Idaho

Tenants Right to Sublet

Tenants can sublet in Idaho unless their lease specifically prohibits it. If the lease requires the Landlord’s permission, the Tenant must get written approval with a Landlord Consent Form.[1]

Short-Term Lodgings Tax Rules

- A short-term rental is defined as property rented for 30 days or less in Idaho. [2]

- The state charges a 6% [3] sales tax and a 2% travel and convention tax on these rentals. [4]

- Some cities have own taxes or fee amounts.

- State taxes are collected by the state and city taxes are collected by the cities.

Sources

Sample Idaho Sublease / Sublet Rental Agreement Template

Sample Idaho Room Rental Lease Agreement

Sample Idaho Rent-to-Own Lease Option Agreement Template

Laws ⚖️

- Maximum Rental Application Fee – There are no statutes governing maximum rental application fees. The fee should be reasonable and based on the actual cost of the screening process. This includes any background checks, credit reports, rental history, reference checks, eviction records, and employment verification.[1]

- Security Deposit Amount – Landlords can charge any amount as theres no limits in Idaho.

Sources

Sample Idaho Rental Application Form

IDAHO RENTAL APPLICATION FORM

Property Address: _________________________________________________

Unit/Apartment Number (if applicable): ___________________________

Desired Move-In Date: ___________________________

Lease Term: ________________ months/years

Applicant Information

Full Name: ______________________________________________________

Date of Birth: ___________________________

Social Security Number (if applicable): ___________________________

Driver’s License/ID Number: ________________ State: ____________

Phone Number: ___________________________

Email Address: ___________________________

Current Address: _________________________________________________

City/State/ZIP: _________________________________________________

How Long at This Address? ___________________________

Landlord/Property Manager: ___________________________

Phone: ___________________________

Reason for Leaving: _________________________________________________

Previous Address: _________________________________________________

City/State/ZIP: _________________________________________________

How Long at This Address? ___________________________

Landlord/Property Manager: ___________________________

Phone: ___________________________

Reason for Leaving: _________________________________________________

Employment & Income Information

Current Employer: _________________________________________________

Employer Address: _________________________________________________

Position/Title: ___________________________

Supervisor’s Name: ___________________________

Phone: ___________________________

Length of Employment: ___________________________

Monthly Income (Gross): $___________________________

Previous Employer (if less than 1 year at current job): ____________________________________

Employer Address: _________________________________________________

Position/Title: ___________________________

Supervisor’s Name: ___________________________

Phone: ___________________________

Length of Employment: ___________________________

Monthly Income (Gross): $___________________________

Other Sources of Income

Source: _________________________________________________

Amount: $__________________________

Frequency: ___________________________

Co-Applicants/Occupants (18 years or older)

Full Name: ______________________________ Relationship: ___________

SIMPLE FORMS

Full Name: ______________________________ Relationship: ___________

Full Name: ______________________________ Relationship: ___________

Total Number of Occupants (including minors): ___________________________

Vehicle Information

Vehicle Make/Model: ___________________________ Year: ___________

License Plate #: ___________________________ State: ___________

Vehicle Make/Model: ___________________________ Year: ___________

License Plate #: ___________________________ State: ___________

Pets

Do you have pets? ☐ Yes ☐ No

If yes, describe (type/breed/weight): ___________________________________________

References

Personal Reference (non-family): ___________________________

Phone Number: ___________________________

Relationship: ___________________________

Emergency Contact: ___________________________

Phone Number: ___________________________

Relationship: ___________________________

Consent and Certification

I/we certify that the information provided in this application is true and complete to the

best of my/our knowledge. I/we authorize the landlord/manager to verify the information

provided, including credit history, employment, and rental history.

Applicant Signature: ____________________________________ Date: ___________

Co-Applicant Signature: _________________________________ Date: ___________

Idaho power of attorney is a legal form that is used to manage the financial and medical affairs of another individual. To make this document valid in Alaska, it must be signed in the presence of a notary public or two witnesses. Once the form has been signed, the agent can use it to act on behalf of the principal.

What is the Definition of “Power of Attorney”?

Definition by the Uniform Power of Attorney Act:

“A “Power of attorney” is a document that gives an agent the authority to act on behalf of the principal.”

Source: Section 102(7)

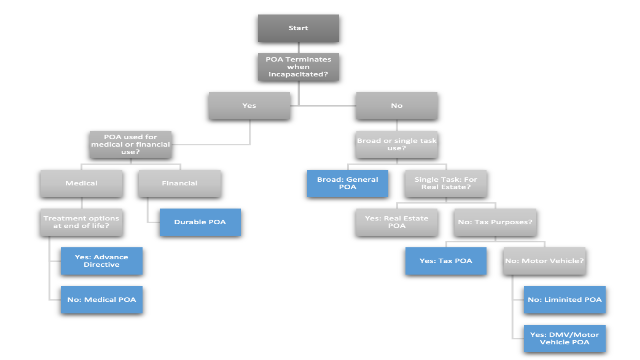

Power of Attorney Flow Chart

Sample Idaho Power of Attorney Form

An Idaho lease agreement is a contract between a landlord and tenant for property use in exchange for rent. The landlord may request a rental application to verify the tenant’s credentials, and upon approval, both parties can sign the lease.

Most Recent US Home Facts

- Population (2023): 334,914,895

- Median Households (2022): 125,736,353

- Median Household Income (2022): $75,149

- Owner-occupied Households (2022): 64.8%

Source: U.S. Census Bureau

Lease Agreement Form Must Include the Following

Disclosure Form (Required)

Security Deposits

Landlord Access

Paying Rent

Grace Period – Idaho does not have a statutory grace period for rent payments. The landlord can use a 3-day notice to quit if rent is not paid on the due date specified in the lease.

Maximum Late Fee – Under Idaho law, there are no regulations in place for rent late fees. As a result, landlords are allowed to charge tenants any amount they deem suitable.

NSF Fee – $20 per bounced rent check.

Source: § 55-314(1)

Sample

Idaho standard commercial lease agreement form is a contract that outlines the terms and conditions of renting commercial property between a Landlord and Tenant. The document becomes legally binding once signed by both parties.

When Does a Commercial Lease Agreement Become Legally Binding?

The Commercial Lease Agreement becomes legally binding when both parties sign the contract and the buyer gets the notice that the seller has accepted the deal. The buyer can get the notice in-person, by phone, and/or email.

Idaho Standard Commercial Lease Agreement Sample

This Idaho Advance Healthcare Directive Form is a legal document ensures that a person’s wishes are respected when they cannot communicate their preferences due to illness or incapacity.

Standard Durable Power of Attorney Forms

Key Elements

- Living Will: This allows individuals to put in writing their medical treatment preferences, including terminal illness, persistent vegetative state, or other severe conditions. It may cover instructions on life-sustaining treatments, pain management, organ donation, and other healthcare decisions.

- Durable Medical Power of Attorney for Healthcare Form: Let’s an individual appoint a healthcare agent to be able to make decisions for the individual. The agent should be trusted and follow the individual’s wishes and make decisions in their best interest.

Healthcare Directive Registration Form

Idaho Health Care Directive Registry Form

Planning Checklist

Advance Directive Planning Worksheet

Idaho Health Care Advance Directive: Preview Sample

https://simpleforms.com/wp-content/uploads/2024/07/IDAHO-ADVANCE-DIRECTIVE-MEDICAL-DURABLE-POWER-OF-ATTORNEY-FORM.pdf

Next →

The Idaho motor vehicle bill of sale is used when a vehicle’s purchase and sale and legally cements the transfer of ownership from a seller to a buyer in the State of Idaho. When you transfer the title of a vehicle to a new owner, a bill of sale is required. The buyer can then use all the documentation to register the car in their name with the Idaho Transportation Department’s Division of Motor Vehicles (DMV). Must include the Odometer Disclosure Statement Form.

What is an Idaho Bill of Sale?

The Idaho bill of sale document serves as a transaction record and contains information that protects both the buyer and the seller. Below is a detailed guide including the details and requirements of an Idaho Bill of Sale.

Key Elements

- Selling Price: This is the agreed-upon amount the buyer pays. The selling price is the value of the transaction and is needed for tax purposes when registering the vehicle.

- Serial Number (Vehicle Identification Number—VIN): This VIN code identifies the vehicle and is used for tracking its history. It is required on the bill of sale in Idaho.

- Odometer Reading: This indicates the vehicle’s mileage at the time of sale. The odometer reading is used for assessing the vehicle’s condition and for the buyer’s records and state reporting requirements.

- Issued Driver: This refers to the individual selling the vehicle including their information, driver’s license or ID number which must be recorded on the bill of sale.

- Personal Property: The bill of sale should include the personal property included, such as accessories or spare parts.

- Driver’s License or ID: The buyer and seller must provide their driver’s license or ID numbers, to verify identities.

Legal Requirements

- Applying for a Title: The buyer must apply for a title to register the vehicle in their name legally after the sale.

- Bill of Sale Required: Idaho law requires a bill of sale for all vehicle transactions.

- Title Within 30 Days: The buyer must apply for the title within 30 days of the sale. Failure to do so can result in penalties and complications with the vehicle’s registration.

- Title Number: This number identifier is assigned to the vehicle’s title and is used to track the title’s status. It is required for many administrative processes.

- Local DMV Office: The buyer submits the necessary paperwork to complete the title transfer at the local DMV office. You can check with the county assessor’s office for any requirements and the office hours of operation.

Final Steps

- You will want to make sure that all the information in the document is correct and both parties receive copies.

- The Release of Liability Form plus a three dollar and fifty cent fee both must be submitted within five days of the transaction and is in the new owners hands (and name).

Where to Register

Register Vehicle: Idaho Transportation Department’s Division of Motor Vehicles (DMV)

Idaho Motor Vehicle Bill of Sale Form Sample

https://simpleforms.com/wp-content/uploads/2024/06/Idaho-Motor-Vehicle-Bill-of-Sale-Form.pdf