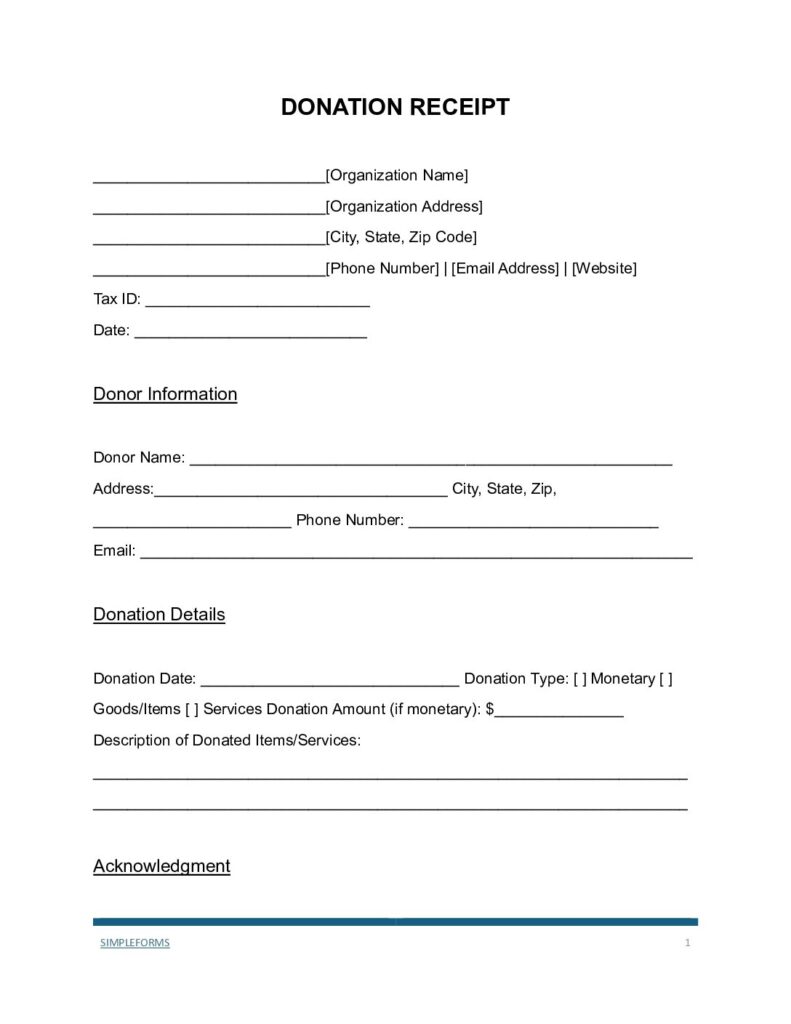

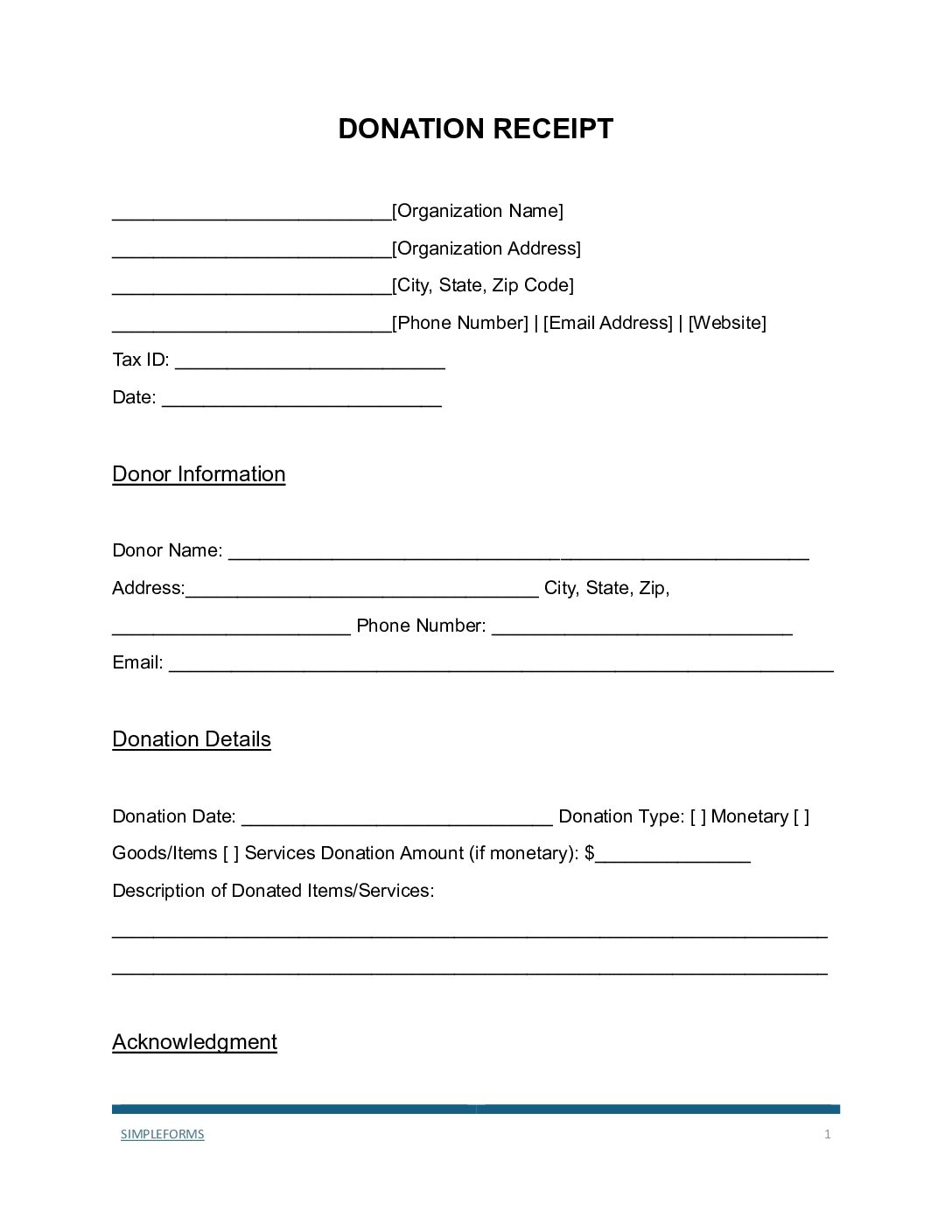

What is a Donation Receipt?

A donation receipt template is a written record of a contribution made to a charity. It includes the date, amount, and type of donation. Donors can use it for tax purposes since charitable donations may be tax-deductible. Nonprofits provide these receipts to show appreciation and adhere to legal compliance.