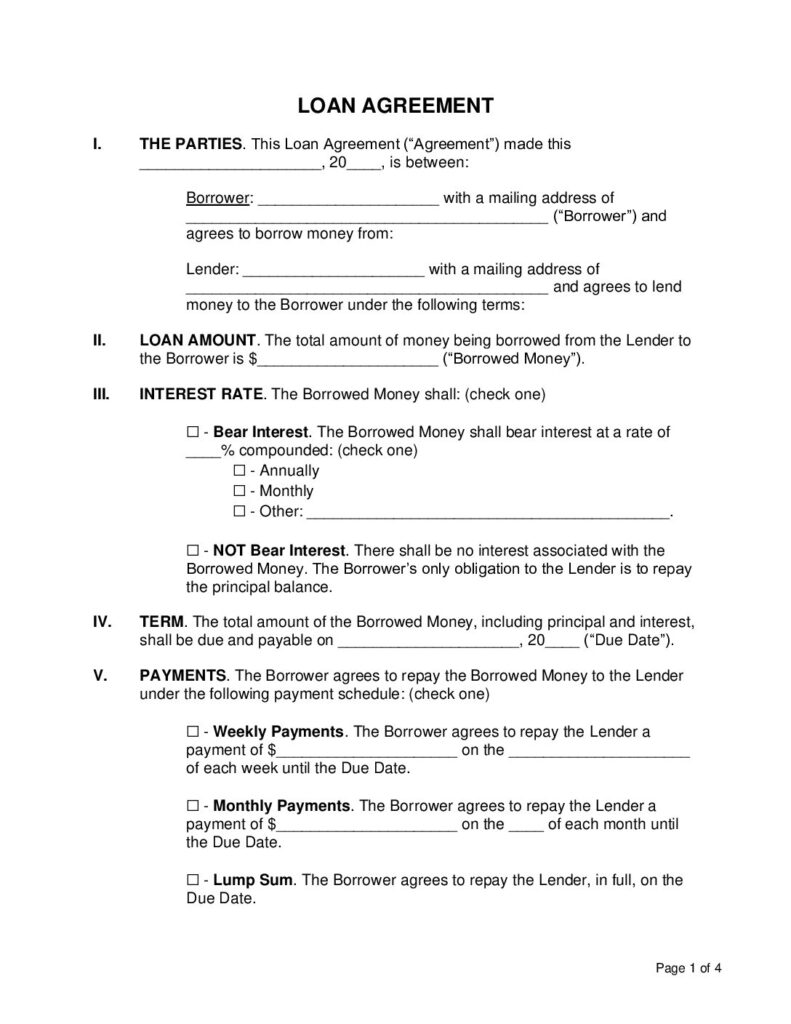

How to write a simple loan agreement?

1. Enter Both Parties Full Legal Names and Contact Information

Enter the date the agreement is entered into on and the full names and mailing addresses of both parties in the transaction:

- Date of Agreement – Write the date when the loan agreement is being signed.

- Borrower Information – Write the borrower’s full legal name and the borrower’s mailing address.

- Lender Information – Write the lender’s full legal name. and also provide the lender’s mailing address.

2. Loan Amount $ and Interest Rate

Put in writing the exact dollar amount of the loan. Then enter the interest rate.

- If interest applies:

- Check the box for “Bear Interest.”

- Add the interest rate % (percentage).

- State whether the interest is compounded annually, monthly, or other (explain if “other”).

- If no interest applies:

- Check “NOT Bear Interest.”

3. Loan Term

Write the final due date for full repayment.

Choose a repayment schedule:

- Business Loan – For expansion or new equipment. If the business is new or in bad financial shape a personal guarantee by the owner of the entity may be required by the lender.

- Car Loan – Used to purchase a vehicle usually with a term of 5 years (60 months).

- FHA Loan – To purchase a home with bad credit (cannot be below 580). Requires the borrower to purchase insurance in the chance of default.

- Home Equity Loan – Secured by the borrower’s home in case the funds are not paid-back.

- PayDay Loan – Also known as a “cash advance”, requires the borrower to show their most recent pay stub and write a check from the bank account where they are paid by their employer.

- Personal Loan – Between friends or family.

- Student Loan – Provided by the federal government or privately in order to pay for academic studies at a college or university.

- Weekly Payments: Specify the amount and the day of the week.

- Monthly Payments: Specify the amount and the day of the month.

- Lump Sum: If the full amount will be repaid on the due date.

- Other: Provide details if the repayment structure is different.

- Unsecured – more than 700 score.

- Secured – less than 700 score.

4. Signatures

Depending on what type on loan, a contract is written up which includes:

- Interest Rate

- Period

- Payment Schedule

- Prepayment Penalties

- Principal Amount

5. The Loan is Funded

6. Fill Out Online Application

There are several online options available to access cash quickly, however, all of these loans come with high interest rates exceeding 200%. Personal loans are best to access to go through a reputable bank.