Florida Sublease Rights

Florida rental laws do not specifically govern subleasing. Whether a tenant can sublet their unit depends on the terms of the original lease agreement. If the lease allows subletting, it may include certain conditions, such as requiring the landlord’s written approval. If permission is needed, tenants should use a Landlord Consent to Sublease Form to get proper authorization.

Florida Short-Term Rental Tax Requirements

- A short-term rental in Florida is defined as a property rented more than three (3) times a year for periods of less than 30 days each. [1]

- The state imposes a 6% sales tax on short-term lodging, in addition to county and municipal tourist development taxes. [2]

- Some local governments also apply additional occupancy or tourism taxes based on the property’s location.

- All short-term rental operators must register and obtain a license through the Florida Department of Business and Professional Regulation (DBPR). [3]

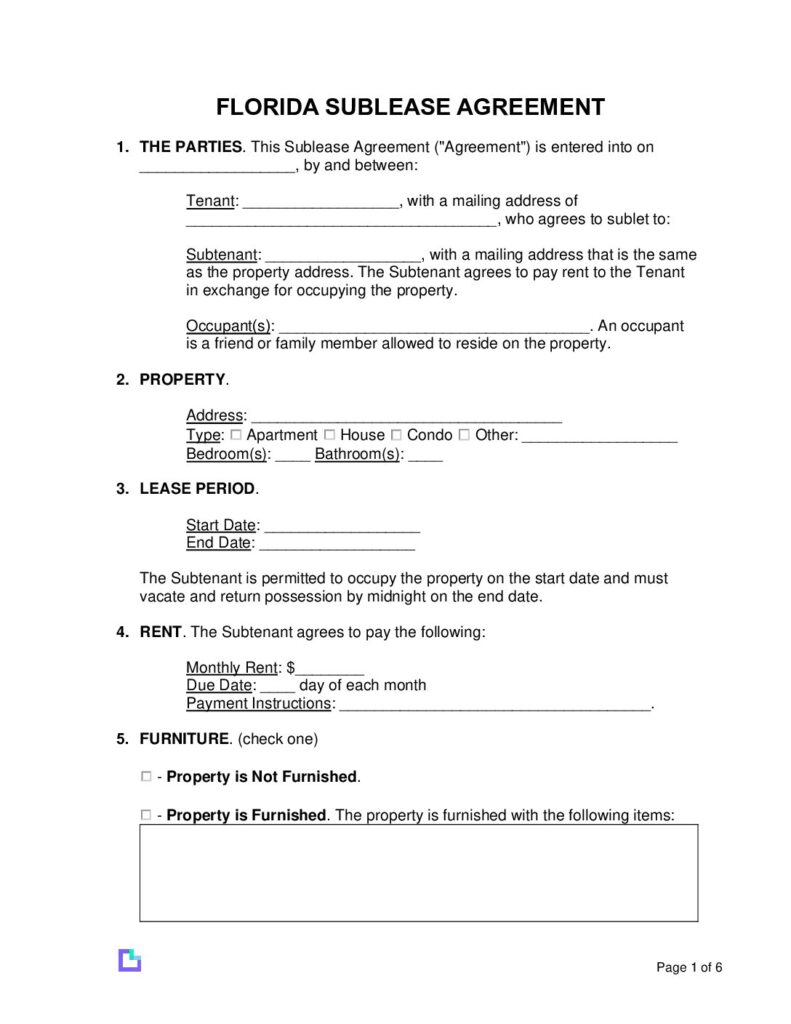

Download a Free Florida Sublease Agreement Template (PDF)

Use our professionally drafted Florida Sublease Agreement to legally sublet your rental unit with landlord consent. The template includes tenant details, rental terms, and signature fields.

Legal Sources & References

- Florida Statutes § 509.013 – Definition of public lodging establishments and short-term rentals.

- Florida Department of Revenue – Overview of Florida sales tax rates and lodging tax rules.

- Florida DBPR Licensing Portal – Apply for short-term rental licenses.