An Washington lease agreement is used when renting rental property and it is a contract between the Landlord and Tenants in exchange for monthly rent payments.

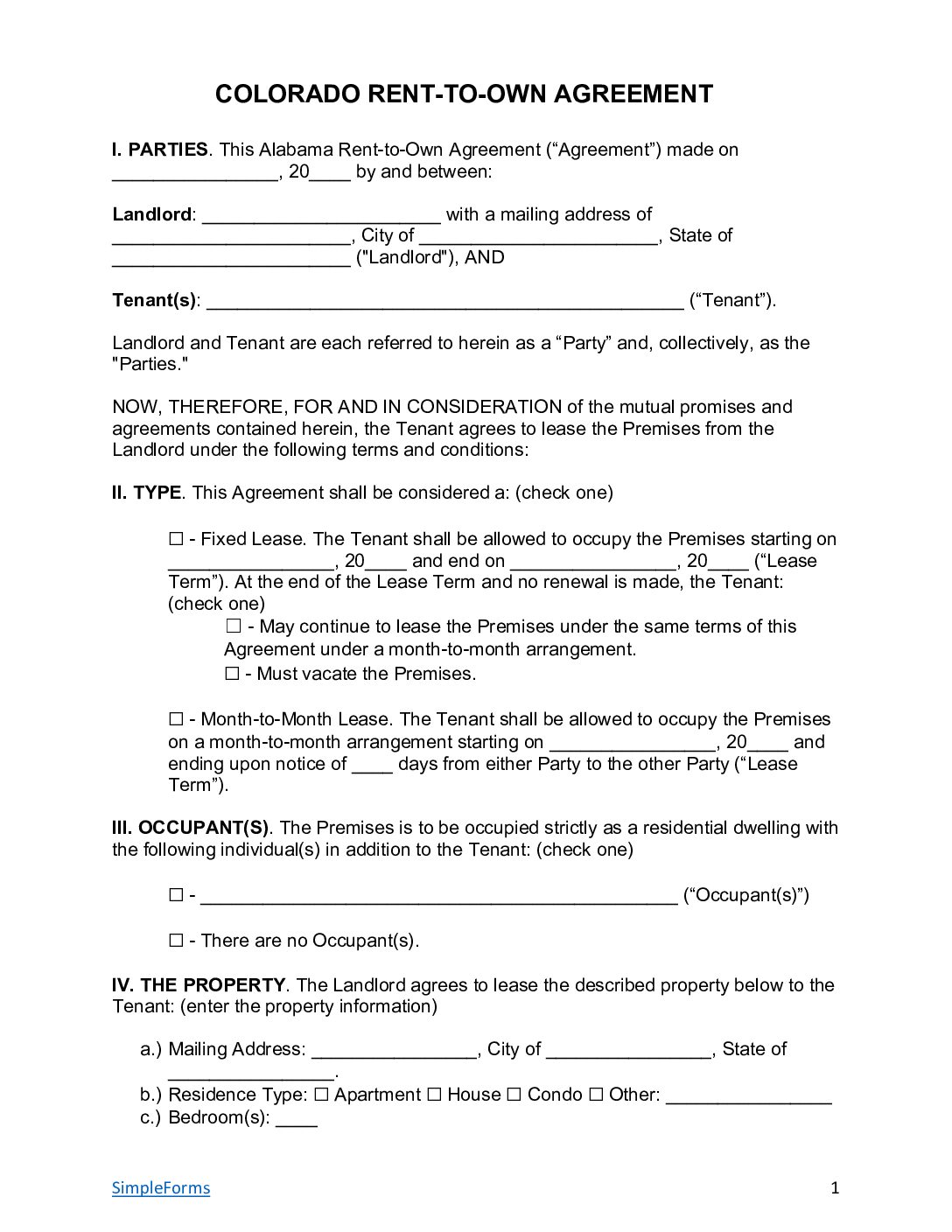

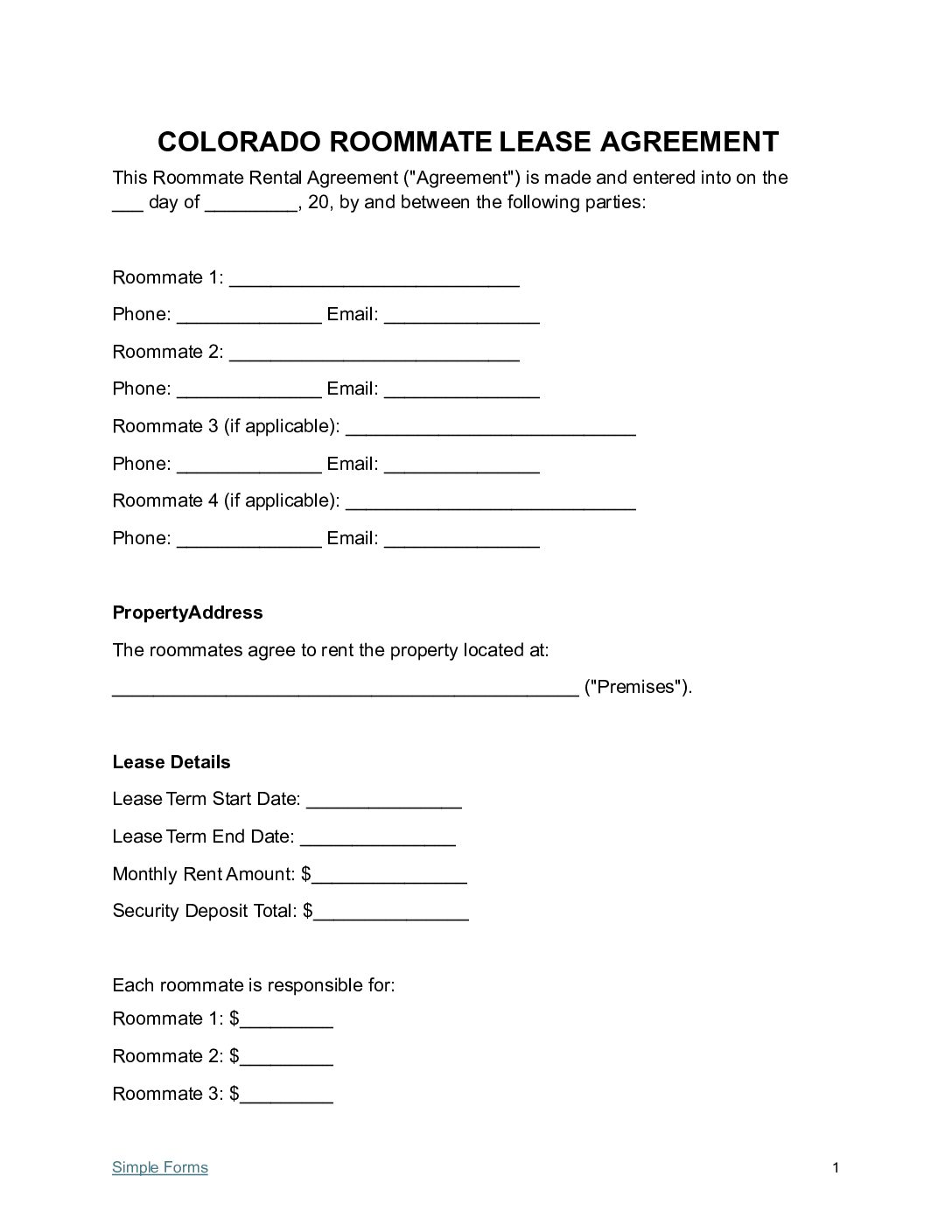

Form Options By Type

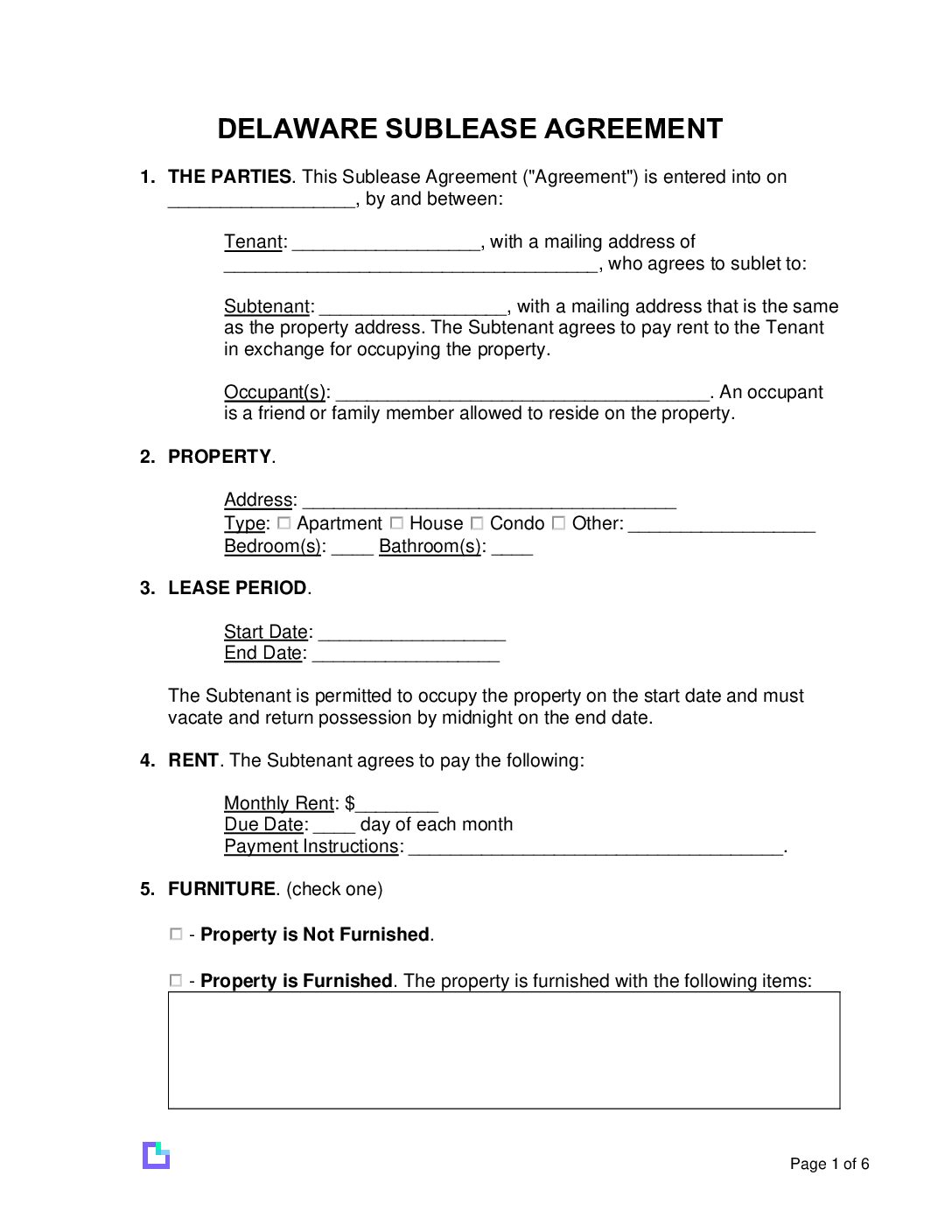

Standard Residential Lease Agreement Standard Residential Lease Agreement

Download: PDF |

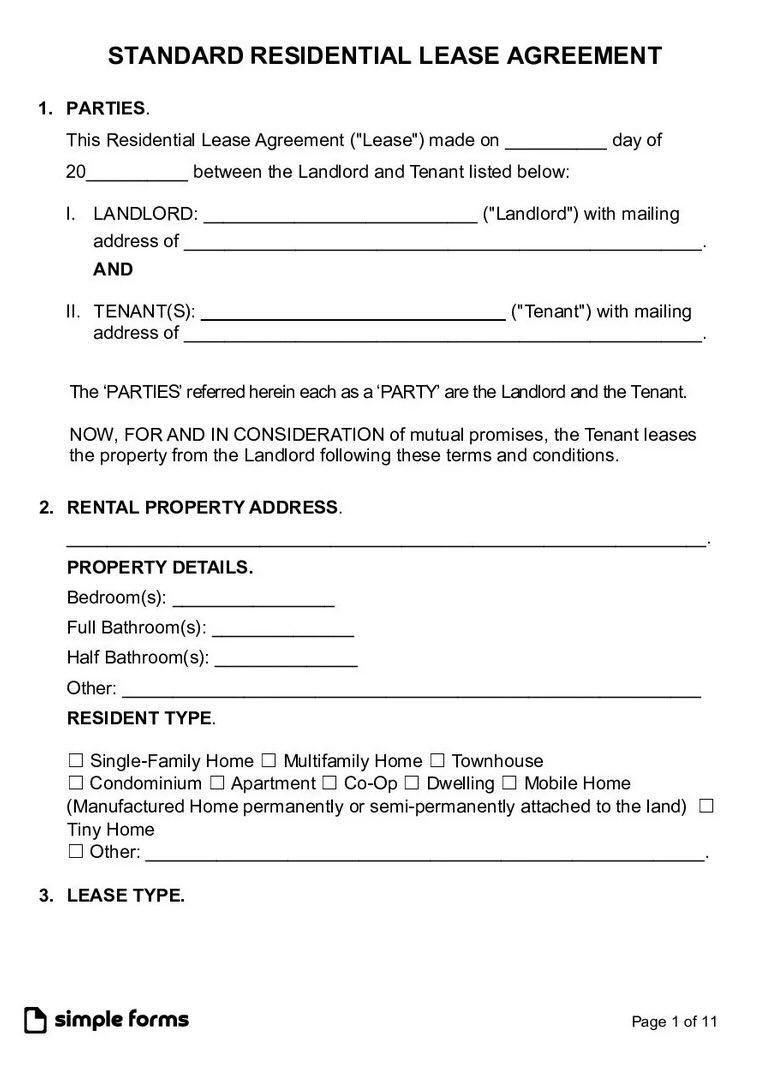

Simple (1-Page) Lease Agreement Simple (1-Page) Lease Agreement

Download: PDF |

Most Recent US Home Facts

- Population (2023): 334,914,895

- Median Households (2022): 125,736,353

- Median Household Income (2022): $75,149

- Owner-occupied Households (2022): 64.8%

Source: U.S. Census Bureau

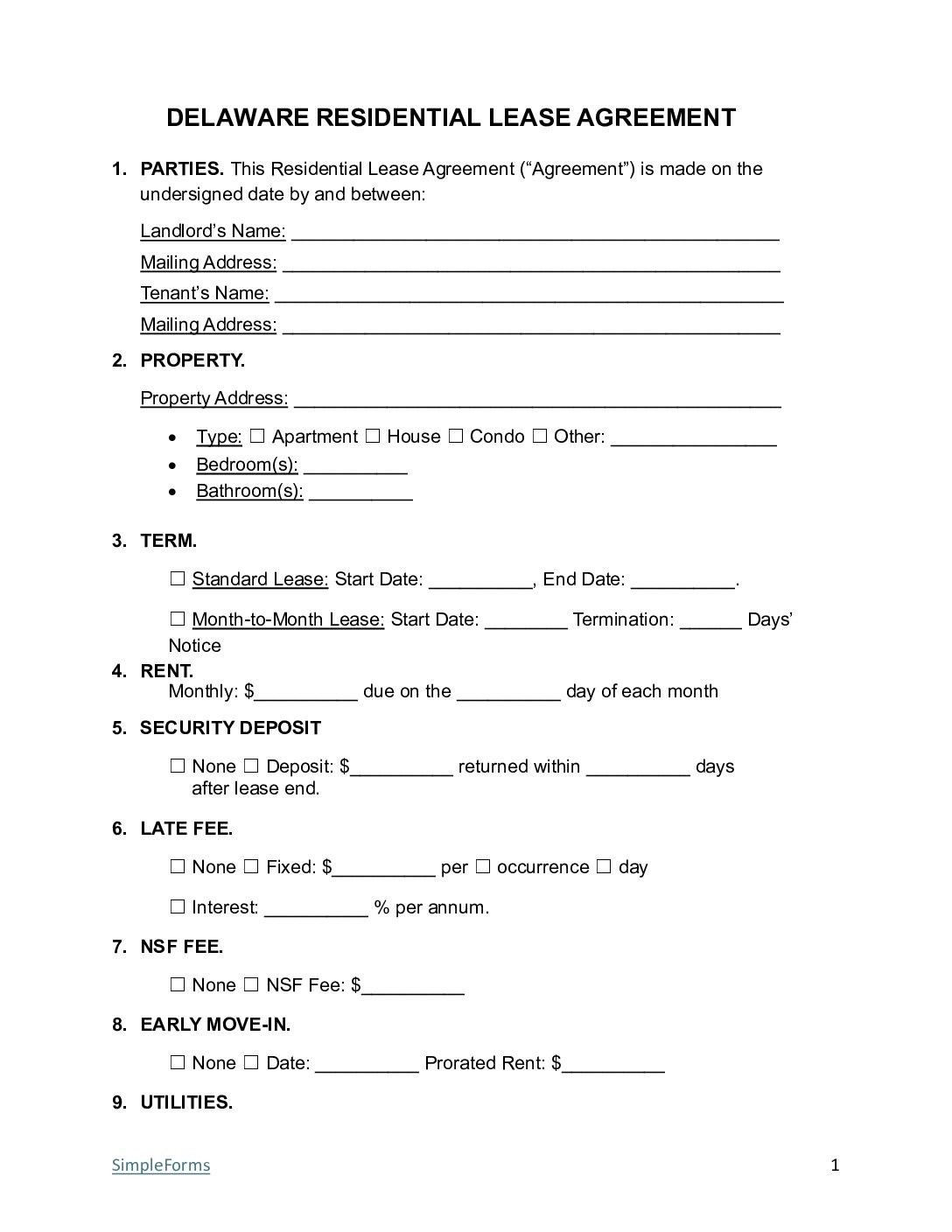

What to Include in the Form?

Required Disclosures (8)

Lead-Based Paint Disclosure

Fire Protection and Evacuation Plan Disclosure

Landlord Identification Disclosure

Mold Disclosure

Move-In Checklist

Nonrefundable Fees

Security Deposit Receipt

Voter Registration Packet (Only for Seattle Rental Properties)

Source: RCW 59.18.060(12)(a)

Security Deposits

Maximum – 25% of one (1) months rent is the maximum amount Landlords can request from Tenants in Washington.

Returns – All deposits must be returned to the Tenant within thirty (30) days of the lease end date..

Source: RCW 59.18.280(1)(a)

Landlord Access

General Access – Landlords must provide prior notice before entering the premises as per state law of least 48 hours (2 days) notice to the Tenants.

Source: RCW 59.18.150(6)

Paying Rent

Grace Period – Five (5) day grace period.

Late Fees – Landlords can charge Tenants up to $20 or 20% of one months rent (the greater of the two).

NSF Fee – $40 per bounced check.

Source: RCW 62A.3-515(a)

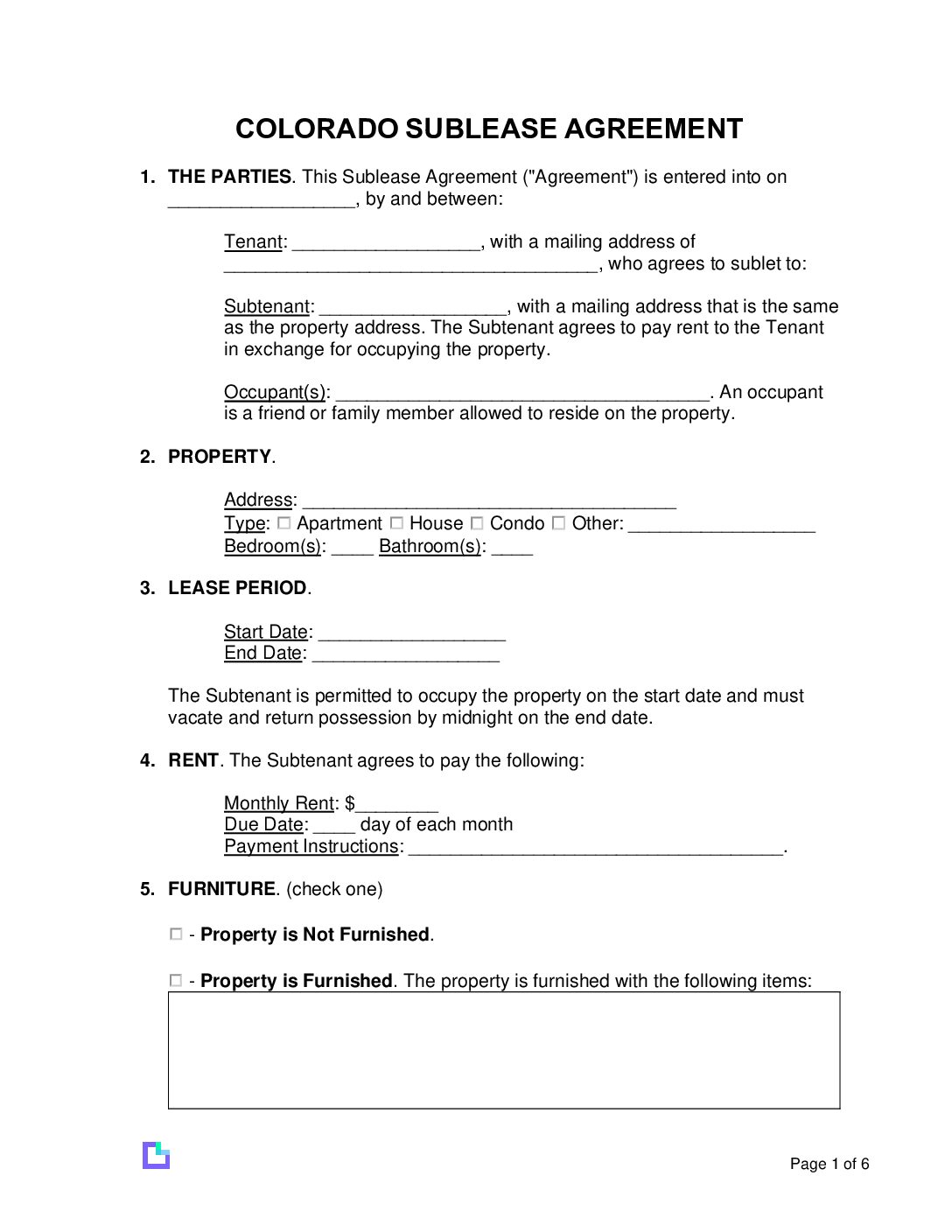

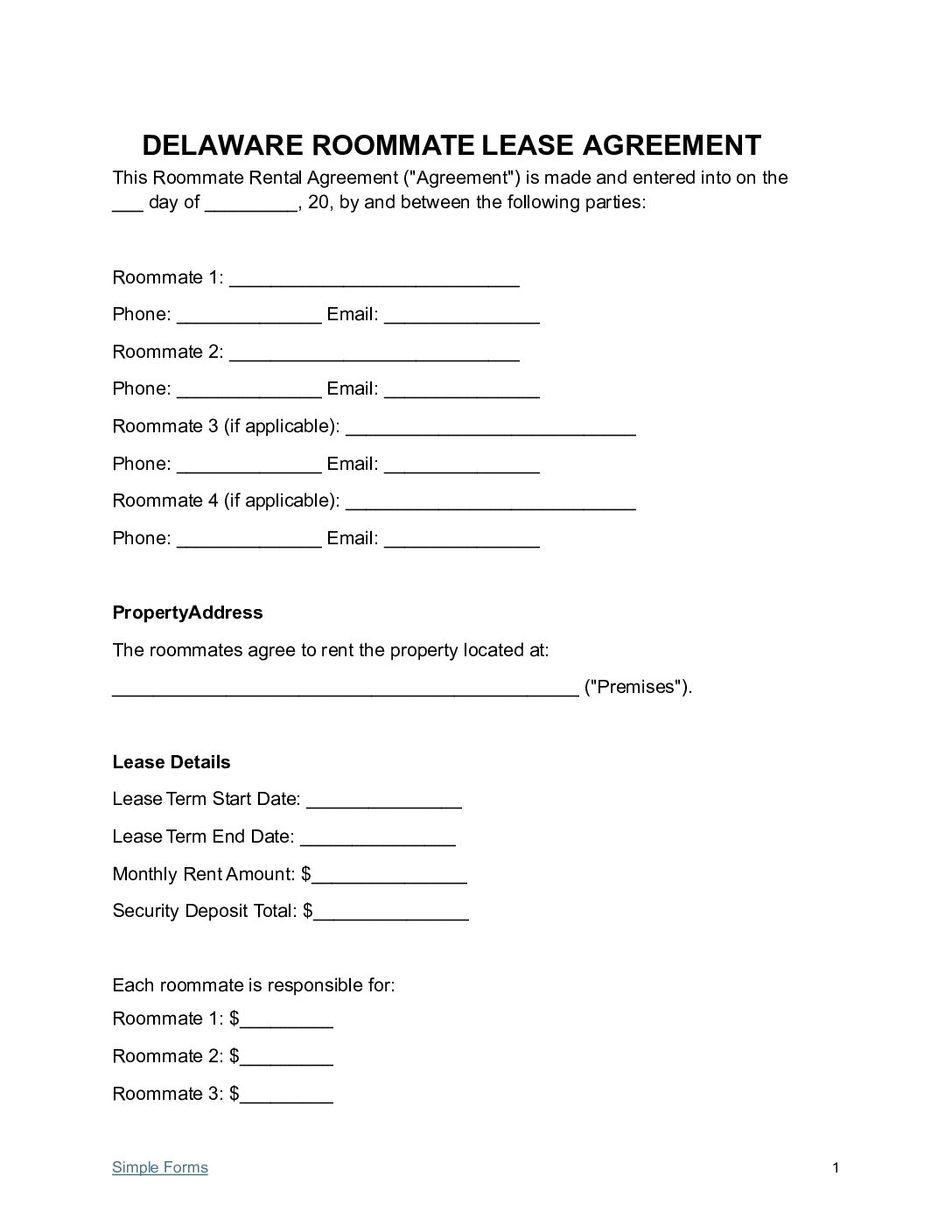

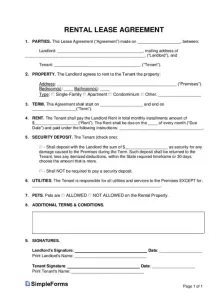

Washington 1-Page Lease Agreement Example

Sample

https://simpleforms.com/wp-content/uploads/2024/04/Washington-Simple-1-Page-Residential-Lease-Agreement.pdf