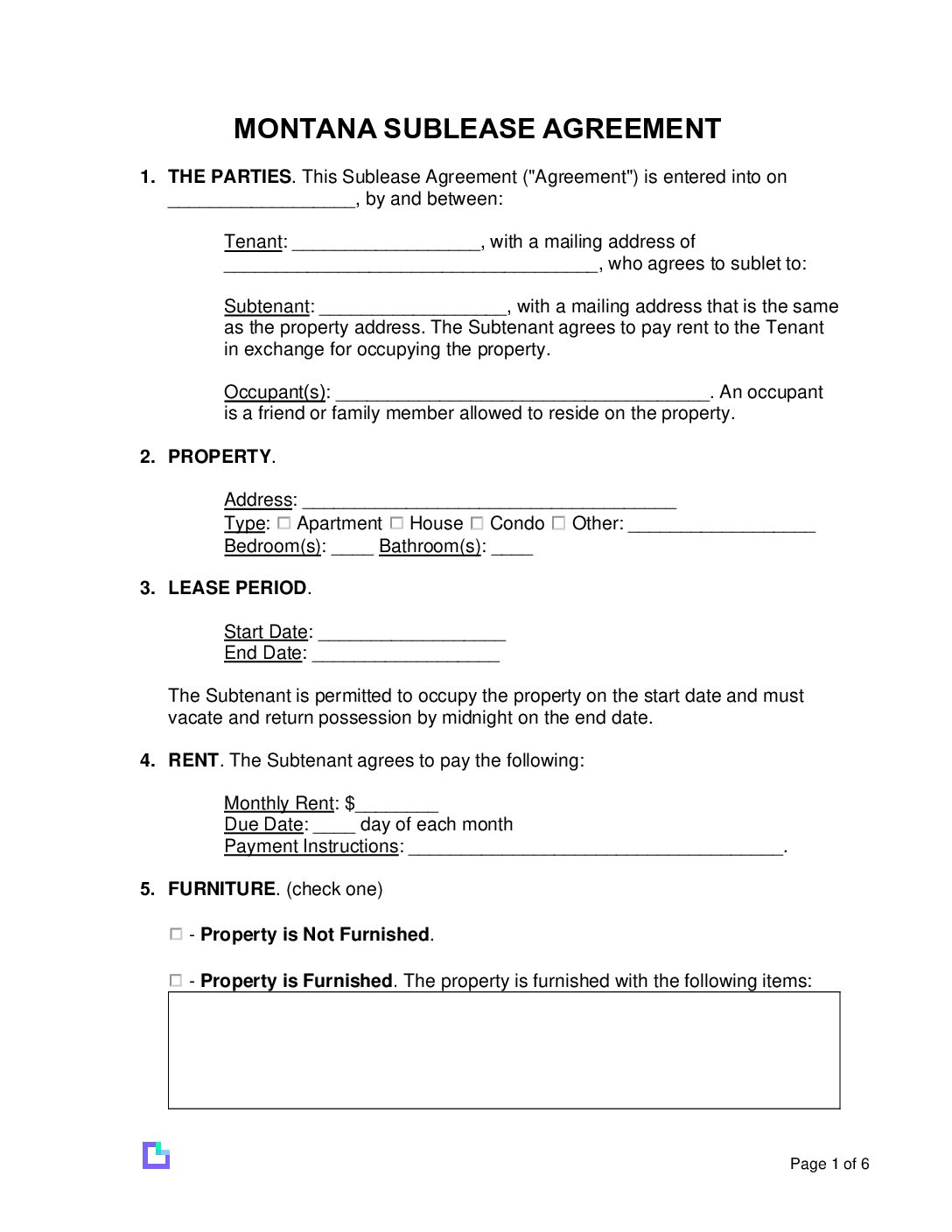

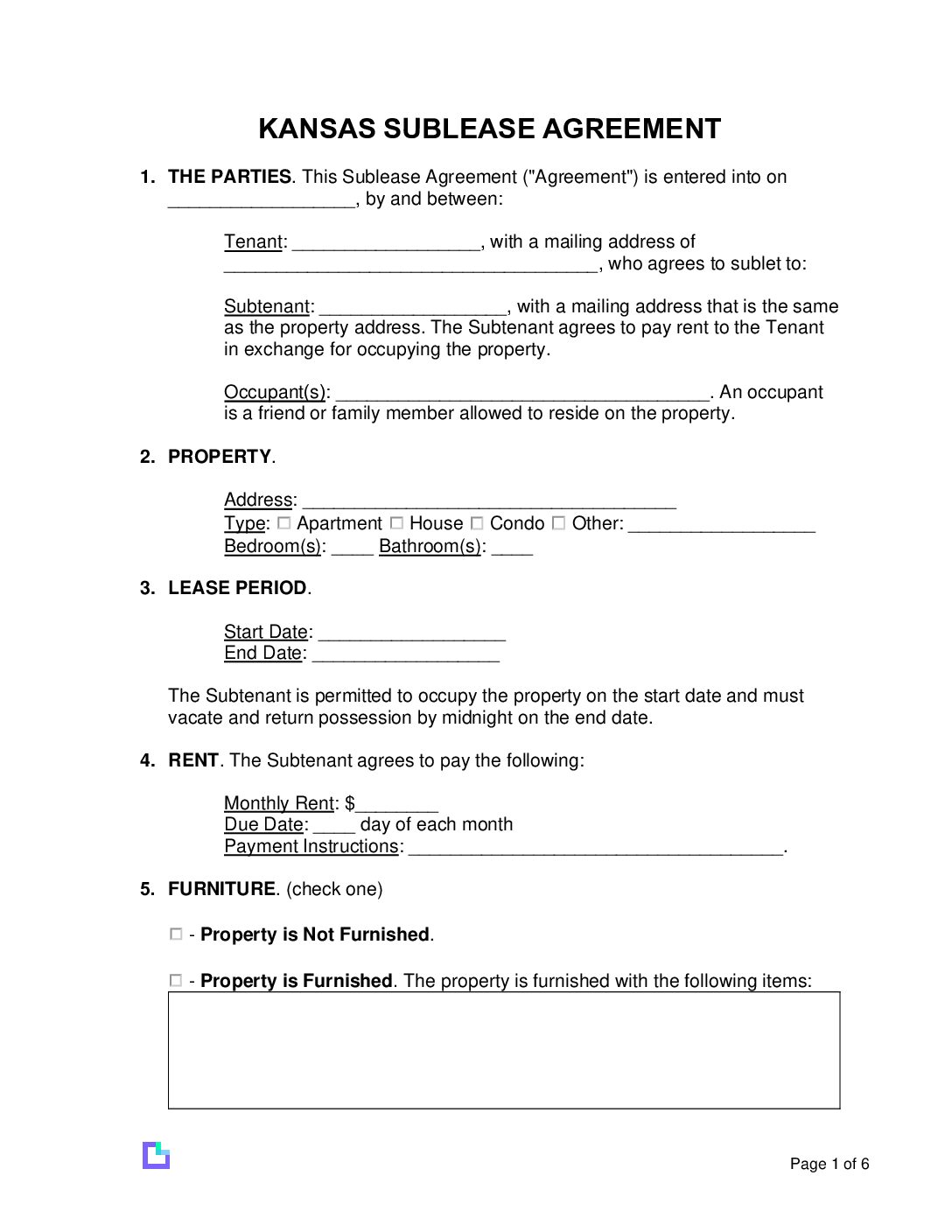

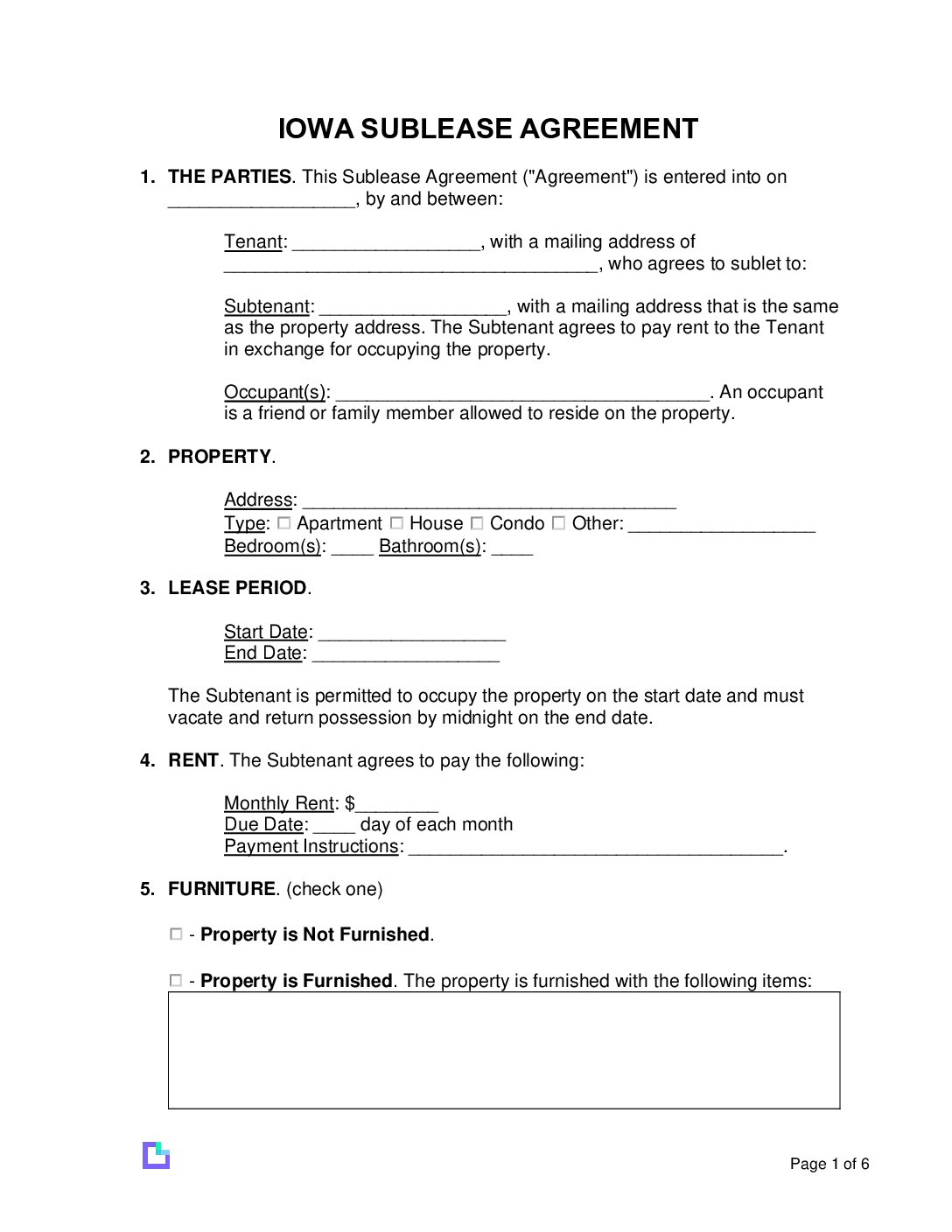

| Sublease Agreement – Used to Sublet unit with landlords approval. Download: PDF | Word (.docx) |

What does the District of Columbia Lease Agreement Cover?

This document includes the following laws between the landlord and tenant in Washington D.C.:

- Washington D.C. Residential Landlord & Tenant Act

- Security Deposit Law

- Lease Termination

- Landlord’s Access to the Property

- Rent Due Date plus Late Fees

- Required Disclosure Forms

Washington D.C. Residential Landlord & Tenant Act

The Washington D.C. Residential Landlord and Tenant Act is a guide for landlords and tenants that outlines the legal rights and responsibilities. It covers lease agreements, rent regulations, eviction processes, maintenance responsibilities, and dispute resolutions. [1]

Security Deposit Requirements

Landlords in Washington D.C. can require a security deposit and must return it within 45 days after the tenant vacates, minus any deductions for damages.

- 45 Days – Timeframe to return the deposit. [2]

- Deductions (if any) must be itemized.

- Normal wear and tear cannot be deducted.

Lease Termination Rules for the Landlord and Tenant

Leases in Washington D.C. may be terminated by either party under the following rules:

- Landlord’s Ability to Terminate

- 5-day notice for nonpayment of rent.

- 30-day notice for material noncompliance with the rental agreement.

- Tenant’s Ability to Terminate

- With proper written notice for unsafe conditions or habitability issues.

- 30 days’ notice to terminate a month-to-month lease. [3]

Landlord’s Access to the Rental Property

Rent Due Dates and Late Fees

- Late Fees – Must be written in the agreement.

- Grace Period – 5-day grace period.

- NSF Fee – $40 per bounced rent check. [5]

Required Disclosure Forms

- Lead-Based Paint Disclosure Form – Landlords must disclose lead-based paint if the property was built before 1978. [6]

- District of Columbia Tenant Bill of Rights – This document outlines the rights and responsibilities of the tenants.[7]

- RAD Form 3 – This form is used by landlords in rent-controlled buildings to notify tenants of any adjustments in the rent.[8]

- RAD Form 5 – This form notifies tenants of rent changes due to reduced services or increased costs under the city’s Rental Housing Act of 1985.[9]

- Bed Bug Fact Sheet– This form us used to discloses any bed bug infestations on the rental property. [10]