Arizona

Minimum Termination Notice Period for a Arizona Month-to-Month Lease Agreement Template

Increasing Rent Notices

Sample Arizona Month-to-Month Lease Agreement Template

Sources

Arizona Association of Realtors Lease Agreement

Fill-in PDF Lease Document from the Arizona Association of Realtors (aar.online.com)

Sample Arizona Residential Lease Agreement

Right to Sublet

Arizona law doesn’t set rules for subleasing, therefore lease agreements should include the subletting terms. If the terms are unclear, use a Landlord Consent Form in order to get permission from the Landlord.

Short-Term Lodgings Tax

Sample Arizona Sublease Agreement Template

An Arizona power of attorney is a legally binding document that enables a person to assign another person to act on their behalf for various reasons such as financial, medical, or parental reasons. For instance, if a person is involved in a car accident and gets hospitalized, this document authorizes their appointed representative (also known as an “agent” or “attorney-in-fact”) to take over temporarily and manage their estate, handle bank accounts, pay bills, and even make medical decisions if necessary.

Signing Requirement ✍️

Yes, must be signed by the Principal and Witness in front of a public notary.

Source: A.R.S. §33-411.01.

What is the Definition of “Power of Attorney”?

Definition by the Uniform Power of Attorney Act:

“A “Power of attorney” is a document that gives an agent the authority to act on behalf of the principal.”

Source: Section 102(7)

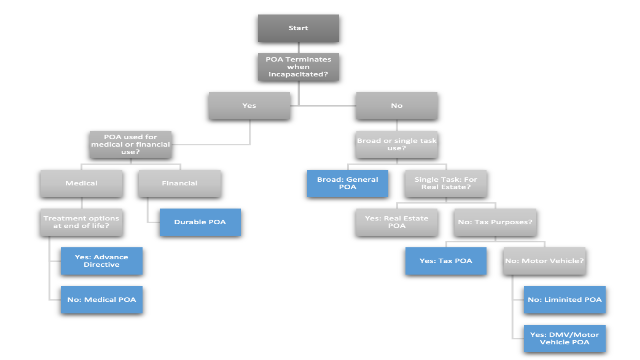

Power of Attorney Flow Chart

Why use a Power of Attorney POA?

- Plan for the future by using a reliable Power of Attorney form template. You can download the PDF or Word document for free to provide peace of mind for yourself and your loved ones.

- This form covers decisions made on your behalf, estate planning, real estate, the agent or attorney in fact, types of powers of attorney (including durable, limited, and springing), family members, care power of attorney, bank accounts, health care power, and more.

- Use this form to grant power to act on your behalf in financial and real estate matters. It’s essential for ensuring that your wishes are carried out in the future.

Sample

An Arizona lease agreement is a legal contract between a Landlord and a Tenant. This document includes the terms and conditions, including the lease’s duration, rent amount, responsibilities of the landlord and tenant, and regulations for maintenance and repairs.

Most Recent US Home Facts

- Population (2023): 334,914,895

- Median Households (2022): 125,736,353

- Median Household Income (2022): $75,149

- Owner-occupied Households (2022): 64.8%

Source: U.S. Census Bureau

What to include in the agreement form?

Required Disclosures

Landlord’s Contact Notice –Landlords must disclose property management contact information and legal notice details in the lease agreement.

Lead-Based Paint Disclosure – Landlords must provide new tenants with information regarding any presence of lead-based paint if property was built before 1978.

Bed Bug Disclosure Form – Landlords must provide educational materials to tenants on bed bug prevention and treatment.

Move-in / Move-out Condition Checklist – Leases require a Move-in / Move-out Condition Checklist. Tenant may not fill it, but Landlord must do a move-out inspection by giving written notice to Tenant before the move-out date.

Landlord Tenant Act Form Copy – The landlord is required to provide the tenant with a copy of the Arizona Residential Landlord and Tenant Act (Title 34, Chapter 3) upon lease signing, as specified in the Landlord-Tenant Act.

Fee Disclosure – Any fees labeled as non-refundable in the agreement are non-refundable.

Pool Safety Notice – Landlords renting a property with a pool must comply with Pool Safety Notice.

Shared Utility Charge Disclosure – If the landlord uses a shared meter to bill the tenant for utility charges, the rental agreement must specify how the costs are calculated. Additionally, the landlord may include administrative costs involved in calculating and paying the utility charges, for which they can reimburse themselves.

Tax Disclosure – The landlord may increase the rent due to changes in the business pass-through tax in the area where the residence is located. However, the landlord must provide the tenant with a notice at least thirty (30) days before the rent increase. This option to increase the rent due to the business pass-through tax must be clearly stated in the lease agreement to be enforceable.

Source: § 33-1322, § 33-1321(C), § 36-1681(E), § 33-1314.01

Right to Enter (Landlord)

Late Fees

Maximum Penalty – There is no statutory maximum penalty that a landlord can charge, but if mentioned in the lease, they can charge any amount.

Manufactured homes – subject to a daily fee of up to $5.00.

NSF Fee – Landlords may charge up to $25 per bounced rent check.

Source: § 33-1414(8)(c)

Security Deposits

Maximum Amount – The landlord may not require a security deposit that exceeds 1.5 times the monthly rent.

Returning to Tenant – It is required that Landlords return security deposits to their Tenants within a period of 14 days following the move-out inspection, exclusive of weekends and holidays. This established time frame must be followed in order to ensure compliance with legal regulations pertaining to landlord-tenant relationships.

Source: § 33-1321

Federal Laws

Recommended Services

- Arizona Real Estate Commission – Azre.gov

Frequently Asked Questions

Does Arizona have state income tax?

Yes.

Where is Arizona State University (ASU)?

Tempe, Arizona.

Is Arizona state university accredited?

Yes.

Is Arizona a state?

Yes.

When did Arizona become a state?

February 14, 1912.

Does Arizona has state tax?

Yes.

Is Arizona a community property state?

Yes.

Is Arizona a red or blue state?

Arizona is a swing state.

Is Arizona a stop and ID state?

Yes.

Is Arizona an open carry state?

Yes, Arizona is an open carry state.

Is Arizona a no fault state?

No.

Lease Agreement Form Preview Example

Arizona Lease Agreement Checklist

✅ Before Signing Checklist

Landlord Preparation:

Tenant Preparation:

✅ After Signing Checklist

Immediate Actions (First 24 Hours):

First Week Actions:

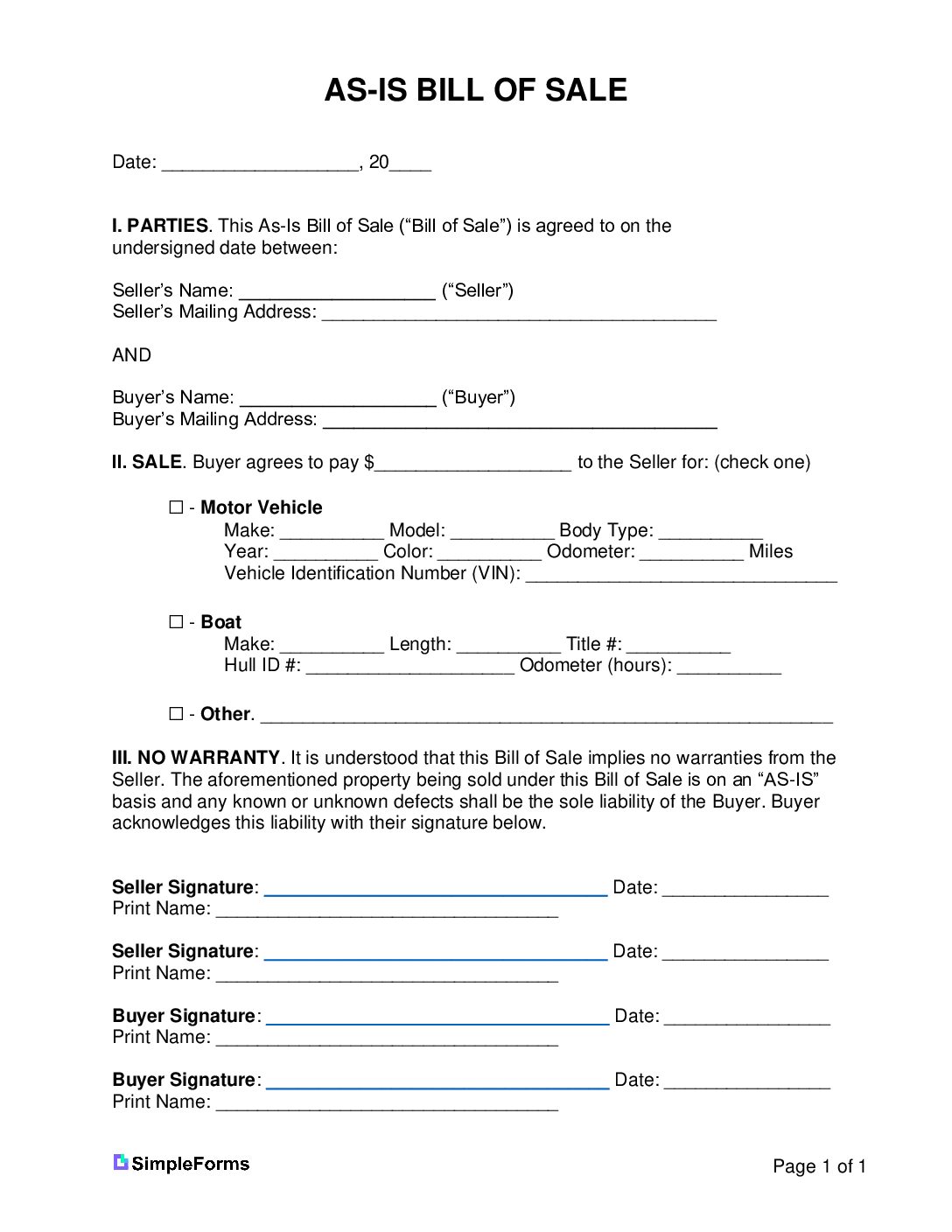

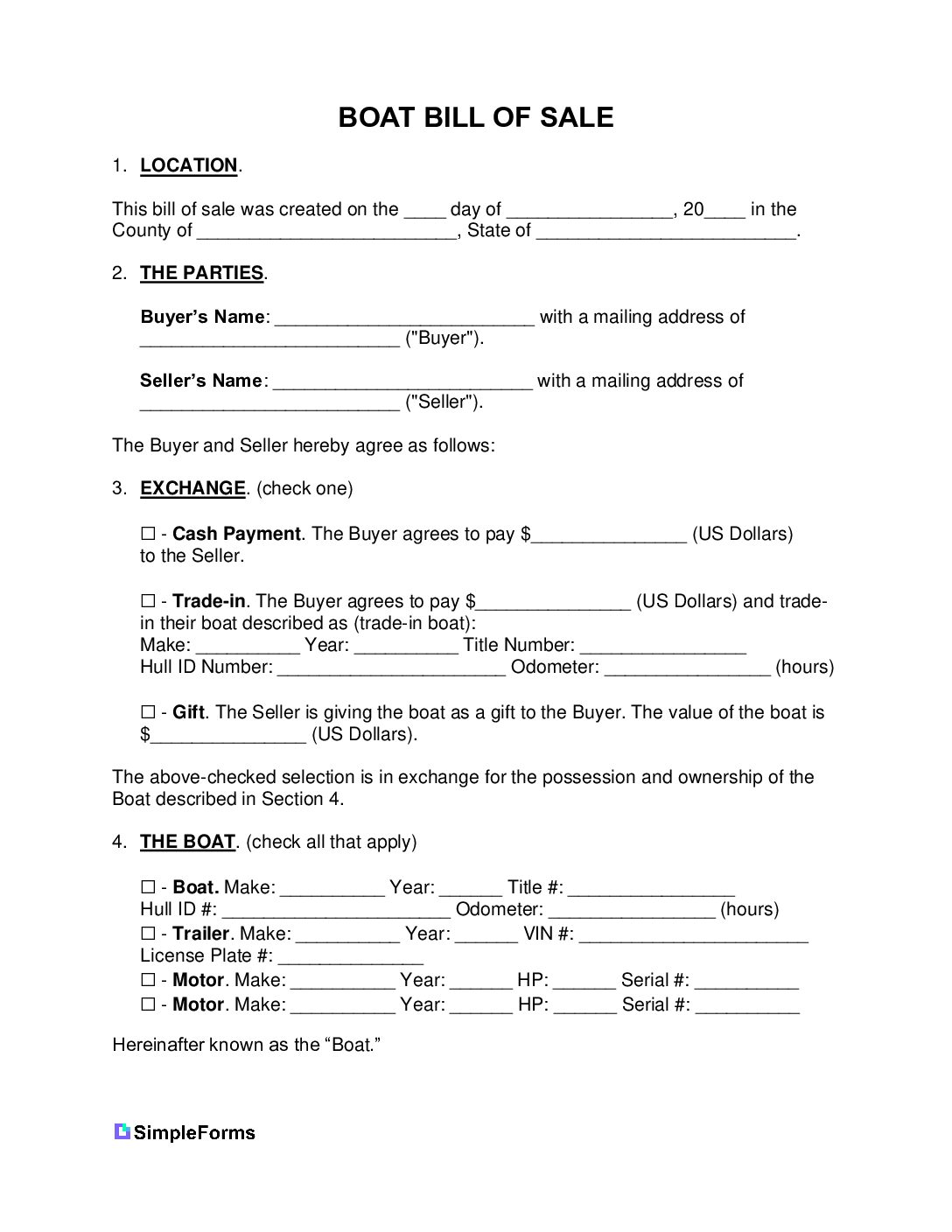

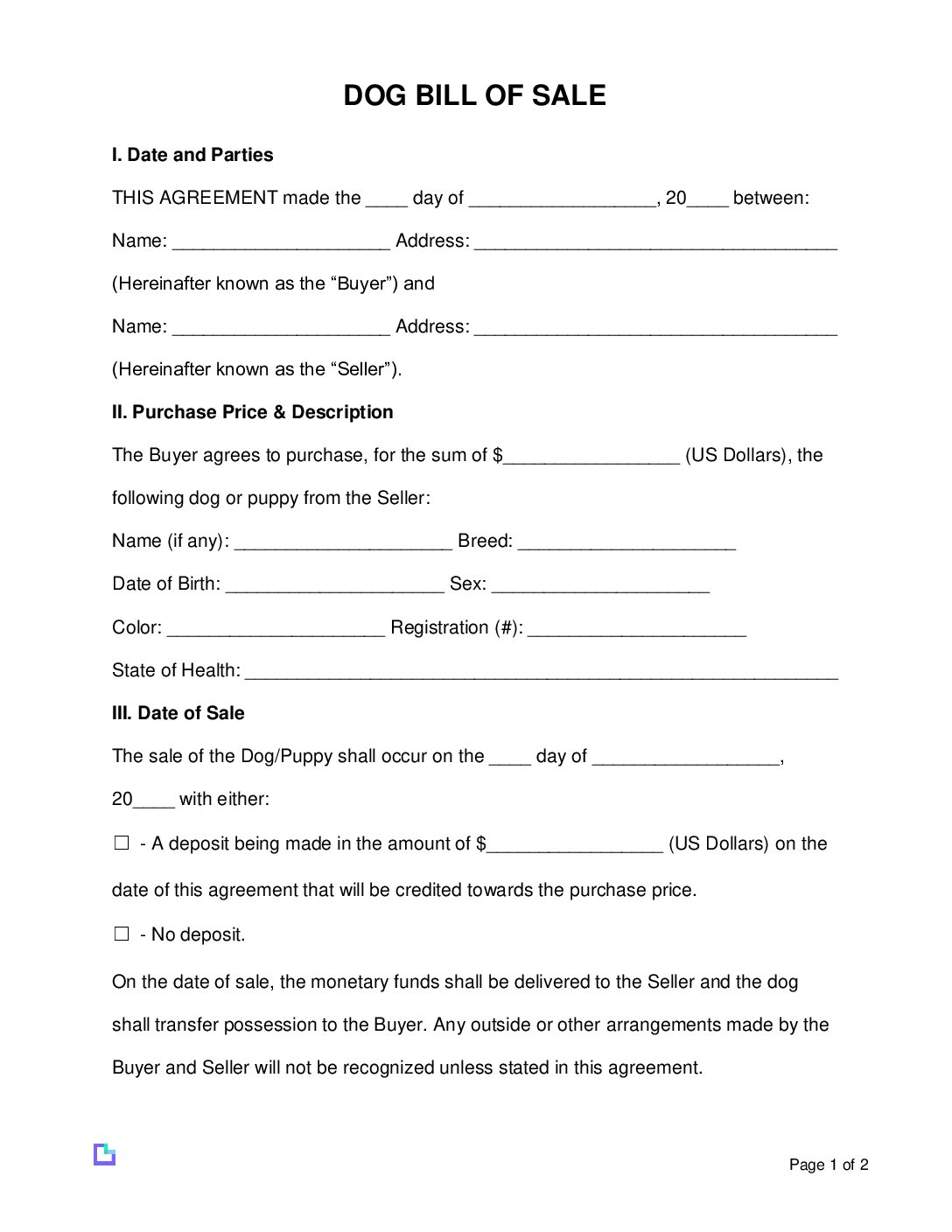

An Arizona Bill of Sale form is a legal document that transfers of ownership of an item from one party (seller) to another (buyer). This form records the transaction.

By Type

Boat Bill of Sale

Download:

Dog / Puppy Bill of Sale

Dog / Puppy Bill of Sale

Download:

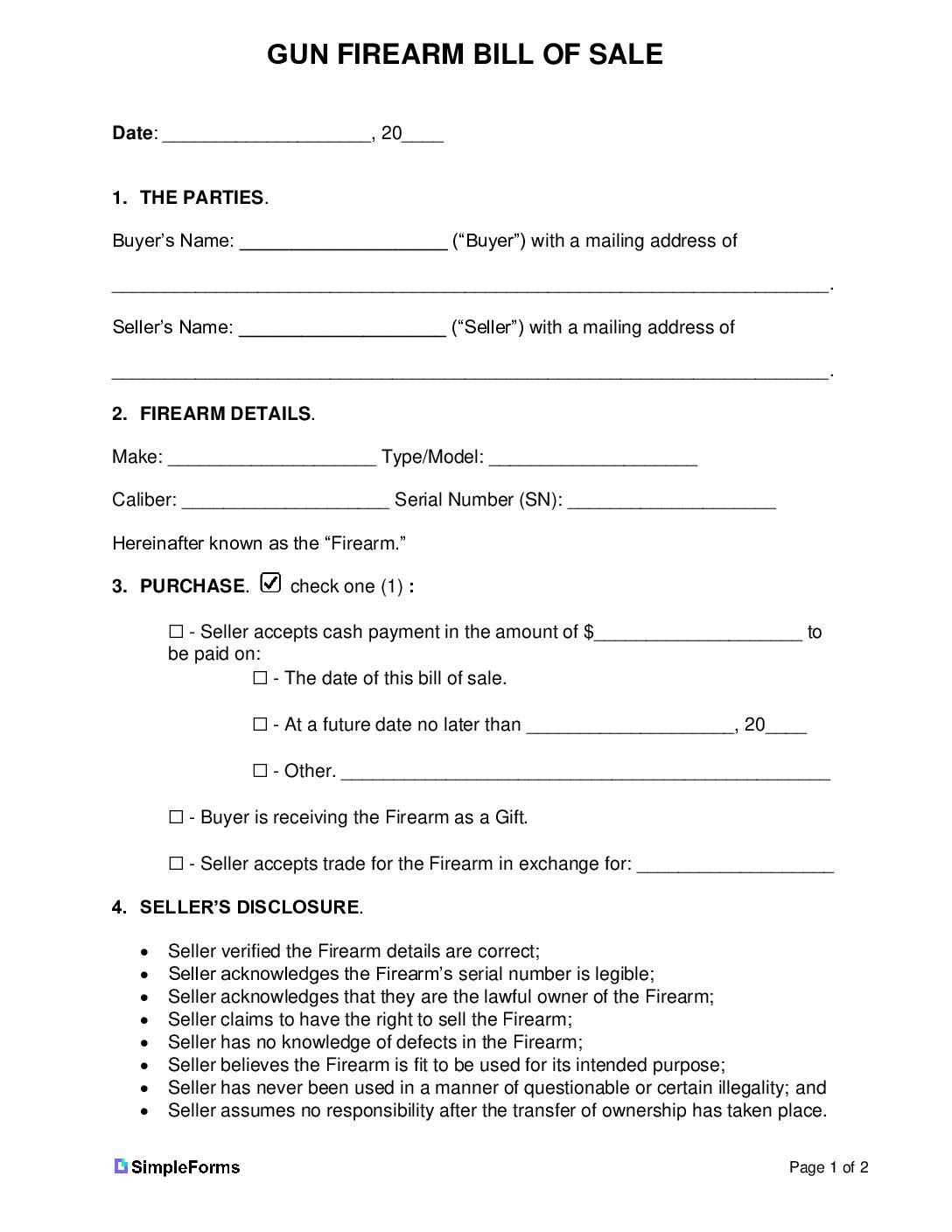

Gun / Firearm Bill of Sale

Download:

Motorcycle Bill of Sale

Motorcycle Bill of Sale

Download:

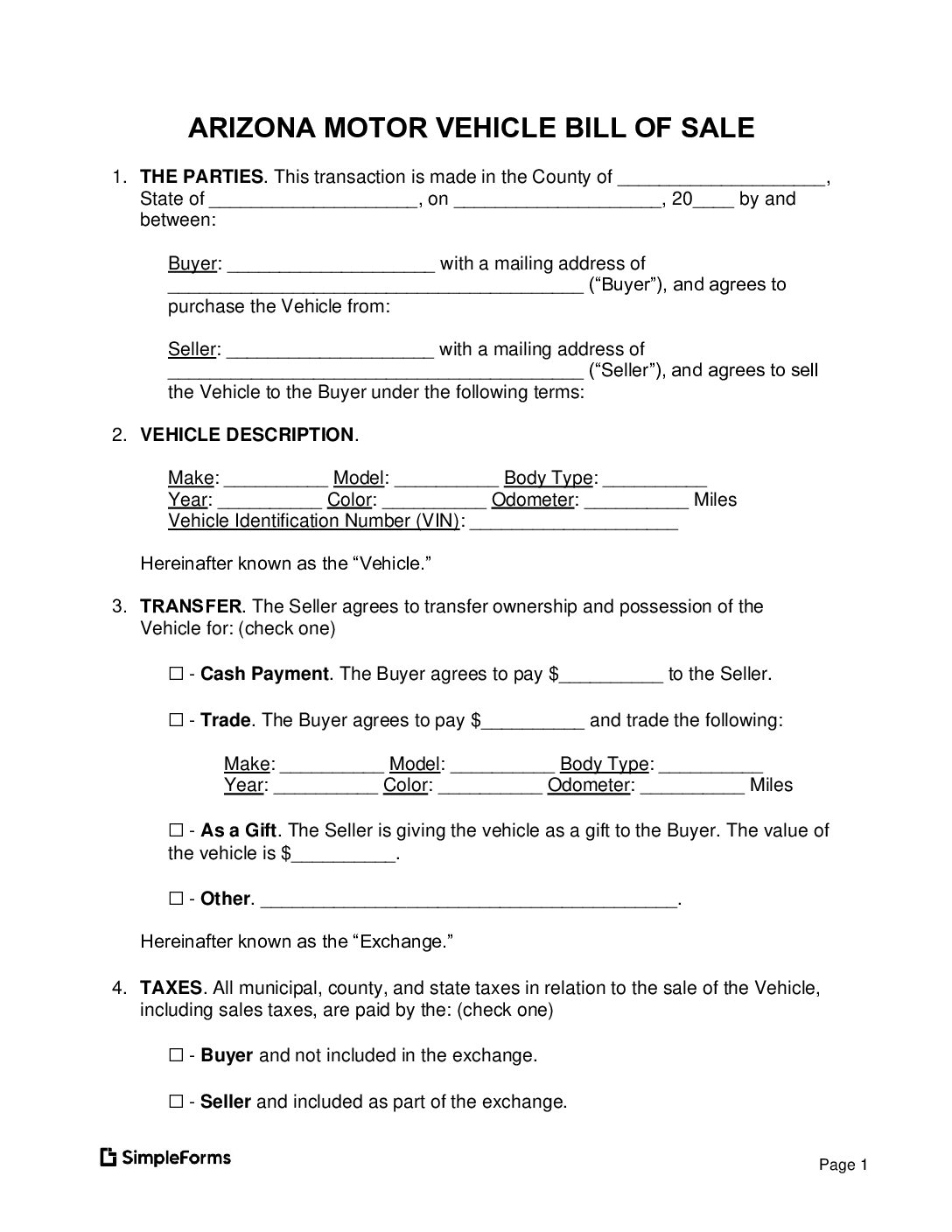

Motor Vehicle (Car) Bill of Sale

Motor Vehicle (Car) Bill of Sale

Download:

Arizona Registration Documents (Required)

- Title Registration Application – Online PDF Form 96-0236

Source: Arizona Motor Vehicle Division

What to Include in an Arizona Bill of Sale Form?

- The buyer’s name + address

- The seller’s name + address

- The vehicle/car description (make, model, year, + body style)

- The car’s vehicle identification number (VIN)

- The sale date

- Transaction details (purchase: price, trade, and/or gift)

- The warranty information (sold “as-is”)

- The Odometer Disclosure

- The Federal Law, 49 U.S. Code § 32705, requires a bill of sale to include a verifying statement about the vehicle’s mileage. Vehicles greater than ten years old and over 16,000 pounds are exempt.

FAQs and Answers: Arizona

- Does Arizona have state income tax? Yes.

- Where is Arizona State University (ASU)? Tempe, Arizona.

- Is Arizona state university accredited? Yes.

- Is Arizona a state? Yes.

- When did Arizona become a state? February 14, 1912.

- Does Arizona has state tax? Yes.

- Is Arizona a community property state? Yes.

- Is Arizona a red or blue state? Arizona is a swing state.

- Is Arizona a stop and ID state? Yes.

- Is Arizona an open carry state? Yes.

Arizona Bill of Sale Template Sample

The Arizona Standard Commercial Lease Agreement form is a legal contract that outlines the terms and conditions of a rental between the Landlord and Tenant for a commercial property.

When Does a Commercial Lease Agreement Become Legally Binding?

The Commercial Lease Agreement becomes legally binding when both parties sign the contract and the buyer gets the notice that the seller has accepted the deal. The buyer can get the notice in-person, by phone, and/or email.

Arizona Business Entity Search

Search Arizona business entity database for a business license

Rental Laws ⚖️

Frequently Asked Questions

Does Arizona have state income tax?

Yes.

Where is Arizona State University (ASU)?

Tempe, Arizona.

Is Arizona state university accredited?

Yes.

Sample Arizona Commercial Lease Agreement

This Arizona advanced directive medical power of attorney document is created by an individual (the “principal”) in case they cannot communicate with medical staff. This situation can often arise due to conditions like dementia or Alzheimer’s Disease or as a result of recent surgery. A medical power of attorney may be revoked by completing a Revocation Form.

Standard Power of Attorney Forms – PDF

Signing Requirements

For a principal to sign, they must have either one (1) witness or a notary public present. However, the witness or notary cannot be the agent named in the advance directive, involved in providing healthcare to the principal, related by family, marriage, or adoption, or entitled to the principal’s estate.

Source: ARS § 36-3221(A)(3), ARS § 36-3221(C)

What happens if you don’t have an Advanced Directive in Arizona?

In Arizona, if you cannot speak for yourself and don’t have an Advance Directive or Medical Power of Attorney, the state has a specific order of priority for who can make healthcare decisions on your behalf. The hierarchy is as follows:

1. Spouse: The spouse is the primary decision-maker unless legally separated.

2. Adult Child: If there is more than one adult child, the healthcare provider must seek the consent of the majority who are reasonably available for consultation.

3. Parent: One or both parents can make decisions.

4. Domestic Partner: A domestic partner can decide if the patient is unmarried.

5. Sibling: A brother or sister of the patient can make decisions.

6. Close Friend: A close friend is defined as someone who has shown exceptional care and concern, is familiar with the patient’s healthcare views, and is willing and able to be involved in their care.

If no one from the above categories is available to make decisions, the physician can consult with an institutional ethics committee. If such a committee is unavailable, the physician may consult a second physician to make decisions.

Source: § 36-3231