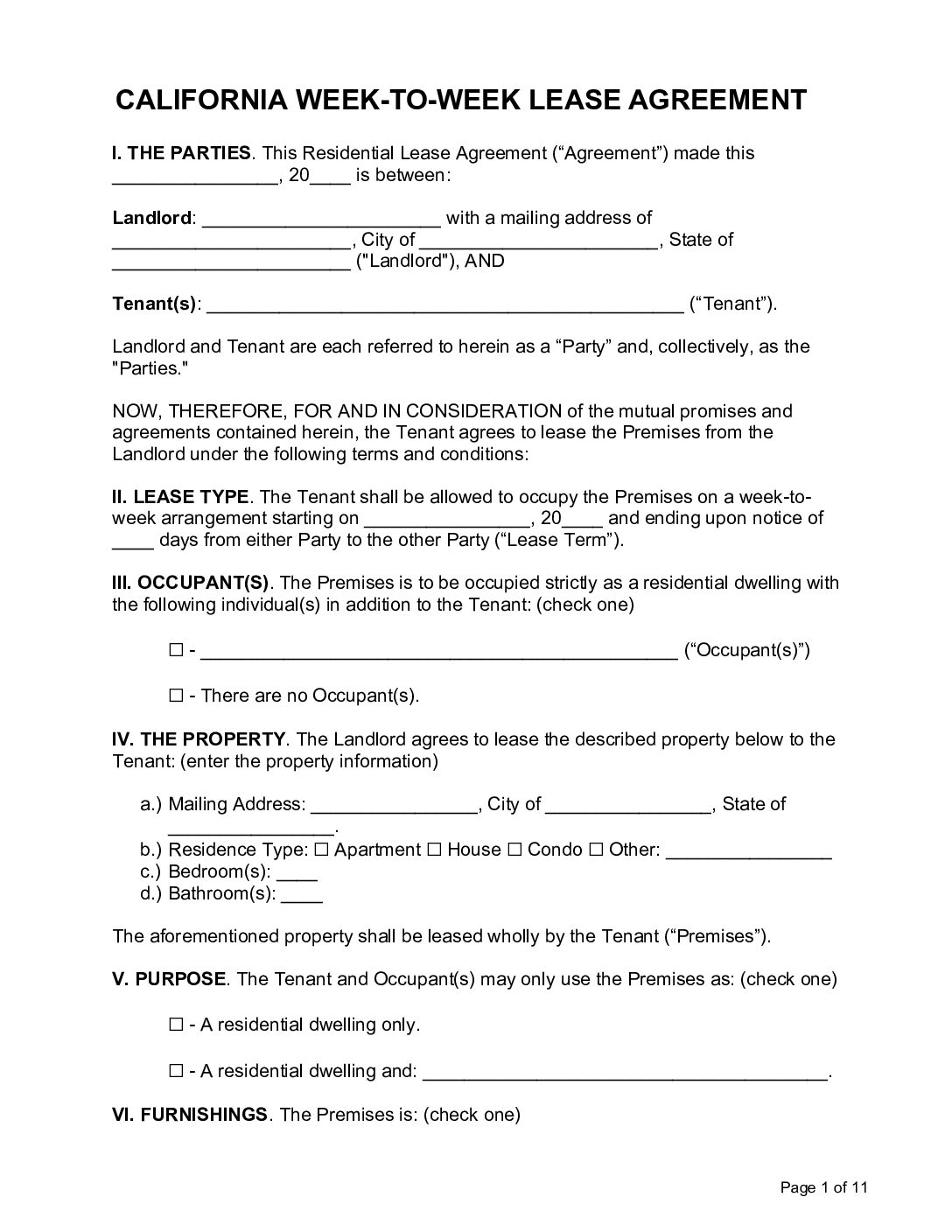

California Lease Agreement Templates By Type

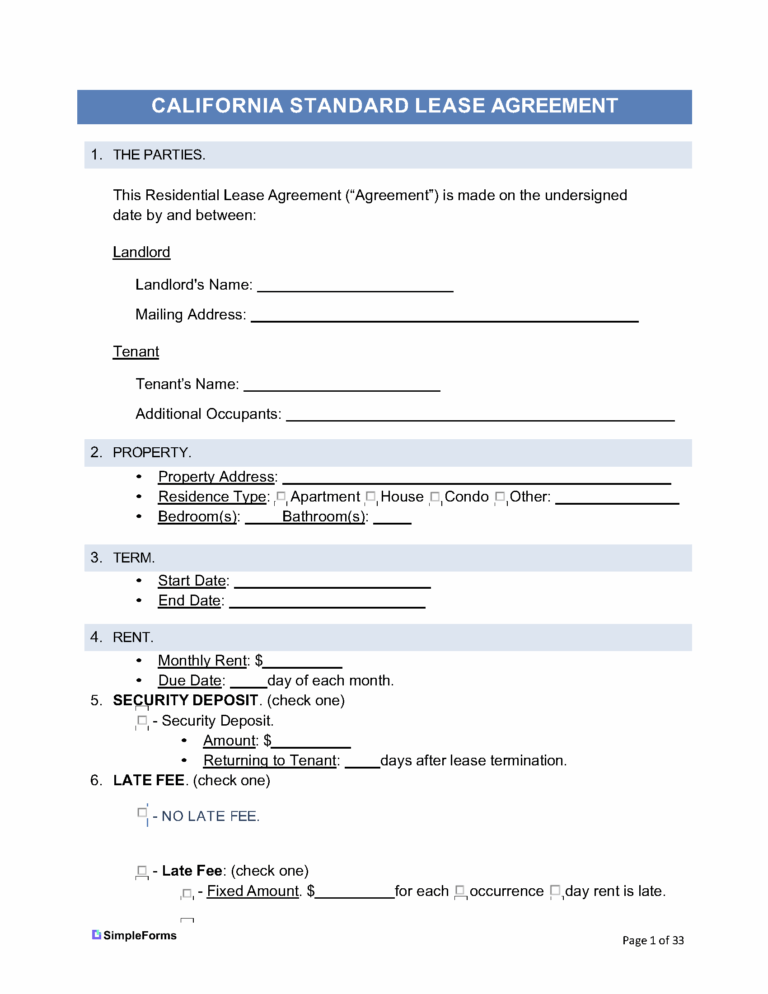

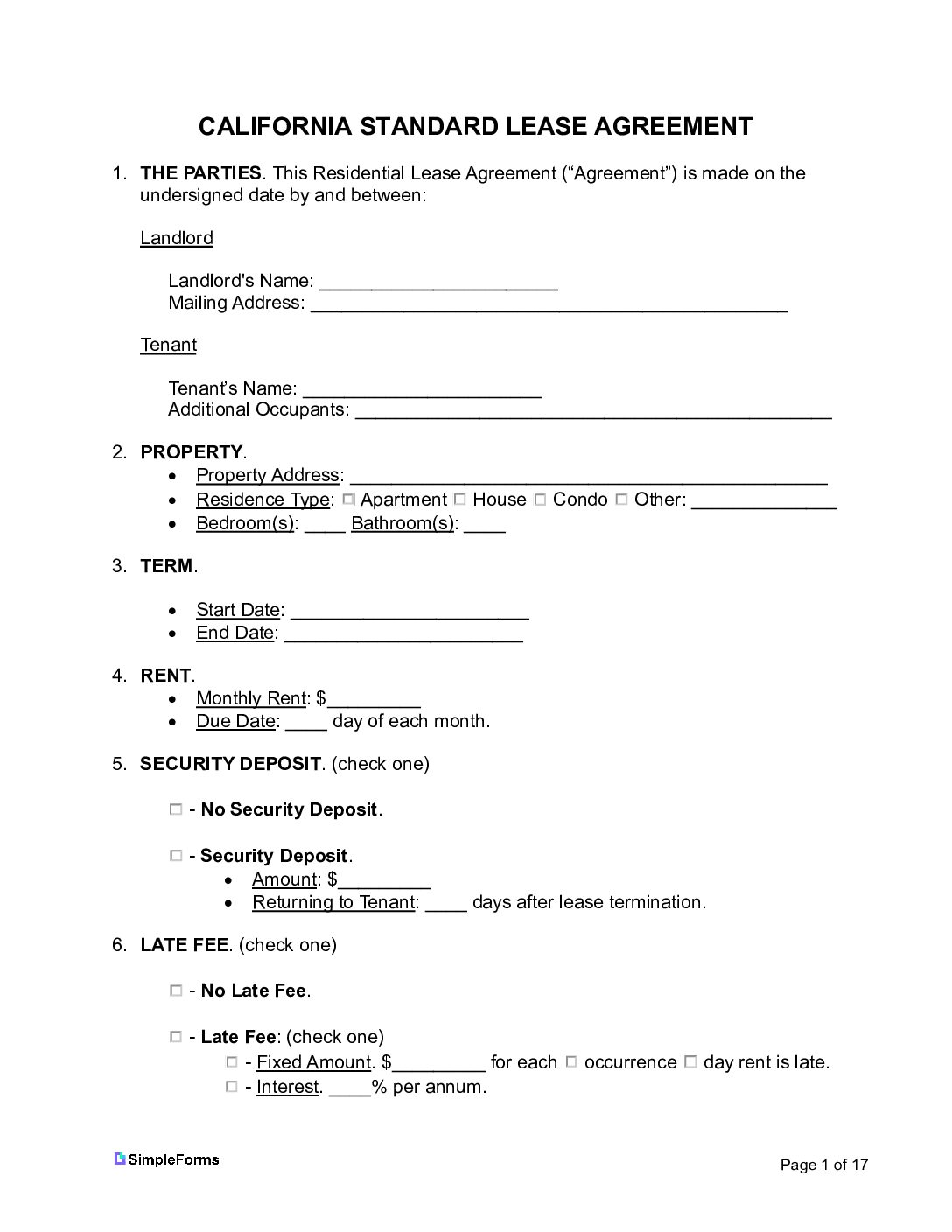

| California Residential Lease Agreement – A standard lease agreement used for renting residential properties, includes the rent amount, term, security deposits, landlord-tenant responsibilities.

Download: PDF | Word (.docx) |

|

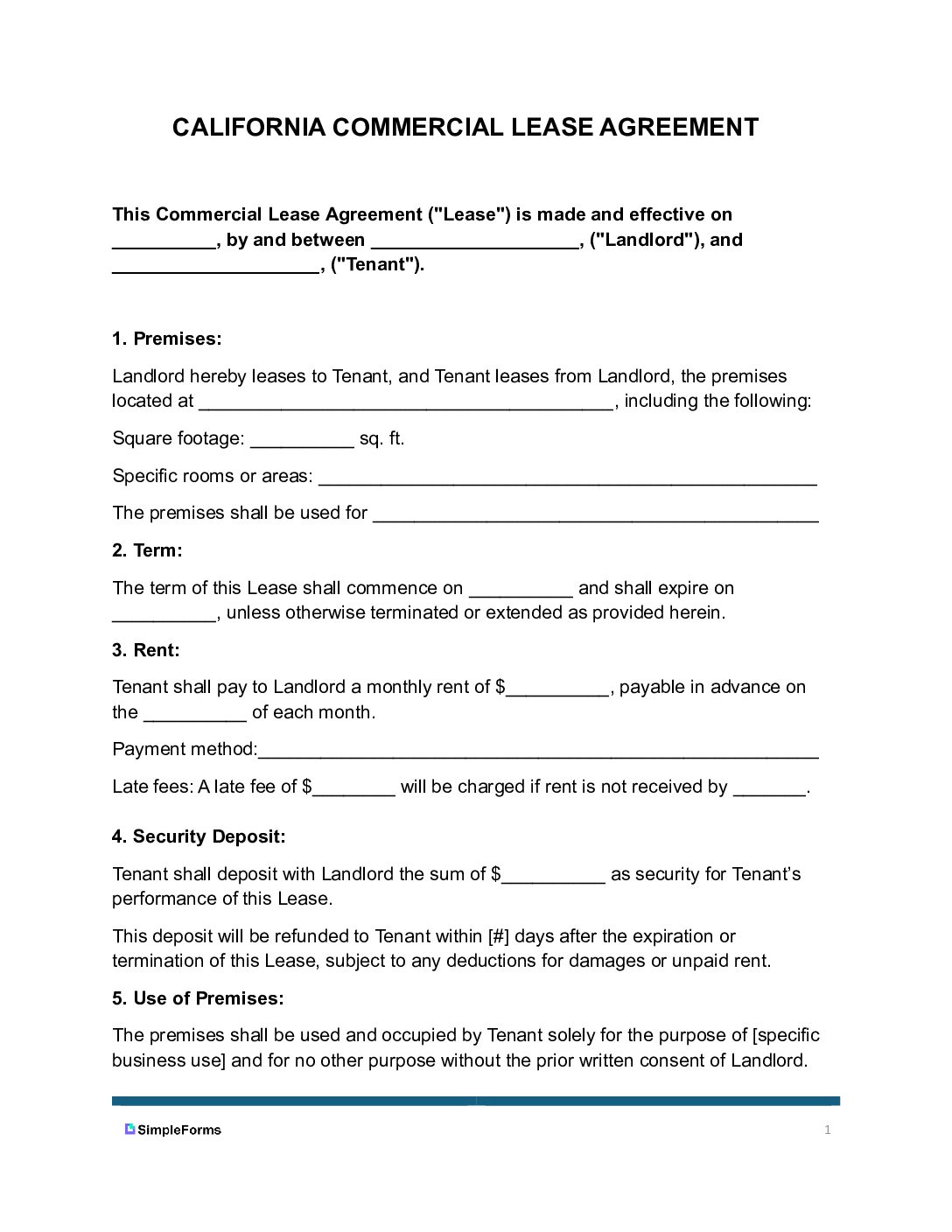

California Commercial Lease Agreement– A formal agreement between a business, individual or corporate, and the office, retail, or industrial property owner.Download: PDF | Word (.docx) |

|

California Month-to-Month Lease Agreement – a rental contract without a fixed end date. Either party can terminate with 30 days’ notice if the lease is under one year or 60 days if it exceeds one (1) year. (Section 1946)Download: PDF | Word (.docx) |

|

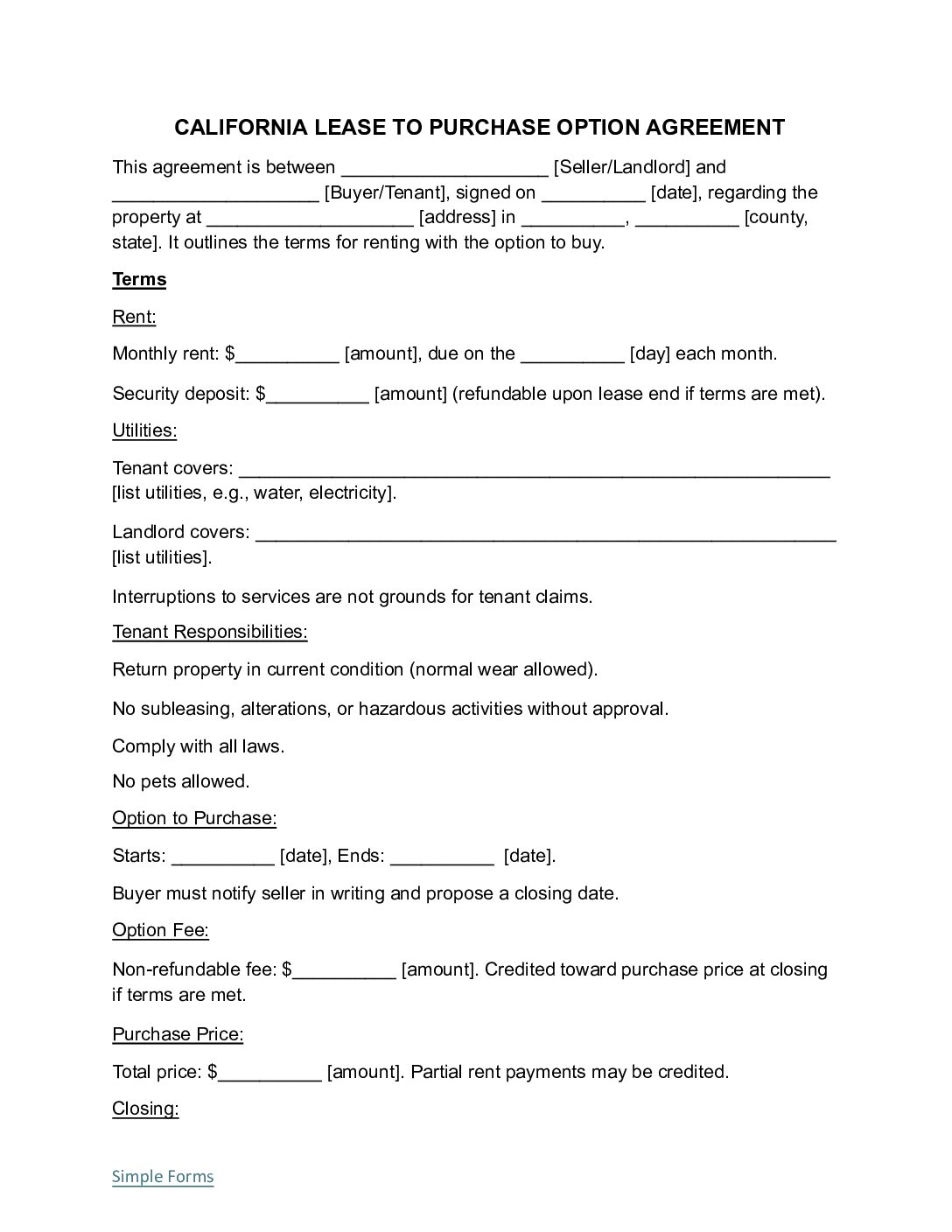

California Rent to Own Lease Agreement– a fixed-term contract with the added option to purchase the property during a specified “option” period.

Download: PDF | Word (.docx) |

|

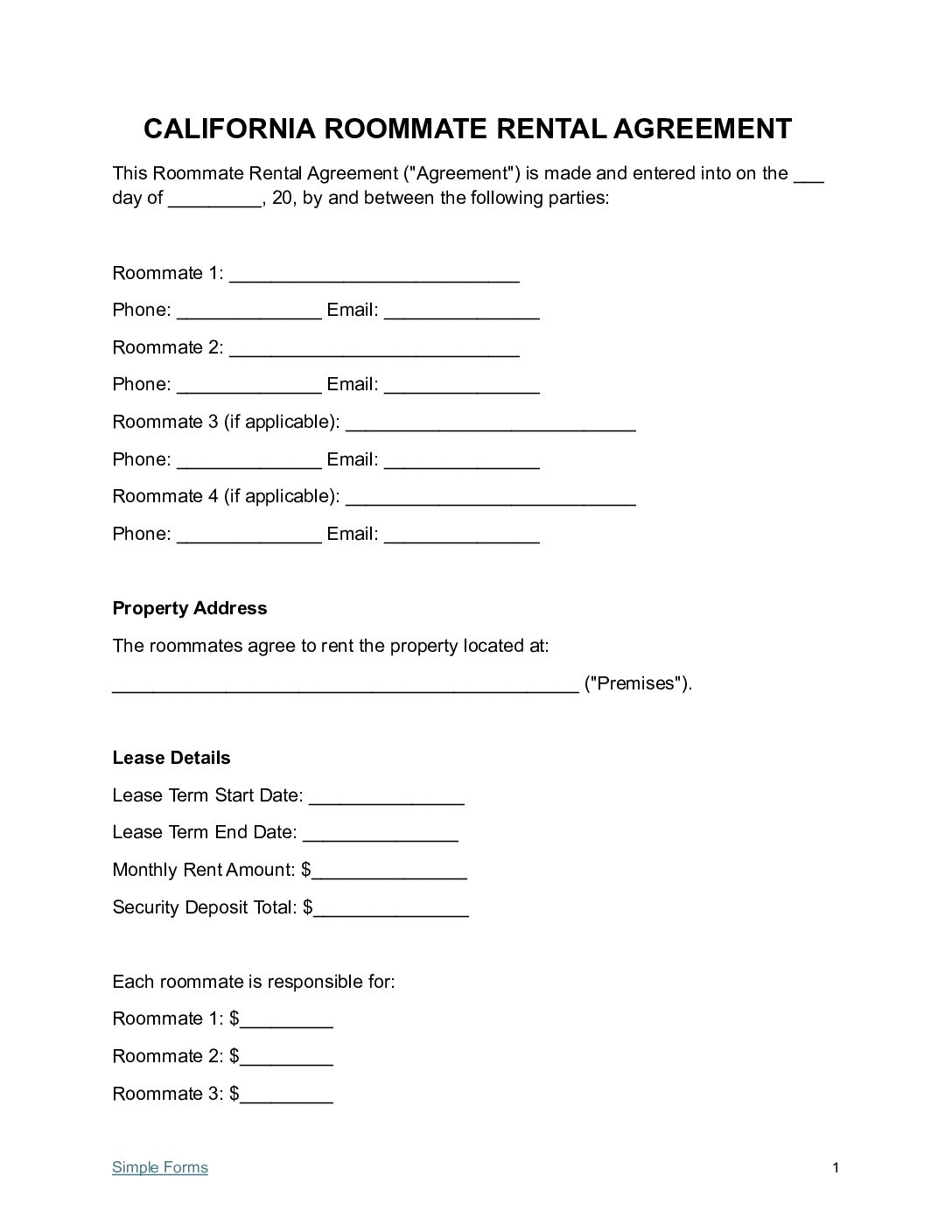

California Roommate Lease Agreement – For a residence where several people rent individual bedrooms and share common spaces.Download: PDF | Word (.docx) |

|

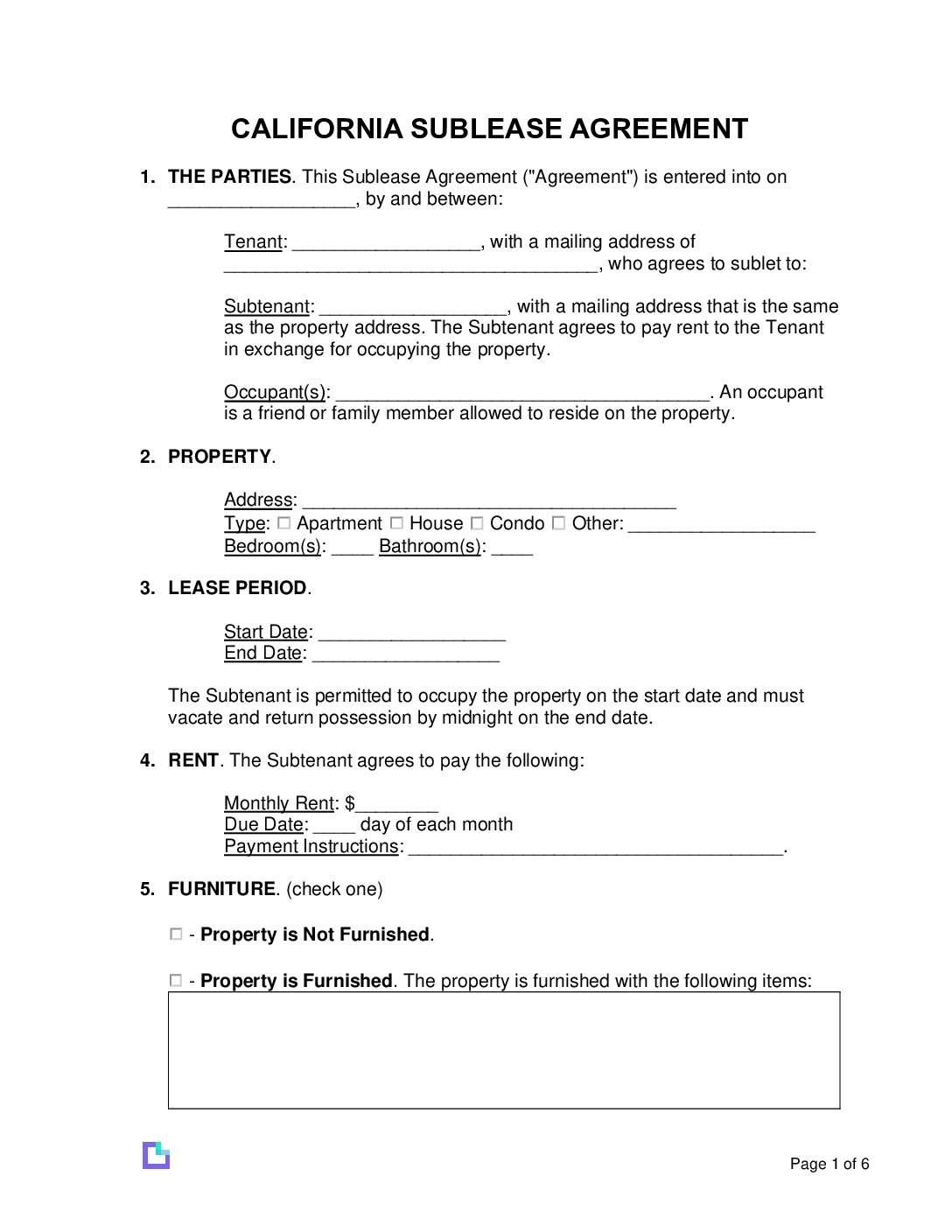

California Sublease Agreement – is used when a tenant rents out the space they currently lease from the landlord. The tenant must get written approval before allowing a subtenant.Download: PDF | Word (.docx) |

California Association of Realtors

California Association of Realtors Residential Lease Agreement [PDF]

What does the California rental lease agreement form cover?

This California rental lease agreement is used by landlords and tenants and includes required disclosure forms and covers the following laws; rent control and rent Increases, evictions, security deposits, discrimination, rent payments, late fees, tenant privacy, termination of tenancy, COVID-19 protections, required disclosure forms, and maintenance and repairs.

The following includes an in-depth look at what laws are included in the California rental lease agreement form:

- Rent Control and Rent Increases in CA

- Eviction Laws

- Security Deposit Requirements

- Discrimination Laws

- Rent Payment and Grace Periods

- Tenant Privacy

- Lease Agreements in Writing

- Termination of Tenancy

- COVID-19 Tenant Protections

- Required Landlord Disclosure Forms

- Maintenance and Repairs

- Utility Responsibilities in California

- Pet Policies

Rent Control and Rent Increase Laws in CA

- Rent control laws in Los Angeles, San Francisco, and Oakland limit rent increases.

- Landlords cannot raise rents more than 5% plus inflation (10% of rent) for rental units not covered by the statewide cap or built before 2005. [1]

California Eviction Laws

- Landlords have the right to evict a tenant if there is a breach in the contract or nonpayment of rent; this is called having ‘just cause for eviction.’ [2]

- If the tenant does something illegal on the rental property.

- Damages the property (committing waste)

Notice Requirements

- Nonpayment of rent or breach of contract – 3 days notice

- Month-to-month leases – 30/60 day notice rule

Security Deposit Requirements

- 21 Days – landlords must return all deposits within 21 days of the lease end date.

- 2 months’ rent – maximum amount landlords can request from tenants for unfurnished rental units

- 3 months’ rent – the maximum for furnished units. [3]

Discrimination Laws in California

California Fair Employment and Housing Act

Rent Payment Date, Grace Periods, and NSF Fees

- The agreed-upon date in the agreement must state when rent is due.

- Grace periods are not mandated by law, although landlords can charge a late fee for late rent if it is written in the lease agreement.

- If a rent check is bounced, the landlord can charge an NFS fee of up to $25 for the first one and $35 per bounced check for any others. [6]

Tenant Privacy Laws, Landlord Notices, and Emergency Protocols

- Landlords must give a 24-hour notice to tenants before entering the rental unit for maintenance and repairs, showings, or inspections, except in emergencies. [7]

- In an emergency, landlords do not have to give tenants prior notice.

Lease Agreements in Writing vs. Verbal: Written and Veral Requirements

- Tenants have protections under California Law with or without a written lease for under a year.

- For leases that are longer than one year, they must be in writing for tenants to have full protection.[8]

Termination of Tenancy Rules for Tenants

- Tenants who are on active military duty can terminate tenancy.

- Tenants can terminate their lease if they are domestic violence victims. [9]

- Tenants must submit the reports and any other documentation to back up the claim.

Required Landlord Disclosure Forms (19)

Landlords in California are required to provide the following disclosure forms and disclose any additional information to tenants prior to the move-in date.

Required Forms

- Lead-Based Paint Disclosure Form (hud.gov) – For properties built before 1978, landlords must disclose any risks related to lead-based paint and provide an EPA-approved pamphlet.

- AB 1482 (Cause and Rent Limit Addendum) (California Civil Code § 1946.2 & § 1947.12)

- Asbestos Disclosure (§ 25915 – § 25915.5) – If a property built before 1979 contains asbestos, landlords must notify tenants about its presence and location.

- Bed Bug Addendum (§ 1954.603) – Landlords must provide tenants with a bed bug addendum with information on the pest, prevention, and how to report infestations to the landlord.

- Carbon Monoxide Detector Compliance (HSC § 17926.10)– Landlords must install carbon monoxide detectors with fossil-fuel heaters or appliances in all living units.

- Carcinogenic Material (Conditional) (Regs. 27, § 25607.34) – Landlords with 10 or more employees must notify tenants if the property contains known carcinogens listed under Proposition 65.

- Landlord/Property Manager Contact Information (§ 1962) – Landlords must provide their name, address, phone number, and details of the property manager. They must also disclose where, when, and how rent payments should be made.

- Obligations of Non-Material Facts/Death (§ 1710.2) – If there was a death on the property, the landlord must disclose these facts to the tenant, unless the prior occupant who died was HIV-Positive or related to any AIDs issues, then the landlord does not have to disclose to the tenant.

- Demolition (§ 1940.6) – If demolition is planned, tenants must be informed before signing the lease.

- Flood Hazard (§ 8589.45) – If a property is in a high-risk flood zone, landlords must include this information in the lease.

- Megan’s Law (§ 2079.10(a))(meganslaw.ca.gov) – Tenants must be notified in writing about California’s online registry of sex offenders.

- Methamphetamine Contamination (§ 25400.45) – Landlords must disclose if the property has been contaminated by chemicals used in methamphetamine production.

- Mold (§ 26147) – If known harmful mold is present, landlords must notify tenants. If unaware of mold issues, landlords may provide a general disclosure form.

- Pest Control (§ 1940.8)—If tenants contract with a pest control company, Landlords must provide them with a list of pesticides used. Failure to do so may result in fines of up to $2,500.

- Proximity to Military Bases (§ 1940.7) – If a property is within 1-mile of a military base using heavy ordnance, landlords must disclose this before signing the lease.

- Smoking and Cannabis Policies (§ 1947.5) – Landlords must include rules about smoking in the lease agreement, including whether it’s allowed or prohibited on the property.

- Shared Utilities (§ 1940.9) – Landlords must explain how utilities are shared between units and common areas and disclose the method for dividing costs.

- Radon Gas Disclosures – Property Owners/landlords with up to four units must disclose any known environmental hazards, such as radon, formaldehyde, and mold. (California Civil Code Sec 1102 – 1102.18)

- Seismic safety or earthquake hazard zones disclosures – Landlords must give Tenants a Natural Hazards Disclosure Statement, indicating if the home is in an Earthquake Fault or Seismic Hazard Zone. Also, provide a Residential Earthquake Risk Disclosure Statement. (DIVISION 2 – GEOLOGY, MINES AND MINING, CHAPTER 7.8)

California Civil Code: Maintenance and Repairs

Summary (California Civil Code § 1942(b)):

- Landlords have 30 days to complete requested repairs after receiving reasonable notice from a tenant.

Emergency Situations

- For emergencies or valid reasons, repairs can be requested sooner.

Utility Responsibilities in California for Vacation Home Rentals

Summary (oag.ca.gov):

- Electricity & Gas– Units must have separate meters. If shared, landlords must disclose and set payment the terms.

- Water & Trash – Responsibility isn’t mandated; leases should clarify who pays. Landlords should include the costs in rent.

- Shared Meters – Landlords must inform tenants of shared meters and outline cost-sharing in writing. No profits allowed.

- Unpaid Bills – The account holder pays. For water, landlords may be liable if tenants default on payments.

Pet Policies / Emotional Support Animals / Service Animals (By Law)

In California, rental pet policies follow the following rules by law when renting residential property.

Disability Rights

- Emotional Support and Service Animals (disabilityrightsca.org) – Service and emotional support animals must be allowed, even with “no pets” policies, and no extra fees can be charged.

California Pet-Friendly Housing Act

- Affordable Housing (California Pet-Friendly Housing Act) – New affordable housing must allow common household pets.

Temporary Pool Addendum to the Lease Agreement

Temporary Pool Addendum to the Lease Agreement – Starting in September 2025, California will require all new pool pumps to be internet-enabled and set to operate between 9 AM and 3 PM. This applies to new pools or when replacing pumps but they can still run outside these hours. Hot tubs are not affected by this rule.

CA Apartment and Home Rentals: Short and Long-Term Leases

California Rentals: Vacation/On the Beach Homes

Lease Inspection Report

Initial Inspection Report – A lease inspection report helps landlords check a rental property’s condition before, during, and after a lease. The lease inspection report allows the tenant to fix any issues before the final inspection. This report lists any damages, needed repairs, and security deposit deductions (if any). (CA Civil Code § 1950.5(f))

California Wildfires 2025 🔥

- Some listings in California may have been affected by the ongoing California wildfires, as many homes and properties are no longer available.

CA Fire and Frontline Wildfire Defense

- Cal Fire (fire.ca.gov) and Frontline Wildfire Defense (frontlinewildfire.com) share California’s most current and updated emergency incidents.

FAQs

Are lease agreements required to be in writing in California?

Yes, for leases over one year. For shorter terms, verbal agreements may still be valid but written leases are strongly recommended.

What is the maximum security deposit in California?

Two months’ rent for unfurnished units, three months for furnished units. Landlords must return deposits within 21 days after move-out.

Can a landlord raise rent in California?

Under AB 1482, most landlords cannot raise rent more than 5% + local inflation (max 10%) annually.

Sample California Rental Lease Agreement Template

Sources

California Lease Agreement Checklist

✅ Before Signing Checklist

Landlord Preparation:

Tenant Preparation:

✅ After Signing Checklist

Immediate Actions (First 24 Hours):

First Week Actions: