Arizona Lease By Type (6)

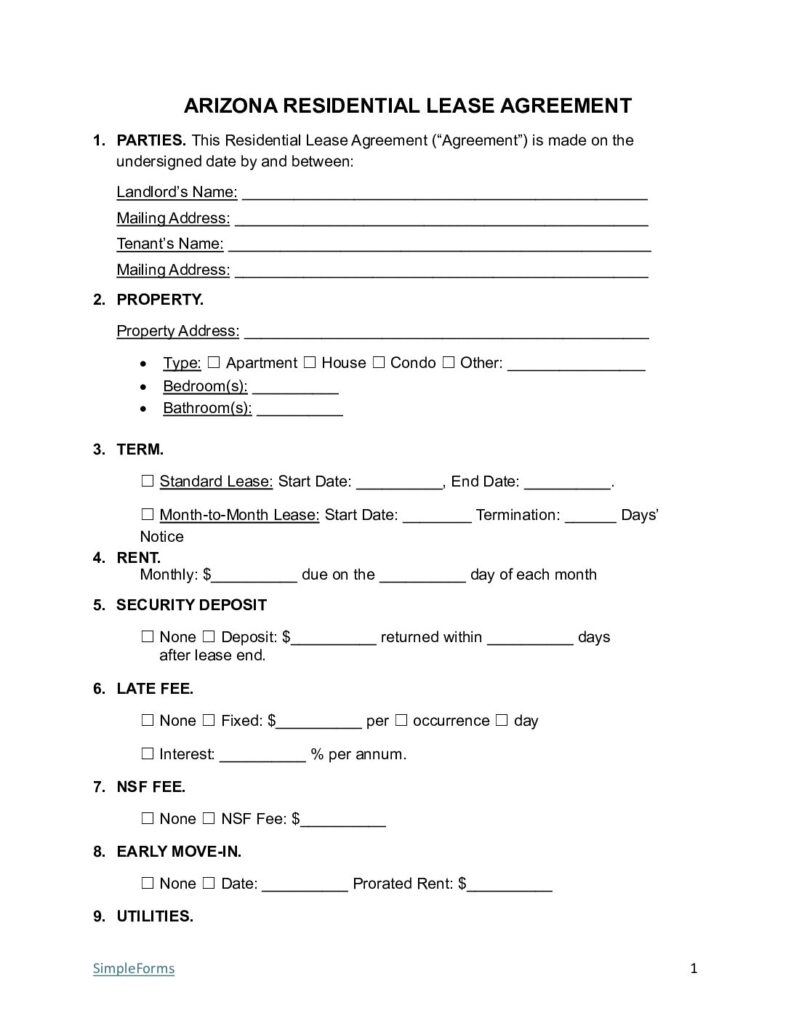

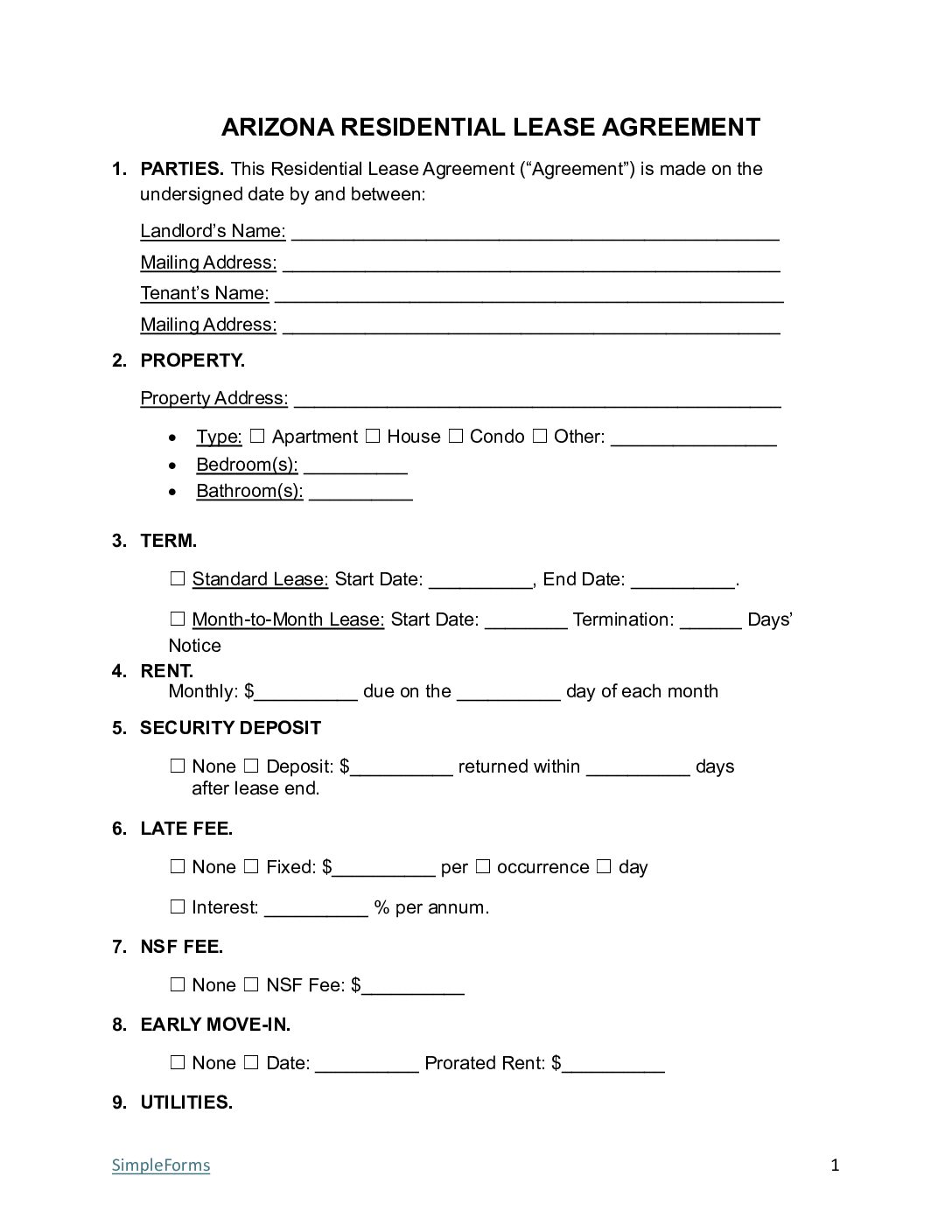

| Arizona Residential Lease Agreement – This type of lease is used for a standard 1-year lease term although it can be a any time period if all parties agree and sign. Download: PDF | Word (.docx) |

|

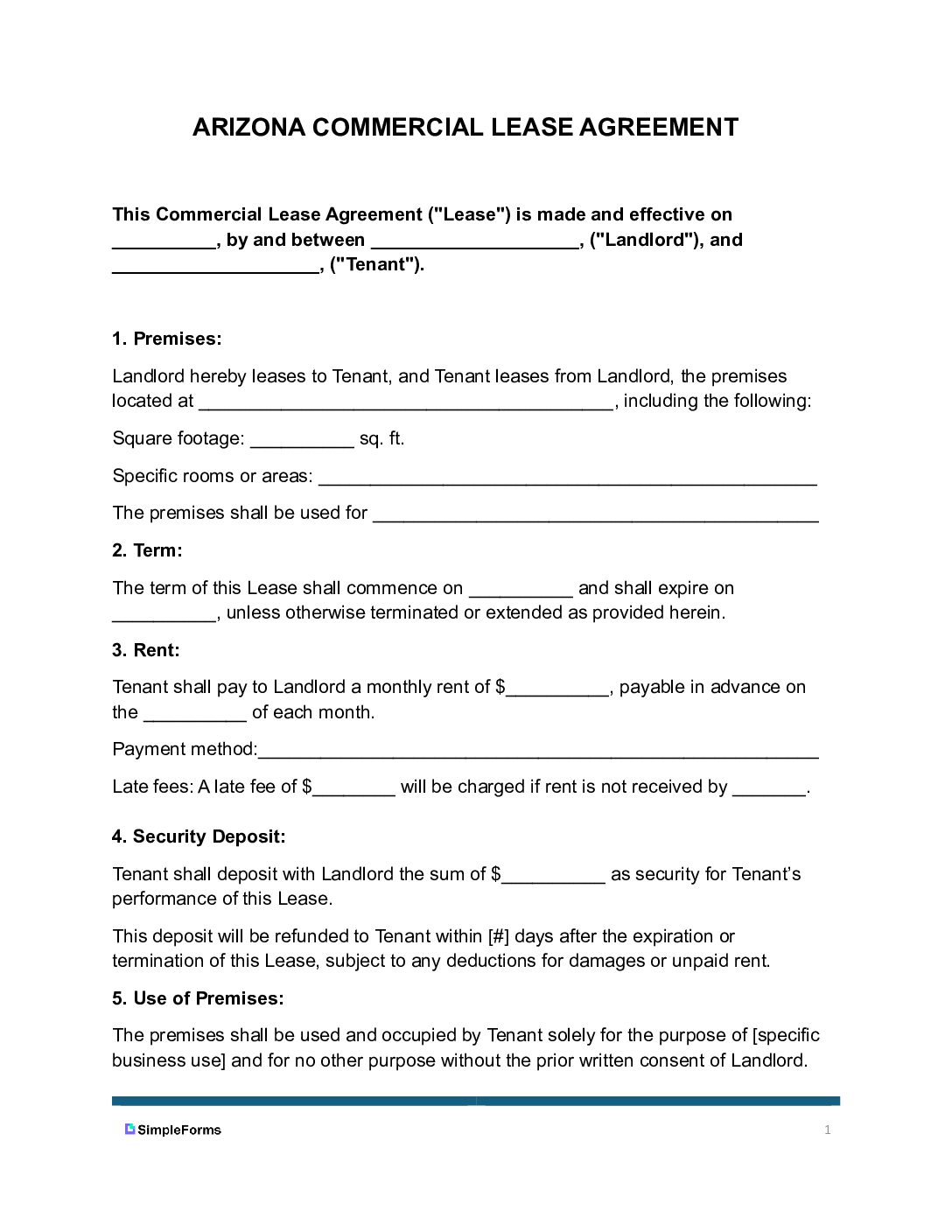

| Arizona Commercial Lease Agreement – Used for retail spaces, office buildings, warehouses, and industrial facilities. Download: PDF | Word (.docx) |

|

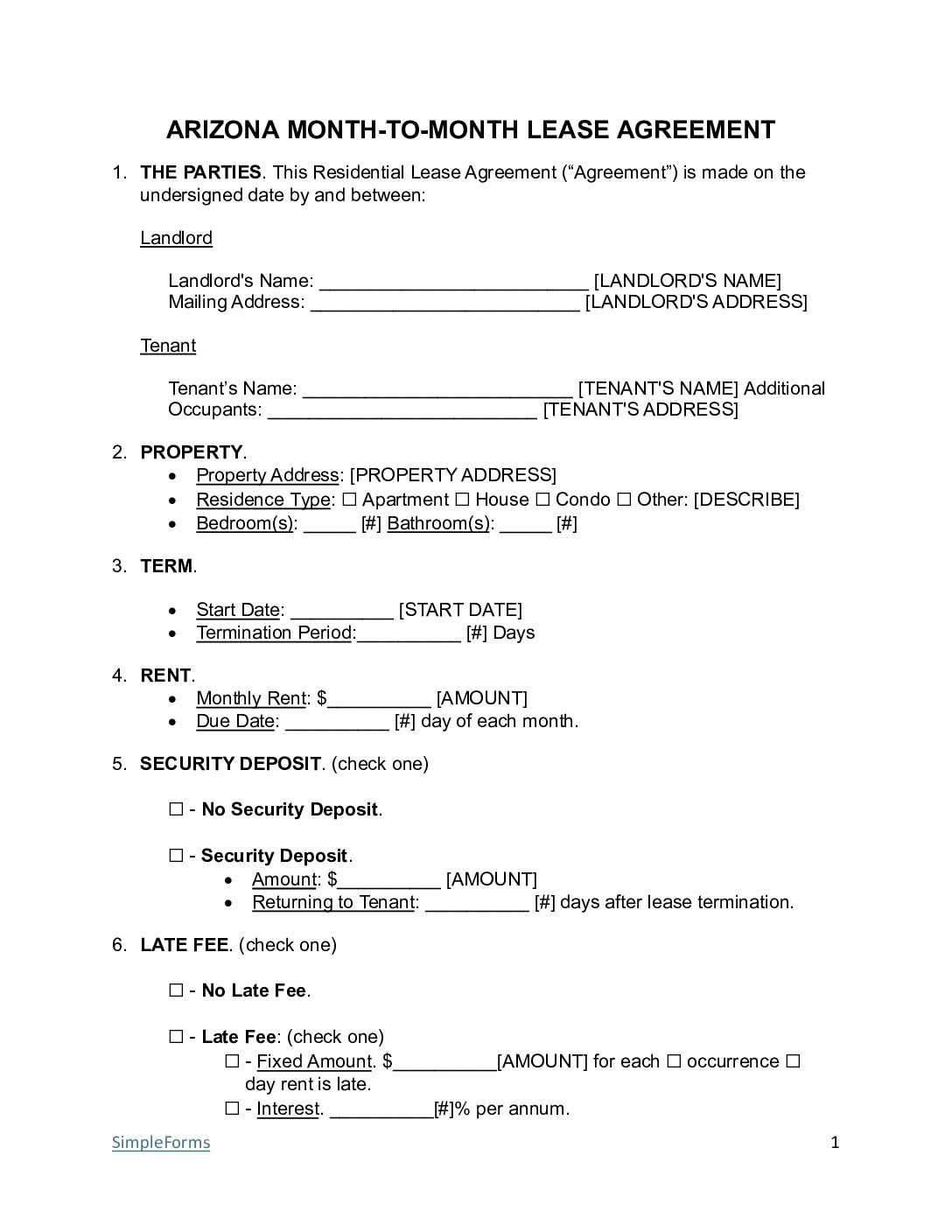

| Arizona Month-to-Month Lease Agreement – Tenancy at will with renewals every 30 days. Download: PDF | Word (.docx) |

|

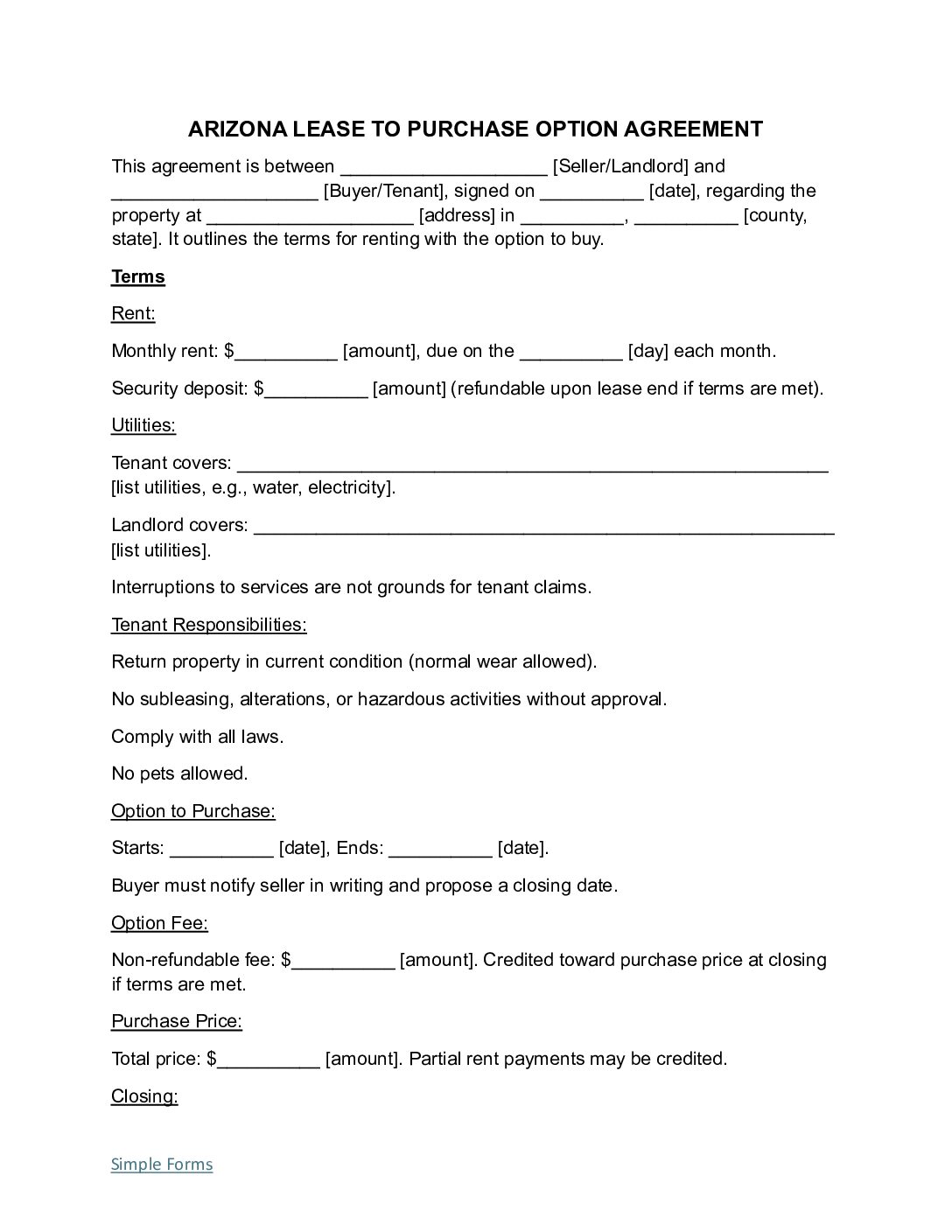

| Arizona Rent to Own Lease Agreement – Tenant has the option to purchase property within an agreed time-frame. Download: PDF | Word (.docx) |

|

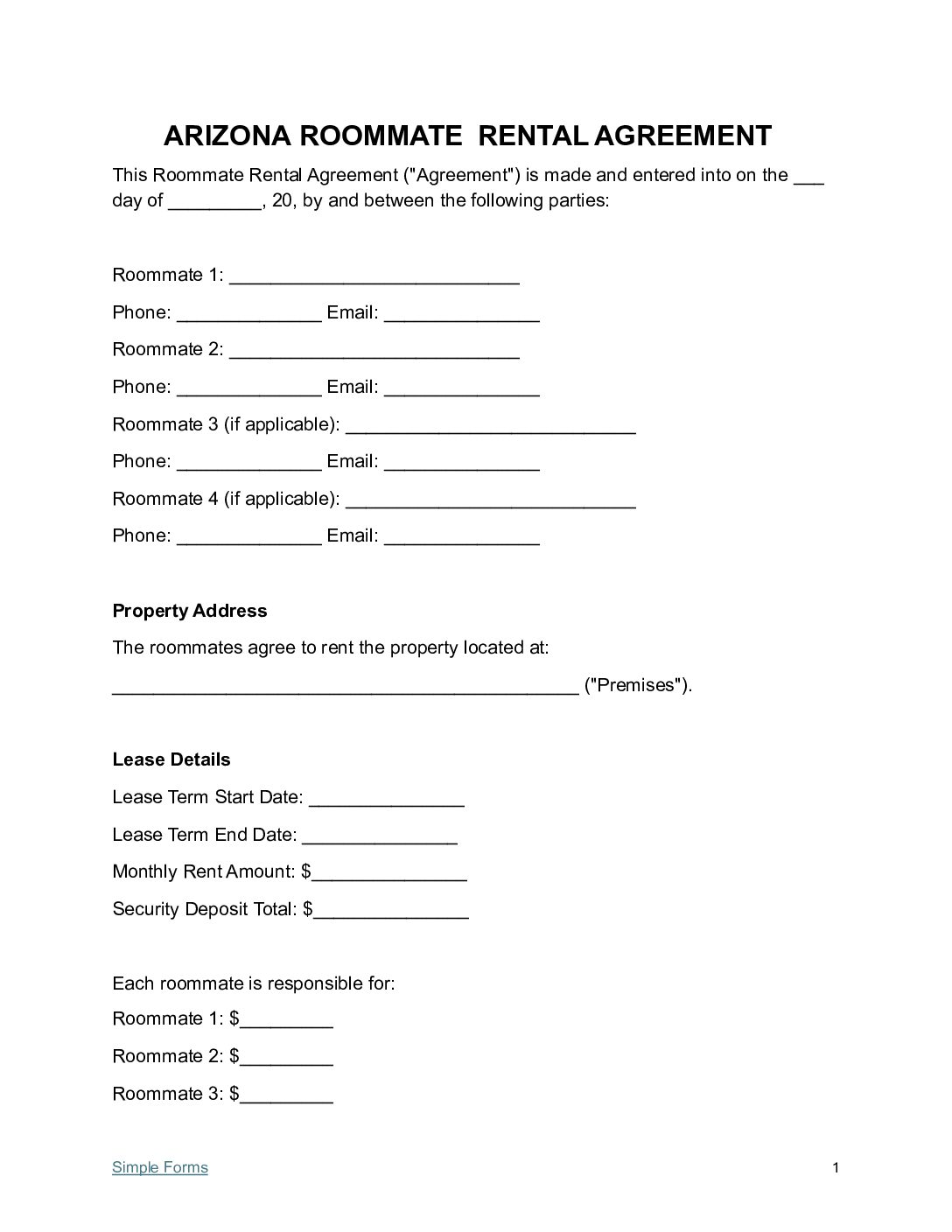

| Arizona Roommate Lease Agreement – When a room is rented out and Tenants become roommates. Download: PDF | Word (.docx) |

|

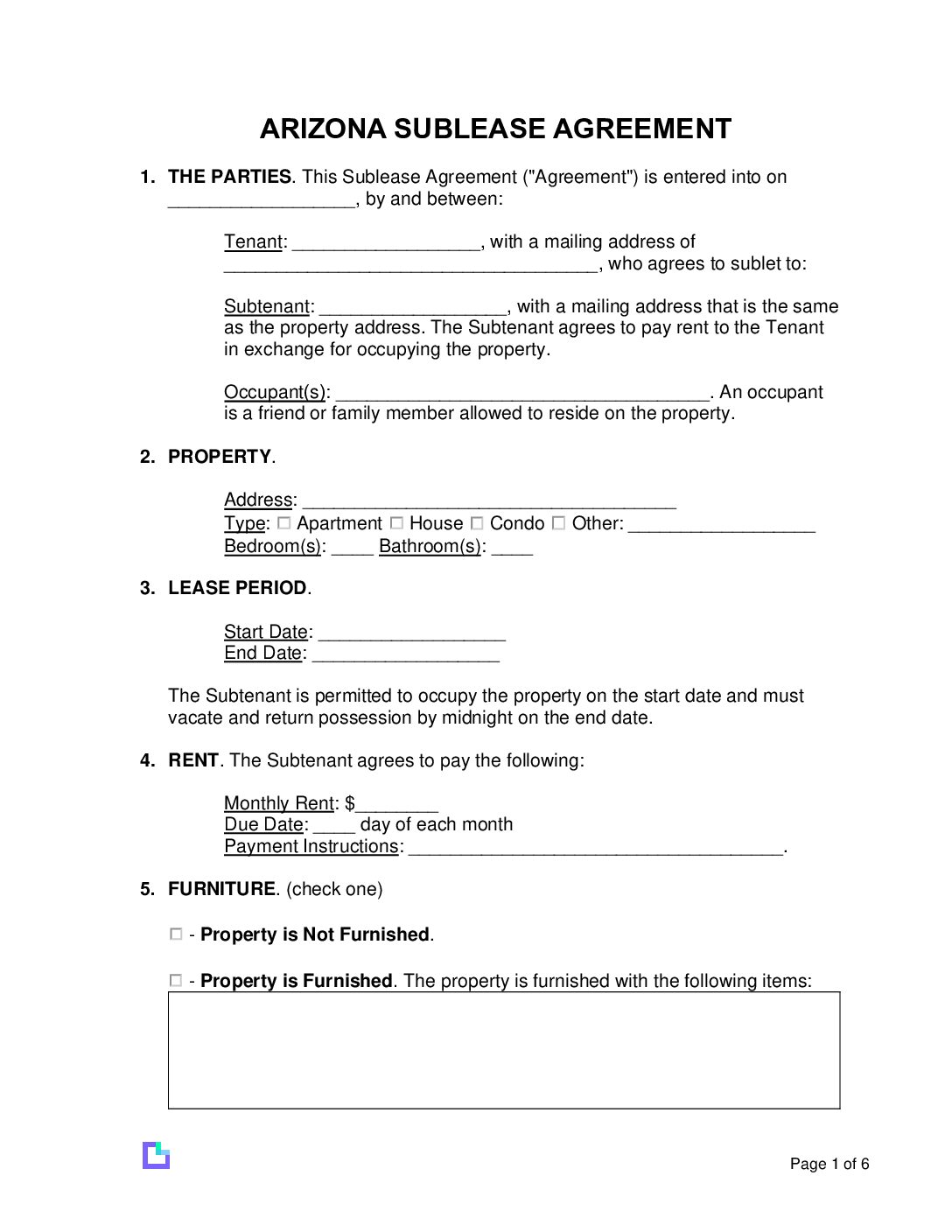

| Arizona Sublease Agreement – Used to Sublet unit with landlords approval. Download: PDF | Word (.docx) |

What the Arizona Residential Lease Agreement Template covers?

This Arizona residential lease agreement template covers what landlords and tenants must know when renting property. The form includes following residential leasing laws:

- Security Deposit Limits

- Termination

- Maintenance and Repairs

- Habitability Standards

- Landlord Entry

- Rent Increases

- Notice of Lease Expiration

- Abandoned Property

- Abandoned Property

Security Deposit Laws

Security deposits that landlords can requests from tenants cannot be more than one-half (1.5) of the monthly rent amount.[1]

- 14 Days to Return – Within fourteen (14) days after the move-out inspection.

- Damages/Unpaid Rent – Landlords can deduct from the security deposit at the end of the lease.

Termination Notices

The negotiated lease termination terms must be outlined in the agreement.[2]

- Landlord’s Ability to Terminate: Must be outlined in the rental agreement and there must be a notice of at least 30 days.

- Tenant’s Ability to Terminate: In military service or domestic violence situations, the tenant can terminate the lease early with proper notice of at least 30 days and must give a copy of the court order or police report to the landlord.

Maintenance and Repairs by Landlords and Tenants

- Landlords must comply with the local health and safety codes. Landlords must maintain and repair the property enough where the rental unit is habitable by making it safe and clean.

- The landlord must maintain the electrical, plumbing, sanitary, heating, ventilating, and air-conditioning by keeping them working and safe.

- Landlords must make sure all appliances (elevators, etc.) are safe to operate.[3]

Habitability Standards: Health and Safety Codes

Landlord Entry Notices

A minimum of forty-eight (48) hours’ notice for non-emergency inspections or maintenance.[5]

Rent Increase Laws

- In Arizona, property managers often charge a lease renewal fee when tenants renew their lease every 12-months.

Notice of Lease Expiration

Abandoned Property in Arizona

Required Disclosure Forms

- Lead-Based Paint Disclosure & EPA Pamphlet – If the unit was built before 1978, the Tenant must sign this disclosure form.

- Bed Bug Acknowledgment – The Tenant confirms receiving information on bed bugs.[9]

- Non-Refundable Fees – Fees are non-refundable unless stated otherwise in the written lease agreement.[10]

- Landlord-Tenant Act – The Tenant confirms receiving the latest version of the Arizona Landlord-Tenant Act.[11]

- Move-In/Move-Out Inspection – The Landlord will provide a signed lease, move-in form for damages, and info about attending the move-out inspection, except in cases of eviction with any safety concerns.[12]

- Manager/Owner Information – The Landlord must provide details on the property manager and authorized persons for legal notices.[13]

- Pool Safety – If there’s a pool, the Landlord must provide safety guidelines from the Arizona Department of Health Services.[14]

- Shared Utility Billing – The billing method must be disclosed if the utilities are shares.[15]

- Foreclosure Notice – In the event that the rental property is in foreclosure, the Tenant must be notified.[16]

Sample Arizona Residential Lease Agreement Template

Arizona Lease Agreement Checklist

✅ Before Signing Checklist

Landlord Preparation:

Tenant Preparation:

✅ After Signing Checklist

Immediate Actions (First 24 Hours):

First Week Actions: