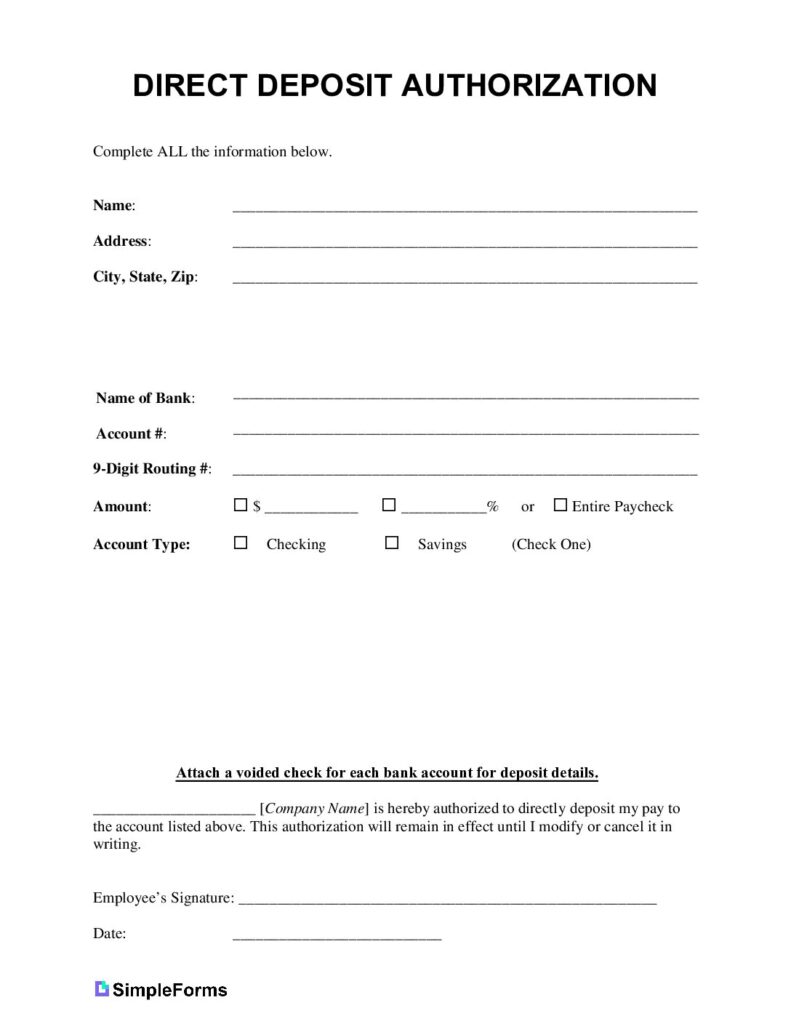

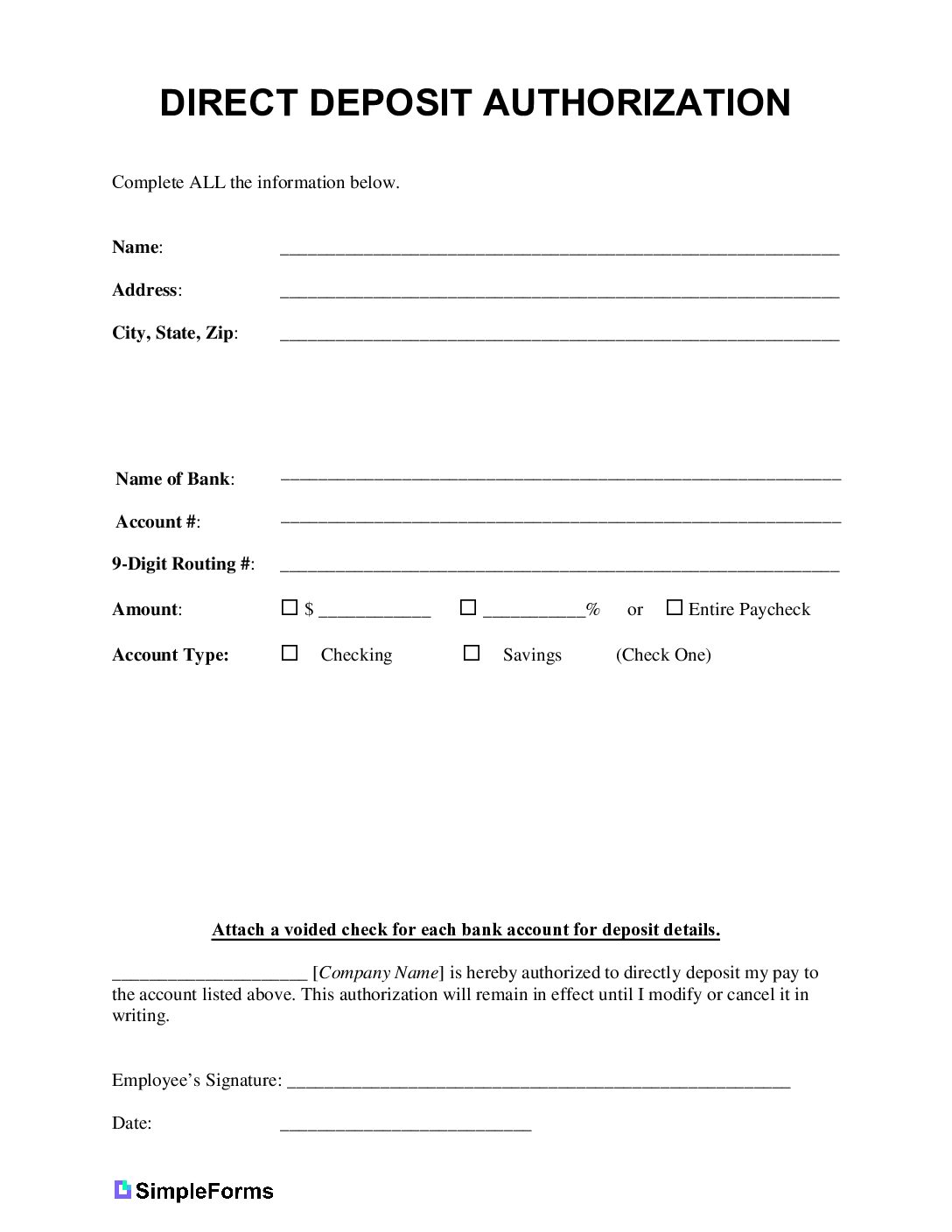

A Direct deposit authorization allows a third party to send money to a bank account, usually for payroll. The employer may ask for a voided check to verify the account. Once authorized, payments can be sent directly to the employee’s account.

What Is a Direct Deposit Authorization Form?

A direct deposit authorization form gives your employer/boss the permission to deposit your reoccurring paycheck directly into your bank account instead of depositing a physical check. The main benefit is that it is a convenient way to make sure you get paid on time.

Bank Direct Deposit Forms Online

How Direct Deposit Works

Provide employer with your bank account information, including your account number and the bank’s routing number for the electronic funds transfer (EFT).

Top Benefits of Direct Deposits

- Convenience

- Security

- Reliability

- Accessibility

How to Sign Up for Direct Deposit

- You will need a direct deposit authorization form from your employer.

- Complete the form by entering your bank account information, including your bank account number and the bank routing number.

- Sign and date the form and return it to your employers payroll department.

How to Fill Out a Direct Deposit Form: Step-by-Step Guide (6 Steps)

Step 1 – Gather Information

- Bank account and routing numbers.

- Employer information – name, address and company’s routing number.

Step 2 – Fill in Your Personal Information

- Full legal name, address, and social security number.

- Enter your bank account number and routing number.

Step 3 – Provide Your Employer’s Information

- Name and address of company.

- Company routing number

Step 4 – Select the Type of Account

- Checking Account

- Savings Account

Step 5 – Sign the Form

Sign the form then hand it into your employer’s payroll or HR department.

Step 6 – Changes or Cancellations

For changes or cancellations, fill out a new form with the updated details or cancellation request and provide it to employer.

Where to Find Direct Deposit Authorization Form Templates Online

Use Simple Forms blank direct deposit authorization forms provided above or your banks website online may provide a template or option to fill form online. Also check with employer.

Customize Your Own Direct Deposit Form

Create your own direct deposit form and include the following information:

- Name and contact details

- Bank name, routing number, and account number

- Account type (checking/savings)

- Amount or percent amount of payment to deposit

- Start date for Deposit to Begin

- Signature and date