Right to Sublet

In Ohio, there are no specific subletting laws. It depends on your lease. If subletting isn’t allowed, you must get your landlord’s written permission.

Short-Term Lodgings Tax

In Ohio, short-term rentals are stays of less than 30 days and are taxed by the state, county, and city. Tax rates vary by location.

Ohio short-term rental taxes include the following:

- 5.75% state sales tax

- Varying county/local sales tax

- Local lodging tax (amount depends on the area)

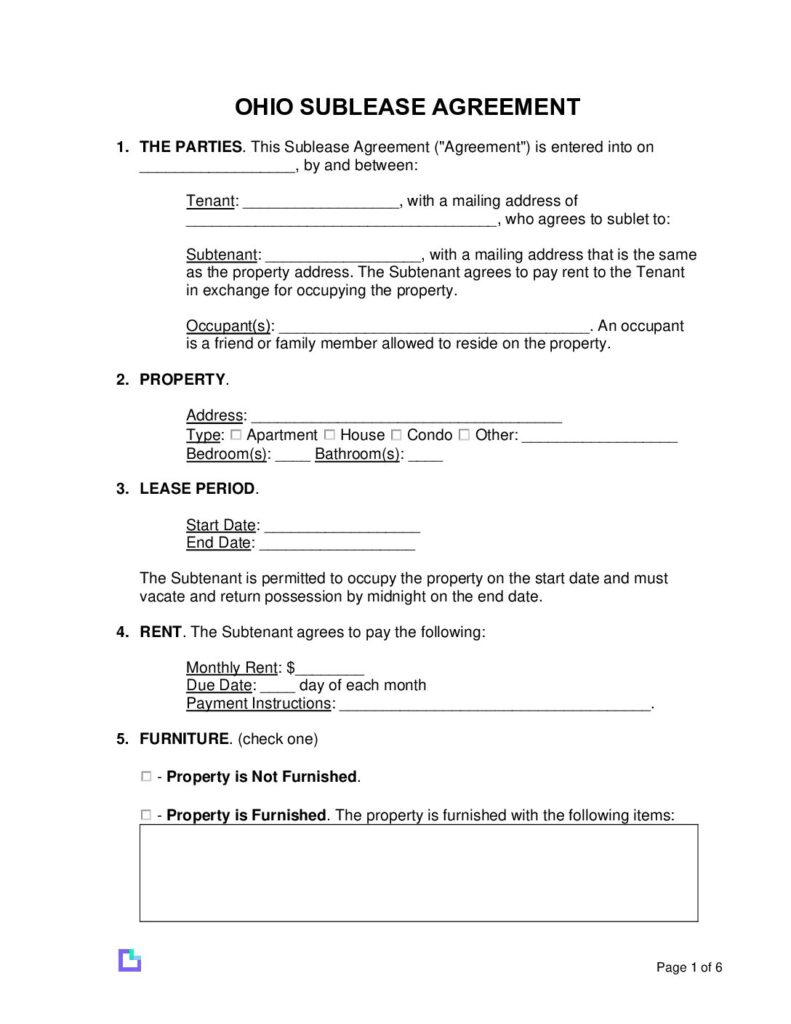

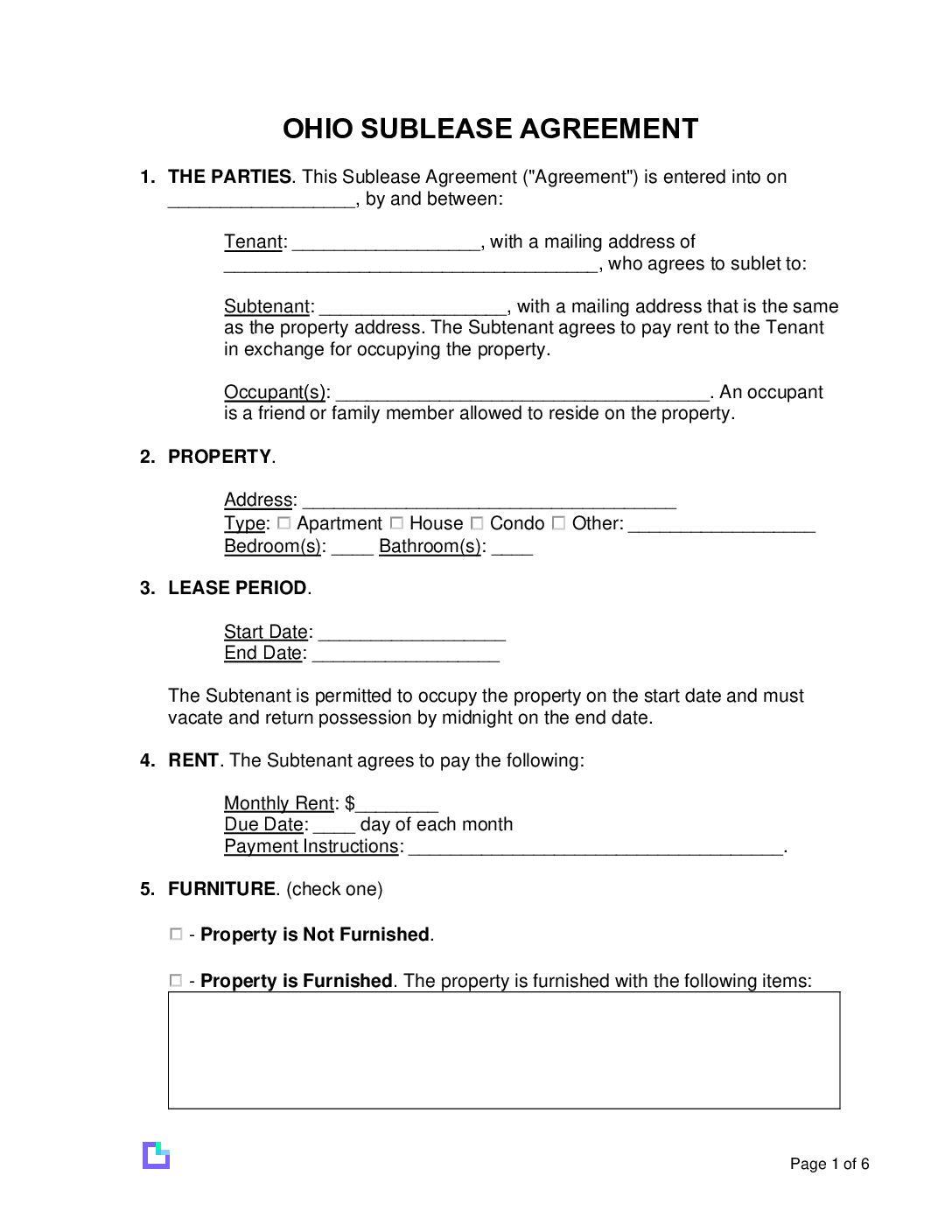

Sample Ohio Sublease Agreement

Ohio-Sublease-Agreement-Template