Rental Application – This form is for Tenants to fill out in order for Landlords to get access to the potential Tenants credit, finances, and employment history.

Purchase Agreement – The contract becomes a purchase agreement if the Tenant decides to buy the property.

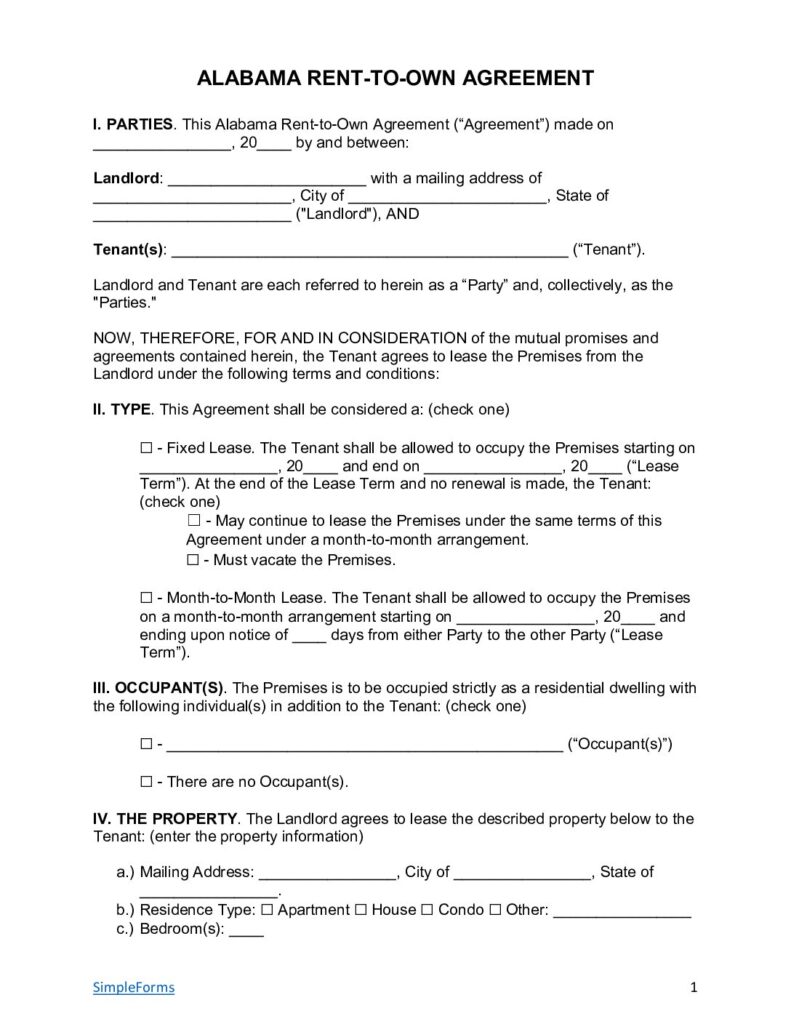

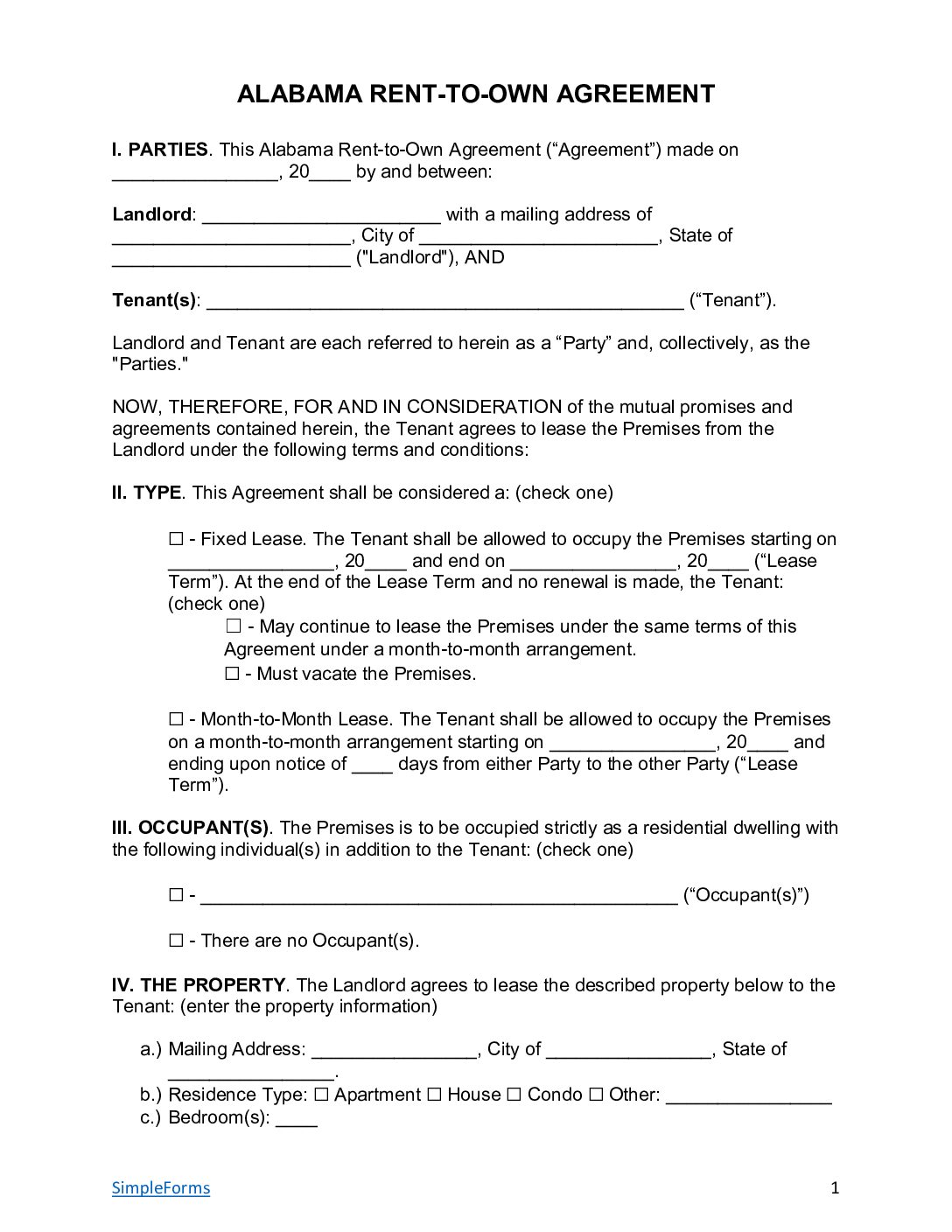

What to Include in an Alabama Lease-to-Own Agreement?

An Alabama lease-to-own (or rent-to-own) agreement lets a tenant rent a property with the option to buy it later. This type of deal includes parts of the regular lease with a purchase contract. It includes rent details, security deposits, late fees, and rules on occupancy, furnishings, utilities, and pets. The agreement covers maintenance, property access, and tenant rights if the landlord sells the property.

Lease Details, Option Fees, and Purchases

- Lease Details – The agreement should include the lease length, monthly rent, payment dates, late fees, and who is responsible for maintenance and repairs.

- Purchase Option – This gives the Tenant the choice (but not the obligation) to buy the property. It includes the purchase price, how to exercise the option, and any rent that goes toward the purchase price.

- Option Fee – Tenants pay a non-refundable option fee to have the option to buy in future.

Landlord-Tenant Laws, Terms, and Required Disclosures

- Landlord-Tenant Laws – Lease-to-own agreements are under Alabama’s landlord-tenant laws – the Uniform Residential Landlord and Tenant Act. It covers rental agreements, Tenant rights, and Landlord duties.

- Required Disclosures – Landlords must follow state and federal disclosure laws.

Attach Addendum

- An attached lease addendum includes the purchase option, price, financing, inspection period, any fixtures or personal property that come with the sale, rules on disputes, property safety, and lead paint disclosure.

Sample Alabama Rent-to-Own Lease Agreement

Alabama Lease-to-Own Purchase Agreement Checklist

✅ Before Signing Checklist

Landlord Preparation:

Property inspection completed

All required disclosures prepared (lead paint for pre-1978 properties)

Background check results reviewed

Previous landlord references verified

Income verification (3x rent minimum recommended)

Security deposit terms comply with Alabama law (no limit but must be reasonable)

Tenant Preparation:

Read entire lease agreement thoroughly

Understand all financial obligations and late fees

Document property condition with photos/video

Verify landlord contact information and proper agent designation

Review Alabama Uniform Residential Landlord and Tenant Act (URLTA)

Confirm utilities responsibilities and connection procedures

✅ After Signing Checklist

Immediate Actions (First 24 Hours):

Exchange signed copies with all parties

Collect security deposit and first month’s rent

Provide keys, access codes, and garage remotes

Provide written receipt for security deposit and rent payments

Schedule and complete move-in inspection

First Week Actions:

Update address with postal service and delivery services

Transfer utilities (Alabama Power, gas, water, internet)

Document move-in condition and submit to landlord

Obtain emergency contact procedures and after-hours maintenance numbers

Review garbage/recycling schedules and HOA rules (if applicable)

Register to vote at new address if applicable

Update driver’s license and vehicle registration (30 days required)