Understanding Receipts: Types, Importance, and How to Create Professional Receipts

Original receipt templates are documents from a vendor that show proof of goods sold or services rendered. A business receipt is proof of goods or services provided by a company. A rent receipt is proof that the Tenant paid rent.

Invoice vs Receipt: What’s the Difference?

An invoice is a payment request; a receipt records the payment.

Types of Receipt Templates

- Business Receipt – is a proof of payment issued by a company to a customer after a transaction, commonly used for sales, services, or consultations.

- Car (Vehicle) Receipt – records the payment and details of a vehicle sale between a buyer and seller, useful for private sales or dealership transactions.

- Cash Payment Receipt – documents a transaction paid with physical cash, typically used in personal, rental, or informal business exchanges.

- Cleaning Service Invoice Receipt – is issued by cleaning companies or independent cleaners to confirm payment for home, office, or commercial cleaning services.

- Credit Card Receipt – verifies that a payment was processed using a credit card and includes transaction details such as date, amount, and card type.

- Delivery Receipt – confirms that goods or packages were successfully delivered and received, often used in shipping, courier, and logistics services.

- Deposit Receipt – acknowledges an upfront payment or down payment made toward a service, rental, or purchase agreement.

- Donation Receipt – serves as official acknowledgment of a charitable gift or contribution, often used for tax deduction purposes.

- Earnest Money Receipt – confirms the transfer of earnest money as a good-faith deposit in real estate transactions to secure a property offer.

- Itemized Receipt – provides a detailed breakdown of purchased goods or services, including prices, quantities, and totals for transparency and record-keeping.

- Rent Receipt – documents rental payments made by a tenant to a landlord, including amount paid, rental period, and property address.

- Security Deposit Receipt – acknowledges funds paid by a tenant at the start of a lease to cover potential property damage or unpaid rent.

- Vehicle (Private Sale) Receipt – confirms the exchange of payment and ownership between two individuals in a used car transaction.

Why should I use a receipt?

Receipt templates offer many benefits for business owners:

-

- Accuracy and Consistency: All details of the transaction are correctly recorded.

- Professionalism: Gives your business a better image and builds trust with clients.

- Timesaving: Speeds up billing by using pre-set fields.

- Expense Tracking: Helps track cash purchases and donations for better financial management.

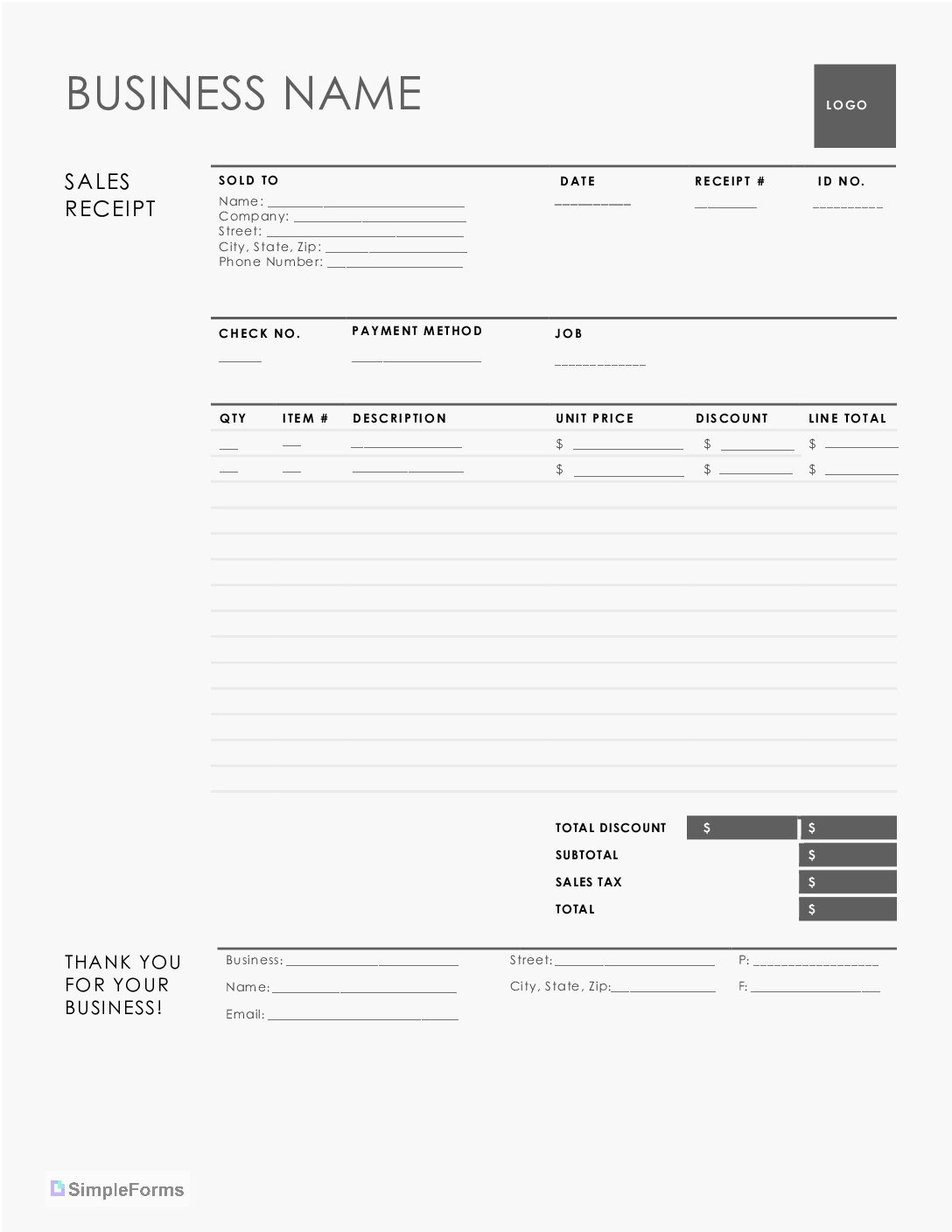

What to include in a professional receipt?

Professional receipt templates include the following information:

- Contact Details: Company Name and Logo

- Date of Transaction

- Itemized List of Goods or Services

- Total Unit Price and Tax Information

- Total Amount Paid

- Payment Terms and Conditions

- Customer Details

- Benefits of Using a Customizable Receipt

- Tips for Creating a Receipt

- Tips for Branded Receipt

- Walmart Receipt Lookup

1. Contact Details: Company Name and Logo

Business contact information should go at the top of the receipt and should include the following:

- Company Name

- Logo

- Address

- Phone Number

- Email Address

- Website [1]

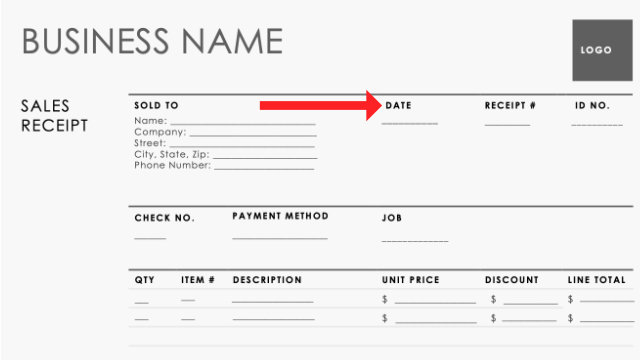

2. Date of Transaction and Payment Method

The transaction details should include the following:

- Date of Purchase

- Receipt Number

- Payment Method [2]

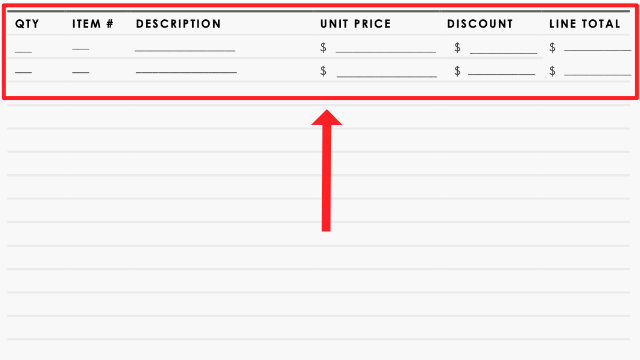

3. Itemized List of Goods or Services

Summarize a list of goods or services provided in detail. The itemized list should include the following:

- Item Descriptions

- Quantities

- Unit Prices

- Total Amounts Paid [3]

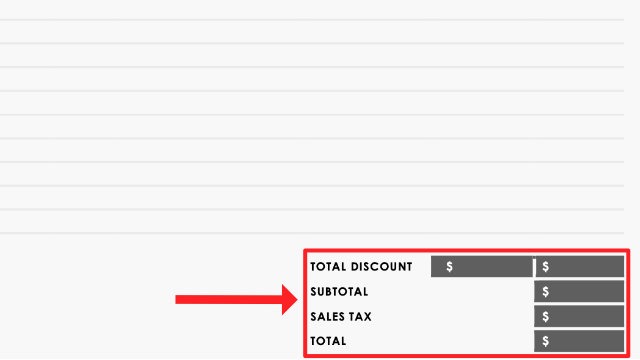

4. Total Unit Price and Tax Information

Include the following:

- Subtotal

- Taxes

- Final Total Amount

5. Total Amount Paid

6. Payment Terms and Conditions

7. Customer Details

Add customer details such as full legal name, mailing address, email, and phone number.

Benefits of Using a Customizable Receipt Template

Using a customizable receipt template includes the following advantages:

- Professional Image: Customize with brands, logos, and fonts.

- Customization: Design, Colors, and Font.

- Easy Record Keeping: Simplifies the way to keep records.

- Tax Records: Organize deductible tax records.

- Legal Compliance: Helps to comply with legal receipt and transaction regulations.

- Impress Clients: Show clients that you value your business operations.

Tips for Creating a Custom Receipt

Tips for creating a receipt include the following:

- Include Logo (Personal or Business)

- Add Personal Message(s)

- Make Clearer Product Descriptions

Tips for Branding Receipt

Branding receipt tips include:

- Add Company Logo

- Professional Font

- Add Business Information

Walmart Receipt Lookup

Walmart receipts (Walmart.com) are easy to look at with only a few details:

- Purchase Location (State, City, Zip Code)

- Purchase Details (Item Name)

Professional Receipt Book

Keeping receipts in an organized booklet can help make doing taxes much more manageable.

Recommendations

Office Depot (officedepot.com)

Return Policies without a Receipt Lookup

- Walmart – Refund times depend on the payment method used. Credit/debit cards take up to 10 days, prepaid cards and PayPal up to 30 days, and third-party gift cards up to 10 days (longer for international banks). Walmart Gift Cards, EBT/SNAP Cards, and Refund Credit process within 3 hours. Healthy Benefits Plus OTC Card and Affirm refunds take up to 5 days. (Walmart.com)

- Target – Return items without a receipt by finding barcodes or receipts in the Target account, app, or emails. Guest Services can also look up purchases using payment methods. Without proof, you may get a merchandise return card. For Target Plus™ items, proof of purchase is required. (target.com)

- Costco – Return policies vary between products and payment methods used. (Costco.com)

- Spotify – Yes, cancel anytime in your account online or in the app. (Spotify.com)

Conclusion: Why Receipts Matter for Your Business

Receipts are key to keeping accurate records of purchases, sales, and payments. They also help with tracking expenses, managing refunds, and complying with legal requirements. A customizable receipt template makes accounting easier, boosts your brand’s image, and builds customer trust.

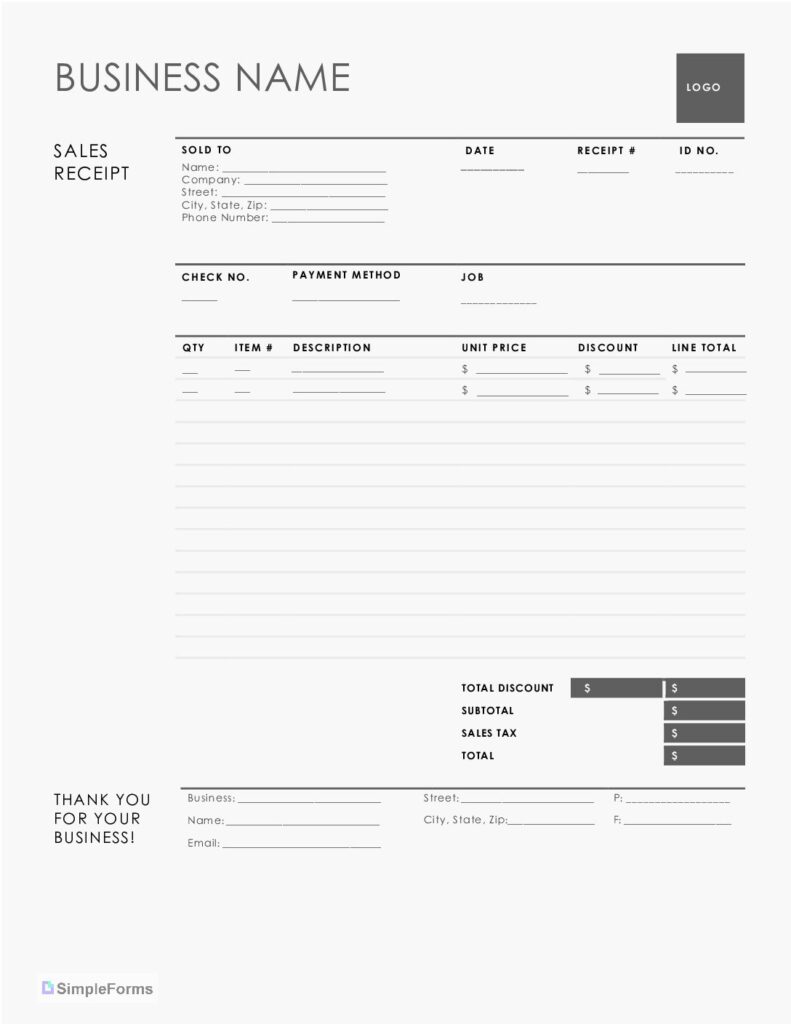

Sample Receipt Template

Our customizable blank receipt template is easy to use in formats such as Adobe PDF, Microsoft Word, ODT, or Excel.

Download: PDF / Word / ODT / Excel

Receipt Template Checklist

✅ Before Issuing a Receipt

General Setup:

Information to Include:

✅ After Issuing the Receipt

Follow-Up: