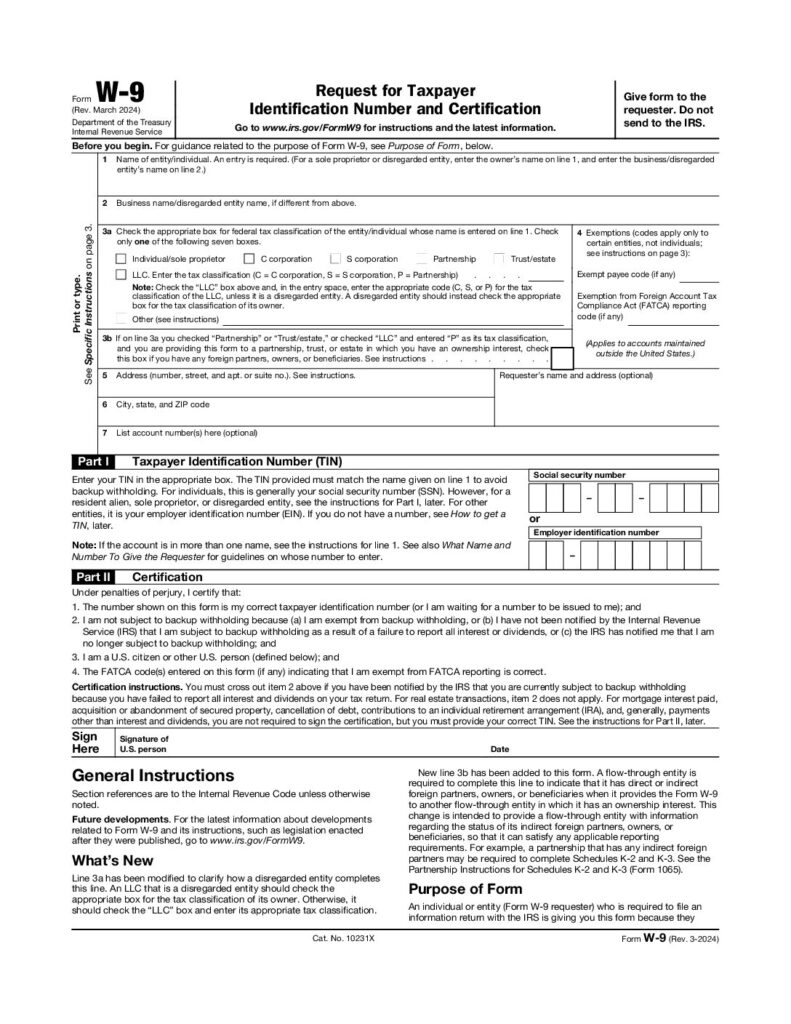

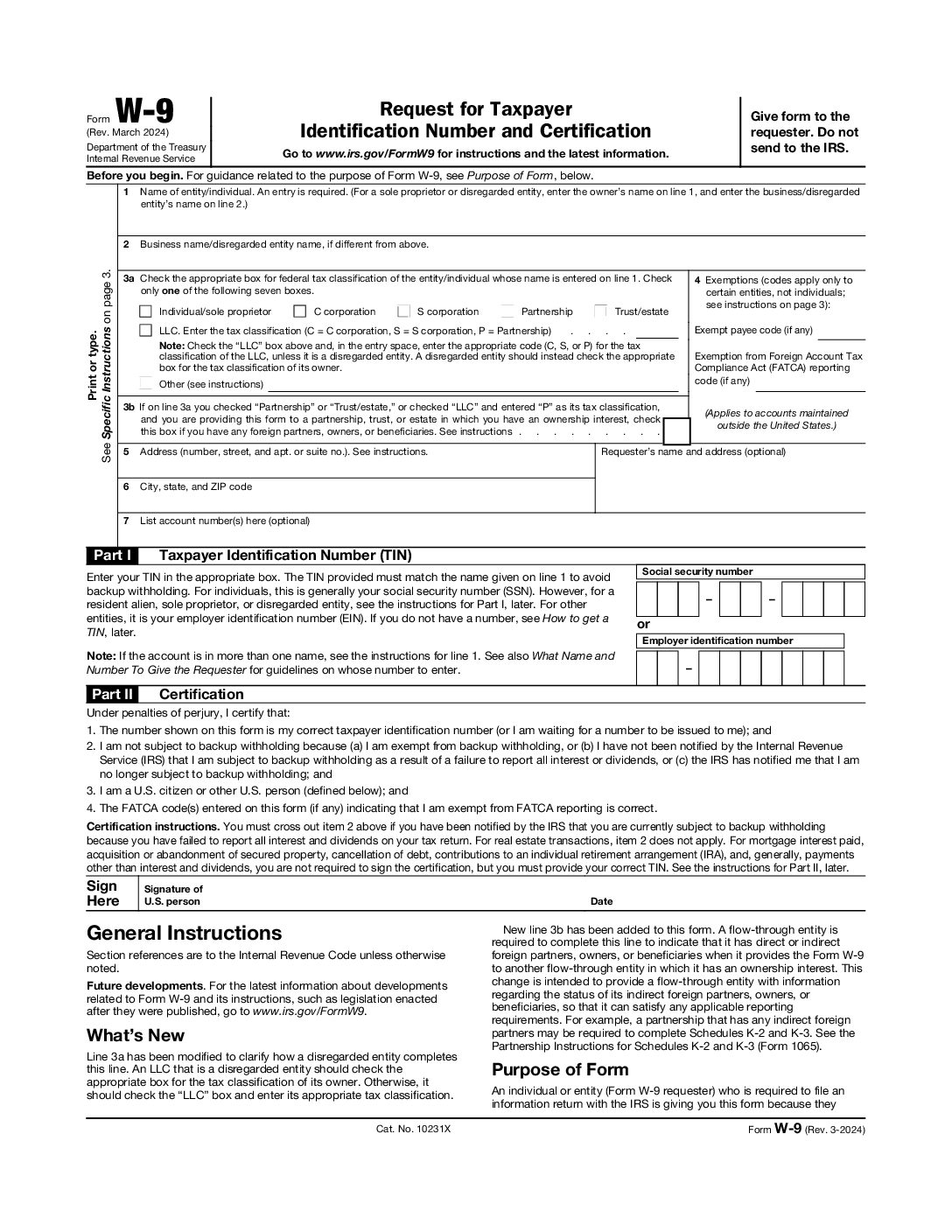

The IRS W-9 form, also called a “Request for Taxpayer Identification Number and Certification,” is the form that is used to gather the legal name and tax identification number (TIN) of an individual or business entity. This form is required when a payment is made, and taxes are not being withheld. Stay up to date with the most recent instructions.

Keep for 4 years

A W-9 is not submitted to the IRS but kept for record-keeping and should be retained for four (4) years.

Source: Forms and Associated Taxes for Independent Contractors

W9 Form By State

| State | PDF URL |

| Massachusetts | mass.gov |

| Indiana | in.gov |

Process Overview (5 Steps)

- Engage/Hire – Bring on an independent contractor for a job.

- Collect W-9 – Have independent contractor fill out a W-9 form.

- Make Payment – Pay them once the W-9 is completed.

- Track Earnings – If total payments reach $600+ in a year, a 1099-NEC is required.

- Report to IRS – Submit the 1099-NEC to the IRS and provide a copy to the contractor by January 31.

Key Components

When is a W-9 form required?

- A W-9 form must be collected if a payment is being made and withholding taxes are not being deducted.

- An employer making payments for wages is responsible for collecting withholdings from employees.

- After completion and signing, a W-9 form requires the recipient to be accountable for the tax liability incurred when accepting a payment.

Source: 26 U.S. Code § 3402(a)(1)

Staying Compliant with Vendors and Contractors

- Businesses need W-9s from vendors and contractors to stay compliant with IRS rules on reporting income.

- If you fail to provide one, and have to withhold taxes at the highest rate.

When do I need to file a W-9 Form?

You’ll need to provide a completed W-9 form anytime you receive payments from which taxes must be withheld.

Some common situations include:

- Independent contractor

- Freelancer

- Receiving interest/dividends

- Income from investments

- Collecting prize money, awards or gambling winnings

W9 Form is Easy and Simple to Complete within Minutes

- Despite its importance, the W-9 is simple. Enter the name, address, and TIN (Social Security Number for

- individuals). Just provide that info, sign it, and you’re done.

Exceptions when to Not Submit a W9 Form 2025

There are a couple of exceptions where you wouldn’t need to submit a W-9 form 2025, such as:

- The income is from your regular job (where you get a W-2 instead)

- The total payments are less than $600 for the year.

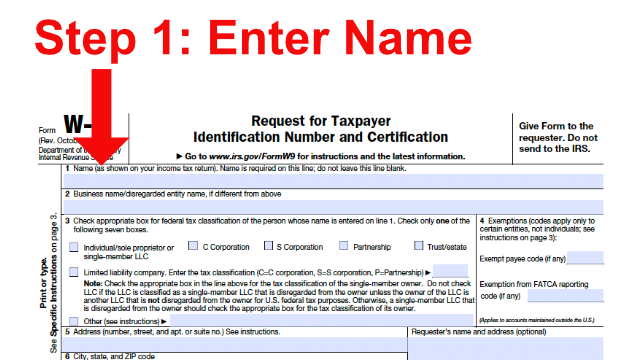

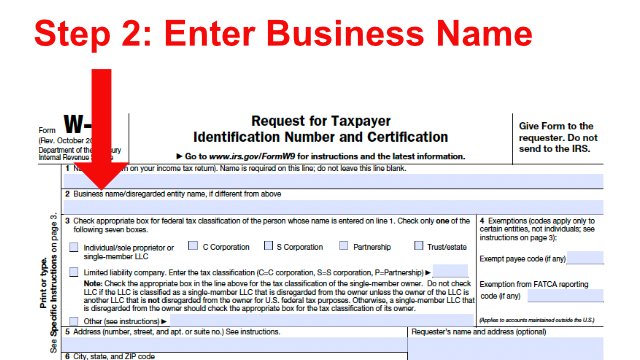

How to Fill out W-9 Tax Form? Steps

Step 1 – Enter Full Legal Name

Enter full legal name in the “Name” field.

Step 2 – Enter the Full Legal Business Name

Enter the “Business Name.”

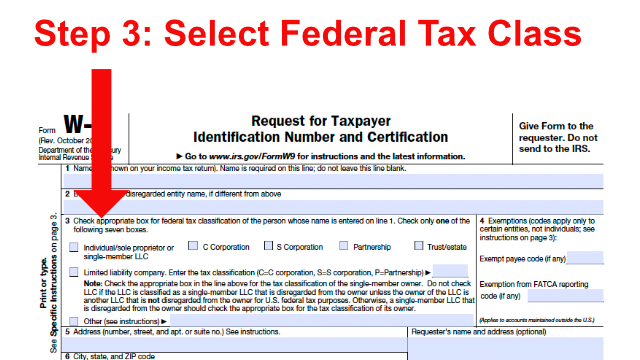

Step 3 – Select Federal Tax Class: Individual, C Corp, S Corp, Partnership, Trust Estate, or Limited Liability Company (LLC)

Check the Federal Tax Class, i.e. “Individual”.

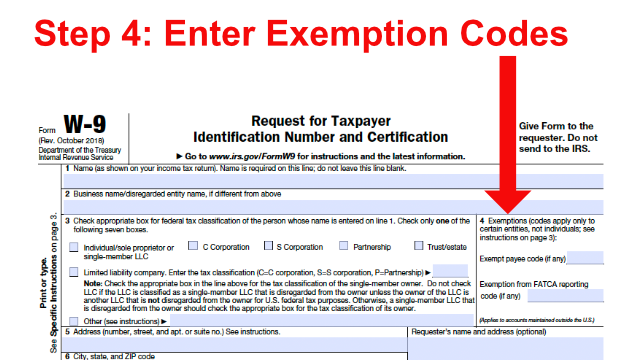

Step 4 – List any Exemptions Codes

Enter “Exemption Codes” (if any).

Frequently Asked Questions

What is the W-9 Form?

The W-9 form is a tax document issued by the Internal Revenue Service (IRS) that requests a taxpayer’s identification number and certification. This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding.

Who Needs to Fill Out a W-9?

If you’re an independent contractor, freelancer, or vendor providing services to a company or individual, you’ll likely be asked to complete a W-9 form. This allows the payer to accurately report your earnings to the IRS and avoid penalties for failure to withhold taxes.

How Do I Get a Free Fillable W-9 Form for 2025?

Accessing a fillable W-9 form for 2024 – simply visit the IRS website and download the latest version. You can fill it out digitally on your computer or print it out and complete it by hand. You can also download a free W-9 form using our free templates.