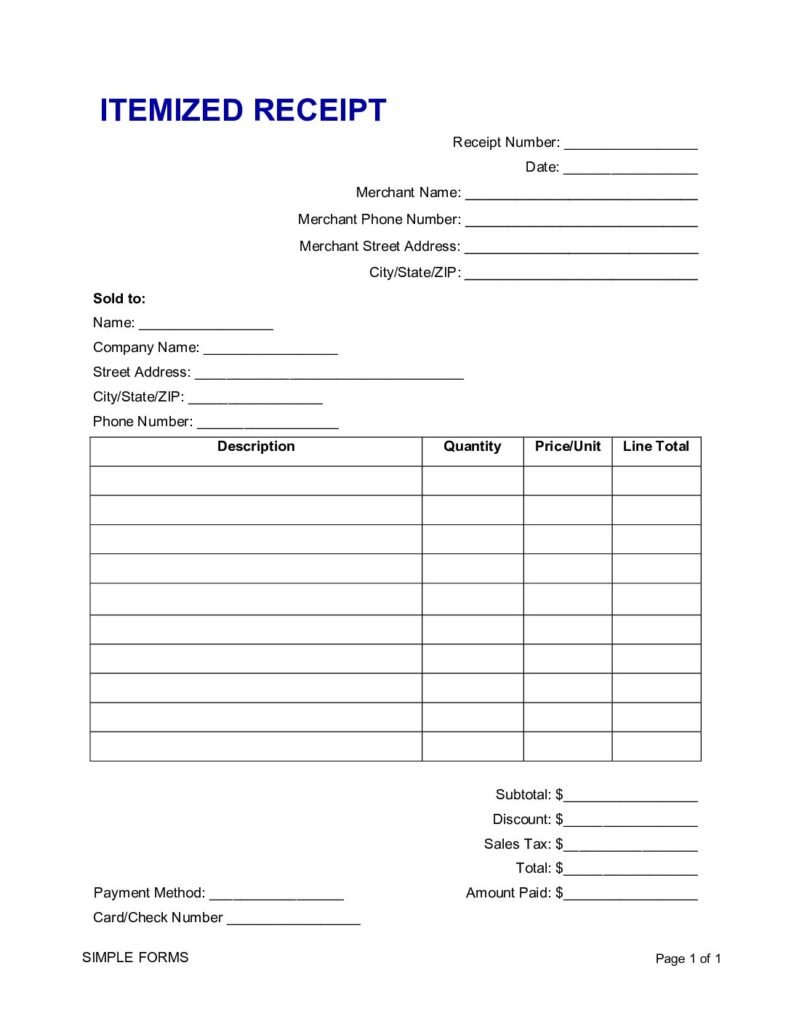

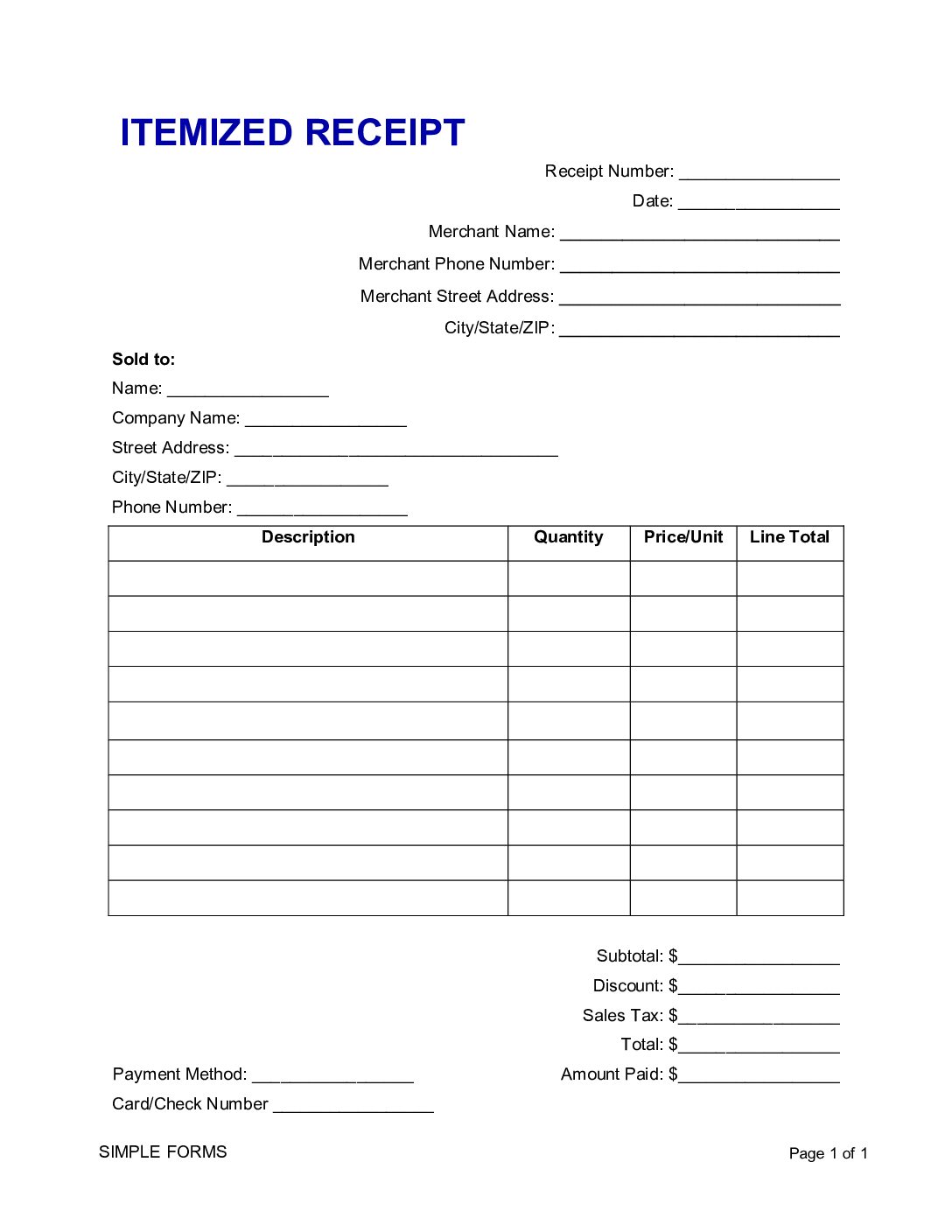

What is an Itemized Receipt?

An itemized receipt provides a detailed breakdown of a transaction, showing individual items, prices, quantities, and taxes, unlike a basic receipt that just shows the total amount.

Key details

- Date, time, and receipt number

- Merchant’s name and contact info

- Item list with prices and quantities

- Subtotal, taxes, and total amount

- Payment method used

Why Itemized Receipts Matter

- Accurate Tracking: They help businesses maintain precise records of expenses.

- Tax Compliance: They provide proof for deductions and reduce tax liability.

- Budget Management: They help identify areas for cost savings.

What’s Included in an Itemized Receipt Form?

An itemized receipt template includes the following information:

- Business Information – Name, logo, address, contact details, and tax/business registration number.

- Customer Information – Name, contact details (optional), and billing address (if needed).

- Receipt Details – Receipt number, date, time, and payment method.

- Itemized List – Product/service description, quantity, unit price, and subtotal.

- Additional Costs and Discounts – Discounts, taxes, and shipping fees.

- Total Amount – Subtotal, total tax, total discounts, and grand total.

- Payment Confirmation – Amount paid, balance due (if any), and payment verification.

- Notes/Policies – Return/refund policy, warranty details, and a thank-you message.