Why Keep Business Receipts?

Businesses must keep receipts for tax purposes—quarterly or at the end of the year. Most receipts are stored electronically, and paper ones are only given if the customer doesn’t want an e-receipt. Business receipt templates are proof that a payment was made.

How long do I need to keep?

- The IRS says businesses should keep receipts for 3 years.

- If a business shows a loss for the year, they keep them for 7 years.

What is the difference between a business receipt and an invoice?

Are Business Receipts Used for Tax Purposes?

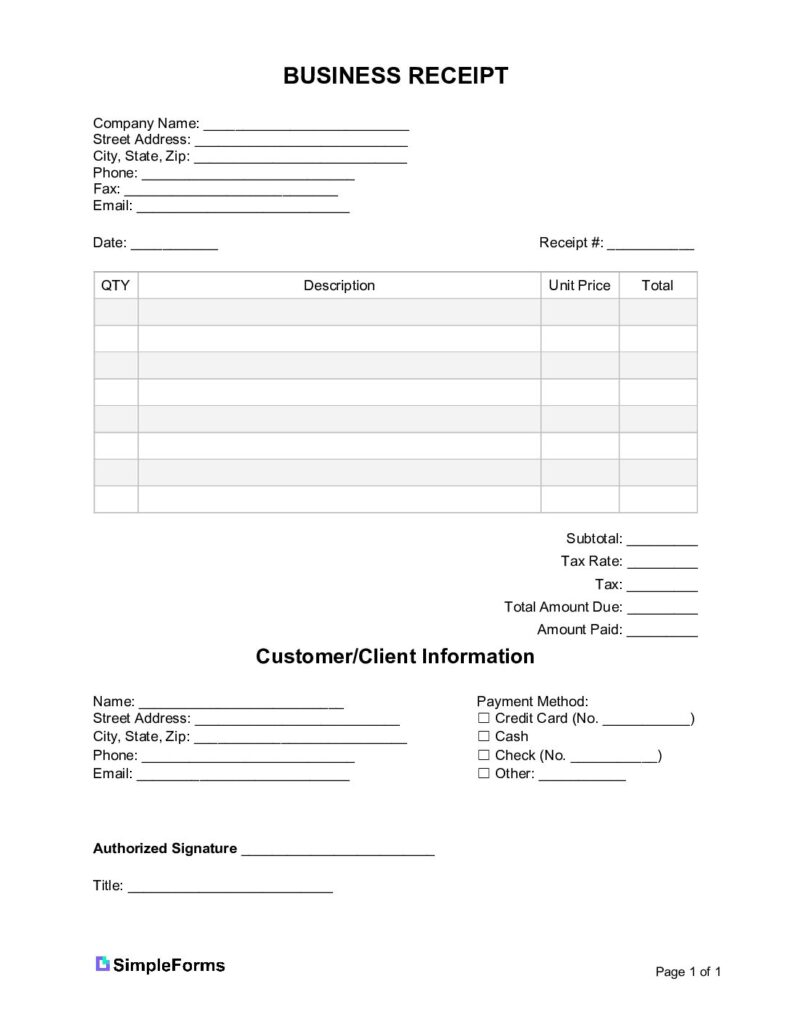

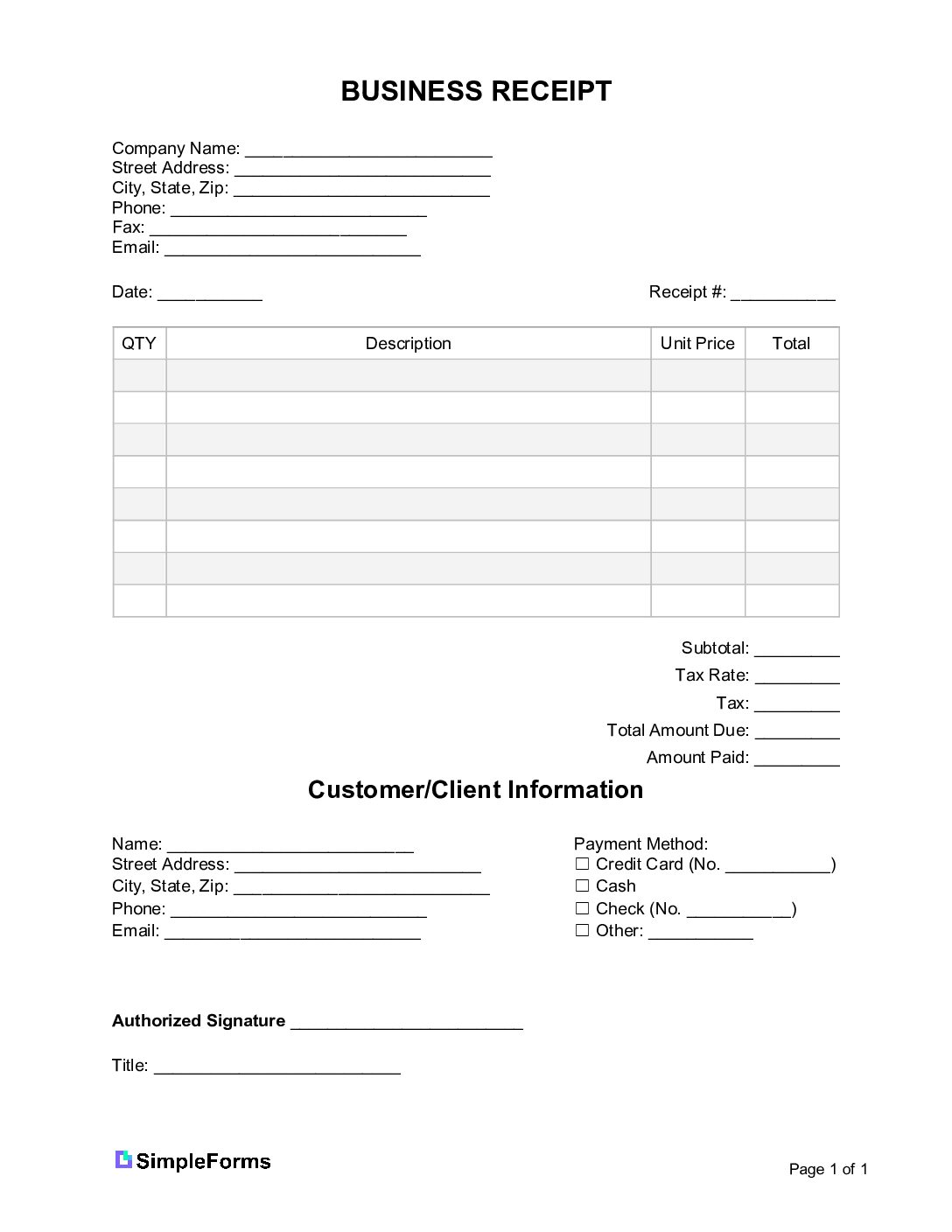

Sample

PDF / Word Processing Format / Excel / Open Document / Google Docs