Lease Agreement

Common Examples for Equipment Rental Agreement Use

An Equipment Rental Agreement Template can be used across a wide range of industries and situations. Below are some of the most common examples:

- Appliances – Items such as refrigerators, stoves, washers, and dryers are often rented for temporary housing, home staging, or short-term use during renovations.

- Electronics (Music/Party DJ Equipment) – Sound systems, speakers, lighting, and DJ gear are frequently rented for weddings, parties, corporate events, and live performances.

- Furniture (Event/Wedding Rentals) – Chairs, tables, tents, stages, and decorations are commonly rented for special occasions and formal gatherings.

- Gym Equipment – Treadmills, elliptical machines, weight benches, and other fitness gear may be leased by personal trainers, temporary fitness centers, or individuals working on home gyms.

- Heavy Machinery – Bulldozers, cranes, backhoes, and other industrial equipment are typically rented for construction projects and large-scale land development.

- Medical Equipment – Wheelchairs, hospital beds, oxygen tanks, and mobility aids are often rented for short-term patient care at home or in clinical settings.

- Power Tools – Drills, saws, generators, and sanders are popular rental items for DIY home improvement, repair jobs, or short-term projects.

- Vehicles – Cars, trucks, trailers, and specialty vehicles are rented for transportation needs, business deliveries, or recreational use.

- Construction Equipment – Scaffolding, jackhammers, concrete mixers, and excavators are rented for building projects, renovations, and infrastructure jobs.

These examples highlight the versatility of an Equipment Rental Agreement and how it provides legal protection for both the owner and the renter across diverse use cases.

Recommendations

- North Star Leasing (northstarleasing.com)

Sample Equipment Rental Agreement Template

Laws

Termination Period – For Month-to-Month it is 30 days and for Week-to-Week leases it’s 7 days.

Rent Increase – No laws mandating rent increases therefore landlords have the option to increase rent as long as they provide a 30 day notice.

Sources

Sample West Virginia Month-to-Month Lease Agreement

Florida Landlord-Tenant Laws

Florida’s residential landlord-tenant laws are covered in Title VI, Chapter 83, Part II of the Florida Statutes. The Florida Department of Agriculture and Consumer Services (FDACS) provides a Landlord/Tenant Law Brochure summarizing key information for renting or leasing a property.

Required Disclosures

Florida law requires landlords to provide security deposit details, disclose any lead-based paint in older homes, and inform tenants about radon gas. Landlords must also give tenants reasonable notice before entering the property for non-emergency reasons.

- Fireproofing and fire protection systems – Landlords must give tenants information about fire protection in buildings over 3-stories. [1]

- Landlord/Owner Contact Information – The landlord’s full mailing address must be provided for tenant notices. [2]

- Lead-Based Paint Disclosure Form – Required for rental units built before 1978. [3]

- Radon Disclosure Form – Tenants must be informed about radon hazardous gas.

- Security Deposit Disclosure – Explains how the tenant’s deposit will be handled during and after the lease.

Security Deposit Requirements

- Maximum Amount ($) – Florida does not mandate the maximum amount that Landlords can request from Tenants.

- Returning – 15 days from the lease end date written in the lease agreement.

Late Fees and Penalties

Forms for Common Landlord-Tenant Disputes (residential only)

Landlord-Tenant forms for common issues that arise between the parties resources (supremecourt.flcourts.gov).

Landlord Resources

Residential Tenancies – Title 6, Ch. 83, Part 2

Handbook (Guide) – Florida’s Landlord/Tenant Law

Sample Florida Residential Lease Template

Download: Word Template (Spanish)

Sample Georgia Association of Realtors Lease

What is included in the Connecticut Association of Realtors (CAR) Residential Lease Agreement PDF Template?

The Connecticut Association of Realtors (CAR) Residential Lease Agreement template outlines the terms for renting a property, including details about the property, lease duration, rent, security deposit, and responsibilities of the landlord and tenant. It covers rules for parking, pets, maintenance, alterations, utilities, and property use. It also includes conditions for property access, compliance with laws, subleasing, and lease termination.

Source: ctrealtors.com↗

Sample Connecticut Association of Realtors Lease

What is an Alaska Month-to-Month Lease?

This Alaska month-to-month lease agreement template is a legally binding contract between a tenant and landlord, with monthly rent payments with no set end date. Either party can terminate with a 30-day notice, and the landlord may request a security deposit to cover any potential damages. The landlord and tenant laws are governed by the Alaska Uniform Landlord and Tenant Act (Alaska Stat.§ 34.03).

Landlord Increasing Rent Requirements

Summary (Alaska Landlord and Tenant Act):

Landlords must give tenants a 30-day notice prior to increasing the rent amount.

Minimum Notice of Termination by Tenant Laws

Summary (§ 34.03.290):

- Week-to-week leases – 14-day notice

- Month-to-month leases – 30-day notice

Sample Alaska Month-to-Month Lease Agreement

By Type

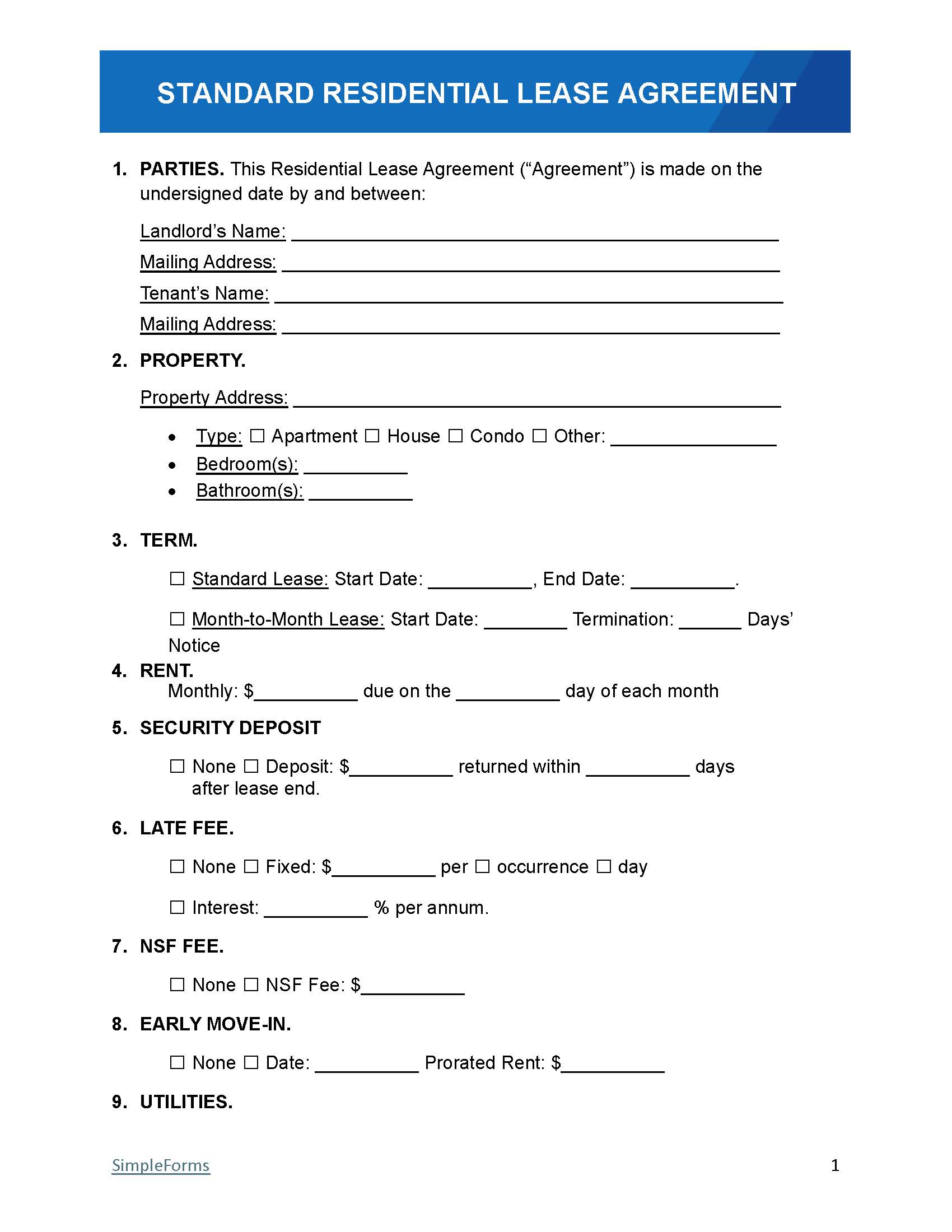

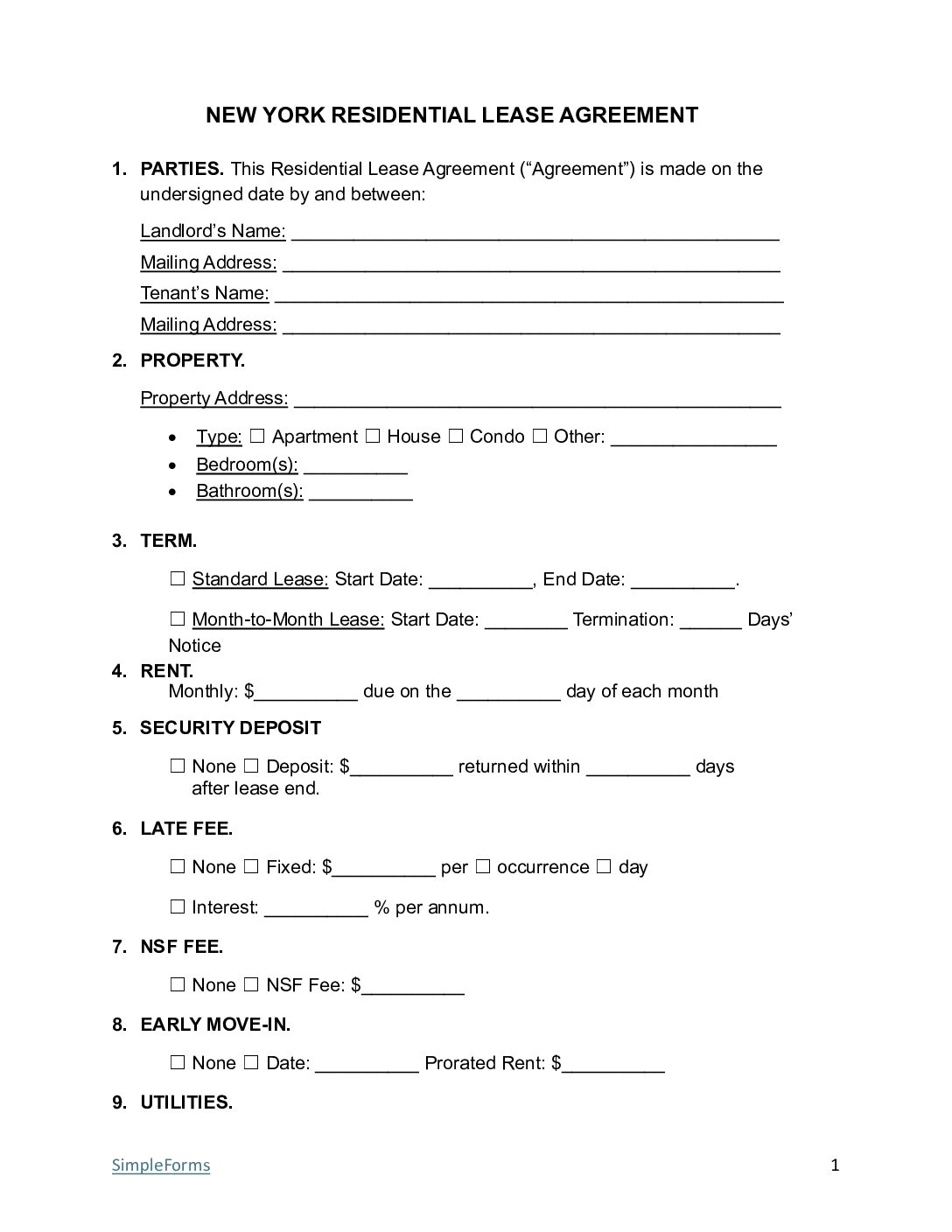

| New York Residential Lease Agreement – A fixed agreement, typically lasting one year. Download: PDF | Word (.docx) |

|

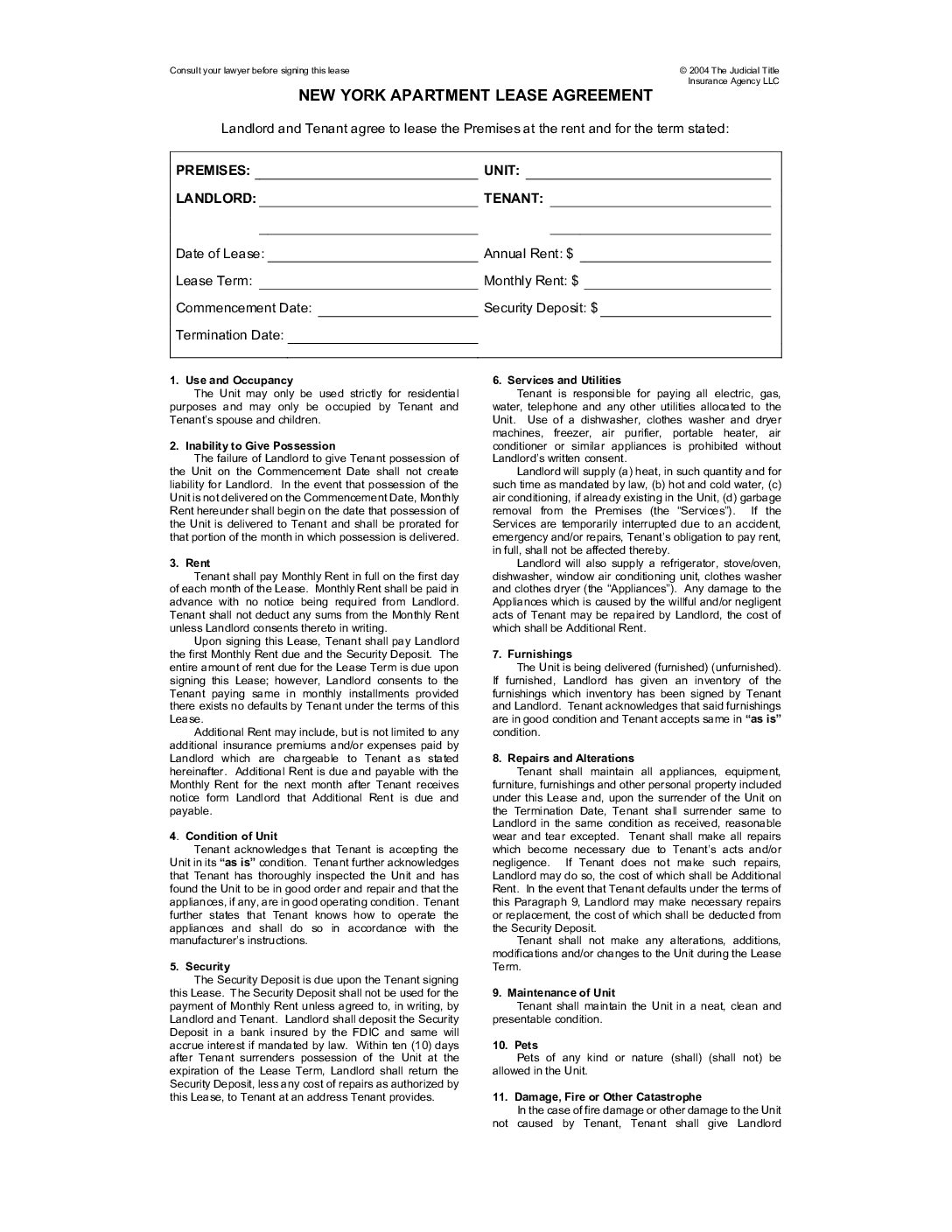

| New York Apartment Lease Agreement – Used for leasing apartments in New York in a residential unit in a multi-family building. Download: PDF | Word (.docx) |

|

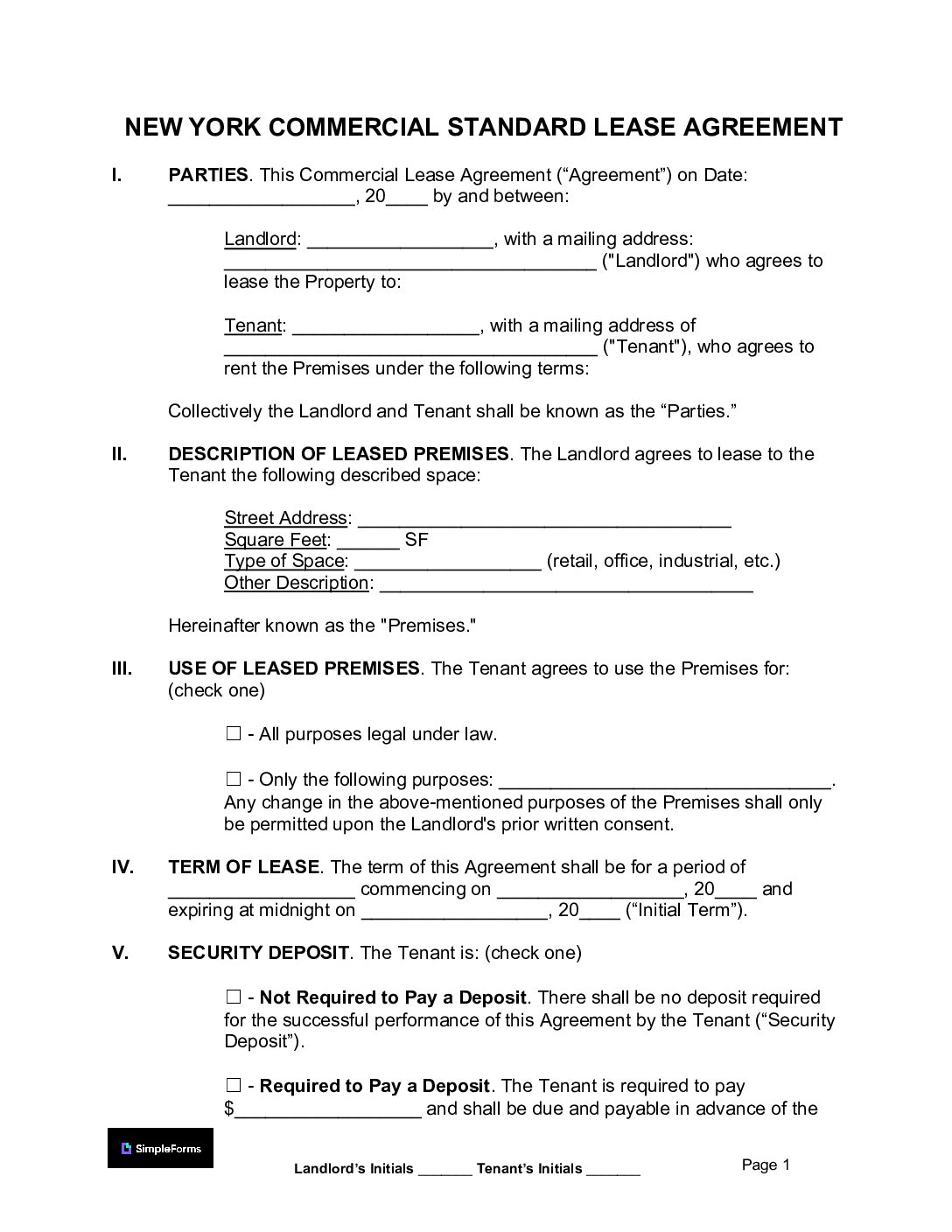

| New York Commercial Lease Agreement – For landlords renting space for office, retail, or industrial purposes. Download: PDF | Word (.docx) |

|

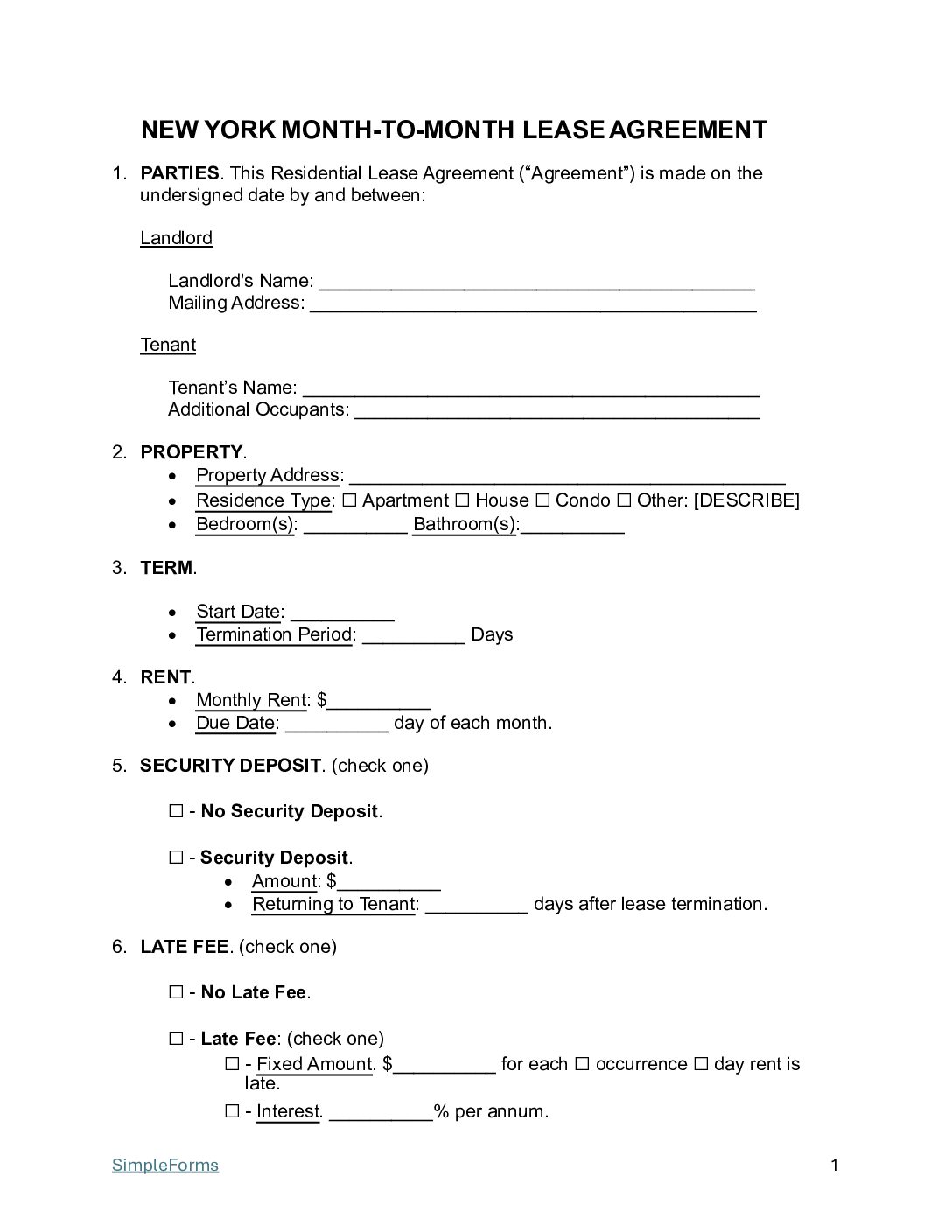

| New York Month-to-Month Lease Agreement – A contract that can be terminated by either party with at least one month’s notice. Download: PDF | Word (.docx) |

|

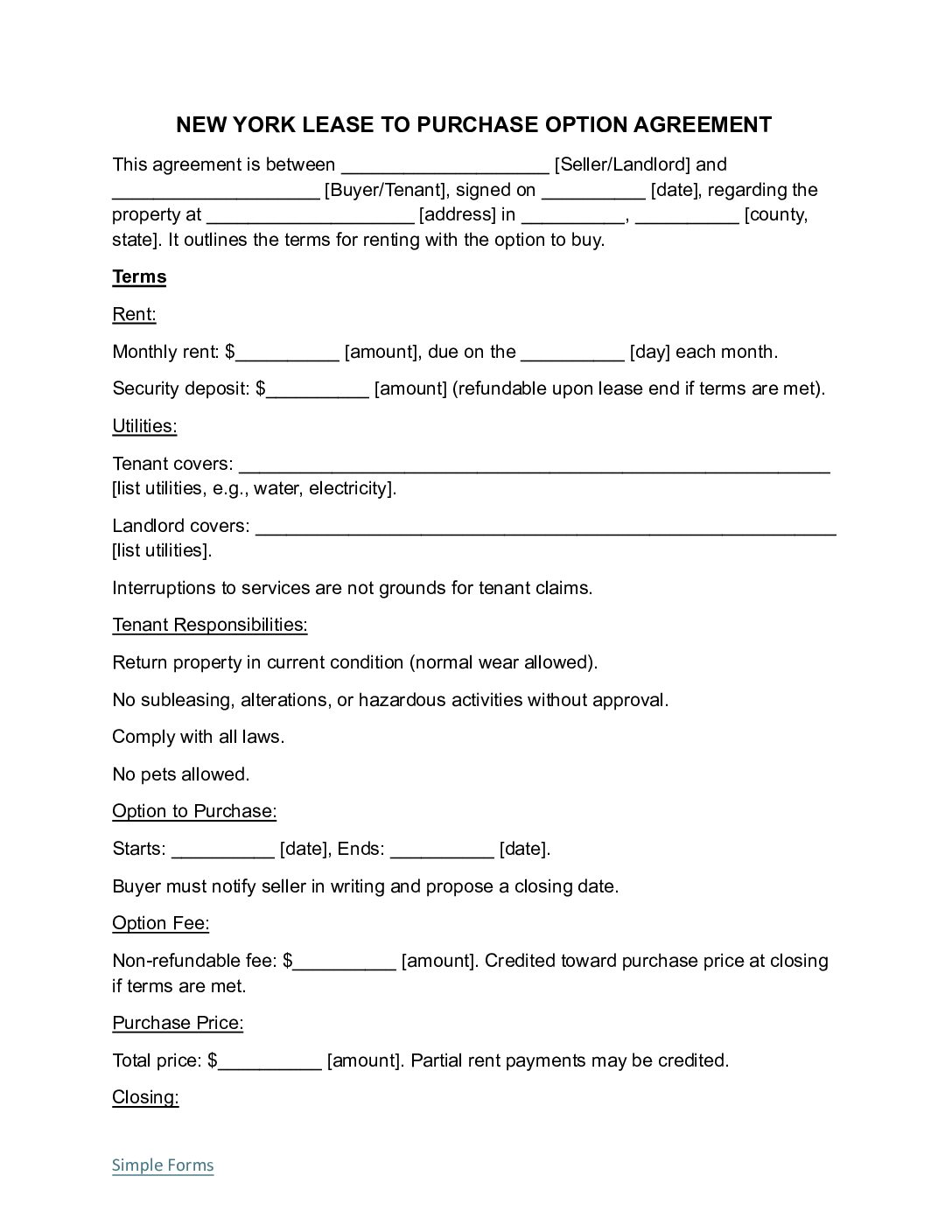

| New York Lease-to-Purchase Agreement – The tenant/buyer has the option to purchase the property under terms set by the owner/landlord during the rental period. Download: PDF | Word (.docx) |

|

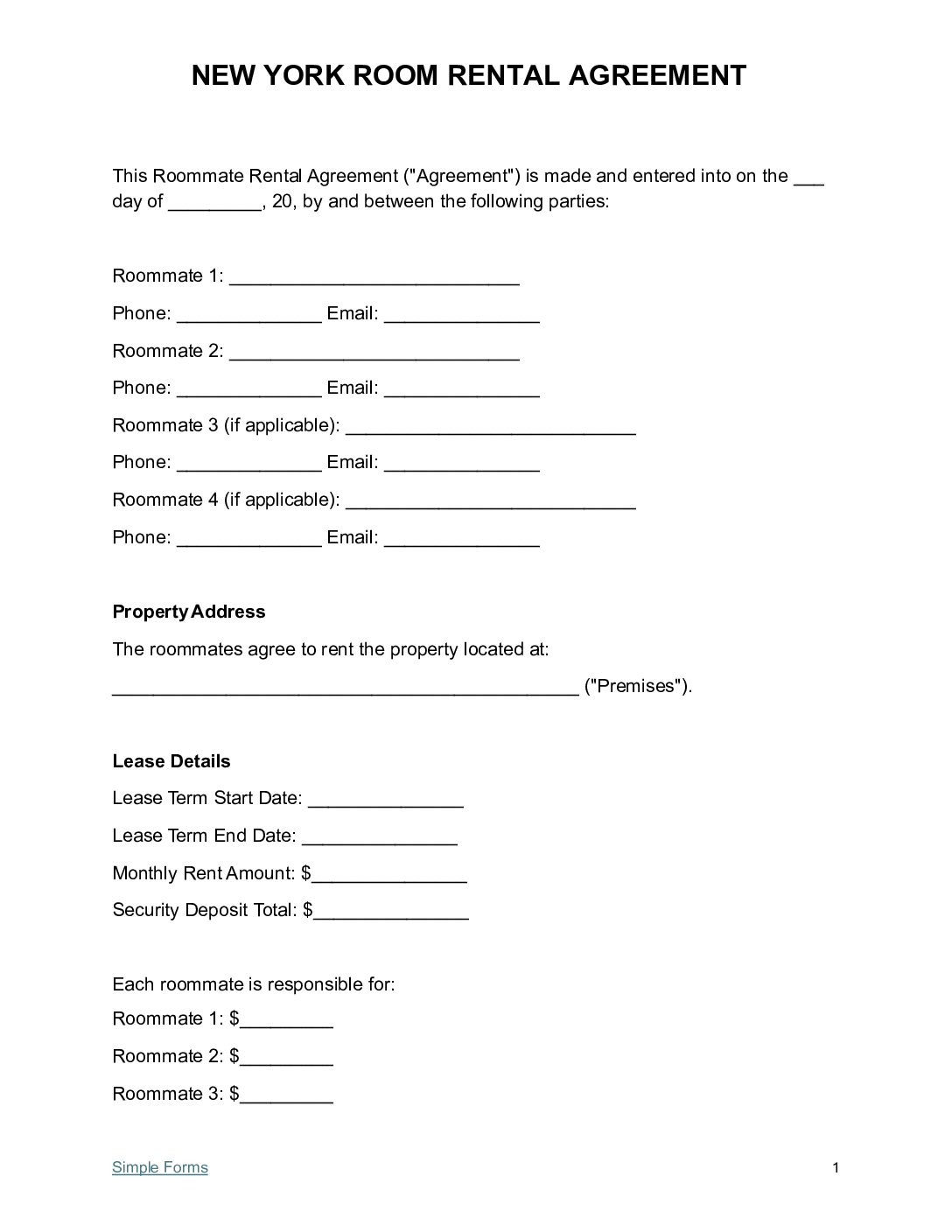

| New York Room (Roommate) Rental Lease Agreement – An agreement that outlines the rules and responsibilities, including fees, for each person living in a shared home. Download: PDF | Word (.docx) |

|

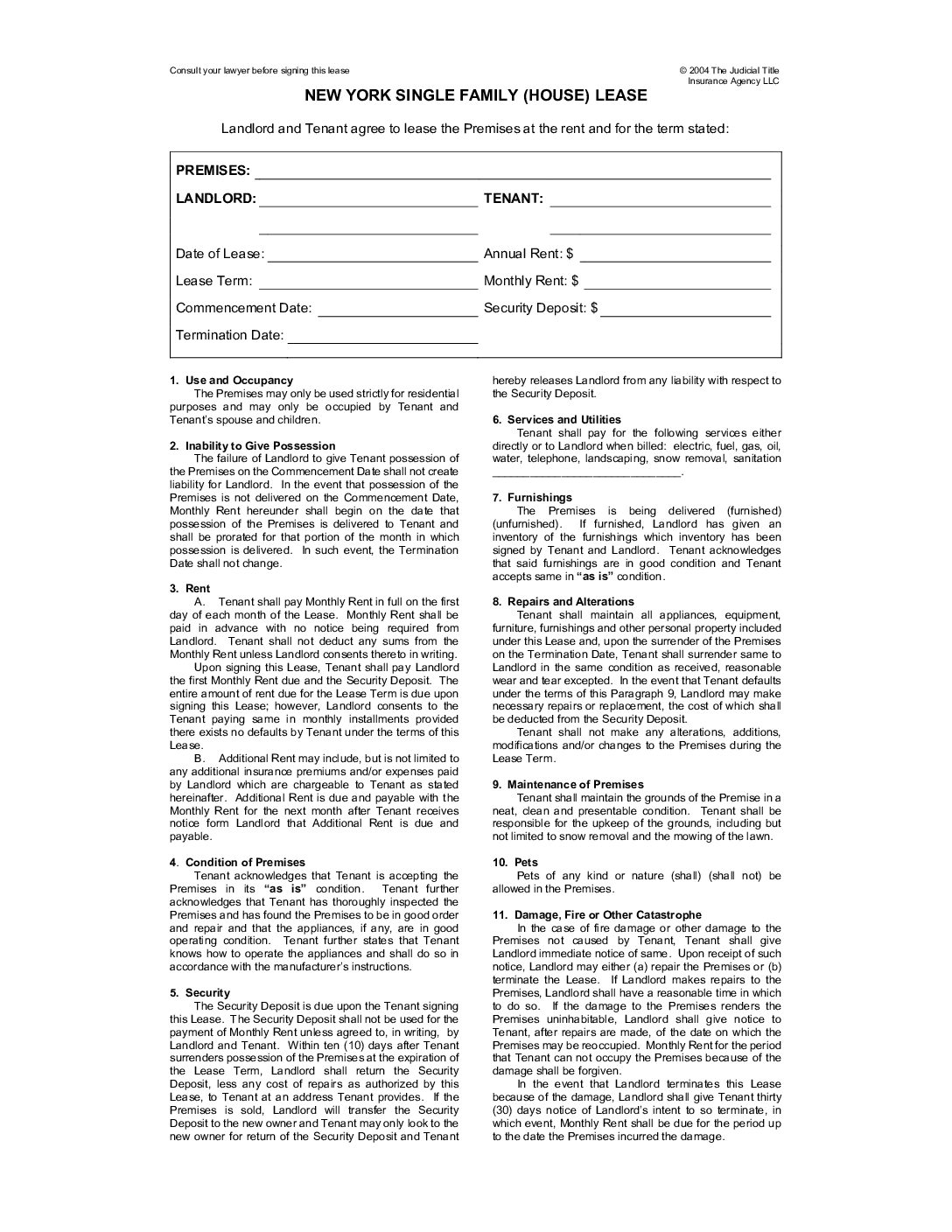

| New York Single-Family Home Lease Agreement – This type of agreement gives the tenant full use of the property, including the yard, driveway, and any included amenities. Download: PDF | Word (.docx) |

|

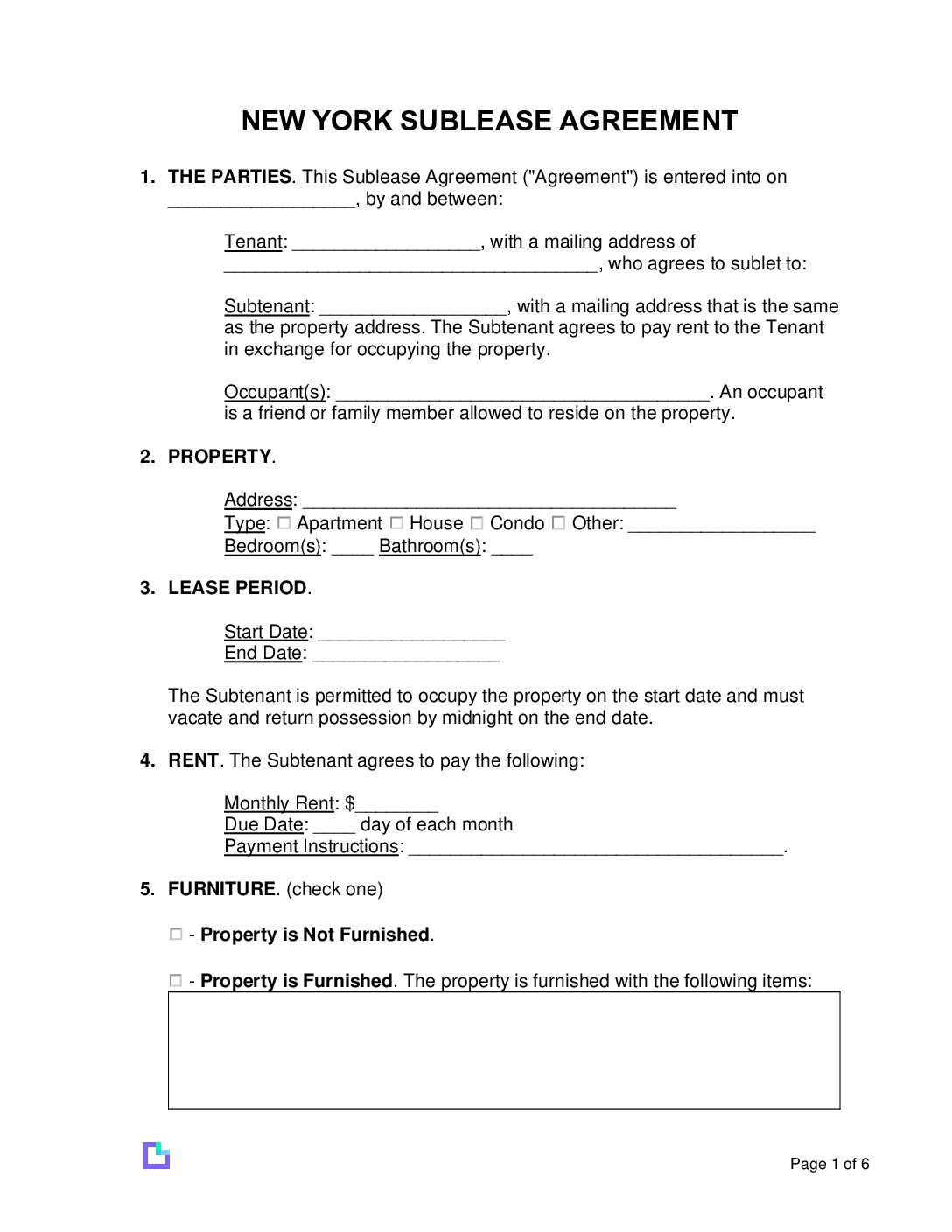

| New York Sublease Agreement Template – Allows the original tenant to let a subtenant take over their lease for part or all of the lease term. Download: PDF | Word (.docx) |

What does the New York Rental Lease Agreement Form Cover?

The New York rental lease agreement includes the following information for landlords and tenants in New York:

- New York Landlord-Tenant Act

- Security Deposit Law

- Lease Termination

- Landlord’s Access to the Property

- Rent Due Date and Late Fees

- Eviction Procedures

- Property Maintenance

- Required Disclosure Forms

- Tenant’s Right to Withhold Rent

New York Landlord-Tenant Act

Security Deposit Laws

Summary (§ 7-108-1-a(a), § 7-108(1-a)(e)):

- 14 Days – Landlords must return the security deposit within 14 days of the lease end date.

- Itemized List – Deductions for damages must be provided with the returned deposit.

- Maximum Amount – Security deposits are capped at one month’s rent for residential leases.

Lease Termination Rules for Landlords and Tenants

- Month-to-month: 30 days’ notice.

- No notice: If the rental unit poses a health or safety threat.

Landlord’s Access to the Rental Property

- Landlords must provide 24 hours before entering the property, except in emergencies.

Rent Due Dates and Late Fees

Summary (§ 238-A(2)):

- Grace Period – Landlords cannot charge late fees until the rent is more than 5 days late.

- Late Fees – Late fees are capped at $50 or 5% of the rent, whichever is less.

Eviction Procedures and Notices

- Notice to Pay or Quit – 14 days.

- Landlords must follow New York’s formal eviction process, starting with a written notice.

Property Maintenance Requirements and Utilities

Required Disclosure Forms

Summary: New York landlords must disclose the following information:

- Allergen Hazards Disclosure (NYC only) (NYC Admin Code § 27-2017.1):

Landlords must complete and sign this form with the Local 55 brochure, confirming an annual inspection for indoor allergens like mold, mice, rats, and cockroaches. - Bedbug Disclosure (NYC only) (NYC Admin Code § 27–2018.1):

Landlords must share the unit’s bedbug infestation history from the past year. - Copy of Signed Lease (conditional) (Tenants’ Rights Guide):

For rent-stabilized tenants, landlords must provide a signed lease copy within 30 days of the tenancy start date. - Flood History Disclosure & Risk Notice (N.Y. Real Prop. Law § 231-B(1)):

Landlords must inform tenants about the property’s flood history, risks, and insurance details. - Lead-Based Paint Disclosure & EPA Pamphlet (conditional)

Required for homes built before January 1, 1978; both the disclosure and EPA pamphlet must be provided and signed. - Notice of Good Cause Eviction Law (N.Y. Real Prop. Law § 231-c):

A notice must be attached to the lease indicating whether the tenancy is subject to the Good Cause Eviction Law. - Security Deposit Receipt (conditional) (N.Y. Gen. Oblig. Law § 7-103):

If a security deposit is collected, landlords must disclose the name and location of the financial institution where it is held. - Sprinkler Disclosure (N.Y. Real Prop. Law § 231-A(1)):

The lease must clearly state in bold text whether a sprinkler system is installed. - Stove Knob Covers (NYC only) (conditional) (NYC Admin Code § 27-2046.4(a)):

If tenants have children under six, they must complete this disclosure. Landlords must provide stove knob covers if requested.

Tenant’s Right to Withhold Rent

Summary (N.Y. Real Prop. Law § 235-a(1)): Tenants may withhold rent under the following conditions:

- The rental unit violates the warranty of habitability.

- The tenant must notify the landlord of the issue and allow reasonable time for repairs.

- If repairs are not made, tenants may pay for them and deduct costs from rent (repair and deduct).

Sample New York Rental Lease Agreement

A commercial lease agreement template outlines the terms and conditions of a rental arrangement between a landlord and a tenant for a commercial property.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

1. How to Lease Commercial Rental Property?

2 Options:

2. How to Process Rental Inquiries?

Property owners will know who is seriously interested in renting the Commercial Rental Property by potential Tenants requesting to see the property in person (property showing).

3. How to Screen Tenants?

There are five ways Landlords can screen potential Tenants to see if they are a good fit for the Commercial Rental Property for Lease:

- Commercial Lease Application

- Copy of Drivers License

- EIN (business)

- Previous two years of business tax returns (IRS Form 8879-S or IRS Form 1120S)

- Previous two years of personal income tax returns (IRS Form 1040).

Screening Services:

Individuals – MySmartMove (TansUnion)

Businesses – Dun & Bradstreet

Commercial Real Estate Definitions

- Absorption Rate – The rate at which available commercial space is leased or sold over a specific period, indicating demand in the market.

- Anchor Tenant – A major tenant in a commercial development (often a large retail store or grocery chain) that attracts other tenants and drives foot traffic.

- Build-to-Suit – A commercial property constructed specifically for a particular tenant’s needs, often under a long-term lease agreement.

- CAM (Common Area Maintenance) Charges – Fees paid by tenants in multi-tenant properties to cover expenses related to shared spaces like lobbies, hallways, elevators, parking lots, and landscaping.

- Cap Rate (Capitalization Rate) – A measure used to estimate the return on an investment property, calculated by dividing the property’s NOI by its current market value or purchase price.

- Commercial Property – Buildings and Land used for profit generation, including office buildings, medical centers, hotels, malls, retail stores, multifamily housing buildings, farmland, warehouses, and garages.

- Commercial Lease/Tenancy – Nonresidential tenancy for property by for-profit entities.

- Gross Lease – A lease where the landlord pays for most or all property expenses, such as taxes, insurance, and maintenance. The tenant pays a fixed rent amount.

- Leasehold Interest – The tenant’s right to use and occupy a commercial property for the term of a lease, distinct from ownership of the land or building.

- Net Operating Income (NOI) – A calculation used to analyze real estate investments, representing the total income from a property minus operating expenses (excluding taxes, interest, and depreciation).

- REIT (Real Estate Investment Trust) – A company that owns, operates, or finances income-producing real estate and allows individual investors to buy shares and receive dividends.

- Sublease – A secondary lease where the original tenant leases part or all of the rented property to another party, typically with the landlord’s consent.

- Tenant Improvement (TI) Allowance – Funds provided by a landlord to customize or improve a commercial space to meet a tenant’s specific business requirements.

- Triple Net Lease (NNN) – A type of lease agreement where the tenant agrees to pay all property expenses including real estate taxes, insurance, and maintenance, in addition to rent and utilities.

- Vacancy Rate – The percentage of all available units in a commercial property or market that are unoccupied at a given time.

- Zoning – Legal regulations that dictate how a property can be used (e.g., commercial, industrial, residential) and what kind of structures can be built on it.

Frequently Asked Questions

What is the penalty for breaking a Commercial Lease Agreement?

What are outgoings in Commercial Leases?

How much is a Commercial Lease Bond?

Do Commercial Tenants have the same rights and protections as Residential Tenants?

When Does a Commercial Lease Agreement Become Legally Binding?

Sample Commercial Lease Agreement Template

Standard Commercial Lease Agreement Checklist

✅ Before Signing Checklist

Landlord Responsibilities:

Tenant Responsibilities:

✅ After Signing Checklist

Immediate Steps:

First Month Steps: