This Oklahoma auto motor vehicle bill of sale document details the buyer, seller, and the vehicle in question. It is important to note that, unlike several other states, Oklahoma does not mandate the presentation of a bill of sale for vehicle registration; however, it may still be required for this purpose in certain instances.

Type of Sale

The Registration Process

When registering a vehicle in Oklahoma, it’s important to note that as of June 2019, a license plate no longer “follows” a car in a transaction. The new motor vehicle owner must apply for vehicle title and registration within thirty (30) calendar days from the date of purchase or acquisition.

The Odometer Disclosure Statement

The Odometer Disclosure Statement (Form 729) form is an official mileage disclosure and must be filled out accurately. Failure to disclose the vehicle’s mileage at the time of sale may result in criminal penalties. However, this form may not be necessary if the car being sold is at least ten years old.

What You Need to Register Online

Registering online takes ten minutes. Make sure you have the following documents and payment forms available before starting the process.

- Last four of VIN

- License plate number

- Oklahoma insurance policy

- Driver License or FEI number of the owner

- Credit card or check

Vehicle Registration Renewal

The vehicle registration must be renewed annually online using the state’s OkCars service. You can register your vehicle at the Oklahoma Tax Commission office or any of the various Tag Agents located throughout the state.

Required Documents

1. A Bill of Sale or a notarized Declaration of Vehicle Purchase Price

2. Manufacturer’s certificate of origin for a new vehicle or the out-of-state title for a used vehicle

3. Proof of inspection from an Oklahoma Tag Agent for a vehicle purchased from another state

4. Application for Oklahoma Certificate of Title for a Vehicle (Form 701-6)

5. Current title for a transfer of Oklahoma title or a used vehicle purchased in the state

6. Odometer Disclosure Statement (not required if the vehicle is at least ten years old)

7. State driver’s license

8. Lien documentation if the vehicle is subject to a lien

9. Release of Lien form if a lien is being released

10. Verification of liability insurance (Check Statue Online)

11. Excise and sales taxes, title and registration fees, and any taxes, fees, interest, and penalty associated with the plate

12. Motor Vehicle Power of Attorney if an agent is purchasing on the new owner’s behalf

Remember, in addition to the required documents, you will need to pay registration and title fees. If you have any questions about motor vehicle liens, you can refer to Form FL-21 for more information.

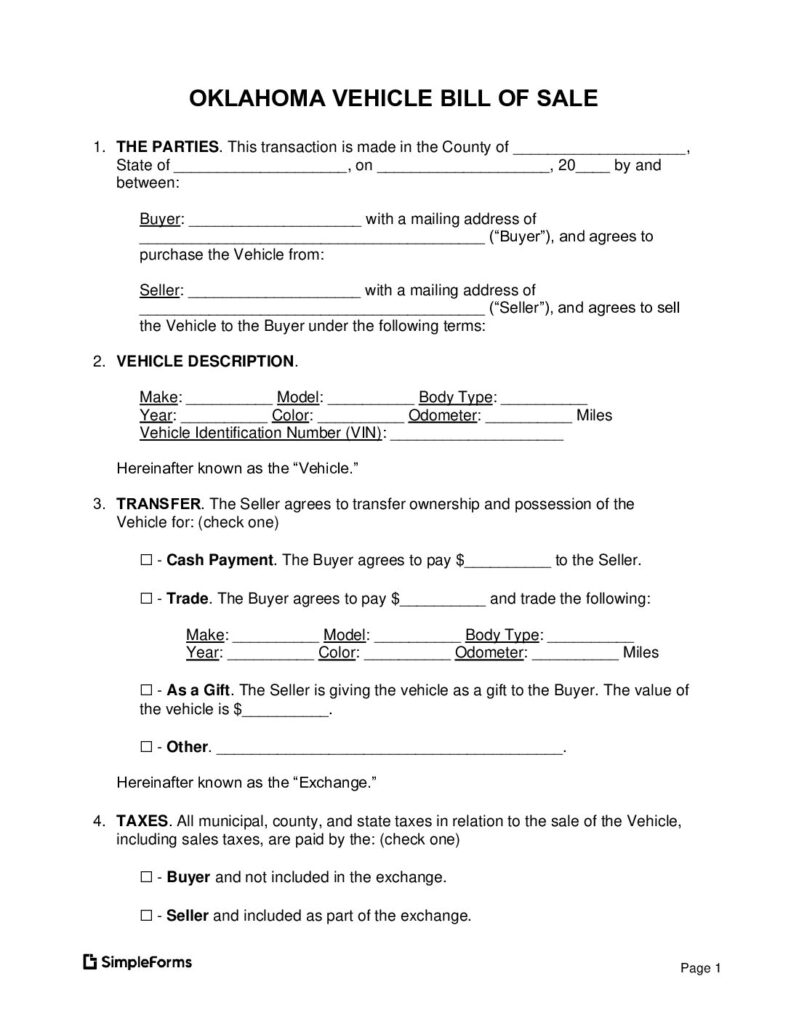

Oklahoma Auto Motor Vehicle Bill of Sale: Basic Template Example

Sample

https://simpleforms.com/wp-content/uploads/2024/06/Oklahoma-Car-Motor-Vehicle-Bill-of-Sale-Form.pdf