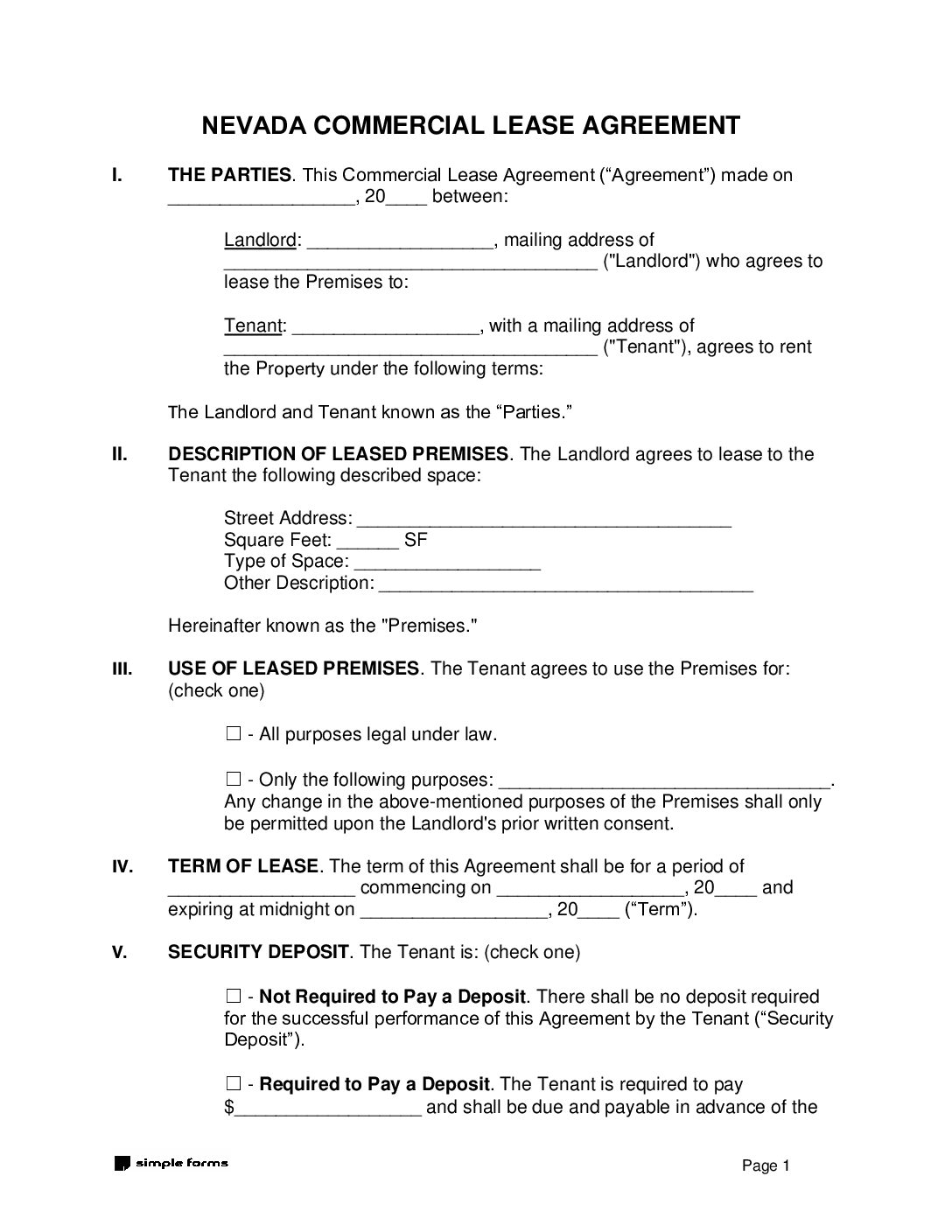

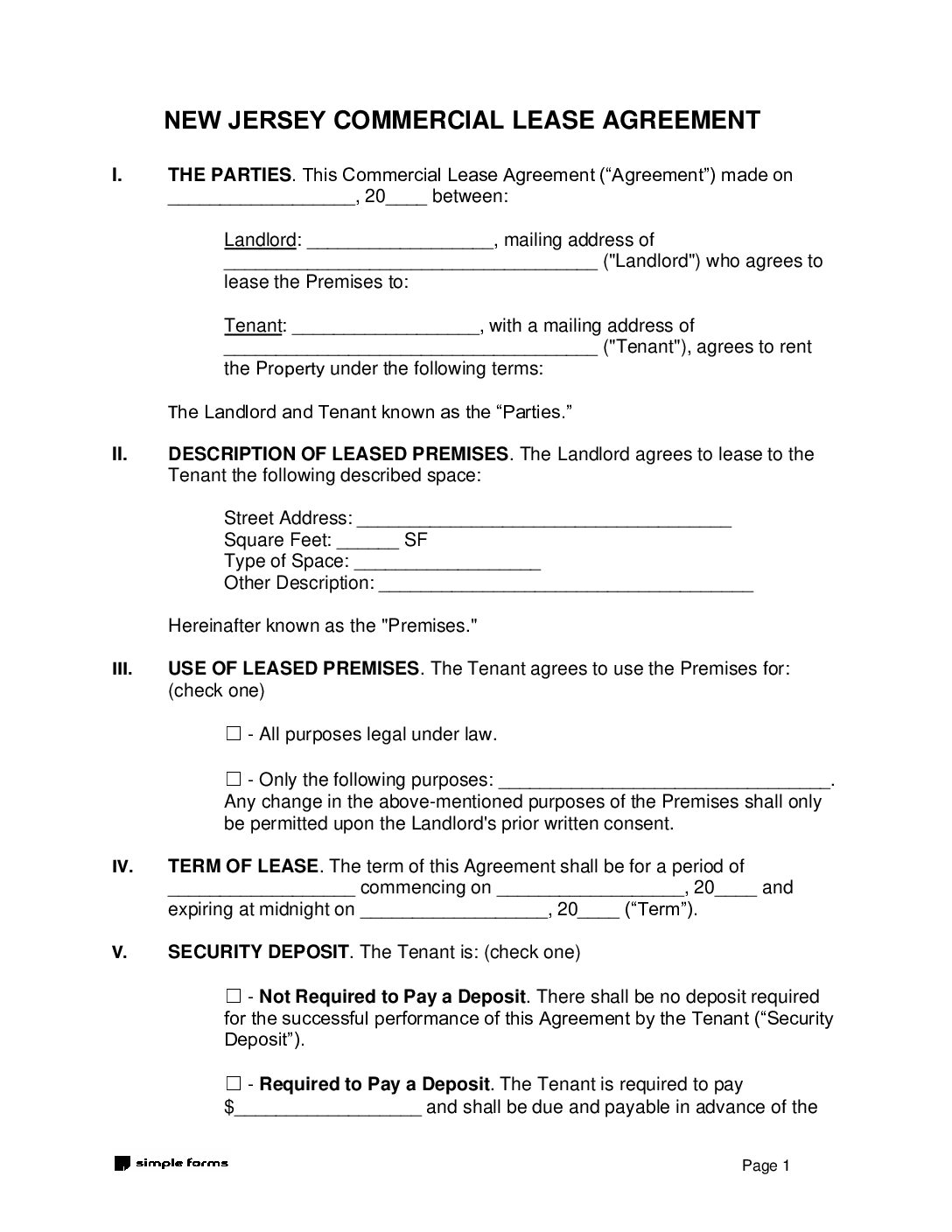

The Arizona Standard Commercial Lease Agreement form is a legal contract that outlines the terms and conditions of a rental between the Landlord and Tenant for a commercial property.

When Does a Commercial Lease Agreement Become Legally Binding?

The Commercial Lease Agreement becomes legally binding when both parties sign the contract and the buyer gets the notice that the seller has accepted the deal. The buyer can get the notice in-person, by phone, and/or email.

Arizona Business Entity Search

Search Arizona business entity database for a business license

Rental Laws ⚖️

Frequently Asked Questions

Does Arizona have state income tax?

Yes.

Where is Arizona State University (ASU)?

Tempe, Arizona.

Is Arizona state university accredited?

Yes.