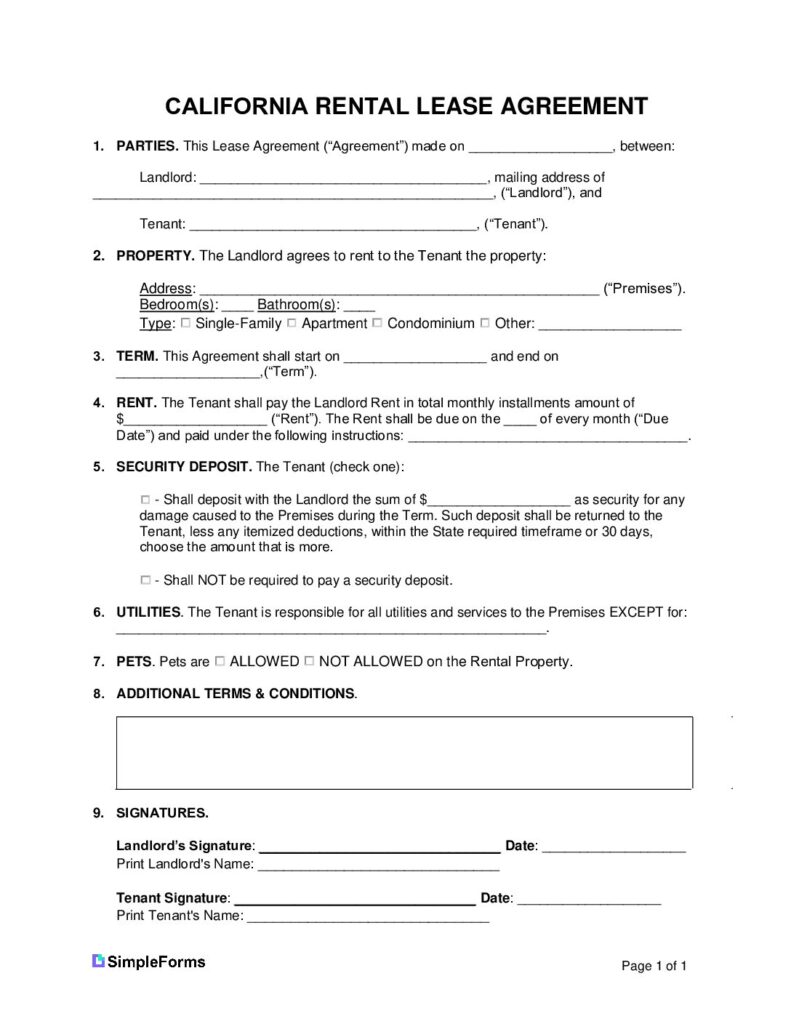

A California 1 page rental lease agreement is legally binding between the Landlord and Tenant(s). It outlines the terms and conditions of the lease including both parties’ responsibilities. This written agreement lasts until the lease end date.

Required Disclosure Forms in California

- AB 1482 Just Cause and Rent Limit Addendum (CIV 1946.2(e)) – AB 1482 is a California law that went into effect on Jan. 1, 2020. It limits rent increases and requires landlords to have “just cause” for terminating a tenancy. For any tenancy starting after July 1, 2020, landlords must provide a written notice with a statement about the rent increase limit. Additionally, landlords must provide a statement of cause in any notice to terminate a tenancy if tenants have continuously and lawfully occupied the property for 12 months or more.

- Lead-Based Paint Disclosure -Owners of housing units built before 1978 must inform tenants of potential lead paint hazards.

- Notice in Question – All lessees residing on a given property must sign on the notice in question. For a detailed explanation of the requisite procedure (§ 1946.2).

- Bedbug Disclosure (CIV § 1942.5(a)(1)) – Landlords must provide a Bedbug Addendum to confirm the absence of bed bugs in the property. The tenant must read and sign the document, agreeing not to transport the insects.

- Demolition (CIV § 1940.6) – Landlords must inform tenants of impending demolition before accepting a rental contract or deposit, if they have received permission from their respective municipal office to demolish a residential unit.

- Death (CIV § 1710.2)– In accordance with California law, landlords are obligated to disclose whether a death has occurred on the property within the past three years to prospective tenants, with the exception of deaths stemming from HIV. This information must be provided in a clear and transparent manner to ensure that potential tenants are fully informed of any relevant circumstances that may impact their decision to rent the property.

- Flood Hazard (GOV § 8589.45)– As of July 1, 2018, it is mandatory for landlords to disclose if the rental property is located in a flood hazard area, as per the Government Code Section 8589.45. The landlord is required to inform the tenant whether the property is in a flood hazard area or not.

- Megan’s Law Disclosure (CIV § 2079.10a) – Disclosure is required to be included in every residential contract in California. A copy of the disclosure can be accessed in PDF, MS Word, or ODT format.

- Mold Disclosure (HSC § 26147) – It is a legal requirement to provide tenants with a mold disclosure document as an attachment to the lease agreement. This document serves to inform tenants of any known mold issues present in the rental property. It is important to comply with this regulation to ensure that tenants are fully aware of any potential health hazards and to maintain a safe and healthy living environment. As such, landlords and property managers must include this disclosure as part of their leasing process.

- Ordnance Locations (CIV § 1940.7(b)) – Before signing a rental agreement, the landlord of a residential dwelling unit must inform the prospective tenant in writing if they are aware of any former federal or state ordnance locations in the neighborhood area.

- Pest Control (GOV § 1099) – In accordance with GOV § 1099, it is required that if remediation has been performed, the tenant must be provided with a pest inspection report. This report serves as evidence that proper measures have been taken to address any pest-related issues within the property. It is important for both the tenant and the landlord to adhere to this regulation in order to maintain a safe and healthy living environment.

- Shared Utilities (CIV § 1940.9) – In instances where an electrical or gas meter is shared, it is incumbent upon the rental agreement to specify the manner in which the utilities will be allocated between the respective parties. This is in accordance with the provisions of Civil Code § 1940.9.

- Smoking Policy Disclosure (CIV § 1947.5) – Landlords are obligated to exhibit a smoking policy that explicitly outlines the areas where smoking is permitted, which includes common spaces. This policy is a requisite that landlords must adhere to, and it is imperative that they conspicuously display it in their premises.

- Methamphetamine or Fentanyl Contamination Disclosure (HSC § 25400.28) – According to the law, landlords are obligated to provide written notice to all prospective tenants if the rental property has been found contaminated or is undergoing remediation. The landlord is also required to provide the potential tenant with a copy of the related order.

Security Deposit Laws

Maximum (§ 1950.5(c)(1)) – If the rental is furnished, the landlord may require up to three months’ rent as a security deposit. If it’s unfurnished, the landlord may require up to two months’ rent.

Returning (§ 1950.5(g)(1)) – The landlord must return the tenant’s deposit within 21 days, accompanied by an itemized statement of any deductions.

Landlord Access Notices for Residential Properties in CA

In order to give a Right to Enter Notice, you can do one of the following things:

- Personally deliver it to the tenant.

- Leave it with someone who is old enough to receive it on the property.

- Leave it on, near, or under the usual entry door of the premises in a way that a reasonable person would find it.

- If you mail the notice at least six days before the intended entry, it is considered reasonable notice unless there is evidence to the contrary.

Source: CIV § 1954(d)

Federal Laws

Frequently Asked Questions

What state laws do Landlords need to know when renting out property in California?

- Landlord-Tenant Laws

- Fair Housing Laws

- Property Maintenance and Safety Codes

- Security Deposit Laws

- Notice Requirements for Entry

- Notice Requirement Terminating Tenancy

- Rental Control and Stabilization

- Tenant Privacy Rights

- Local Regulations

Is California an at will state?

Yes, except for termination due to discrimination or retaliation.

How to pay California state taxes?

Pay online through California Franchise Tax Board (FTB) website.

What is the deadline to file California state taxes?

April 15th.

Is California a no fault divorce state?

Yes.

Is a DUI a felony in the state of California?

Yes, depending on the circumstances (injury or death).

What is the minimum wage in California?

$15 for 26 or more employees and $14 for 25 and fewer employees.

Sample 1-Page Rental Lease Agrement Template

California 1-Page Rental Lease Agreement Checklist

✅ Before Signing Checklist

Landlord Preparation:

Tenant Preparation:

✅ After Signing Checklist

Immediate Actions (First 24 Hours):

First Week Actions: