Required Disclosure Forms

- Lead-Based Paint Disclosure Form – Required for any rental properties built before 1978.

- Move-In Checklist – Records the rental unit’s condition before and after Tenancy.

An Washington lease agreement is used when renting rental property and it is a contract between the Landlord and Tenants in exchange for monthly rent payments.

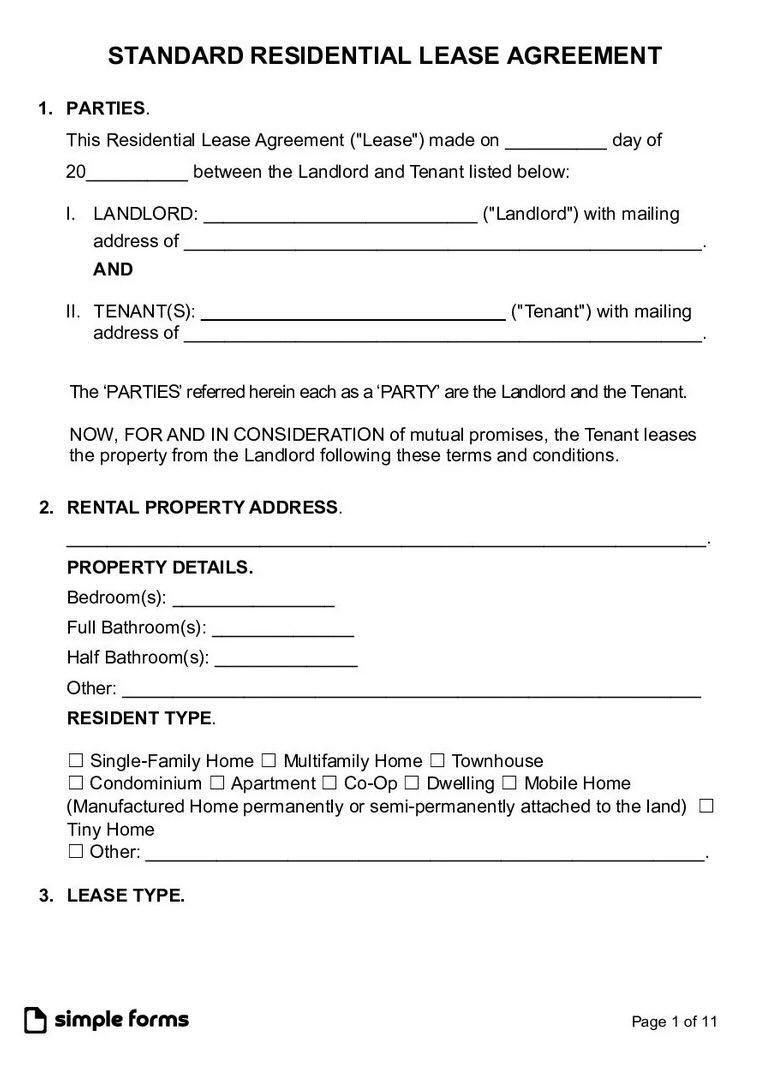

Standard Residential Lease Agreement Standard Residential Lease Agreement

Download: PDF |

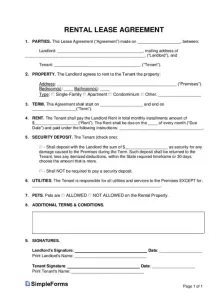

Simple (1-Page) Lease Agreement Simple (1-Page) Lease Agreement

Download: PDF |

Source: U.S. Census Bureau

Lead-Based Paint Disclosure

Fire Protection and Evacuation Plan Disclosure

Landlord Identification Disclosure

Mold Disclosure

Move-In Checklist

Nonrefundable Fees

Security Deposit Receipt

Voter Registration Packet (Only for Seattle Rental Properties)

Source: RCW 59.18.060(12)(a)

Maximum – 25% of one (1) months rent is the maximum amount Landlords can request from Tenants in Washington.

Returns – All deposits must be returned to the Tenant within thirty (30) days of the lease end date..

Source: RCW 59.18.280(1)(a)

General Access – Landlords must provide prior notice before entering the premises as per state law of least 48 hours (2 days) notice to the Tenants.

Source: RCW 59.18.150(6)

Grace Period – Five (5) day grace period.

Late Fees – Landlords can charge Tenants up to $20 or 20% of one months rent (the greater of the two).

NSF Fee – $40 per bounced check.

Source: RCW 62A.3-515(a)

https://simpleforms.com/wp-content/uploads/2024/04/Washington-Simple-1-Page-Residential-Lease-Agreement.pdf

A California 1 page rental lease agreement is legally binding between the Landlord and Tenant(s). It outlines the terms and conditions of the lease including both parties’ responsibilities. This written agreement lasts until the lease end date.

Maximum (§ 1950.5(c)(1)) – If the rental is furnished, the landlord may require up to three months’ rent as a security deposit. If it’s unfurnished, the landlord may require up to two months’ rent.

Returning (§ 1950.5(g)(1)) – The landlord must return the tenant’s deposit within 21 days, accompanied by an itemized statement of any deductions.

In order to give a Right to Enter Notice, you can do one of the following things:

Source: CIV § 1954(d)

Yes, except for termination due to discrimination or retaliation.

Pay online through California Franchise Tax Board (FTB) website.

April 15th.

Yes.

Yes, depending on the circumstances (injury or death).

$15 for 26 or more employees and $14 for 25 and fewer employees.

Landlord Preparation:

Tenant Preparation:

Immediate Actions (First 24 Hours):

First Week Actions:

An Alabama residential lease agreement is a written and oral legally binding contract between the Landlord and Tenant(s). Oral agreements are considered tenancy-at-will with no specific end date.

Source: U.S. Census Bureau

Maximum Amount – Landlords may not charge Tenants a security deposit equal to more than one month’s rent. The security deposit must be placed in an escrow account with a bank or lending institution.

Returning to Tenant – A security deposit must be returned to the Tenant within 60 days after the lease end date.

Source: §35-9A-201

Must include an itemized list, costs, fees and calculations.

Unamortized Tenant Improvements and Tenant Broker Commissions.

The agreement becomes legally binding once the Landlord and Tenant have signed the form.

The Landlord must notify the Tenant in writing to vacate the property after seven days of no rent payments in a rental without a lease (tenancy-at-will).

A guest becomes a Tenant when staying on the rental property for an extended period of time.

The right to rental a dwelling that is habitable, privacy, non-discrimination, and the right of security deposit returns.

Alabama is mostly in the Central Time Zone (CT) but there are a few locations in eastern Alabama that are in the Eastern Time Zone (ET).

No. Alabama follows the equitable distribution principles when the division of property takes place.

Landlord Preparation:

Tenant Preparation:

Immediate Actions (First 24 Hours):

First Week Actions:

An Alaska 1-Page Lease Agreement Template is used to legally establish a rental relationship between landlords and tenants in the state of Alaska.

Source: Zillow.com

Alaska landlords and tenants must comply with the Alaska Uniform Residential Landlord and Tenant Act. This comprehensive legislation governs all rental relationships in Alaska and provides the legal framework for lease agreements.

Your Alaska lease agreement must also comply with these federal regulations:

| City | 1-Bedroom Avg | 2-Bedroom Avg | Security Deposit Avg |

|---|---|---|---|

| Anchorage | $1,350 | $1,650 | $2,700 |

| Fairbanks | $950 | $1,200 | $1,900 |

| Juneau | $1,100 | $1,400 | $2,200 |

| Wasilla | $900 | $1,150 | $1,800 |

| Kenai | $850 | $1,100 | $1,700 |

Source: § 34.03.070

Grace Period – There’s no grace period in the state of Alaska.

Source: § 34.03.160

Source: § 34.03.100

Source: § 09.45.090 – § 09.45.105

Landlord Preparation:

Tenant Preparation:

Immediate Actions (First 24 Hours):

First Week Actions:

A: Yes, Alaska has no rent control laws. Landlords can increase rent to any amount with proper notice (typically 30 days for month-to-month leases). However, increases cannot be discriminatory or retaliatory.

A: The maximum security deposit cannot exceed two months’ rent, including any pet deposits. This is one of the higher limits in the U.S., providing good protection for landlords.

A: Landlords must return security deposits within 14 days if no damages occur, or within 30 days if deductions are made. Interest is not required to be paid on deposits.

A: No, Alaska does not have a statutory grace period for rent payments. Rent is due exactly when specified in the lease agreement.

A: Landlords must provide 24 hours written notice before entering rental units, except in emergencies. The notice must specify the purpose and approximate time of entry.

A: Alaska became the 49th U.S. state on January 3, 1959.

A: Juneau is the capital of Alaska.

A: Alaska uses Alaska Time Zone (AKT) and Alaska Daylight Time (AKDT) during daylight saving time.

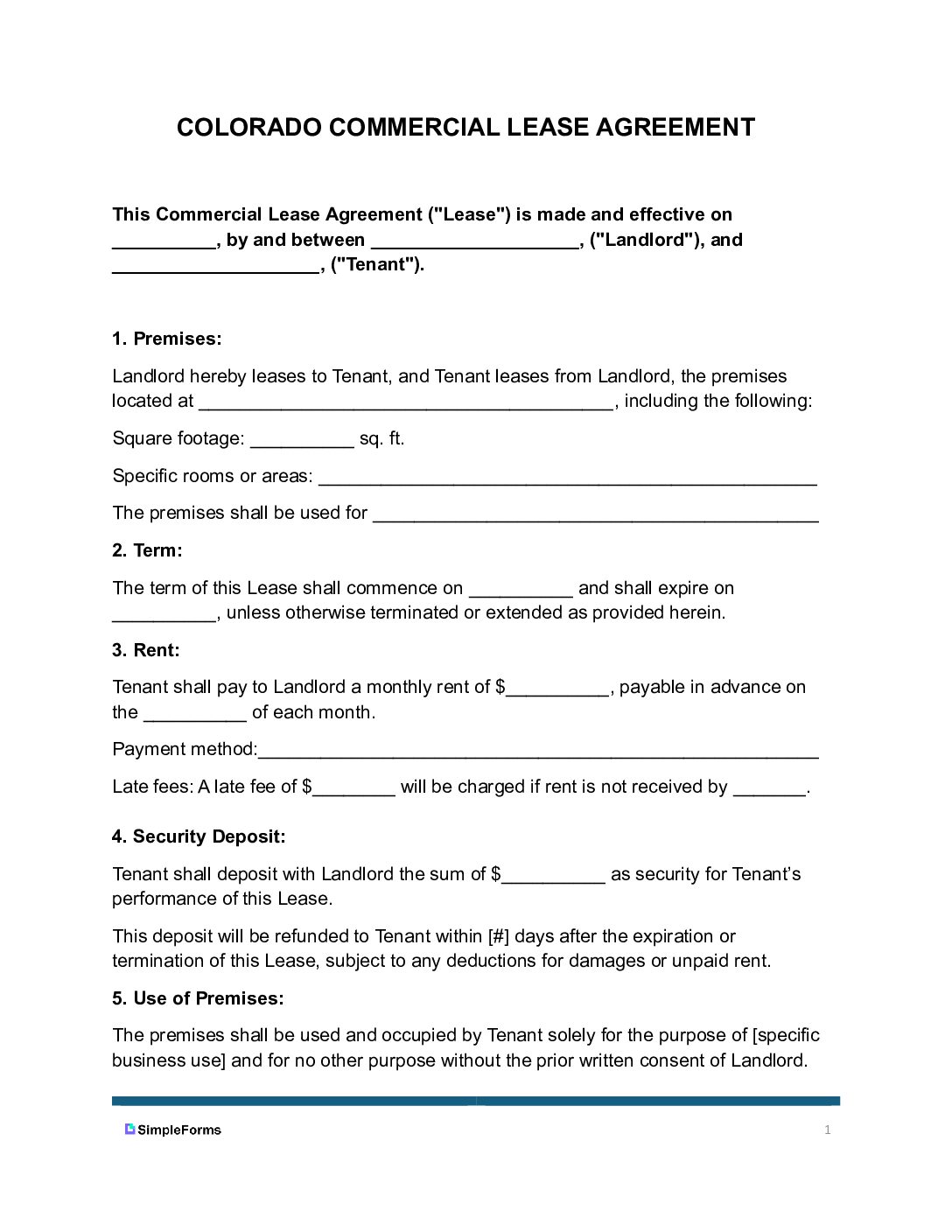

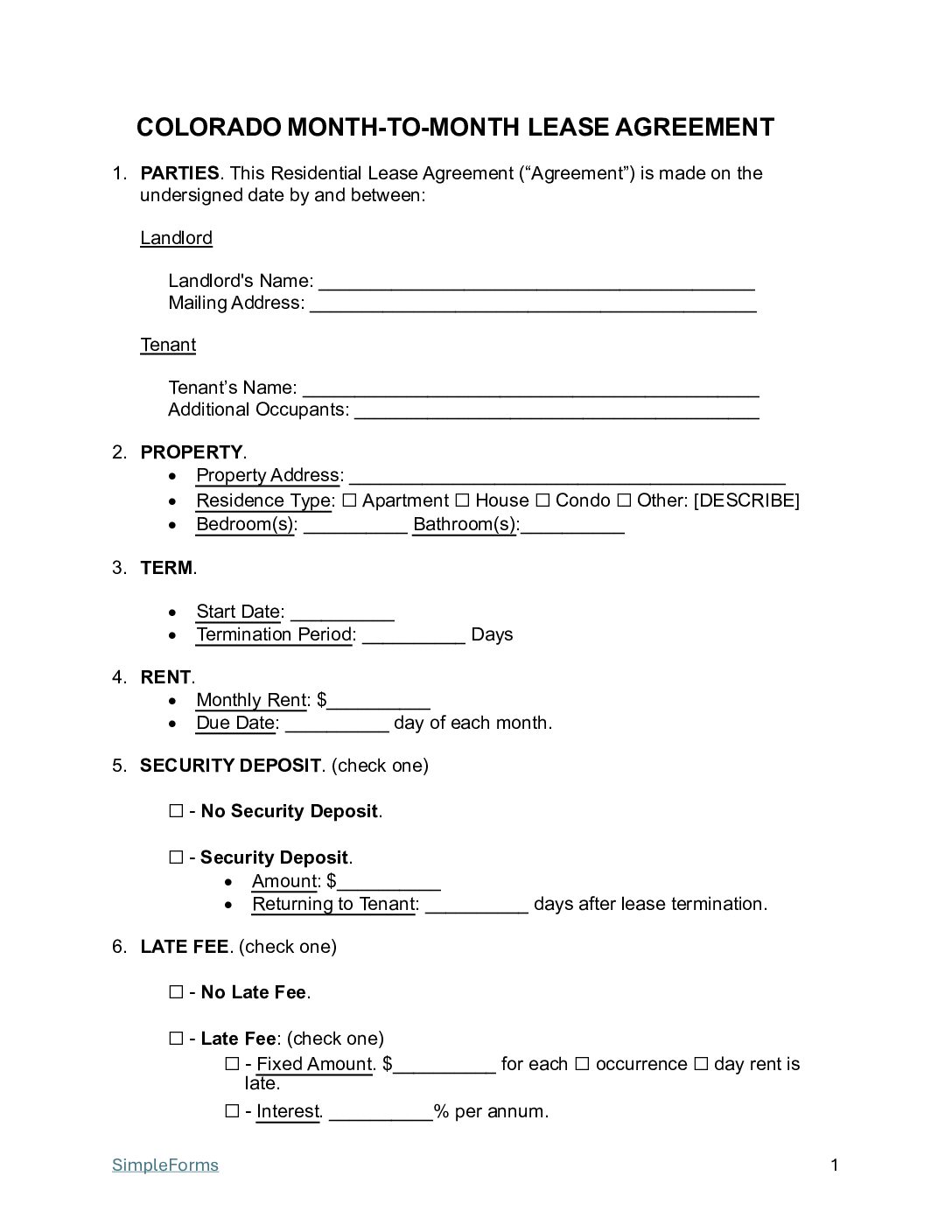

A Colorado lease agreement is a contract for renting property. Landlords should obtain the tenant’s personal information to run a credit and background check to verify their ability to pay rent.

Download:

Month-to-Month

Month-to-MonthDownload:

Download:

Room (Roommate)

Room (Roommate)Download:

Sublease Agreement

Sublease AgreementDownload:

Source: U.S. Census Bureau

Source: C.R.S. § 38-12-803

Source: C.R.S. § 38-12-102.5

NSF Fee – $20 per bounced check.

Source: C.R.S. § 38-12-105(a), C.R.S. § 38-12-105(1)(c), C.R.S. § 38-12-105(1)

For any other questions you may have, refer to the Colorado Division of Real Estate website.

Give the other party proper notice, pay the associated fees and/or penalties and find new Tenant.

Must provide written notice. If the Tenant refuses to leave then the Landlord must file legally through the Colorado Judicial Branch.

Complete the sales agent courses, pass exam and any other requirements by the Colorado Real Estate Commission.

April 15th.

Yes.

No. Colorado marital property is divided fairly but not always equally because Colorado follows equitable distribution laws.

Fort Collins, Colorado.

There are many places to vacation in Colorado. The most popular destinations include Denver, Boulder, Aspen, Breckenridge, Colorado Springs. Rocky Mountain National Park, Telluride and Vail.

Check the status of your refund with the Colorado Department of Revenue.

Landlords cannot discriminate against Tenants, enter rental properties without prior notice and/or retaliate against Tenants.

Landlord Preparation:

Tenant Preparation:

Immediate Actions (First 24 Hours):

First Week Actions:

Source: U.S. Census Bureau

Source: § 47a-21d(2)

General Access – The Landlord must give Tenant(s) “reasonable notice” before entering the rental property unless it’s an emergency or by court order.

Source: § 47a-16

For any other questions you may have, refer to the

Connecticut Real Estate Commission website.

Connecticut rentals can be found on Craigslist.com, zillow.com, Vrbo.com, AirBnb.com, Trulia.com and apartments.com.

As of January 1st, 2024, the minimum wage in Connecticut is $15.69.

Yes, residents over the age of 21 can consume and possess marijuana.

The most popular destinations in Connecticut are the Mystic Seaport, Yale University and its museums, Mark Twain House & Museum, Mystic Aquarium, and Gillette Castle State Park.

Contact the Connecticut Department of Housing.

Complete the sales agent classes, pass the state exam and any other requirements by Connecticut Department of Consumer Protection.

The price can vary depending on location and home value. Check with local insurance companies and compare prices.

Damage to home and natural disasters.

Yes.

Yes. Connecticut is both landlord and tenant friendly.

Depending on the rental the prices can vary. Check local listings for current prices.

An Illinois Lease Agreement is a legal document that outlines the terms and conditions between a landlord and tenant for residential or commercial property use.

Source: U.S. Census Bureau

Although no state law mandates that Landlords provide notice to their Tenants prior to entering a rental property for maintenance or any other issue, it is recommended for Landlords to provide reasonable notice to Tenants.

Grace Period – Tenants are granted a grace period of five days. It is prohibited for the landlord to impose any late payment fees before the sixth day of late rent payment.

Maximum Late Fee – The maximum penalty for late rent payment is either $20 or 20% of the rent, whichever amount is greater.

Returned Checks (NSF) – $25 per bounced check.

Source: 770 ILCS 95/7.10, 810 ILCS 5/3-806

The Indiana Lease Agreement is a legally binding contract between a landlord and a tenant for the purpose of renting either commercial or residential property. The tenant will typically view the property and, if interested, will negotiate with the landlord to come to an agreement.

Source: U.S. Census Bureau

Grace Period – As per the terms of the lease agreement, rent is due on the specified date. It is important to note that there is no grace period mandated by Indiana state law.

Maximum – There is no statutory limit on late fees that a landlord can charge.

NSF Fee – The maximum fee for a returned check is $25.

Source: § 24-4.5-7-202(1)

A Kansas lease agreement is a legally binding document that establishes the terms of a rental arrangement between a landlord and tenant for residential or commercial use of a property.

| Residential Lease Agreement – Standard 1-year lease term. Download: PDF | Word (.docx) |

|

| Association of Realtors Lease Agreement – Kansas Assoc. of Realtors Residential Lease Version. Download: PDF | Word (.docx) |

|

| Commercial Lease Agreement – Used for retail spaces, office buildings, warehouses, and industrial facilities. Download: PDF | Word (.docx) |

|

| Month-to-Month Lease Agreement – Tenancy at will with renewals every 30 days. Download: PDF | Word (.docx) |

|

| Rent to Own Lease Agreement – A lease that includes an option for the tenant to purchase the property. Download: PDF | Word (.docx) |

|

| Roommate Lease Agreement – Shared living arrangements. A binding contract outlining responsibilities and agreements between co-tenants. Download: PDF | Word (.docx) |

|

| Sublease Agreement – Used to Sublet unit with landlords approval. Download: PDF | Word (.docx) |

Source: U.S. Census Bureau

Source: § 16a-2-501(e)(iii)