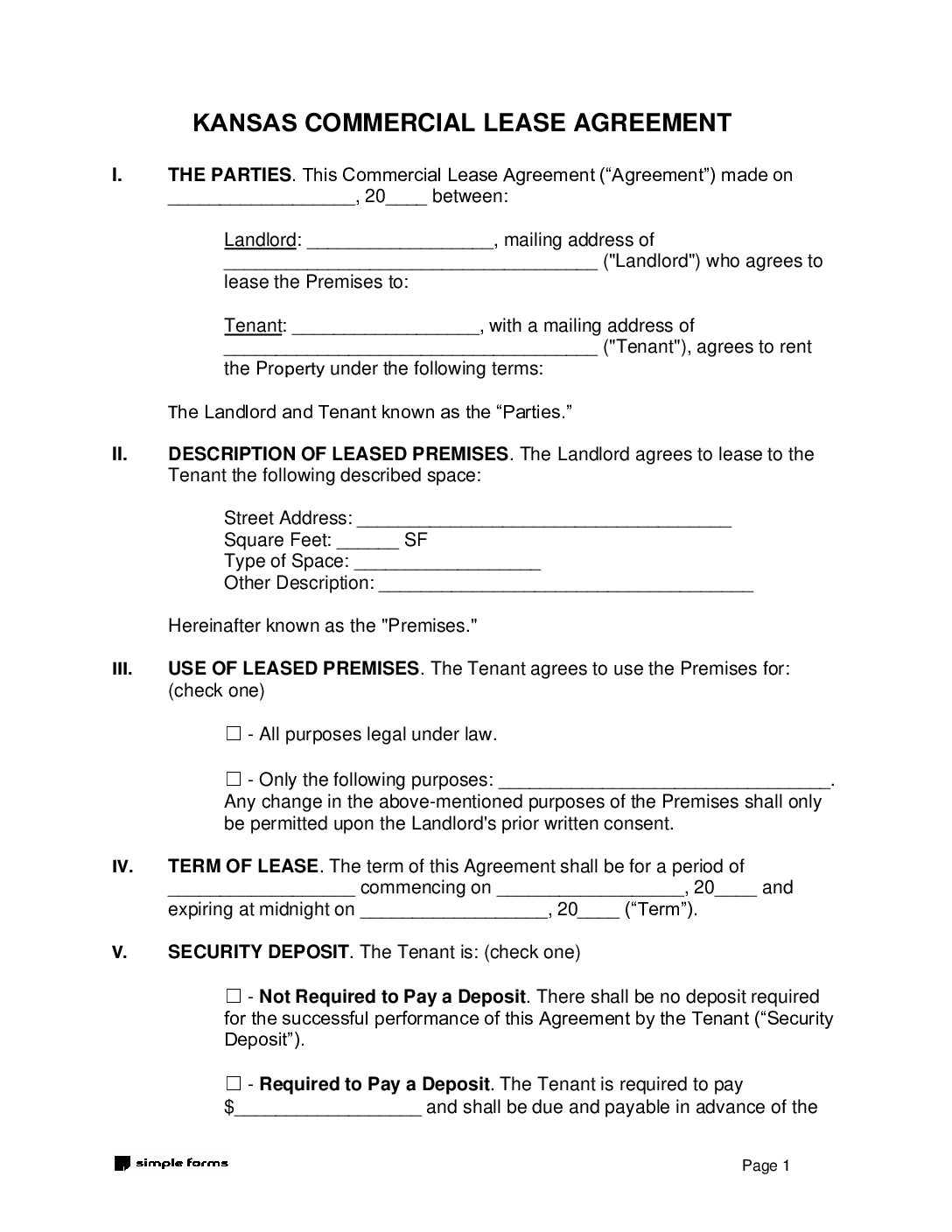

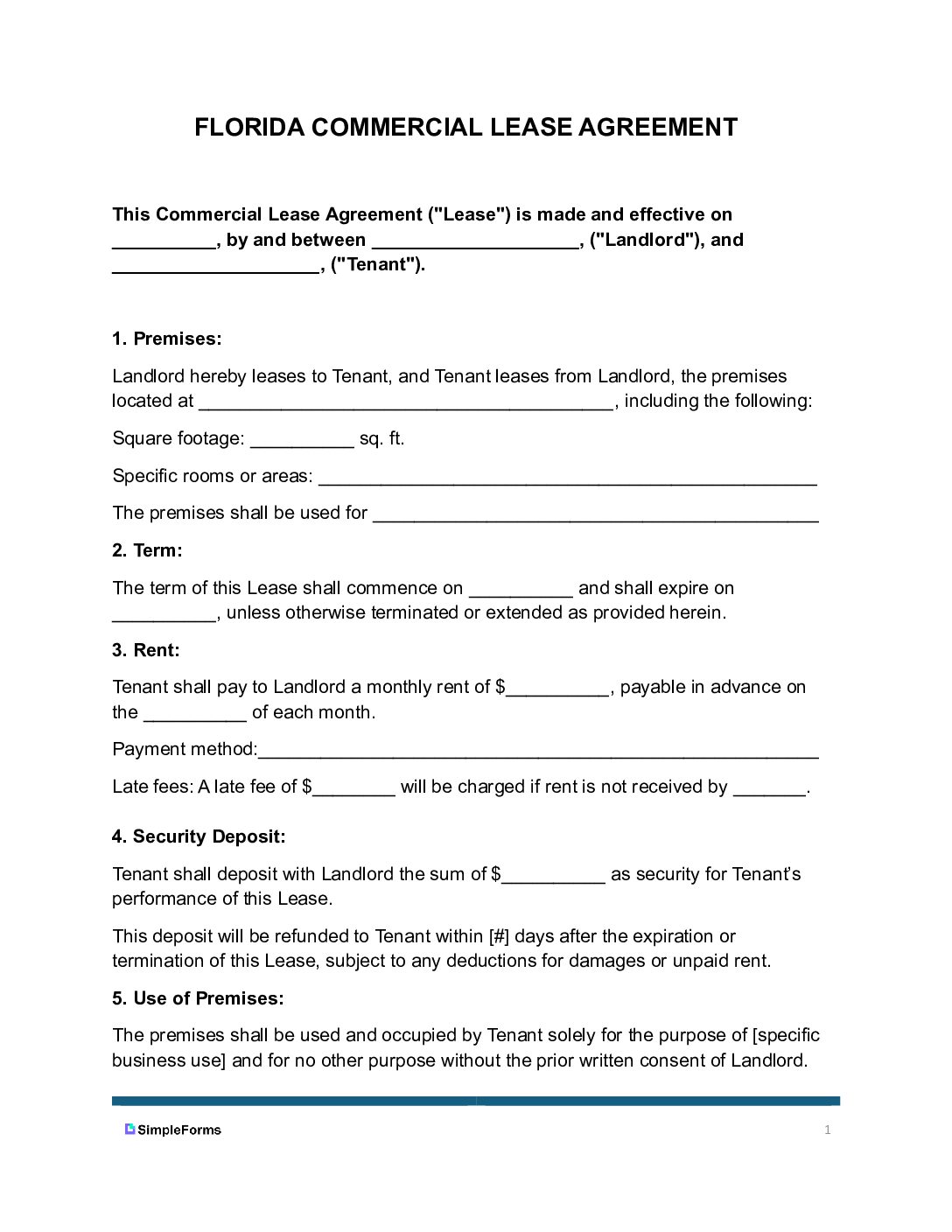

A commercial lease agreement template outlines the terms and conditions of a rental arrangement between a landlord and a tenant for a commercial property.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

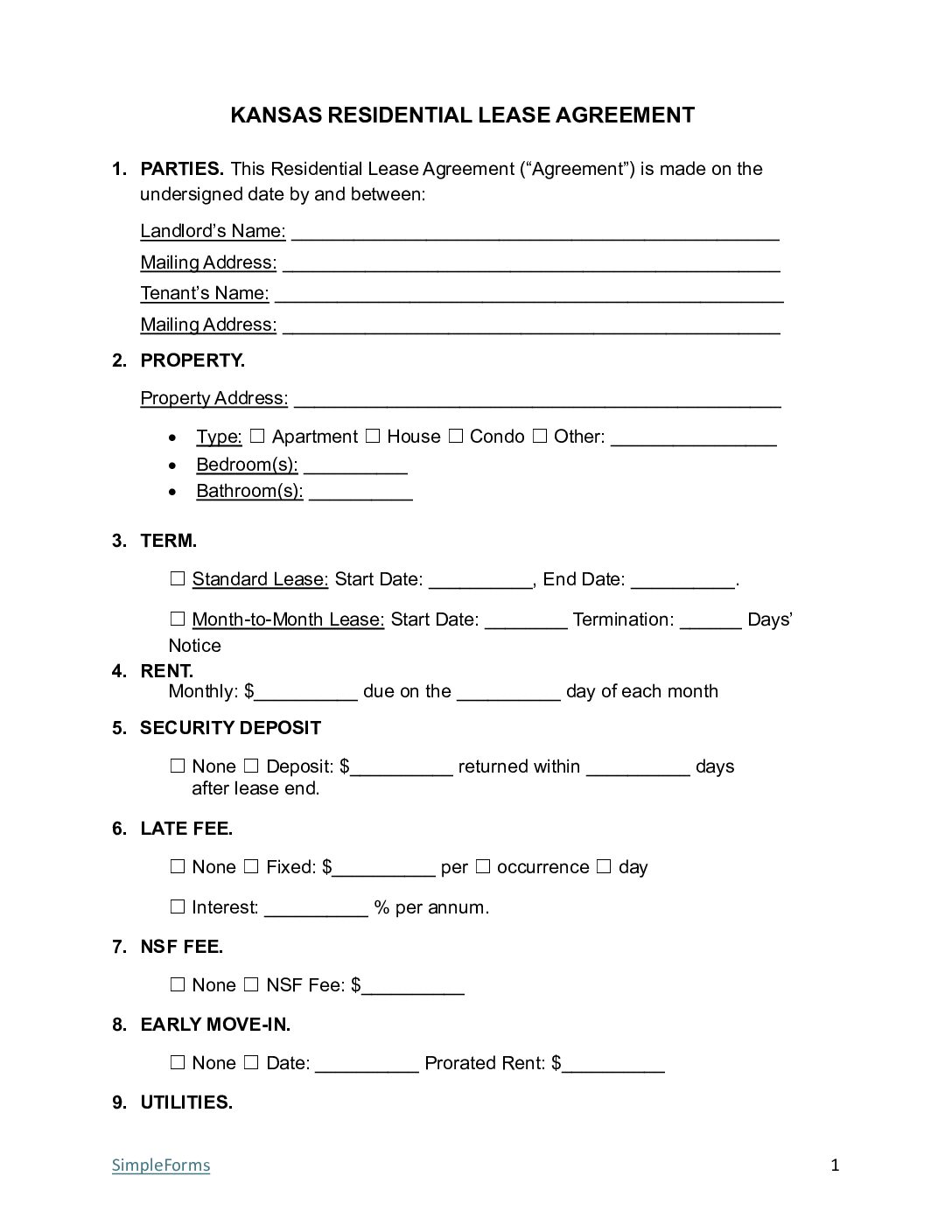

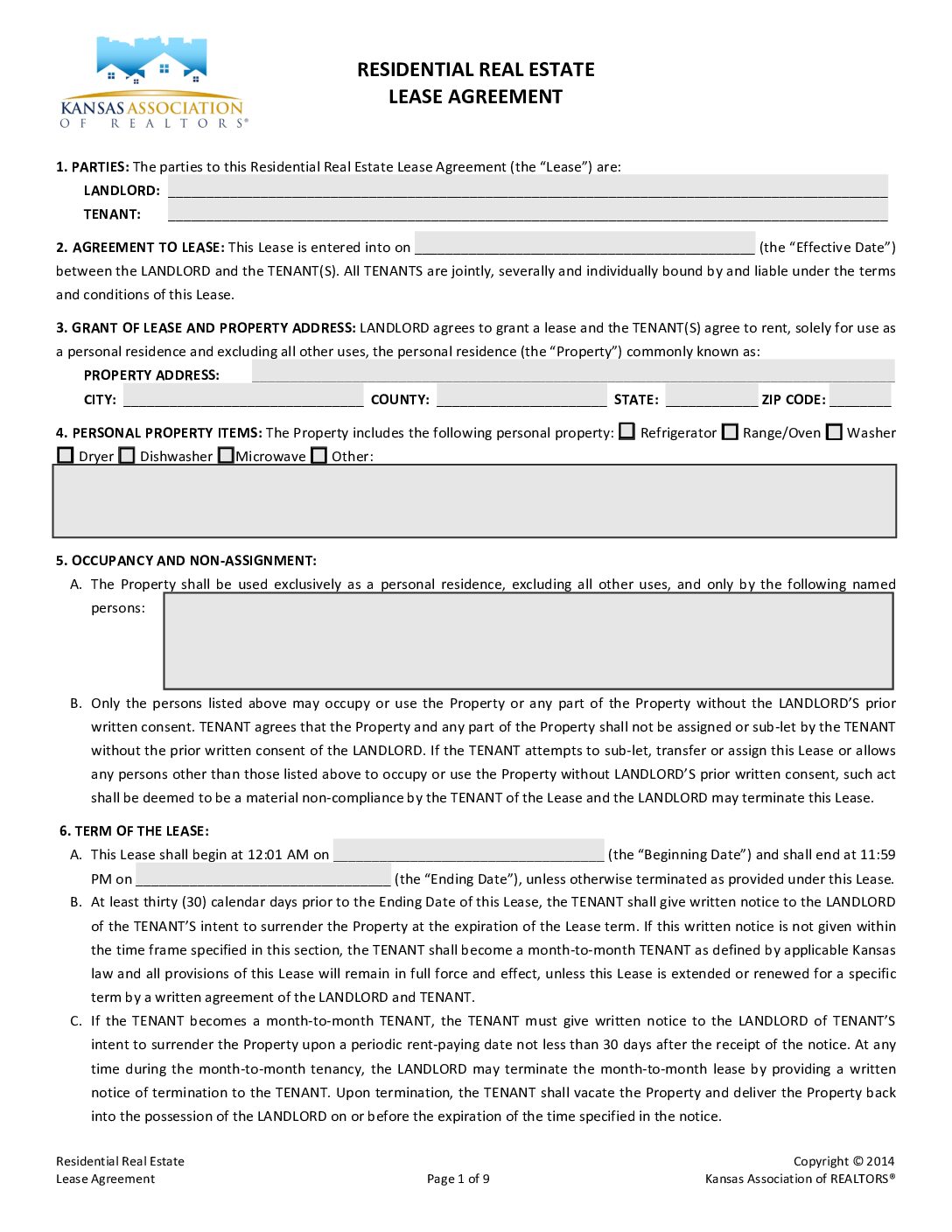

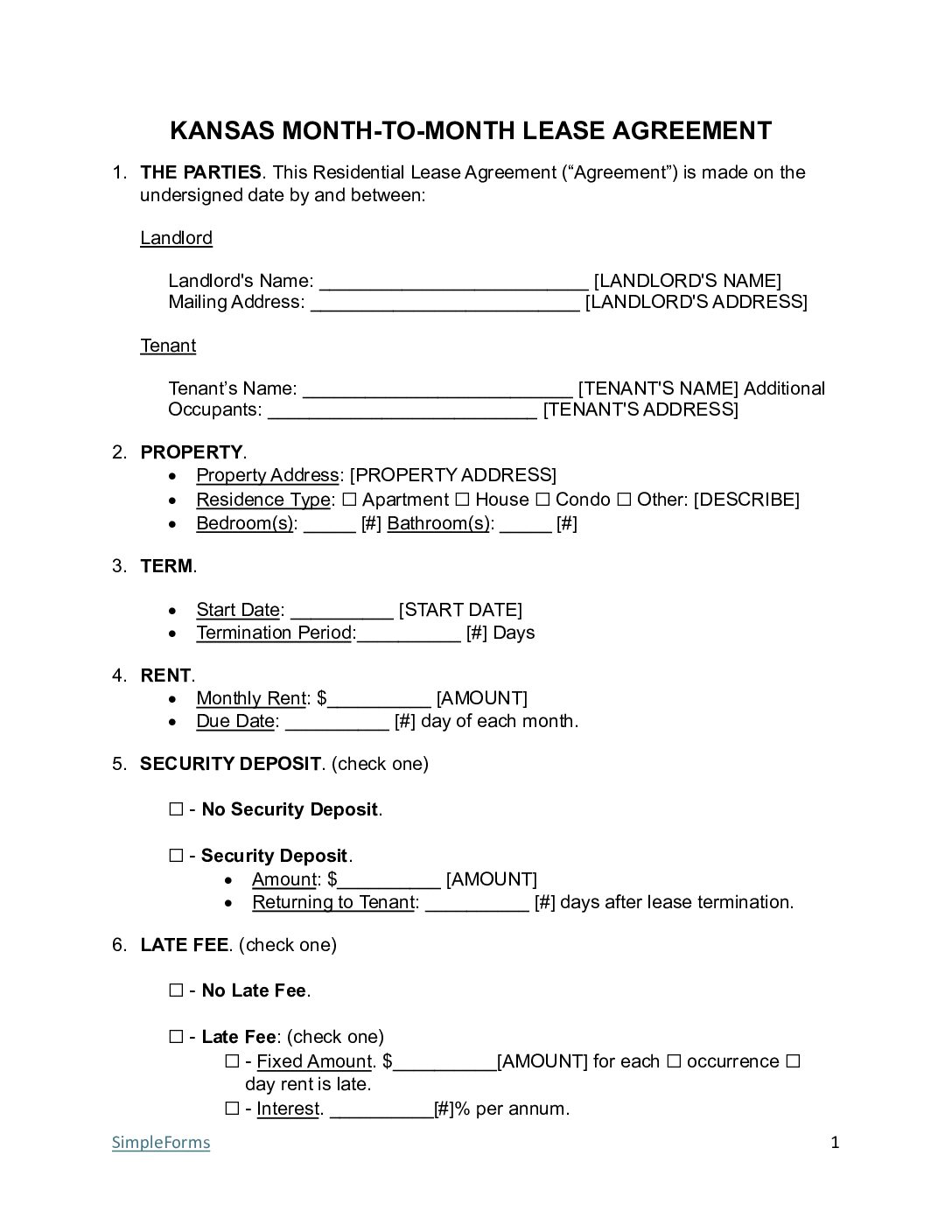

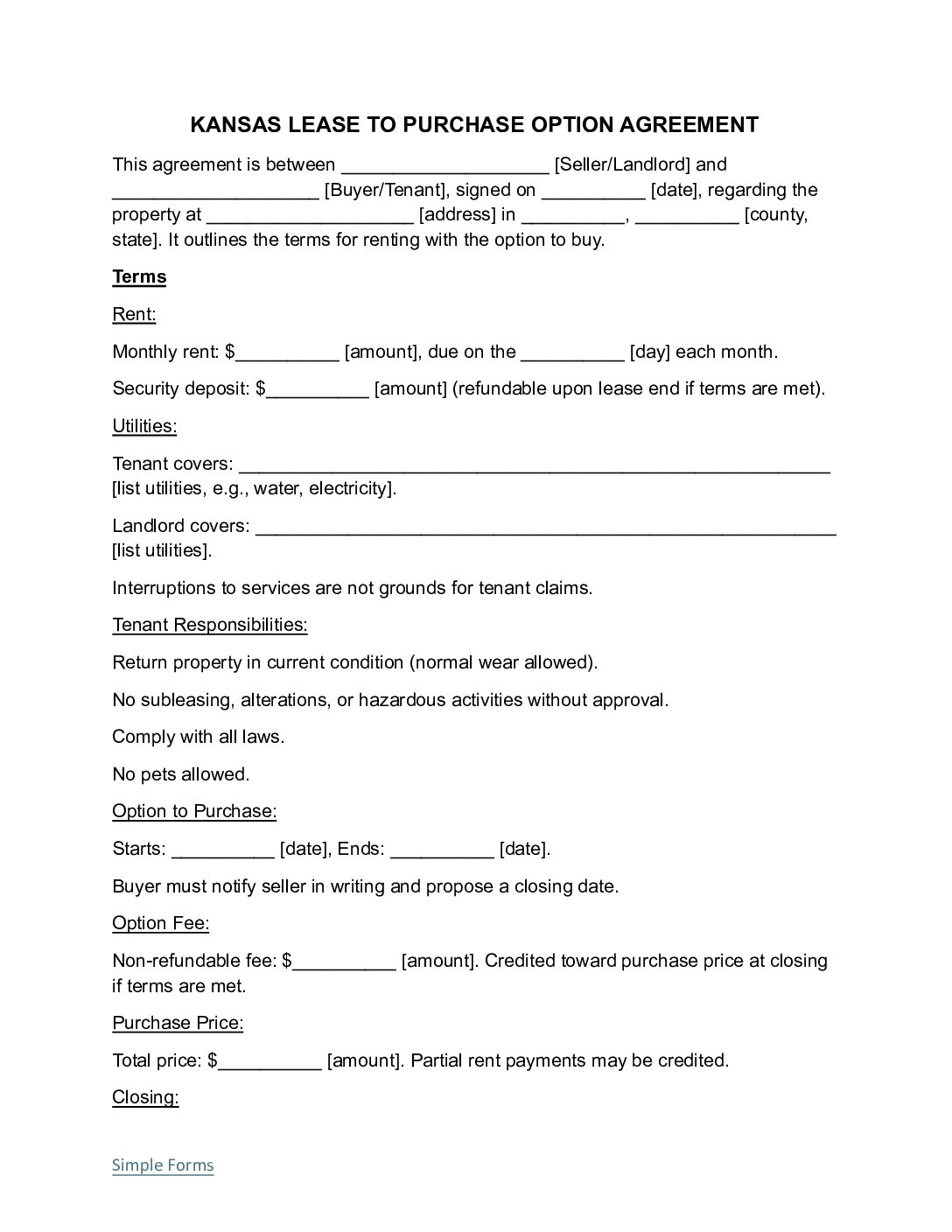

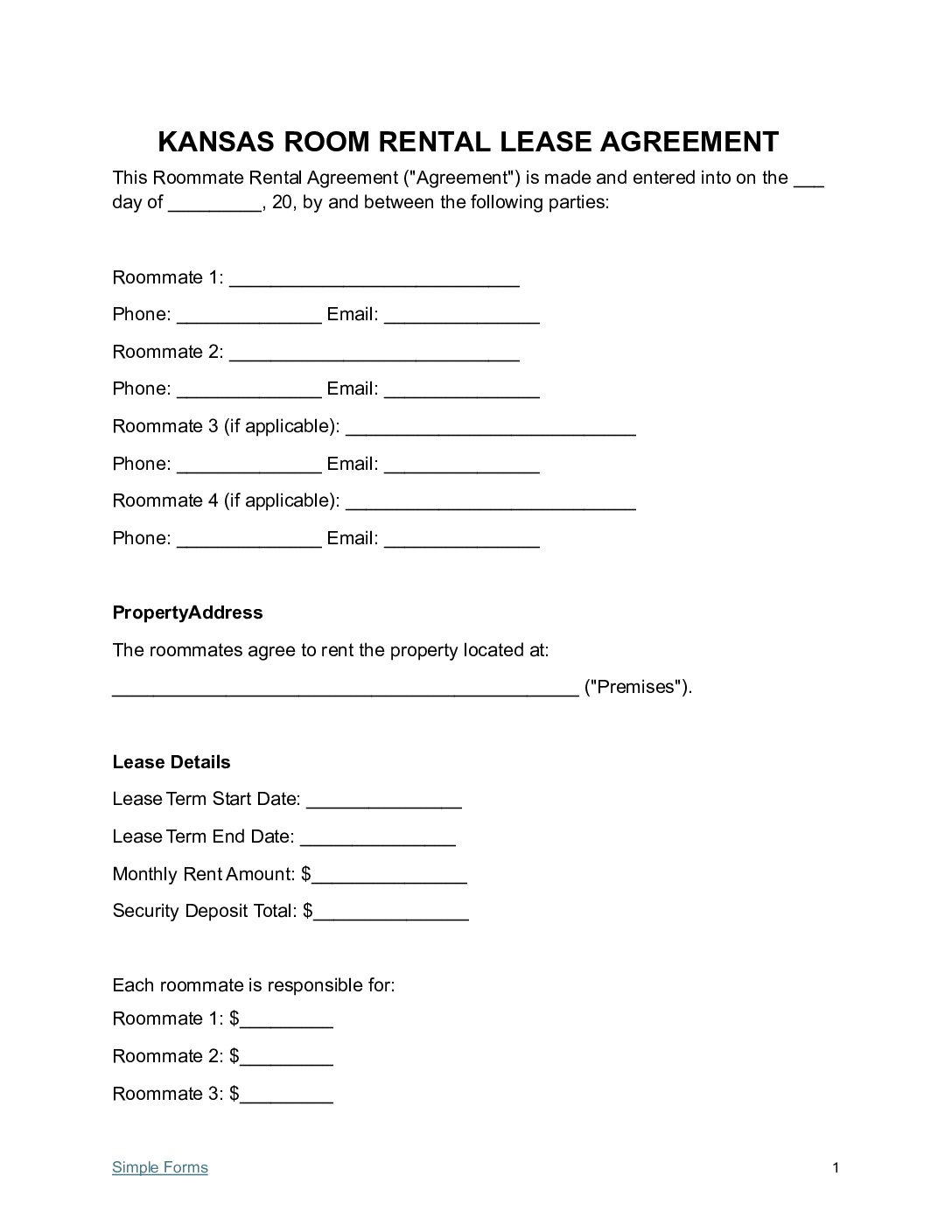

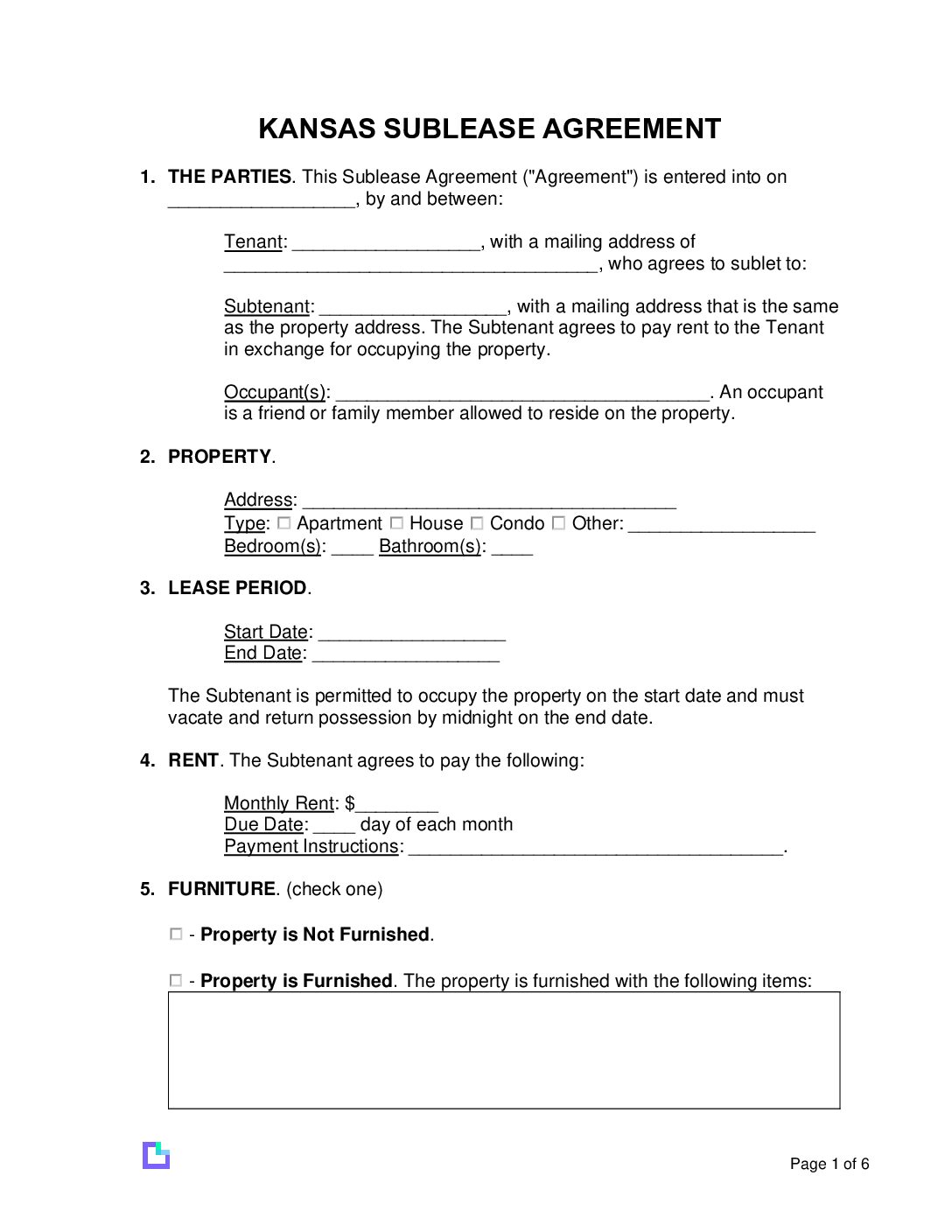

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

1. How to Lease Commercial Rental Property?

2 Options:

2. How to Process Rental Inquiries?

Property owners will know who is seriously interested in renting the Commercial Rental Property by potential Tenants requesting to see the property in person (property showing).

3. How to Screen Tenants?

There are five ways Landlords can screen potential Tenants to see if they are a good fit for the Commercial Rental Property for Lease:

- Commercial Lease Application

- Copy of Drivers License

- EIN (business)

- Previous two years of business tax returns (IRS Form 8879-S or IRS Form 1120S)

- Previous two years of personal income tax returns (IRS Form 1040).

Screening Services:

Individuals – MySmartMove (TansUnion)

Businesses – Dun & Bradstreet

Commercial Real Estate Definitions

- Absorption Rate – The rate at which available commercial space is leased or sold over a specific period, indicating demand in the market.

- Anchor Tenant – A major tenant in a commercial development (often a large retail store or grocery chain) that attracts other tenants and drives foot traffic.

- Build-to-Suit – A commercial property constructed specifically for a particular tenant’s needs, often under a long-term lease agreement.

- CAM (Common Area Maintenance) Charges – Fees paid by tenants in multi-tenant properties to cover expenses related to shared spaces like lobbies, hallways, elevators, parking lots, and landscaping.

- Cap Rate (Capitalization Rate) – A measure used to estimate the return on an investment property, calculated by dividing the property’s NOI by its current market value or purchase price.

- Commercial Property – Buildings and Land used for profit generation, including office buildings, medical centers, hotels, malls, retail stores, multifamily housing buildings, farmland, warehouses, and garages.

- Commercial Lease/Tenancy – Nonresidential tenancy for property by for-profit entities.

- Gross Lease – A lease where the landlord pays for most or all property expenses, such as taxes, insurance, and maintenance. The tenant pays a fixed rent amount.

- Leasehold Interest – The tenant’s right to use and occupy a commercial property for the term of a lease, distinct from ownership of the land or building.

- Net Operating Income (NOI) – A calculation used to analyze real estate investments, representing the total income from a property minus operating expenses (excluding taxes, interest, and depreciation).

- REIT (Real Estate Investment Trust) – A company that owns, operates, or finances income-producing real estate and allows individual investors to buy shares and receive dividends.

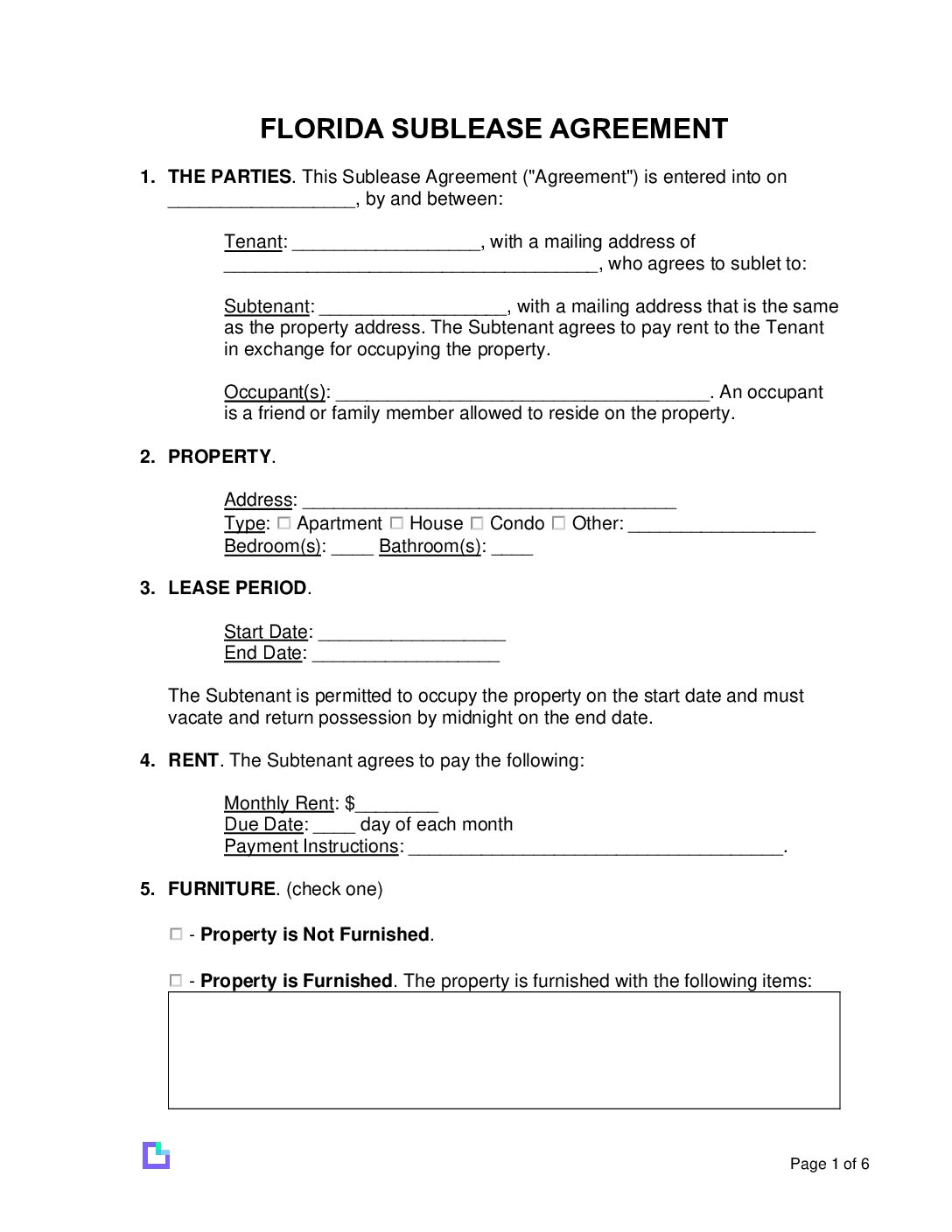

- Sublease – A secondary lease where the original tenant leases part or all of the rented property to another party, typically with the landlord’s consent.

- Tenant Improvement (TI) Allowance – Funds provided by a landlord to customize or improve a commercial space to meet a tenant’s specific business requirements.

- Triple Net Lease (NNN) – A type of lease agreement where the tenant agrees to pay all property expenses including real estate taxes, insurance, and maintenance, in addition to rent and utilities.

- Vacancy Rate – The percentage of all available units in a commercial property or market that are unoccupied at a given time.

- Zoning – Legal regulations that dictate how a property can be used (e.g., commercial, industrial, residential) and what kind of structures can be built on it.

Frequently Asked Questions

What is the penalty for breaking a Commercial Lease Agreement?

What are outgoings in Commercial Leases?

How much is a Commercial Lease Bond?

Do Commercial Tenants have the same rights and protections as Residential Tenants?

When Does a Commercial Lease Agreement Become Legally Binding?

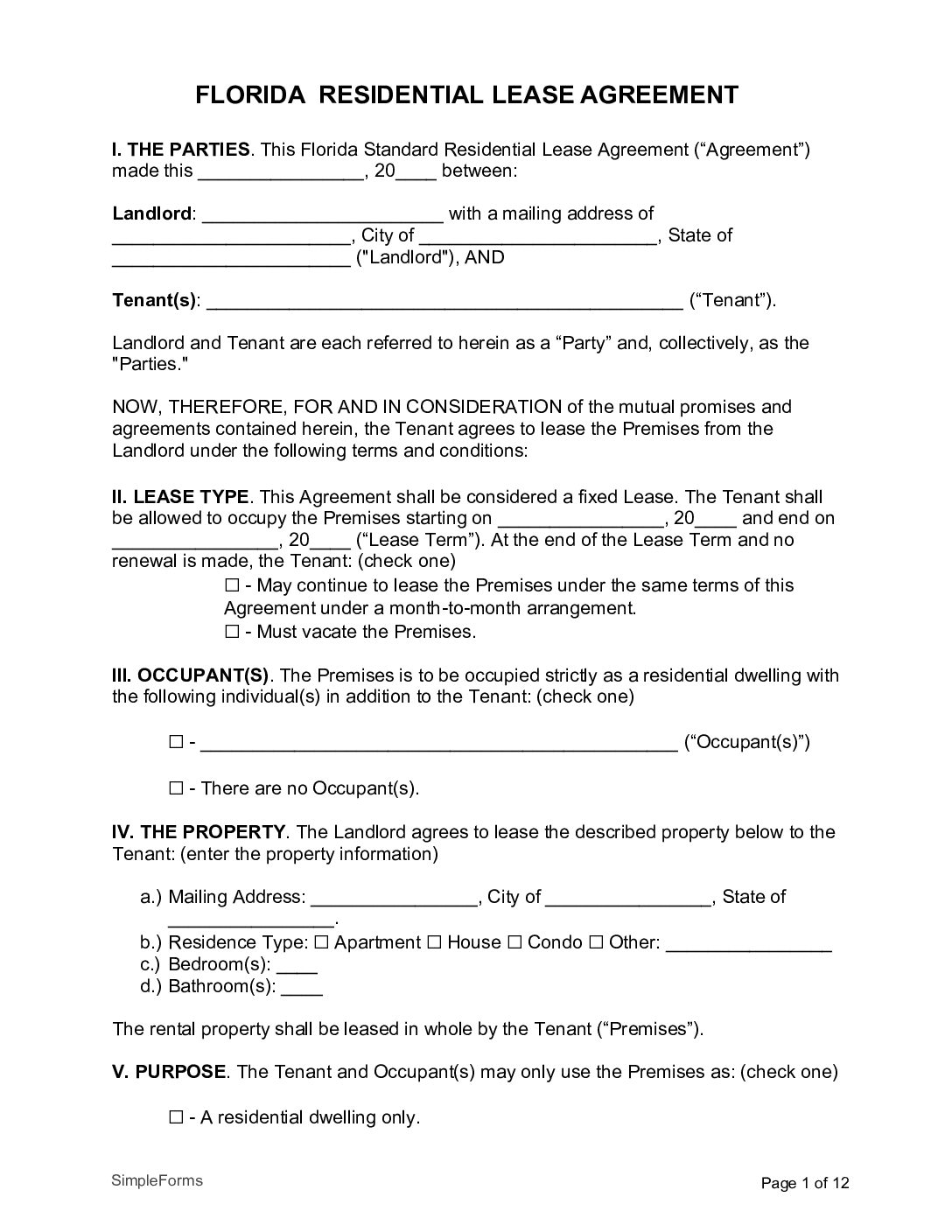

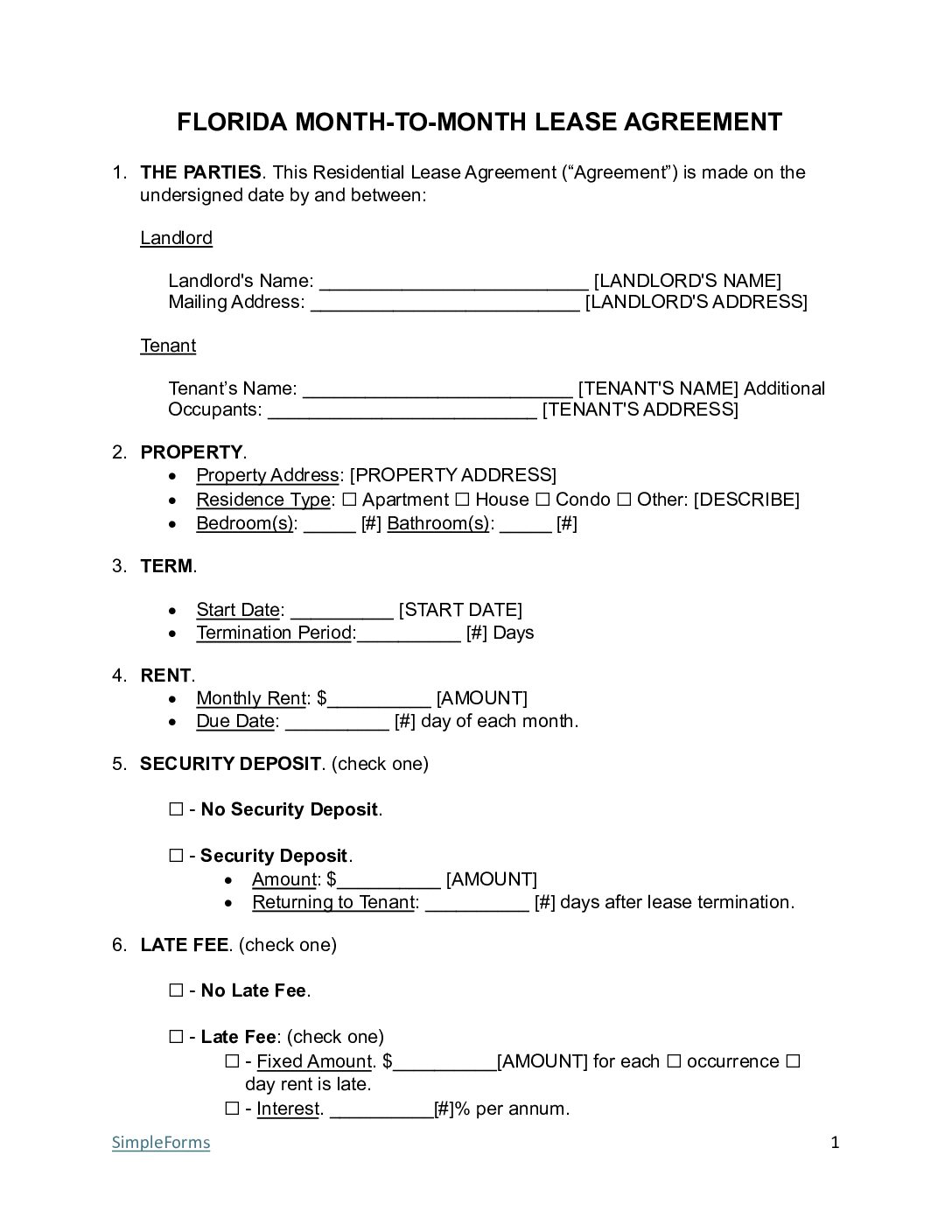

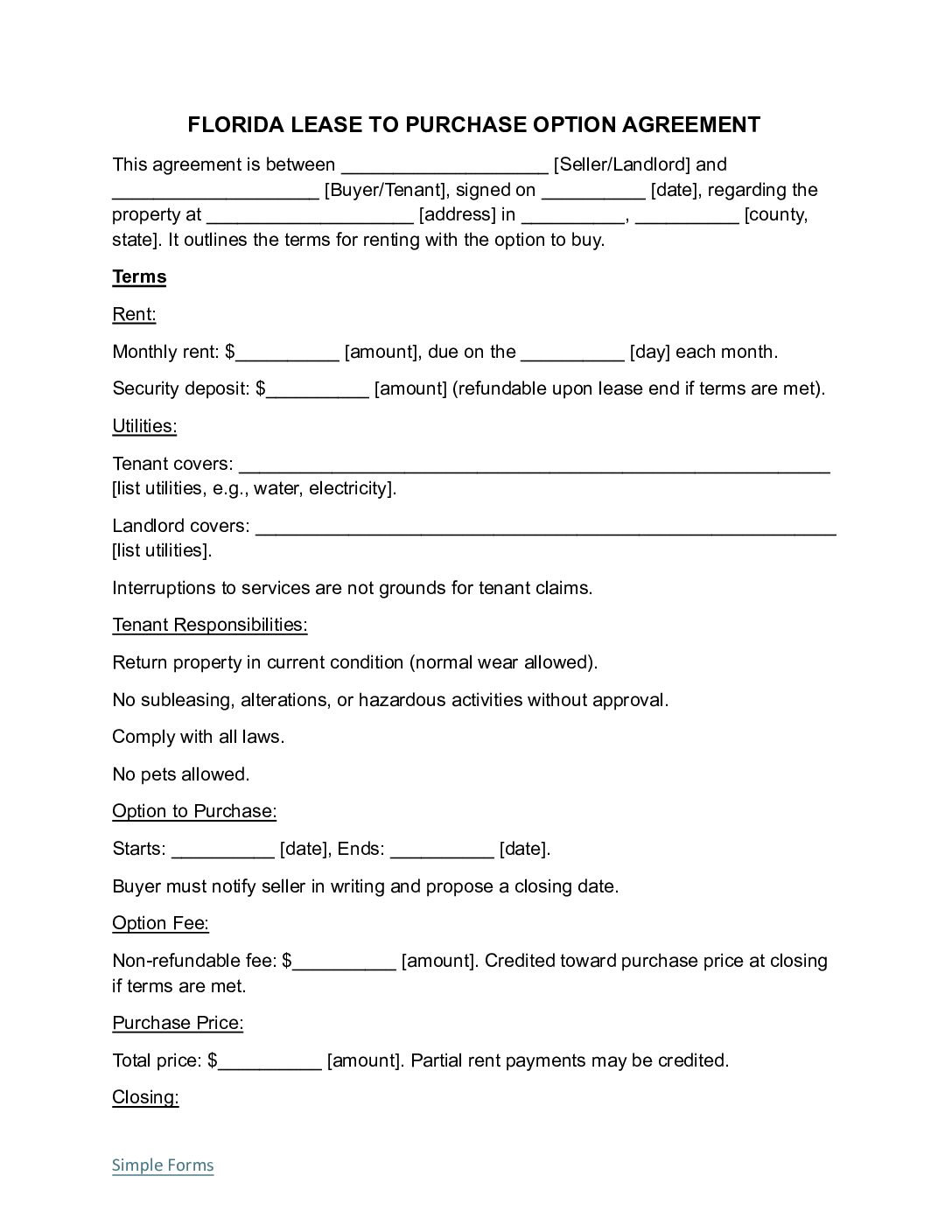

Sample Commercial Lease Agreement Template

Standard Commercial Lease Agreement Checklist

✅ Before Signing Checklist

Landlord Responsibilities:

Tenant Responsibilities:

✅ After Signing Checklist

Immediate Steps:

First Month Steps: